Wound Closure Devices Market Dynamics, Recent Developments, and Strategic Insights by 2031

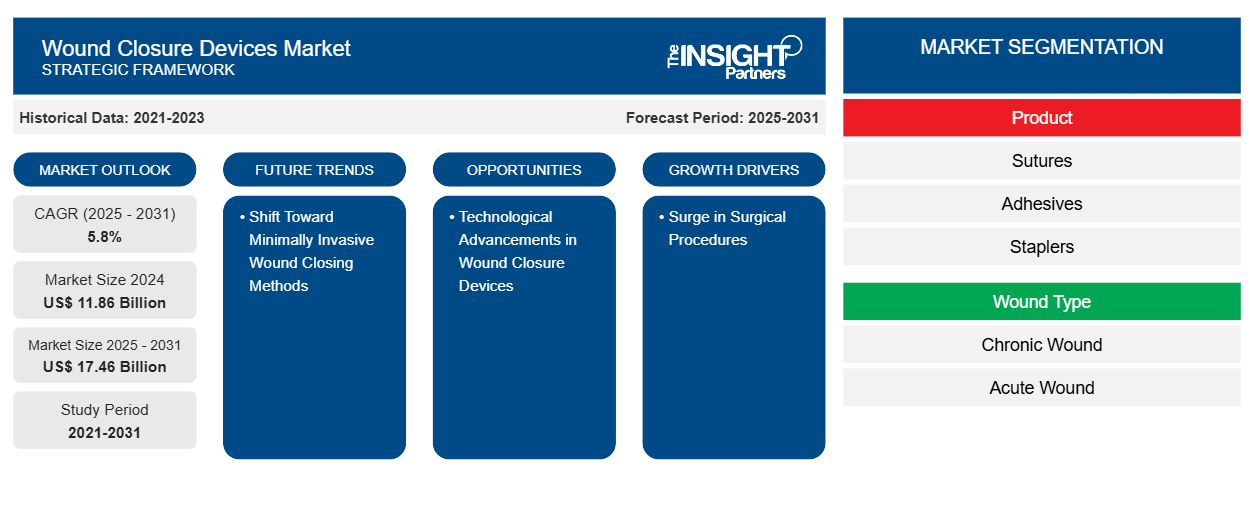

Wound Closure Devices Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Sutures, Adhesives, Staplers, Strips, and Others), Wound Type (Chronic Wound and Acute Wound), End User (Hospitals, Clinics, Ambulatory Surgery Centers, and Others), and Geography

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : May 2025

- Report Code : TIPRE00040912

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 224

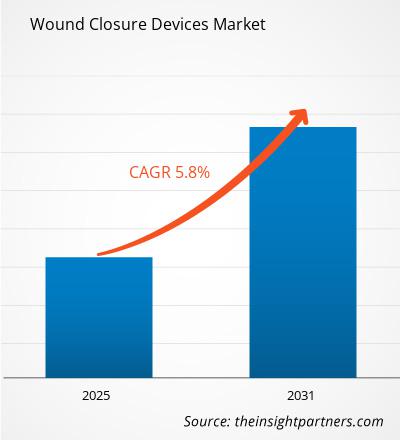

The wound closure devices market size is projected to reach US$ 17.46 billion by 2031 from US$ 11.86 billion in 2024. The market is expected to register a CAGR of 5.8% during 2025–2031. The Shift Toward Minimally Invasive Wound Closing Methods is likely to bring in new market trends during the forecast period.

Wound Closure Devices Market Analysis

With an increasing number of surgeries, including C-sections, orthopedic procedures, and plastic surgeries, the demand for efficient and effective wound closure products is also growing across the world. Appropriate wound closure methods facilitate proper healing and reduce complications. As per the Eurostat, in 2022, cesarean section procedures were performed at least 1.10 million times in the European Union. A total of 230,200 cesarean sections were performed in Germany, while the procedures performed in France, Italy, and Poland ranged between 125,400 and 150,700. As per the same source, hip replacements were performed 326.2 times per 100 000 inhabitants in Germany in 2022, and the number was between 282 and 302 per 100 000 inhabitants in Austria, Denmark, and Belgium; these were the highest frequencies among the EU countries.

Wound closure devices such as sutures, staples, and newer adhesive strips assist in achieving improved results by facilitating quicker healing, lowering infection risks, and enhancing the cosmetic outcome post operation. The growing number of surgeries in developing and developed countries, combined with advances in healthcare technology, is boosting the demand for innovative closure solutions for wounds. Owing to the abovementioned factors, hospitals and specialty clinics are spending more on high-quality devices for wound closure.

Wound Closure Devices Market Overview

The wound closure devices market is rapidly expanding due to the surge in surgical procedures and technological advances in wound closure devices. Prominent players operating in the market are focusing on innovations and collaborative efforts for enhanced product availability and reach. However, the high price of advanced wound closure devices hinders market growth.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONWound Closure Devices Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Wound Closure Devices Market Drivers and Opportunities

Technological Advancements in Wound Closure Devices Fuels Market Growth

Technological advances are significantly contributing to the wound closure devices market. Advances like bioresorbable sutures, advanced technology tissue adhesives, and improved design surgical staplers offer greater functionality and ease of use for surgeons. These devices reduce complications associated with traditional wound closure methods, such as infection, scarring, and delayed healing. Intelligent sutures that monitor healing and release drugs into the wound are a highly anticipated innovation in the market. Massachusetts Institute of Technology announced in 2023, that it has developed tissue-derived smart sutures, which can not only hold tissue in place but also detect inflammation and release drugs.

