Companion Animal Segment to Lead Veterinary Diagnostics Products Market Based on Animal Type During 2025–2031

According to our new research study on “Veterinary diagnostics products Market Forecast to 2031 – Global Analysis – by Product, Animal Type, Application, and End User,” the veterinary diagnostics products market size is expected to grow from US$8.68 billion in 2024 to US$16.68 billion by 2031; the market is anticipated to register a CAGR of 9.9% during 2025–2031. Major factors driving the veterinary diagnostics products market growth include the surging prevalence of zoonotic diseases, soaring initiatives for animal health, growing pet ownership, and companion animal adoption drive the market growth.

Veterinary diagnostics products include tools and technologies used to detect diseases in animals. Key classifications of these products include immunodiagnostics (ELISA, rapid tests), clinical chemistry, molecular diagnostics (PCR), and hematology. These products serve companion animals and livestock, supporting disease management, animal health, and zoonotic risk reduction. Rising pet ownership, livestock productivity demands, and the need for faster, point-of-care testing drive the market. Emerging trends include portable devices, AI-assisted diagnostics, and multiplex testing. Major players include IDEXX, Zoetis, and Heska. The sector faces challenges such as cost, infrastructure gaps, and regulatory variation, but is growing steadily worldwide.

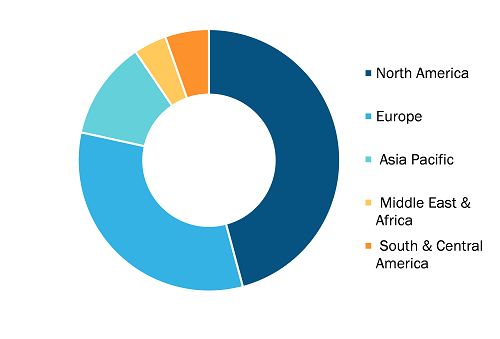

Veterinary Diagnostics Products Market, by Region, 2024 (%)

Veterinary Diagnostics Products Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Kits and Reagents [ELISA Test Kits, Antibodies Test Kits, Polymerase Chain Reaction (PCR) Test Kits, Hematology Test Kits, Biochemistry Test Kits, Immunoassay Reagents, and Others]and Analyzers [Biochemistry Analyzers, Hematology Analyzers, Immunoassay Analyzers, PCR Analyzers, and Others]), Animal Type (Companion Animal [Dogs, Cats, Horses, and Others] and Livestock Animal [Cattles, Pigs, Poultry, and Others]), Application (Infectious Diseases [Rabies, Avian Influenza, Leishmania, Methicillin-Resistant Staphylococcus Aureus (MRSA) Infection, and Others] and Non-Infectious Diseases [Pneumonia, Gastritis, Bronchitis, and Others]), End User (Public Healthcare Facilities and Private Healthcare Facilities), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America)

Veterinary Diagnostics Products Market Size & Trends 2031

Download Free Sample

Source: The Insight Partners Analysis

Veterinary Diagnostics Products Market Analysis Based on Segmental Evaluation:

Companion and farm animals are the two product market segments in veterinary diagnostics. Companion animals accounted for the most significant market share in 2024. Products and services for identifying, treating, and preventing animal disease in pets such as dogs and cats come under companion animal healthcare. These include diagnostic exams, prescription medication, and therapeutic food to improve animal well-being. In the US, ~94 million homes have a pet. According to the 2025 American Pet Products Association (APPA) National Pet Owners Survey, Americans spent ~US$151.9 billion on pets in 2024. Based on the PDSA Animal Well-being (PAW) Report 2023, ~29% of individuals in the UK possess a dog, which is estimated at ~11 million pet dogs. As pet ownership is rising globally, pet health and wellness are becoming a priority for pet owners.

In 2010, the World Small Animal Veterinary Association created a One Health committee to highlight the role of companion animals. Since then, the AVMA, the Federation of Veterinarians of Europe, and the Canadian Veterinary Medical Association have supported this initiative. Veterinarians in companion animal practices support public health by addressing zoonoses, using animal models for research, tackling antimicrobial resistance (AMR), and exploring the human-animal bond, especially its positive effects on physical and mental health. The growing awareness of companion animal welfare and the rise in pet ownership increase the demand for healthcare products such as drugs, vaccines, and supplements that prevent infectious diseases. Pet owners are becoming more proactive in protecting their pets’ health. They seek preventive care such as vaccinations and reliable diagnostic testing to monitor and detect issues such as rabies, distemper, and parvovirus in dogs, or feline leukemia and calicivirus in cats. Diagnostic tools, including ELISA-based assays, rapid test kits, and molecular diagnostics, are vital for confirming infections before clinical symptoms worsen. For instance, before administering the Nobivac Canine Distemper Vaccine, diagnostic screening can be done to verify that a puppy is healthy enough to take it. Greater travel with pets drives the demand for diagnostic certification.

The scope of the veterinary diagnostics products market report includes an assessment of the market performance in North America, Europe, Asia Pacific, South and Central America, the Middle East, and Africa. Regarding revenue, North America dominated the veterinary diagnostics products market in 2024.

