Prescription Drugs Market Size and Growth 2031

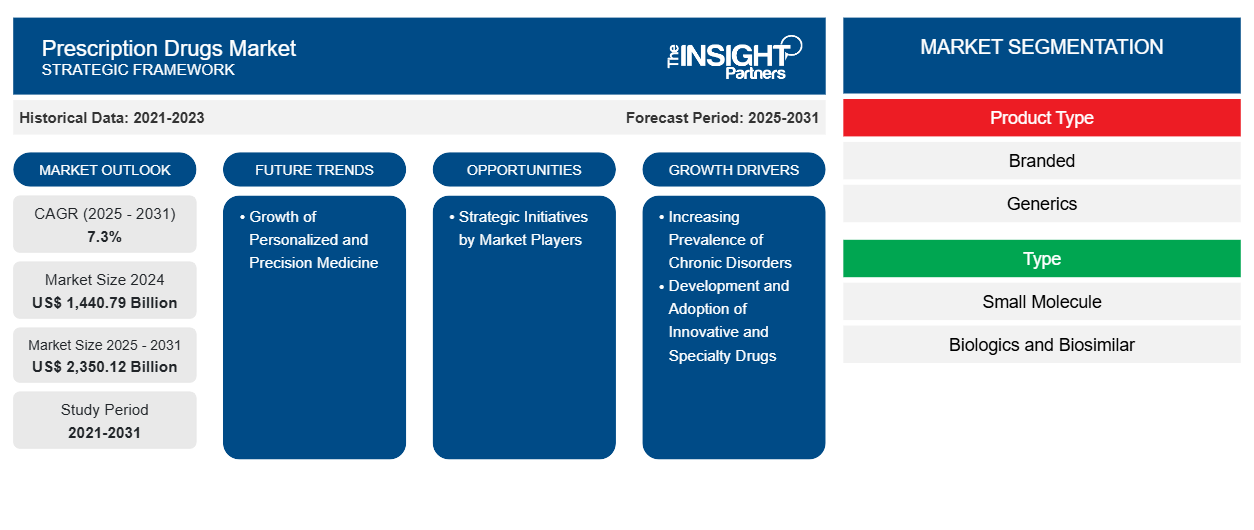

Prescription Drugs Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: Product Type (Branded and Generics), Drug Type (Small Molecule and Biologics and Biosimilar), Therapeutic Area (Oncology, Cardiovascular Diseases, Neurological Diseases, Metabolic Diseases, Respiratory Diseases, Immunology, and Others), Route Of Administration (Oral, Injectable, Topical, and Others), Distribution Channel (Hospital Pharmacies, Retail Pharmacies and Online Pharmacies), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Jul 2025

- Report Code : TIPRE00040966

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 315

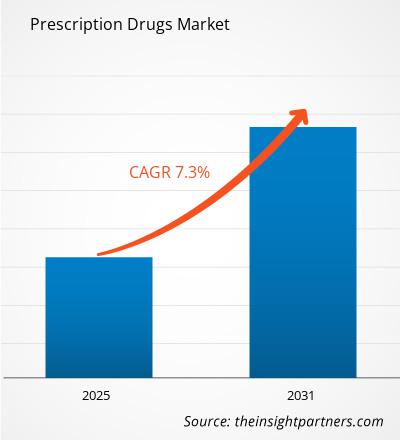

The prescription drugs market size is projected to reach US$ 2,350.12 billion by 2031 from US$ 1,440.79 billion in 2024. The market is expected to register a CAGR of 7.3% during 2025–2031. The growth of personalized and precision medicine is likely to bring new trends in the prescription drugs market in the coming years.

Prescription Drugs Market Analysis

The increasing prevalence of chronic disorders and the rising development and adoption of innovative and specialty drugs boost the prescription drugs market. Additionally, increasing awareness of various conditions and the development of new drugs are expected to contribute to market growth in the near future. Moreover, new product developments, launches, approvals, and expansions are expected to create ample opportunities in the coming years.

Prescription Drugs Market Overview

North America is projected to dominate the prescription drugs market with the largest share during the forecast period. Further, Asia Pacific is expected to register a significant CAGR owing to the aging population, which increases the demand for chronic disease management and long-term medication use. With rising incidences of lifestyle-related diseases, the need for effective prescription drugs has surged. Additionally, improving healthcare infrastructure and increasing access to medical facilities in developing countries such as India, China, and Southeast Asian nations have expanded the reach of prescription medications to previously underserved populations. Rising disposable incomes and expanding middle-class populations have improved affordability and willingness to spend on healthcare, including prescription drugs. Governments in Asia Pacific have prioritized healthcare reforms and increased healthcare expenditure, encouraging better insurance coverage and reimbursement policies that support pharmaceutical consumption.

