Sutures Segment based on Product to Bolster Wound Closure Devices Market Growth During 2025–2031

According to our new research study on "Wound Closure Devices Market Forecast to 2031 – Global Analysis – by Product, Wound Type, and End User," the market was valued at US$ 11.86 billion in 2024 and is projected to reach US$ 17.46 billion by 2031; it is anticipated to record a CAGR of 5.8% from 2025 to 2031. The report emphasizes the wound closure devices market trends, along with drivers and deterrents affecting the market growth. An upsurge in the number of surgical procedures and technological advancements in wound closure devices are significantly contributing to the growing wound closure devices market size. However, the high price of advanced wound closure devices hampers the market growth. Further, the shift toward minimally invasive wound-closing methods is expected to emerge as a new market trend in the coming years.

Technological Advances in Wound Closure Devices Bolsters Wound Closure Devices Market Growth

Technological advancements such as bioresorbable sutures, tissue adhesives, and improved surgical stapler designs offer greater functionality and ease of use for surgeons. These devices mitigate the risk of complications associated with traditional wound closure methods, such as infection, scarring, and delayed healing. Intelligent sutures that monitor healing and release drugs into the wound are a highly anticipated innovation in the market. In 2023, the Massachusetts Institute of Technology unveiled tissue-derived smart sutures, which can not only hold tissue in place but also detect inflammation and release drugs at the wound site.

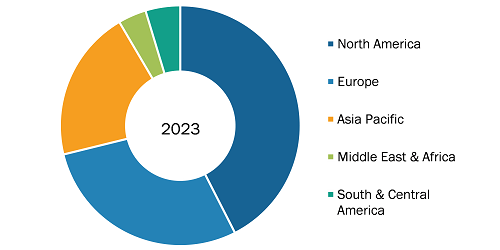

Wound Closure Devices Market Share, by Region, 2024 (%)

Wound Closure Devices Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Sutures, Adhesives, Staplers, Strips, and Others), Wound Type (Chronic Wound and Acute Wound), End User (Hospitals, Clinics, Ambulatory Surgery Centers, and Others), and Geography

Wound Closure Devices Market Trends, Share, Growth 2031

Download Free Sample

Source: The Insight Partners Analysis

Minimally invasive techniques of wound closure are also gaining popularity as they ensure faster recovery, minimal scarring, and fewer complications. For instance, stapling and skin adhesives that result in healing at a faster rate with less damage to tissues are widely used nowadays. In May 2024, Ethicon launched the ECHELON LINEAR Cutter, a first-of-its-kind surgical stapler that lowers the risk of leaks by 47% at the staple line to help reduce surgical risks. As the healthcare sector strongly emphasizes accuracy and patient-centric therapeutic approaches, the application of next-generation wound closure technologies would increase further over the next several years. Smart materials and enhanced biocompatibility, rendering wound closure devices more efficient and patient-friendly, are among other factors contributing to the market.

Scope of Wound Closure Devices Market Report:

The wound closure devices market analysis has been carried out by considering the following segments: product, wound type, end user, and geography. Based on product, the market is segmented into sutures, adhesives, staplers, strips, and others. The sutures segment held the largest wound closure devices market share in 2024. Sutures can be classified into two categories: absorbable and nonabsorbable. The choice between these types depends on the nature of the wound and the specific healing requirements. Absorbable sutures are designed to be gradually broken down by the body, eliminating the need for removal, which enhances patient comfort, particularly for internal tissues. Conversely, nonabsorbable sutures are utilized for external injuries that require extended support. Technological developments such as antimicrobial coatings on sutures improve their efficacy by lowering the risk of infections.

The rising prevalence of chronic diseases, such as diabetes and obesity, which often result in complexities in wound healing, further contribute to the demand for sutures to provide additional healing support. Moreover, the heightened focus on minimally invasive surgical techniques, where sutures facilitate precise wound closure and enhance aesthetic results, has positioned them as leading products in the wound closure devices market. In August 2023, Healthium Medtech launched TRUMAS, an exclusive range of sutures for minimal access surgery.

In terms of wound type, the wound closure devices market is bifurcated into chronic wound and acute wound. The chronic wound segment dominated the market in 2024. Chronic wounds are further categorized into diabetic foot ulcers, venous leg ulcers, pressure ulcers, and other chronic wounds. According to a study published in the Journal of Personalized Medicine in 2021, chronic wounds affect 1% of the total population in the US, leading to nearly 4 million cases per year; they affect ~0.8% of the population in Europe, 0.86% in Australia, 0.8–1% in China, and 0.6–1% in India. The prevalence of chronic wounds is increasing in the geriatric population; it is also on the rise in people suffering from obesity, diabetes, and cardiovascular diseases. In healthy individuals, the wound healing process occurs in different stages—inflammation, cell proliferation, and extracellular matrix healing. However, in chronic wounds, a chronic inflammatory status is observed; therefore, it takes longer to reach the cell proliferation and healing phases. Moreover, chronic inflammation exhibits persistent exudate.

In terms of end user, the wound closure devices market is categorized into hospitals, clinics, ambulatory surgical centers, and others. The hospitals segment dominated the market in 2024. Hospitals are among the essential parts of healthcare systems in various countries. They provide extensive healthcare and medical services to patients suffering from various diseases and disorders. Wound closure devices are required for treating acute and chronic wounds in hospital settings. Many patients suffering from diabetic foot ulcers and venous leg ulcers approach hospitals for their treatment. Further, there is a notable trend of multispecialty hospitals establishing dedicated departments for wound management. Consequently, hospitals play a pivotal role in contributing a substantial share to the wound closure devices market, and they are anticipated to maintain this trajectory throughout the forecast period.

Wound Closure Devices Market Analysis: Based on Geography

The geographic scope of the wound closure devices market includes the assessment of the market performance in North America (US, Canada, and Mexico), Europe (Spain, UK, Germany, France, Italy, and Rest of Europe), Asia Pacific (South Korea, China, India, Japan, Australia, and Rest of Asia Pacific), South & Central America (Brazil, Argentina, and Rest of South & Central America), and the Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa).

The Open Journal of Nursing, Ministry of Internal Affairs and Communications, International Wound Journal, Diabetic Foot Australia, Journal of Personalized Medicine, Centers for Disease Control and Prevention (CDC), International Journal of Tissue Repair and Regeneration, the Canadian Institute for Health Information (CIHI), the International Diabetes Federation (IDF), the Organization for Economic Co-operation and Development (OECD) are among the primary and secondary sources referred to while preparing the wound closure devices market report.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com