Minimally invasive techniques of wound closure are also gaining popularity as they ensure faster recovery, minimal scarring, and fewer complications. For instance, stapling and skin adhesives that result in healing at a faster rate with less damage to tissues are widely used nowadays. In May 2024, Ethicon launched echelon linear cutter, a first-of-its-kind surgical stapler that delivered 47% fewer leaks at the staple line to help reduce surgical risks.

As the healthcare industry places greater emphasis on accuracy and patient-centered therapy, applications for these next-generation wound closure technologies will increase over the next several years, setting technological innovation among the strongest influences in driving growth in the industry. Smart materials and enhanced biocompatibility are also factors contributing to the market, enabling devices for wound closure to become both more efficient as well as more patient friendly.

Growing Incidence of Chronic Diseases and Trauma Cases to Create Lucrative Opportunities in Market

The growing number of chronic disease cases, including diabetes and cardiovascular diseases, presents a major opportunity for the wound closure devices market. Chronic diseases tend to cause complications that may necessitate surgeries or prolonged wound care. For instance, diabetic patients are likely to develop chronic wounds, including diabetic ulcers, which require appropriate care and closure devices for healing. As per the University of Michigan Health, in the US, diabetic foot ulcer is prevalent among 15% of diabetic patients, and ~14–24% of patients with diabetes who develop a foot ulcer undergo an amputation procedure. Moreover, the increasing number of trauma cases such as burns, accidents, and injuries is fueling the demand for effective wound care solutions. As per the US Department of Transportation, in 2021, ~43,230 people were killed in motor vehicle crashes, including 7,388 pedestrians. Wound closure devices form an essential part of the treatment of these conditions, providing quicker healing, minimizing infection risk, and enhancing overall patient outcomes. With a growing population of older people who are more susceptible to chronic conditions and a rise in the incidence of trauma cases, healthcare professionals prefer sophisticated wound closure solutions to meet these demands. As a result, market players continuously emphasize innovations specific to chronic wounds and trauma, which will likely generate significant growth opportunities for them in the long term.

Wound Closure Devices Market Report Segmentation Analysis

Key segments that contributed to the derivation of the wound closure devices market analysis are product, wound type, and end user.

- Based on product, the wound closure devices market is segmented into sutures, adhesives, staplers, strips, and others. The sutures segment held the largest share of the market in 2024.

- In terms of wound type, the wound closure devices market is bifurcated into chronic wound and acute wound. The chronic wound segment dominated the market in 2024.

- In terms of end user, the wound closure devices market is categorized into hospitals, clinics, ambulatory surgical centers, and others. The hospitals segment dominated the market in 2024.

Wound Closure Devices Market Share Analysis by Geography

The geographic scope of the wound closure devices market report mainly focuses on five regions: North America, Asia Pacific, Europe, South & Central America, and the Middle East & Africa. In terms of revenue, North America dominated the market in 2024. It is expected to continue its dominance in the global market during the forecast period. The US is the largest market for wound closure devices in the world. Chronic wounds associated with diabetes include foot, venous, and pressure ulcers. According to The International Journal of Tissue Repair and Regeneration, active or healed venous ulcers occur in 1% of the US population. As per the National Diabetes Statistics Report 2020, a publication of the Centers for Disease Control and Prevention (CDC), 34.2 million people of all ages in the US have diabetes, and ~1 million diabetics develop a foot ulcer each year, while 6-7 million diabetes patients develop ulcers in their lifetime. Thus, the rising incidence of diabetes and chronic wounds leads to an increase in demand for wound dressing and contributes to the wound closure devices market growth during the forecast period. Companies in the US are focused on expanding their presence by adopting organic and inorganic strategies. In October 2021, Medline Industries announced an investment of US$ 77.5 million to build a new distribution center in Kansas.

Wound Closure Devices

Wound Closure Devices Market Regional Insights

The regional trends influencing the Wound Closure Devices Market have been analyzed across key geographies.

Wound Closure Devices Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 11.86 Billion |

| Market Size by 2031 | US$ 17.46 Billion |

| Global CAGR (2025 - 2031) | 5.8% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Wound Closure Devices Market Players Density: Understanding Its Impact on Business Dynamics

The Wound Closure Devices Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Wound Closure Devices Market News and Recent Developments

The wound closure devices market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. Below are a few of the key developments witnessed in the wound closure devices market:

- CooperSurgical, a brand of CooperCompanies, acquired obp Surgical, a US-based medical device company with a suite of single-use cordless surgical retractors with an integrated multi-LED light source and dual smoke evacuation channels. The acquisition, worth approximately US$ 100 million, also included single-use surgical suction devices with an integrated, cordless radial LED light source. The acquisition of obp Surgical’s distinctive ONETRAC portfolio of surgical retractors and suction devices complements CooperSurgical’s existing surgical portfolio, including INSORB, Lone Star, and the Doppler Blood Flow Monitor. (Source: CooperSurgical, August 2024)

- Advanced Medical Solutions Group plc, a globally leading specialist in tissue healing technologies, agreed to execute the proposed acquisition of Peters Surgical, a leading global provider of specialty surgical sutures, mechanical hemostasis, and internal cyanoacrylate devices. (Source: Advanced Medical Solutions Group plc., Press Release, June 2024)

Wound Closure Devices Market Report Coverage and Deliverables

The "Wound Closure Devices Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Wound closure devices market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Wound closure devices market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Wound closure devices market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the wound closure devices market

- Detailed company profiles

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For