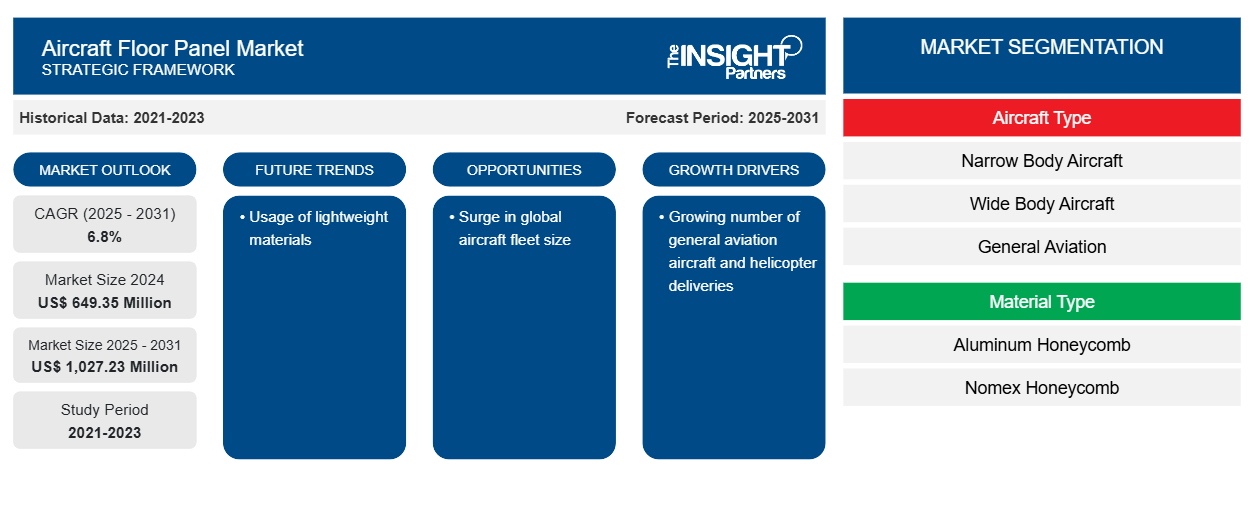

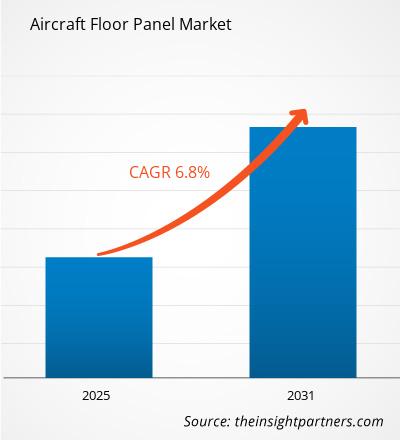

The aircraft floor panel market size is projected to reach US$ 1,027.23 million by 2031 from US$ 649.35 million in 2024. The market is expected to register a CAGR of 6.8% during 2025–2031. Focus on fabricating sustainability in aerospace manufacturing is likely to bring new trends in the market in the coming years.

Aircraft Floor Panel Market Analysis

The key factors fueling the growth of the aircraft floor panel market include the increasing number of MRO activities in emerging economies, a growing number of general aviation aircraft and helicopter deliveries, and a rising number of orders and production of narrow body aircraft. However, an increase in geopolitical events hinders the supply chain of aircraft components, further hampering the growth of the aircraft floor panel market. Irrespective of the hindrances, the integration of simulation technologies is projected to create opportunities for the key players operating in the market during the forecast period.

Aircraft Floor Panel Market Overview

According to The Insight Partners analysis, in 2023, North America had a fleet of more than 8,000 operational commercial aircraft, which is expected to reach ~10,000 by the end of 2033. Such a huge number of operating commercial aircraft will further generate the demand for aircraft floor panel products in this region. Moreover, the increase in the number of aircraft fleets across North America is expected to bolster the requirement for aircraft floor panels from the major aircraft MRO companies.

