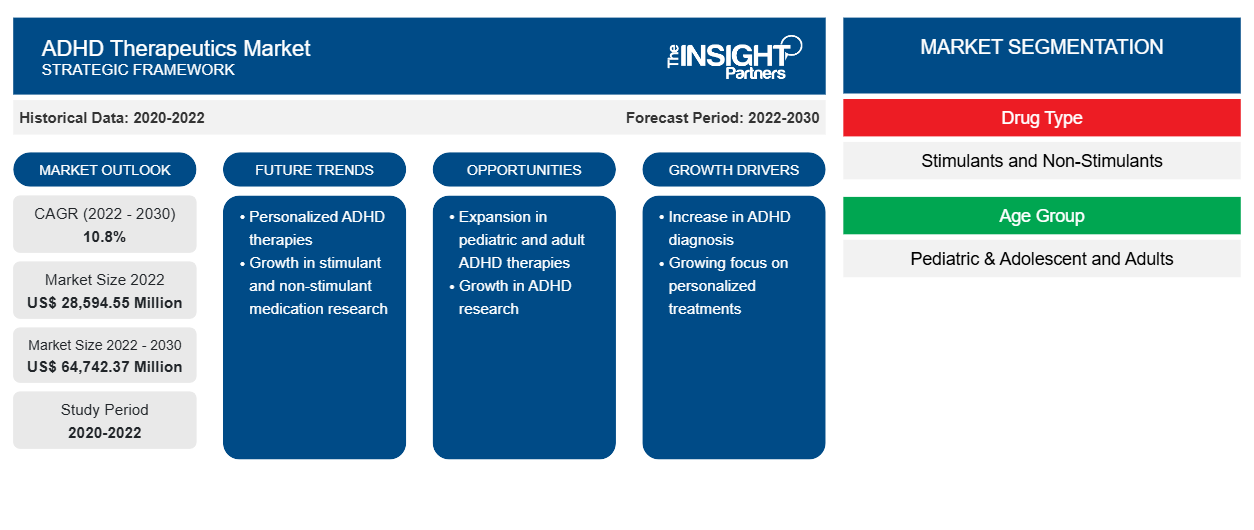

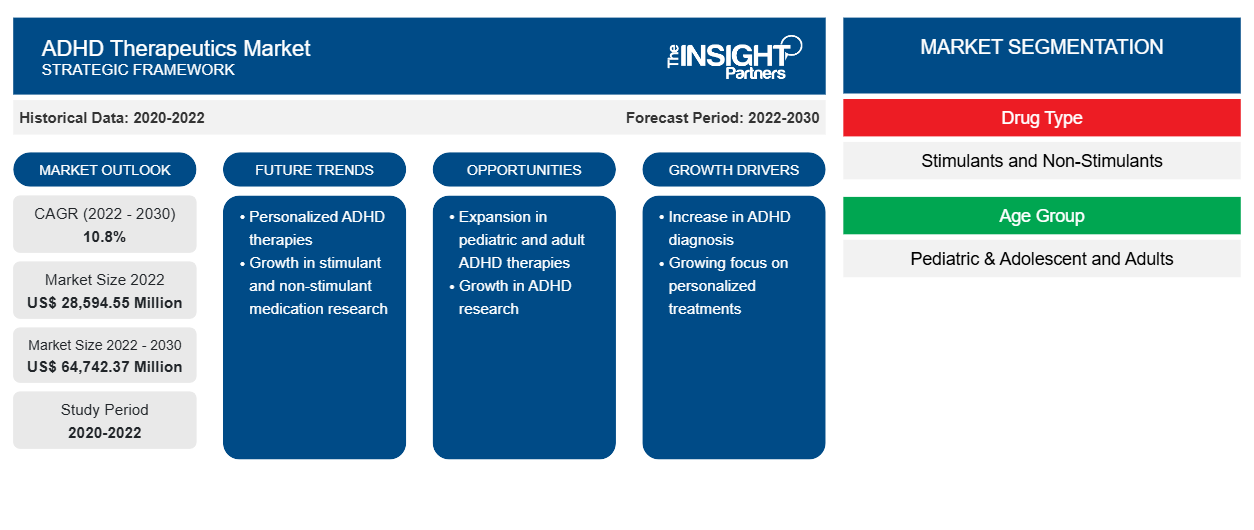

[Research Report] The ADHD therapeutics market size was valued at US$ 28,594.55 million in 2022 and is expected to reach US$ 64,742.37 million by 2030; it is estimated to record a CAGR of 10.8% during 2022–2030.