Technological advancements and the growth of pharmaceutical research and development have led to the innovation of targeted therapies, attracting more patients and physicians to prescribed medicines. The growing awareness and adoption of modern healthcare practices, coupled with urbanization and lifestyle changes, have further contributed to the increased demand for prescription drugs. Moreover, the rise of digital health platforms and telemedicine has improved patient access to healthcare providers, facilitating better diagnosis and prescription compliance.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONPrescription Drugs Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Prescription Drugs Market Drivers and Opportunities

Increasing Prevalence of Chronic Disorders

The increasing aging population and changing lifestyle contribute to a few common long-term health conditions. As per the World Health Organization (WHO), the prevalence of chronic lifestyle diseases is expected to increase by 57% by the end of 2026. With the increasing urbanization, people are more inclined toward a sedentary lifestyle, which results in rheumatoid arthritis, diabetes, and other disorders. Diabetes is one of the major global health issues of the 21st century. According to the International Diabetes Federation (IDF), there were 589 million adults living with diabetes globally in 2024, and it is expected to reach 853 million by the end of 2050. The increase in disease prevalence is expected to be 35% during the forecast period.

Other chronic conditions, such as multiple sclerosis, Crohn’s disease, neurological disorders, and cardiovascular disorders, require various drugs for the long-term management of the chronic conditions. As per the WHO, cardiovascular disorders are one of the leading causes of death, accounting for 17.9 million deaths worldwide every year. Moreover, the nature of chronic diseases often requires the use of multiple medications and advanced therapies, including biologics and specialty drugs that are sold on prescription, which are typically more expensive and generate higher revenues for pharmaceutical companies. Additionally, the development of new treatments is incentivized by the unmet clinical needs of patients with rare diseases, leading to increased investment in research and development by major pharmaceutical firms. Therefore, the increasing prevalence of chronic disorders and unmet clinical needs drives the prescription drugs market.

Strategic Initiatives by Market Players Create Ample Opportunities for Market Growth

Various players in the prescription drugs market focus on product approvals, launches, and strategic collaborations to develop effective products required to treat and manage chronic disorders. Subsequently, several recent developments have taken place in the prescription drugs market. A few are mentioned below:

- In May 2025, Bio-Thera Solutions, Ltd. received FDA approval for Starjemza Injection. It is a human interleukin-12 and -23 antagonist interchangeable biosimilar to Stelara, used to treat Crohn's disease, plaque psoriasis, ulcerative colitis, and psoriatic arthritis.

- In November 2024, Sunshine Biopharma Inc. launched a new generic prescription drug called Ursodiol, also known as ursodeoxycholic acid (UDCA). It is indicated for the management of cholestatic liver diseases, including primary biliary cirrhosis (PBC).

- In June 2024, Teva launched an authorized generic of Victoza (liraglutide injection 1.8 mg) in the US. It is recommended to improve glycemic control in adults and pediatric patients aged 10 years and older living with type 2 diabetes mellitus; it also reduces the risk of cardiovascular events in type 2 diabetes patients.

- In April 2024, ImmunityBio, Inc. received FDA approval for ANKTIVA plus Bacillus Calmette-Guérin (BCG) for the treatment of patients with BCG-unresponsive non-muscle invasive bladder cancer (NMIBC) with carcinoma in situ (CIS), with or without papillary tumors.

- In October 2022, Pfizer Inc. completed the acquisition of Biohaven Pharmaceutical Holding Company Ltd to add a breakthrough calcitonin gene-related peptide portfolio, including NURTEC ODT, to address the needs of migraine patients worldwide.

- In January 2022, Cosette Pharmaceuticals acquired US sales and distribution rights to eight prescription medications from Daiichi Sankyo Company and its affiliates. The products include Benicar, Benicar HCT, Azor, Tribenzor, Welchol, Welchol Oral Suspension, Effient, and Evoxac.

Therefore, increasing product launches, approvals, and strategic collaborations are expected to create ample opportunities for the growth of the prescription drugs market in the coming years.

Prescription Drugs Market Report Segmentation Analysis

Key segments that form the foundation of the prescription drugs market analysis are product type, drug type, route of administration, therapeutic area, and distribution channel.

- Based on product type, the prescription drugs market is bifurcated into branded and generics. The branded segment held a larger market share in 2024 and is expected to register a higher CAGR during 2025–2031.