One of the factors catalyzing the aircraft floor panel market is the continued emphasis on increasing the spending on maintenance and repair activities of various components. Furthermore, MRO service providers in the region continually focus on adopting innovative materials for aircraft floor panels. Aircraft MRO service companies, airlines, and military forces are adopting lightweight materials for each component of the aircraft to increase fuel efficiency. Aircraft MRO companies are adopting advanced materials for manufacturing aircraft floor panels. For instance, in March 2022, Airbus's subsidiary Satair launched an advanced aircraft floor panel product aimed at repairing and replacing aircraft cabin floors of Airbus. The company developed these aircraft floor panels in collaboration with Airbus and German composites manufacturer Schutz. Satair's Airbus semi-finished floor panel (ASFP) was developed in response to overcoming the challenges with traditional floor panel solutions. Satair reduced weight and downtime required for repairs and replacements in passenger, aisle, and galley areas.

The raw material suppliers in the aircraft floor panel market include aluminum alloy manufacturers, composites suppliers, and carbon fiber manufacturers. The demand for aircraft parts is majorly driven by new orders for military and commercial aircraft and the rising requirement from aircraft MRO service providers. The raw material suppliers include HD Metal Materials Co., Ltd.; Fonnov Aluminum; Euro-Composites; and Dupont.

Major suppliers in the market include Comtek Advanced Structures, EFW, The Gill Corporation, Jones Metal Products, EnCore Group, Collins Aerospace, Satair, Skytecno, The NORDAM Group LLC, Composite Industrie, and Triumph Group. The aircraft floor panel is a crucial component for any type of aircraft, including commercial, military, and business. The demand for aircraft floor panels is majorly driven by the rising number of new orders for military and commercial aircraft, along with a surge in demand from the aircraft MRO service providers.

The increasing requirement for aircraft MRO services and the rising demand for new commercial and military aircraft drive the aircraft floor panel market. To provide robust maintenance services to various aircraft components, companies such as Lufthansa Technik AG, AAR Corp., and Rolls-Royce PLC are increasingly focusing on developing innovative aircraft floor panels. Airbus, Boeing, GE Aviation, Safran Power Systems, and Rolls Royce are among the major aircraft manufacturers that require aircraft floor panels.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Aircraft Floor Panel Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Aircraft Floor Panel Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Aircraft Floor Panel Market Drivers and Opportunities

Increasing Orders and Production of Single Aisle Aircraft

In the last two years, Boeing and Airbus have experienced a significant increase in orders for narrow body aircraft. According to the Airbus order and delivery database, there were 820 commercial aircraft orders in 2022, which reached 2,094 in 2023. However, there was a rise in deliveries for narrow body aircraft—such as A220, A319 & A320, and A321—compared to the wide body aircraft—such as A330 and A350—in 2023, shown in the figure below.

Airbus and Boeing are the two aircraft manufacturing giants with significantly higher volumes of orders and delivery statistics. These two aircraft original equipment manufacturers (OEMs) continuously encounter orders for various aircraft models from civil airlines.

Airbus estimates that 40,850 new passenger and cargo aircraft will be delivered from 2023 to 2042, of which approximately 32,630 will be typical single-aisle aircraft, and 8,220 will be typical wide body aircraft. In addition, the requirement for freight aircraft is projected to reach ~2,510 aircraft, with around 920 newly built freight aircraft during the same timeframe. Thus, the rising number of orders and production of narrow body aircraft is boosting the aircraft floor panel market growth.

Retrofitting of Older Aircraft Fleet

Retrofitting facilitates passenger comfort and safety and helps airlines maintain their older fleets. One substantial example is Air India's aircraft retrofit program in 2024. This initiative is anticipated to focus on cabin retrofits across its legacy widebody fleets and some narrow body aircraft. The goal is to modernize the passenger experience and ensure that the aircraft meets current comfort and safety standards. Air India is targeting retrofitting over 100 planes, including 40 wide body planes, and has ordered ~25,000 aircraft seats as part of revamping the fleet. Continuous advancements in aircraft technologies are leading to the upgrade of MRO capabilities. MRO service companies are continuously seeking upgrades and purchasing newer technologies in order to service the newer aircraft as well as retrofit the advanced technologies on the older aircraft fleets. This factor is compelling the airlines to opt for MRO activities frequently, facilitating the MRO service providers to offer the airlines to retrofit the aircraft fleet with newer technologies. Thus, the integration of advanced and modern technologies into older aircraft fleets is expected to bring new trends into the aircraft floor panel market in the coming years.