The veterinary diagnostics products market in North America is segmented into the US, Canada, and Mexico. North America is anticipated to lead the market throughout the forecast period. North America's veterinary diagnostics products market is leading owing to its advanced infrastructure, high adoption rates of cutting-edge technologies, and substantial consumer expenditure on animal healthcare. Driven chiefly by a rapidly growing companion animal population and a shift toward precision medicine, the market is buoyed by the proliferation of pet ownership and increased demand for diagnostically driven preventive care, particularly among owners who see pets as family members. North America is expected to lead the global veterinary diagnostics market in 2025. The US is anticipated to account for almost one-third of the worldwide market share. This growth in the region is driven by innovations such as AI imaging, handheld point-of-care devices, and digital health platforms that combine diagnostic information to support quick decision-making. These technologies have moved the market emphasis from reactive therapy to early detection, wellness screening, and incorporating diagnostic protocols into companion animal clinics and livestock production.

Major US players such as IDEXX Laboratories, Zoetis, Antech Diagnostics, and Thermo Fisher Scientific dominate the market. They collaborate with veterinary schools and offer comprehensive diagnostic solutions that enhance clinic and specialty center workflows. The prevalence of point-of-care technologies providing immediate analysis and results has grown swiftly, especially in rural and underserved locations, supporting faster and better disease management. This acceleration in diagnostics is reflected in recurring diagnostic revenue outpacing traditional clinical visit volume, and the introduction of digital triage services is boosting practice efficiency.

Factors driving expansion in the veterinary market include the increasing number of veterinary practitioners projected to grow by 19% during 2021–2031, according to the US Bureau of Labor Statistics, along with rising pet insurance coverage and heightened awareness of zoonotic disease management. Government initiatives and educational outreach support this awareness. The market responds to changes in consumer demand for animal-derived food products. This has led to required surveillance measures, including H5N1 biosecurity protocols for poultry and strict screening for antimicrobial resistance in livestock. Canada continues to experience steady growth, being the region's second-largest market, driven by similar trends and increased regulatory requirements within the poultry and meat-based food sectors. However, the market faces barriers such as elevated costs for pet care, including diagnostics, challenges linked to arable land competition, and regulatory constraints on vaccine and parasiticide use in livestock.

Recent developments show a shift toward sustainability and eco-friendly practices. The adoption of telemedicine allows for remote diagnostics. There is also a rise in AI-powered, portable tools for pet owners. The regional market leads in technological innovation and global influence, and these growing market trends are propelling the market. Lifestyle choices, management of chronic diseases, and regulatory pressures increasingly influence the mix of products. A shortage of qualified veterinary technicians and rising wage inflation may slow growth. However, these challenges also encourage automation, the integration of digital platforms, and investment in education to ensure market stability and long-term success.

The US veterinary diagnostics products market expansion is attributed to growing technological advancements, increasing pet ownership, and a rising focus on animal health. Innovations in diagnostic technologies, including artificial intelligence (AI), molecular diagnostics, and point-of-care platforms, fuel this expansion. Zomedica has launched the TRUFORMA system. This point-of-care diagnostic platform uses bulk acoustic wave technology for real-time diagnostics. This platform addresses a substantial market opportunity and has expanded its reach beyond the US following CE mark certification in 2024, enabling entry into the market in Europe.

Artificial intelligence is also pivotal in enhancing diagnostic accuracy and efficiency. For instance, a study developed a machine learning algorithm capable of classifying clinical wellness visits in cats and dogs with high sensitivity and specificity, facilitating early disease detection during routine check-ups. Moreover, advancements in radiology data generation using generative active learning frameworks address data scarcity issues, improving the development of computer-aided diagnostic systems in veterinary medicine.

The US market is also witnessing consolidation and strategic partnerships among key industry players. Zoetis reported high demand for pet treatments and vaccines in 2024, resulting in updated revenue forecasts. Even with staffing shortages and rising costs affecting visits to veterinary clinics, Zoetis is observing an expansion owing to its treatments for chronic pet conditions.

Additionally, the expanding diagnostic platforms in the US is expected to increase the reach and impact of veterinary diagnostics in the coming years.

Zoetis Inc., Thermo Fisher Scientific Inc., Randox Laboratories Ltd, Bionote Inc., Gold Standard Diagnostics Budapest Kft., Ubio Biotechnology Systems Pvt Ltd, Secure Diagnostics Pvt Ltd, InBios International Inc., VMRD Inc., and Fujifilm Corp. are among the leading companies profiled in the veterinary diagnostics products market report.

Based on animal type, the veterinary diagnostics products market is bifurcated into companion animal and livestock animal. By product, the market is bifurcated into kits & reagents and analyzers. The kits & reagents segment accounted for a larger share of the veterinary diagnostics products market in 2024. Based on application, the veterinary diagnostics products market is bifurcated into infectious diseases and non-infectious diseases. In terms of end users, the veterinary diagnostics products market is categorized into public and private healthcare facilities. The public healthcare facilities segment held a larger share of the veterinary diagnostics products market in 2024. Based on geography, the market is categorized into North America (the US, Canada, and Mexico), Europe (France, Germany, the UK, Spain, Italy, and the Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, and the Rest of Asia Pacific), the Middle East and Africa (Saudi Arabia, South Africa, the UAE, and the Rest of Middle East and Africa), and South and Central America (Brazil, Argentina, and the Rest of South and Central America).

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com