- By drug type, the prescription drugs market is bifurcated into small molecule and biologics and biosimilar. The small molecule segment held a larger share of the market in 2024. The biologics and biosimilar segment is expected to register a higher CAGR in the market during 2025–2031.

- In terms of therapeutic area, the prescription drugs market is segmented into oncology, cardiovascular diseases, neurological diseases, metabolic diseases, respiratory diseases, immunology, and others. The oncology segment dominated the market in 2024 and is anticipated to register the highest CAGR during 2025–2031.

- By route of administration, the prescription drugs market is segmented into oral, injectable, topical, and others. The oral segment held the largest share of the market in 2024, and is expected to register the highest CAGR in the market during 2025–2031.

- In terms of distribution channel, the prescription drugs market is segmented into hospital pharmacies, retail pharmacies, and online pharmacies. The hospital pharmacies segment dominated the market in 2024 and is anticipated to register the highest CAGR during 2025–2031.

Prescription Drugs Market Share Analysis by Geography

The geographical scope of the prescription drugs market report is mainly divided into five regions: North America, Asia Pacific, Europe, and Middle East & Africa, and South & Central America. North America held a significant share of the market in 2024. The prescription drugs market in North America is driven by the aging population. As the baby boomer generation grows older, the prevalence of chronic diseases such as diabetes, cardiovascular disorders, and cancer has increased, thereby boosting the demand for prescription medications.

Advancements in pharmaceutical research and biotechnology have also played a critical role. Innovations in drug development, including biologics and personalized medicine, have expanded treatment options, enhancing efficacy and safety. The introduction of novel therapies for previously untreatable conditions propelled the market growth.

Another major contributor is the strong healthcare infrastructure in North America, supported by substantial investments in healthcare facilities, insurance coverage, and pharmaceutical distribution networks. The widespread availability of healthcare services and better patient awareness about disease management have increased prescription drug consumption. Additionally, regulatory support from agencies such as the US Food and Drug Administration (FDA) facilitates quicker approval processes for innovative drugs, enabling faster market entry. Furthermore, government initiatives aimed at expanding healthcare coverage, such as the Affordable Care Act in the US, have increased access to prescription drugs for a broader population.

Also, the rise in lifestyle-related diseases and increased prevalence of mental health disorders have created a sustained demand for therapeutic drugs. The COVID-19 pandemic also emphasized the importance of pharmaceutical interventions, accelerating investments in drug development and distribution.

Prescription Drugs

Prescription Drugs Market Regional Insights

The regional trends influencing the Prescription Drugs Market have been analyzed across key geographies.

Prescription Drugs Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 1,440.79 Billion |

| Market Size by 2031 | US$ 2,350.12 Billion |

| Global CAGR (2025 - 2031) | 7.3% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Prescription Drugs Market Players Density: Understanding Its Impact on Business Dynamics

The Prescription Drugs Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Prescription Drugs Market News and Recent Developments

The prescription drugs market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the market are listed below:

- ESTEVE plans to invest 100 million euros in a new manufacturing plant at its Celrà industrial center in Girona, aiming for completion by 2026. The expansion will enhance the production capacity for active pharmaceutical ingredients and add ~100 new jobs, raising the workforce to ~470. The project includes new production and service buildings, with the installation of 150 cubic meters of reaction volume, resulting in a 45% increase in production capacity at Celrà and a 15% boost in the company’s overall capacity. (Source: ESTEVE, Company Website, June 2025)

- Roche will invest US$ 50 billion in the US in the next five years. These investments further strengthen Roche’s significant US footprint with 13 manufacturing and 15 research and development sites across the Pharmaceutical and Diagnostics Divisions, and are expected to create more than 12,000 new jobs, including ~6,500 construction jobs, as well as 1,000 jobs at new and expanded facilities. (Source: F. Hoffmann-La Roche Ltd , Company Website, April 2025)

- Pfizer Inc. received the U.S. Food and Drug Administration (FDA) approval for the supplemental Biologics License Application (sBLA) for ADCETRIS (brentuximab vedotin) in combination with lenalidomide and a rituximab product. This treatment is for adult patients with relapsed or refractory large B-cell lymphoma (LBCL), including various forms of diffuse large B-cell lymphoma (DLBCL), following two or more lines of systemic therapy. It is intended for those who are not eligible for autologous hematopoietic stem cell transplantation (auto-HSCT) or CAR T-cell therapy. (Source: Pfizer Inc., Company Website, February 2025)

Prescription Drugs Market Report Coverage and Deliverables

The “Prescription Drugs Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Prescription drugs market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Prescription drugs market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Prescription drugs market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the prescription drugs market

- Detailed company profiles

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For