Aircraft MRO Market Size and Growth 2031

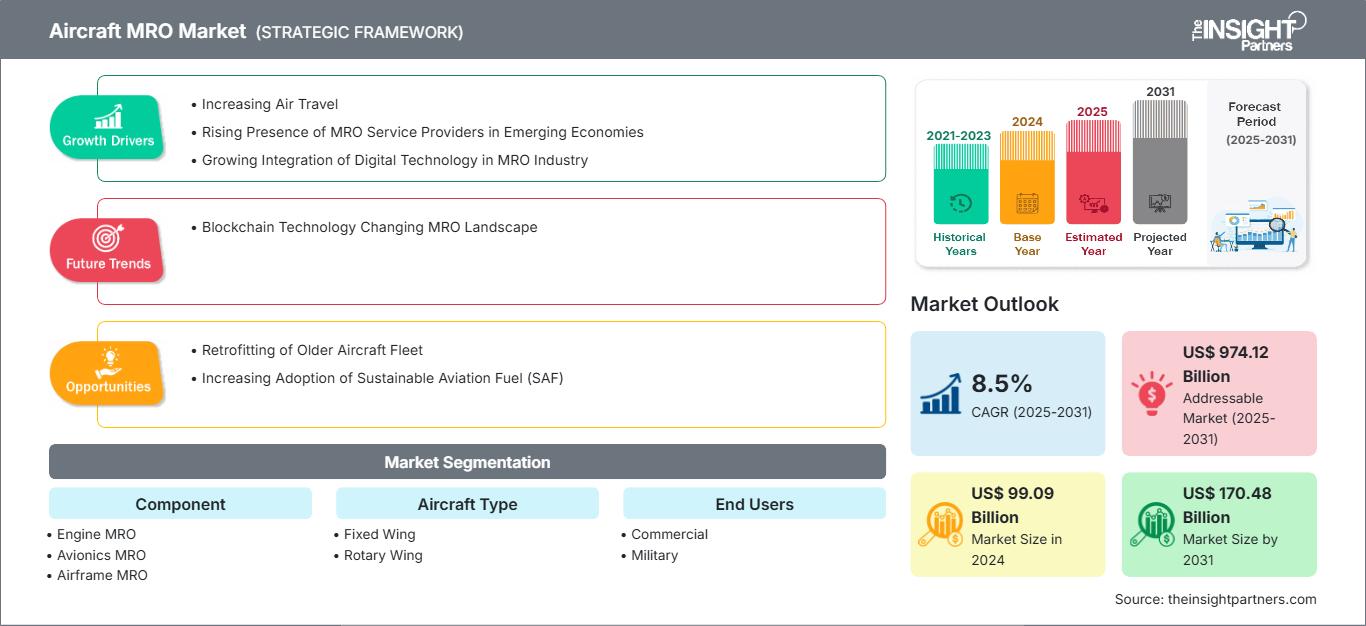

Aircraft MRO Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Engine MRO, Avionics MRO, Airframe MRO, Cabin MRO, Landing Gear MRO, and Others), Aircraft Type (Fixed Wing and Rotary Wing), End Use (Commercial and Military), and Geography

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Jul 2025

- Report Code : TIPRE00007899

- Category : Aerospace and Defense

- Status : Published

- Available Report Formats :

- No. of Pages : 237

The aircraft MRO market size is projected to reach US$ 170,482.90 million by 2031 from US$ 99,086.94 million in 2024. The market is expected to register a CAGR of 8.5% during 2025–2031. Blockchain technology is transforming the MRO landscape, which is likely to introduce new trends in the market in the coming years.

Aircraft MRO Market Analysis

The aviation industry is growing and will continue to grow, owing to the ever-expanding global middle class. According to the report published by IATA in January 2025, the aviation industry experienced a significant rebound in 2024, with total full-year traffic measured in revenue passenger kilometers (RPKs) rising by 10.4% compared to 2023, surpassing pre-pandemic levels by 3.8%. This growth was driven by a robust increase in both international and domestic travel, with international traffic increasing by 13.6% and domestic traffic by 5.7%. The overall capacity, measured in available seat kilometers (ASK), also saw a notable rise of 8.7%, leading to a record load factor of 83.5% for the year. The Civil Aviation Administration of China (CAAC) aims to build 216 new airports by 2035 to meet the growing demands for air travel, which will have a direct impact on the aircraft MRO market in a positive way.

