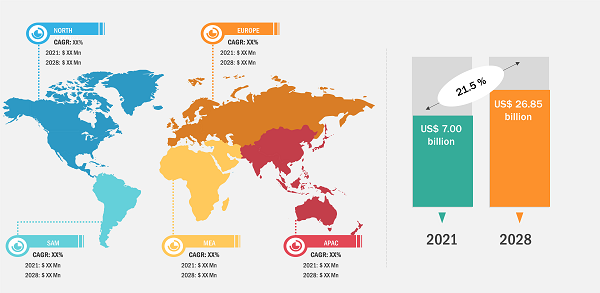

The public safety LTE market was valued at US$ 7.00 billion in 2021; registering at a CAGR of 21.5% from 2022 to 2028, according to a new research study conducted by The Insight Partners.

Increasing Demand for Reliable Networks During Emergencies is Catalyzing Public Safety LTE Market Growth

Public Safety LTE Market Size and Forecasts (2021 - 2031), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Infrastructure (Radio Access Network, Evolved Packet Core & Policy, and Mobile Backhaul & Transport), Management & Integration Solutions (Network Integration & Testing, Device Management & User Services, Managed Services, Operations & Maintenance, and Cybersecurity), Device (Smartphones & Handportable Terminals, Vehicle Mount Routers & Terminals, Tablets & Notebook PCs, USB Dongles, and Others), Subscription (Private LTE and Commercial LTE), Application (Video Applications, GIS, AVLS & Mapping, Mobile VPN Access & Security, CAD, Remote Database Access, Telemetry & Remote Diagnostics, Bulk Multimedia/Data Transfers, PTT & Voice over LTE, and Situational Awareness Applications), and Geography (North America, Europe, Asia Pacific, and South and Central America)

Public Safety LTE Market Size and Forecasts (2021 - 2031), Global and Regional Share, Trends, and Growth Opportunity Analysis

Download Free Sample

Source: The Insight Partners Analysis

Network operators focus on new strategies for the design and management of communications infrastructure to respond to a rapid ongoing evolution in networks and services to assure reliable network operations. Telecom providers are likely to begin the second phase of 5G communication network deployments. Companies require changes in network infrastructures to support new ultra-reliable services with up to six nines availability. Similarly, disaster resiliency in communication networks is gaining unprecedented interest from the media, governments, and businesses. For example, during the COVID-19 pandemic, countries need a worldwide network traffic deluge to facilitate remote working. Increased network reconfigurability enabled by software-defined networking (SDN); integration/convergence of technologies such as optical, wireless satellite, and datacenter networks; enhanced forms of data/service replication, supported by edge computing; network slicing, used to carve highly-reliable logical partitions of network, computing, and storage resources. Thus, increasing demand for reliable networks during emergencies is catalyzing public safety LTE market growth.

In the public safety LTE market, factors such as, rise in terrorism and the growing need for public safety, leading to the need for a reliable network during emergencies, are contributing to the public safety LTE proliferation. However, high implementation costs, restricted data transit capabilities, and limited spectrum bandwidth hinder the public safety LTE market growth. Government investments in mission-critical communication systems in the defense sector, on the other hand, are likely to boost the public safety LTE market growth in the coming years. LTE Broadcast, a single-frequency network (SFN), presented an efficient approach to provide mass media materials over LTE-Advanced cellular networks by allowing dynamic, scalable, and cost-effective applications; this development helped telecom companies address the needs for on-demand viewing of lengthy and live video broadcasts on mobile devices. eMBMS also improved the efficiency of mission-critical push-to-talk (PTT) conversations (voice/data/text) in public safety and other vital communications by transferring audio data through a single IP multicast broadcast to all group participants in a cell.

The shifting focus of corporations toward the implementation of PTT solutions offered by upgraded LTE networks is one of the developing trends in the public safety LTE market. LTE networks in mobile communication have replaced LMR communication technology. These networks are being used by different organizations to offer enhanced communications. As a result, a huge-bandwidth architecture is being developed for mission-critical PTT, push-to-locate, push-to-message, and push-to-alert communication services, contributing to the public safety LTE market growth. Furthermore, large businesses in various sectors including public safety, government, defense, and transportation and logistics—are implementing LTE-powered solutions in their business applications to boost the productivity and efficiency of field personnel, streamline their workflow, and minimize corporate hardware expenditures. Wireless technologies such as WLAN and LTE in PTT devices make multiple communications at a time. The high demand for LTE network-powered PTT systems is ascribed to their cost-effectiveness and multiple features, catalyzing the public safety LTE market growth. Key players in the public safety LTE market are pursuing different business strategies, such as mergers, collaborations, and product launches, to meet the expanding needs for these solutions. Siyata Mobile, e.g., teamed with Verizon, a Canadian provider of cellular PTT communications equipment, in March 2020, and together, they introduced the "Uniden UV350" PTT LTE in-vehicle cellular IoT device. This device offers corporate clients access to Siyata Mobile's in-vehicle communication solutions.

Amdocs; Apple Inc.; Alcatel-Lucent SA; AT&T Inc.; Broadcom Ltd.; Cisco Systems Inc.; Dell Inc.; Eden Rock Communications; Ericsson; and Fujitsu Ltd are among the key players profiled during this study on the public safety LTE market. Several other major companies were studied and analyzed during this research study to get a holistic view of the public safety LTE market and its ecosystem.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com