Market Insights and Analyst View:

Attention deficit/hyperactivity disorder (ADHD) is a complex neurodevelopment disorder that affects individuals’ ability to focus, control impulsive behaviors, and manage hyperactivity. It is mostly diagnosed in childhood, but symptoms can persist into adolescence and adulthood. Treatment for ADHD often involves a multidisciplinary approach, including behavioral therapy, education, and medication such as stimulants and non-stimulants.

Factors such as the growing prevalence of ADHD and a surge in the demand for treatment drugs propel the growth of the market. However, side effects associated with ADHD drugs and their limited relief impede the ADHD therapeutics market growth.

Growth Drivers and Restraints:

As per the article published by the Centers for Disease Control and Prevention (CDC), in February 2022, approximately 6 million children aged 3–17 years in the US were diagnosed with ADHD, accounting for 9.8% of the population between 2016 and 2019. Additionally, according to an article published by PubMed Central in 2022, ADHD affects 5–7.2% of children and 2.5–6.7% of adults worldwide. According to recent estimates, the frequency of adolescents in the US is much greater, at roughly 8.7% or 5.3 million. Although it has traditionally been thought of as a childhood condition, up to 90% of children with ADHD continue to have symptoms in adulthood. It is also possible to diagnose in adults because 75% of individuals with ADHD were not previously diagnosed during childhood, according to a research study. ADHD is frequently associated with comorbid conditions such as anxiety, depression, learning disorders, and substance abuse. The presence of these comorbidities increases the treatment complexity, necessitating a multi-dimensional approach that addresses both ADHD symptoms and associated conditions. Drugs such as psychostimulants and non-stimulants are recommended, which can assist children in managing their ADHD symptoms in their daily lives and can help regulate behaviors that may cause difficulties in various aspects of their lives, including personal life and academic performance. Thus, the factors mentioned above are increasing the demand for drugs indicated for ADHD, facilitating the expansion of the ADHD therapeutics market share.

However, the growth of the ADHD therapeutics market is restricted due to the limited relief of symptoms and the side effects associated with the use of therapeutics. Common side effects of psychostimulant medication include decreased appetite, insomnia, increased anxiety, increased irritability, stomach ache, and headache. When the effects of the medication wear off, ADHD symptoms may return, causing the "rebound" effect that can be more intense.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

ADHD Therapeutics Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

ADHD Therapeutics Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The “ADHD therapeutics market analysis” has been carried out by considering the following segments: drug type, age group, and distribution channel.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Segmental Analysis:

The ADHD therapeutics market, by drug type, is segmented into stimulants and non-stimulant drugs.

The stimulant drug segment held a larger ADHD therapeutics market share in 2022 and is anticipated to register a higher CAGR during 2022–2030.

ADHD Therapeutics Market by Drug Type – 2022 and 2030

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Based on age group, the ADHD therapeutics market is segmented into pediatric & adolescent and adult. The pediatric & adolescent segment held a larger market share in 2022. The adult segment is anticipated to register a higher CAGR from 2022 to 2030.

In terms of distribution channel, the ADHD therapeutics market is categorized into hospital pharmacies, retail pharmacies, and E-commerce. In 2022, the hospital pharmacies segment held the largest market share and is anticipated to register the highest CAGR during 2022–2030.

Regional Analysis:

North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa are the major regions analyzed for deriving the ADHD therapeutics market report scope.

In 2022, North America held the largest global market share. In North America, the US held the largest share of the market in 2022 and is estimated to continue its dominance from 2022 to 2030. The ADHD therapeutics market growth is largely driven due to the high prevalence of ADHD in the US. According to Cingulate, ~6.4 million children and adolescents between 4 and 17 years of age were diagnosed with ADHD in 2022. Among them, over 80% of this group receive treatment, and about 65% experience ongoing symptoms of ADHD into adulthood. Additionally, improved patient affordability, favorable reimbursement policies, and increased awareness of current drugs are expected to drive market growth.

Asia Pacific is the fastest-growing market for ADHD owing to the presence of key players in the region and several strategic initiatives undertaken to develop and market new products. For example, in June 2020, Otsuka Pharmaceutical Co., Ltd. and Otsuka Pharmaceutical Development & Commercialization, Inc. reported positive results from its two six-week phase 3 clinical trials that assessed the effectiveness, safety, and tolerability of oral centanafadine. Centanafadine is a new experimental drug designed to treat adult patients diagnosed with ADHD. The company also planned to study the effects of centanafadine in children with ADHD and to discuss the next steps with the US Food and Drug Administration.