Major factors driving the growth of the aircraft MRO market worldwide include increasing air travel, rising presence of MRO service providers in emerging economies, and growing integration of digital technology in the MRO industry. According to the Insight Partners analysis, the global commercial aircraft fleet stood at ~29,000 aircraft in January 2025, which is likely to reach ~38,300 aircraft by the end of 2035. Similarly, the global air passenger traffic stood at around 9.5 billion passengers in 2024, witnessing an increase of around 10% compared to the global air passenger traffic of 2023. Moreover, the air passenger traffic of 2024 was equivalent to 104% of the 2019 levels, showing a full recovery to pre-pandemic levels.

Aircraft MRO Market Overview

The rapidly growing aviation industry in recent years has increased the demand for airline MRO services. The emerging economies, such as those in APAC, are highly focused on extending MRO services to commercial as well as military aircraft companies. Major aircraft MRO businesses in APAC include Guangzhou Aircraft Maintenance Engineering Co., Ltd. (GAMECO), China; MTU Maintenance; and ExecuJet Haite Aviation Services China Co., Ltd. Heavy spending on aviation infrastructure, economic growth, and an increase in passenger count are the factors propelling the adoption of aircraft maintenance services. Moreover, the soaring number of middle-class travelers, especially in APAC countries such as China, Singapore, and India, is the main factor contributing to air travel growth, which is consequently increasing the need for aircraft maintenance services in the region. The Rest of APAC countries, which include Singapore, Malaysia, and Thailand, produce a large amount of revenue from the aviation MRO market due to well-established MRO hubs. For instance, Singapore dominates the Rest of APAC due to its established MRO hubs, and major market players such as GE Aviation, Airbus, and Rolls-Royce have substantial footprints in Singapore. According to the Wisconsin Economic Development Corporation (WEDC), Singapore houses 120 aerospace companies, which have gathered one-quarter of the APAC MRO market.

- In 2025, Safran Electronics & Defense announced the expansion of its activities in India with the opening of a new production site for electronic cards and aeronautics and defense calculators in Bengaluru, as well as a new research and development center in electronics.

- In 2024, Safran announced that it is building one of its largest MRO facilities in Hyderabad, India.

- In 2025, Thales opened its new avionics MRO facility in Gurugram, near the New Delhi airport.

- In 2023, Pratt & Whitney and Mitsubishi Heavy Industries Aero Engines Ltd. announced a second operational GTF MRO facility in Japan.

Such establishments and the expansion of existing MRO facilities across emerging regions are further propelling the growth of the aircraft MRO market.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONAircraft MRO Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Aircraft MRO Market Drivers and Opportunities

Growing Integration of Digital Technology in MRO Industry

Considering the growing competition worldwide, the implementation of digital technologies is a necessary step toward the growth of MRO companies; this helps them create continuous data flow through various levels of the supply chain, further streamlining the communication between the stakeholders and accelerating innovation in various operations. The digital revolution in the aviation industry significantly impacts all areas of the supply chain of the aviation industry, including aircraft operations, air traffic management, and aircraft and component manufacturing and servicing. The data-driven technologies, such as data analytics, which help track aircraft MRO activities in real-time, would also optimize the air travel experience of crew and passengers. Other advanced technologies, such as AI and machine learning, facilitate the airline crew and management to understand the airworthiness of the aircraft. Also, the MRO service providers incorporate AI technologies to boost their procedures by easily and efficiently conducting visual checks and understanding the degree of maintenance and repairs required on the aircraft. Thus, the increasing integration of digital technologies such as AI and machine learning drives the aircraft MRO market.

Retrofitting of Older Aircraft Fleet

Retrofitting, which refers to the installation or addition of newer technologies on older aircraft fleets, helps increase passenger comfort and safety and facilitates the airlines in maintaining their older fleets. Continuous advancements in aircraft technologies are resulting in the upgrade of MRO capabilities. MRO service providers are constantly seeking upgrades and procurement of newer technologies in order to service the newer aircraft as well as retrofit the upgraded technologies on the older aircraft fleets. In the current scenario, global commercial airlines are holding on to their older aircraft fleet owing to the drop in fuel prices. This factor is compelling the airlines to opt for MRO activities frequently, which is facilitating the MRO service providers to offer the airlines to retrofit the aircraft fleet with newer technologies. The retrofitting trend is soaring among the MRO service providers. Thus, the integration of advanced and modern technologies into older aircraft fleets is expected to change the aircraft MRO market landscape as well as the face of the aviation industry.