Aircraft Floor Panel Market Report Segmentation Analysis

Key segments that contributed to the derivation of the aircraft floor panel market analysis are aircraft type, material type, application, and end use.

- Based on aircraft type, the aircraft floor panel market is segmented into narrow body aircraft, wide body aircraft, general aviation, and others. The narrow-body aircraft segment held the largest market share in 2024.

- By material type, the market is divided into aluminum honeycomb and Nomex honeycomb. The Nomex honeycomb segment held a larger share of the market in 2024.

- Based on application, the market is divided into commercial aviation and military aviation. The commercial aviation segment held a larger share of the market in 2024.

- Based on end use, the market is divided into OEMs and aftermarket. The OEMs segment held a larger share of the market in 2024.

Aircraft Floor Panel Market Share Analysis by Geography

The geographic scope of the aircraft floor panel market report is mainly divided into five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America. North America dominated the aircraft floor panel market in 2024; it is likely to continue its dominance during the forecast period. The US, Canada, and Mexico are the major economies in North America. Asia Pacific is likely to register the highest CAGR during the forecast period of 2025-2031. The increasing demand for aircraft floor panels is primarily driven by the rapid growth of aircraft MRO services in Asia Pacific. Numerous global players are expanding their MRO facilities across APAC. For instance, in July 2022, Safran AB (one of the leading suppliers of key aircraft components, including landing gear, wheels and brakes, and wiring) announced an investment of US$ 305 million in India to expand its MRO activities in the region. The company is planning to invest US$ 204.15 million in one of the largest MRO facilities in the world in Hyderabad, India. Several aircraft MRO companies are investing in Asia Pacific to increase their service capabilities. For instance, in February 2023, O Collins Aerospace, an aviation avionics manufacturer, invested more than US$ 27 million to double the size of its aircraft MRO operations in Xiamen, China, and quadruple its facility size in Selangor, Malaysia. The additional capacity increased the demand for several aircraft components, including floor panels, airframes, and others.

APAC has had a strong import of advanced commercial aircraft in the past few years owing to an increase in international travelers in countries such as India, China, Japan, and Taiwan. Owing to the increasing number of aircraft and airports, the demand for aircraft floor panel products is likely to increase during the forecast period. The region is expected to account for ~40% of the future airline production to cater to the aircraft demand. The growing number of airports and the increasing regional flight connections among Asian nations are boosting the demand for aircraft floor panels.

In addition, Southeast Asian countries have witnessed growth in the overall aviation industry in recent years. The rising demand for new aircraft from Southeast Asian countries is driving the aircraft floor panel market growth. For instance, in November 2024, Vietnam Airlines ordered 50 aircraft in 2025 with Boeing as the top contractor. Vietnam Airlines invested more than US$ 7.8 billion to procure 50 aircraft from different manufacturers across the globe.

Aircraft Floor Panel Market Regional Insights

The regional trends and factors influencing the Aircraft Floor Panel Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Aircraft Floor Panel Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Aircraft Floor Panel Market

Aircraft Floor Panel Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 649.35 Million |

| Market Size by 2031 | US$ 1,027.23 Million |

| Global CAGR (2025 - 2031) | 6.8% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Aircraft Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Aircraft Floor Panel Market Players Density: Understanding Its Impact on Business Dynamics

The Aircraft Floor Panel Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Aircraft Floor Panel Market are:

- Singapore Technologies Engineering Ltd

- Collins Aerospace

- Safran SA

- Triumph Group Inc

- Latecoere SA

- The Gill Corporation

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Aircraft Floor Panel Market top key players overview

Aircraft Floor Panel Market News and Recent Developments

The aircraft floor panel market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the aircraft floor panel market are listed below:

- The Gill Corporation introduced Gillfab 5433F, a lightweight hybrid laminate material designed specifically for the rigorous conditions found in aircraft cargo areas. This innovative material features aluminum faces bonded with an epoxy laminate, fortified by woven fiberglass, providing exceptional resilience in high-traffic zones such as around cargo doors and within bulk cargo sections. (The Gill Corporation, Press Release, 2024)

Comtek Advanced Structures Ltd., a Latecoere Company (Comtek), has been awarded the design-build contract for composite floors on the De Havilland Aircraft of Canada Limited (De Havilland Canada) De Havilland Canadair 515. The scope includes the complete flooring system for cabin and cockpit areas. (Comtek Advanced Structures Ltd, Press Release, 2024)

The Gill Corporation (TGC) announced it had been awarded a production contract extension with Boeing to supply fabricated floor panel assemblies for the Boeing 777, 777X, and 787 programs. The company provides the "drop-in ready" kitted chipsets directly to Boeing. TGC was initially awarded the tier 1 contract for the 787 program in 2014, followed by fabrication contracts for the 777 and 777X programs, all of which utilized TGC's lightweight, high-performance composite sandwich panels. (The Gill Corporation, Press Release, 2022)

Aircraft Floor Panel Market Report Coverage and Deliverables

The "Aircraft Floor Panel Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Aircraft floor panel market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Aircraft floor panel market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter’s Five Forces and SWOT analysis

- Aircraft floor panel market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the aircraft floor panel market

- Detailed company profiles

Frequently Asked Questions

Which is the leading application segment in the aircraft floor panels market?

The commercial aviation segment led the aircraft floor panels market with a significant share in 2024.

Which is the fastest-growing region in the aircraft floor panels market?

North America is anticipated to have largest share in aircraft floor panels market.

What are the future trends of the aircraft floor panels market?

Usage of Lightweight Materials; and Retrofitting of Older Aircraft Fleet are some of the key trends in the aircraft floor panels market.

Which are the leading players operating in the aircraft floor panels market?

The key companies operating in the aircraft floor panels market include Singapore Technologies Engineering Ltd, Collins Aerospace, Safran SA, Triumph Group Inc, Latecoere SA, The Gill Corporation, Nordam Group LLC, Aeropair Ltd., The Boeing Co., VINCORION Advanced Systems GmbH, JCB Aero, Jones Metal Products, Geven Spa, LMI Aerospace, Eco Earth Solutions, and Euro Composite SA

What are the driving factors impacting the aircraft floor panels market?

Growing Number of General Aviation Aircraft and Helicopter Deliveries; and The Rising Number of Orders and Production of Narrow Body Aircraft are some of the major factor propelling the growth of aircraft floor panels market.

What is the estimated global market size for the aircraft floor panels market in 2024?

The aircraft floor panels market was valued at US$ 649.35 million in 2024 and is projected to reach US$ 1,027.23 million by 2031; it is expected to register a CAGR of 6.8% during 2025–2031.

What will the aircraft floor panels market size be by 2031?

The aircraft floor panels market is expected to reach US$ 1,027.23 million by 2031.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Aircraft MRO Market

- Helicopter Hoists Winches and Hooks Market

- Fixed-Base Operator Market

- Aerospace Fasteners Market

- Aerospace Stainless Steel And Superalloy Fasteners Market

- Military Optronics Surveillance and Sighting Systems Market

- Smoke Grenade Market

- Airport Runway FOD Detection Systems Market

- Artillery Systems Market

- Aircraft Brackets Market

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - Aircraft Floor Panel Market

- Singapore Technologies Engineering Ltd.

- Collins Aerospace

- Safran SA

- Triumph Group Inc.

- Latecoere SA

- The Gill Corporation

- Nordam Group LLC

- Aeropair Ltd.

- The Boeing Co.

- VINCORION Aqdvanced Systems GmbH

- JCB Aero

- Jones Metal Products

- Geven Spa

- LMI Aerospace

- Eco Earth Solutions

- Euro Composite SA

Get Free Sample For

Get Free Sample For