Industry Developments and Future Opportunities:

The ADHD therapeutics market forecast can help stakeholders in this marketplace plan their growth strategies. Initiatives taken by key players performing in the market are listed below:

- In September 2023, Cingulate Inc. announced results from its Phase 3 study of adult efficacy and safety of its lead candidate, CTx-1301 (dexmethylphenidate), for treating ADHD. The company utilizes Precision Timed Release (PTR), its patented drug delivery platform technology, to build and advance a pipeline of next-generation pharmaceutical products. The results were presented on September 8th at the 36th Annual Psych Congress in Nashville, TN.

- In March 2022, Noven Pharmaceuticals, Inc., a completely owned subsidiary of Hisamitsu Pharmaceutical Co., Inc., got approval from the US Food and Drug Administration (FDA) for its XELSTRYM (dextroamphetamine) transdermal system, CII, for the treatment of ADHD in adults and pediatric patients aged six years and above.

- In July 2021, Corium, Inc. launched AZSTARYS. This innovative medication combines Serdexmethylphenidate (SDX) and dexmethylphenidate (d-MPH) in the US for symptomatic treatment in patients aged 6 years and above. AZSTARYS got FDA approval in March 2021. It comprises a combination of two types of medication: 70% extended-release prodrug of d-MPH SDX (Schedule IV) and 30% immediate-release d-MPH (Schedule II).

- In April 2021, Supernus Pharmaceuticals, Inc. announced that the US FDA had approved a Qelbree (viloxazine extended-release capsules) to treat ADHD in patients aged 6–17.

Competitive Landscape and Key Companies:

Amneal Pharmaceuticals, Inc.; Novartis AG; Pfizer, Inc.; Eli Lilly and Company; Noven Pharmaceuticals, Inc.; Janssen Pharmaceuticals, Inc.; Johnson & Johnson Services, Inc.; Corium Inc; Adlon Therapeutics LP; and Teva Pharmaceutical Industries Ltd. are among the key players profiled in the ADHD therapeutics market report. These companies adopt product development strategies to meet growing customer demands, which allows them to maintain their brand name.

ADHD Therapeutics Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 28,594.55 Million |

| Market Size by 2030 | US$ 64,742.37 Million |

| Global CAGR (2022 - 2030) | 10.8% |

| Historical Data | 2020-2022 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Drug Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Frequently Asked Questions

What was the estimated size of the ADHD Therapeutics market in 2022?

The digital health market was valued at US$ 28,594.55 billion in 2022.

Which drug type segment dominates the ADHD Therapeutics market?

The ADHD Therapeutics market, by drug type, is segmented into stimulants and non-stimulant drugs. The stimulant drug segment held a larger market share in 2022, and the same segment is anticipated to register a higher CAGR during 2022-2030.

Which end-user segment dominates the ADHD Therapeutics market?

The ADHD Therapeutics market, by end-user, is segmented into hospitals and clinics, providers, payers, and others. In 2022, the hospitals and clinics segment held the largest market share, and the same segment is anticipated to register the highest CAGR during 2022–2030.

What is ADHD?

Attention deficit/hyperactivity disorder (ADHD) is a complex neurodevelopment disorder that affects individuals’ ability to focus, control impulsive behaviors, and manage hyperactivity. It is mostly diagnosed in childhood, but symptoms can persist into adolescence and adulthood. Treatment for ADHD often involves a multidisciplinary approach, including behavioral therapy, education, and medication such as stimulants and non-stimulants.

Who are the major players in the ADHD Therapeutics market?

The digital health market majorly consists of the players, including Amneal Pharmaceuticals, Inc.; Novartis AG; Pfizer, Inc.; Eli Lilly and Company; Noven Pharmaceuticals, Inc.; Janssen Pharmaceuticals, Inc.; Johnson & Johnson Services, Inc.; Corium Inc; Adlon Therapeutics LP; and Teva Pharmaceutical Industries Ltd. are among the key players profiled in the ADHD therapeutics market.

What factors drive the ADHD Therapeutics market?

Key factors driving the increasing prevalence of ADHD, combined with the increased demand for drugs for treatment, is propelling the market.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

I wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA, MANAGING DIRECTOR, PineCrest Healthcare Ltd.The Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

Yukihiko Adachi CEO, Deep Blue, LLC.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Strategic Planning

- Investment Justification

- Identifying Emerging Markets

- Enhancing Marketing Strategies

- Boosting Operational Efficiency

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

Get Free Sample For

Get Free Sample For