Aircraft MRO Market Report Segmentation Analysis

The key segments contributing to the derivation of the aircraft MRO market analysis are component, aircraft component, and end user. Based on component, the market has been segmented into engine MRO, avionics MRO, airframe MRO, cabin MRO, landing gear MRO, and others. The engine MRO segment held the largest market share in 2024. By aircraft type, the market has been bifurcated into fixed-wing aircraft and rotary-wing aircraft. The fixed-wing aircraft segment held a larger market share in 2024. Further, based on end user, the market has been categorized into commercial and military. The commercial segment held a larger market share in 2024.

Aircraft MRO Market Share Analysis by Geography

The geographical scope of the aircraft MRO market report is divided into five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America. Asia Pacific accounted for the largest market share of 39.1% in 2024 and is projected to register a CAGR of 9.9% during the forecast period. The global air passenger traffic is increasing at a constant pace, which has forced airlines to increase their flight movements and introduce new aircraft. Aircraft MRO activities are essential in keeping up component availability, consistency, and quality. Airline operators depend on MRO services to ensure the safety of the aircraft and enhance fuel efficiency. The MRO market has become a viable business in the aviation industry since original equipment manufacturers (OEMs) mainly focus on aircraft development. In most regions of the world, economic performance has been remarkable over the last few years, largely due to better consumer buying power, growing equity markets, and industry consolidation. In spite of Brexit and various other trade barriers, the global markets have remained relatively stable.

The strong performance in December 2024, with an overall demand increase of 8.6% year-on-year and a load factor reaching 84%, further underscores the sustained recovery and growing appetite for air travel. This consistent demand is likely to drive airlines to invest more in their fleets, leading to an uptick in MRO contracts as they seek to maintain operational efficiency and compliance with safety regulations.

Moreover, the increase in capital expenditure by MRO providers, as seen with Delta TechOps securing nine new component contracts worth US$ 225 million, reflects the industry's readiness to meet this rising demand. As airlines continue to modernize their fleets with next-generation aircraft, MRO providers will need to enhance their capabilities and invest in advanced technologies to support these aircraft models.

Aircraft MRO

Aircraft MRO Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 99.09 Billion |

| Market Size by 2031 | US$ 170.48 Billion |

| Global CAGR (2025 - 2031) | 8.5% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Aircraft MRO Market Players Density: Understanding Its Impact on Business Dynamics

The Aircraft MRO Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Aircraft MRO Market News and Recent Developments

The aircraft MRO market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the aircraft MRO market are listed below:

- Pratt & Whitney, an RTX (NYSE: RTX) business, and Air New Zealand hosted a groundbreaking ceremony for a US$ 150 million, 14,000-square-meter expansion of its Christchurch Engine Centre. The expansion will add maintenance, repair, and overhaul (MRO) capabilities for the Pratt & Whitney GTF engine in New Zealand, with capacity for up to 140 GTF engines overhauls planned annually by 2032. (RTX, Press Release, 2024)

- Rheinland Air Service GmbH (RAS), a leading provider of aircraft maintenance, repair, and overhaul (MRO) services, announced a strategic collaboration with Lufthansa Technik AERO Alzey GmbH (LTAA), a globally recognized MRO provider specializing in regional aircraft engines and a proud member of the Lufthansa Technik Group and Lufthansa Group. (Rheinland Air Service GmbH, Press Release, 2024)

- Eastern Airlines Technic (EASTEC), a subsidiary of China Eastern Airlines, signed a twelve-year exclusive maintenance services agreement with Lufthansa Technik that encompasses the technical support for the auxiliary power units (APUs) of China Eastern Airlines' entire Airbus A350 fleet. Under this long-term contract, Lufthansa Technik will deliver comprehensive MRO services for the aircraft type’s Honeywell HGT1700 APUs at its specialized APU maintenance facility in Hamburg, Germany. (Eastern Airlines Technic, Press Release, 2025)

Aircraft MRO Market Report Coverage and Deliverables

The "Aircraft MRO Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Aircraft MRO market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Aircraft MRO market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter’s Five Forces and SWOT analysis

- Aircraft MRO market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, market share analysis of prominent players, and recent developments for the aircraft MRO market

- Detailed company profiles

Frequently Asked Questions

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For