Aerospace Fasteners Market Dynamics, Recent Developments, and Strategic Insights by 2031

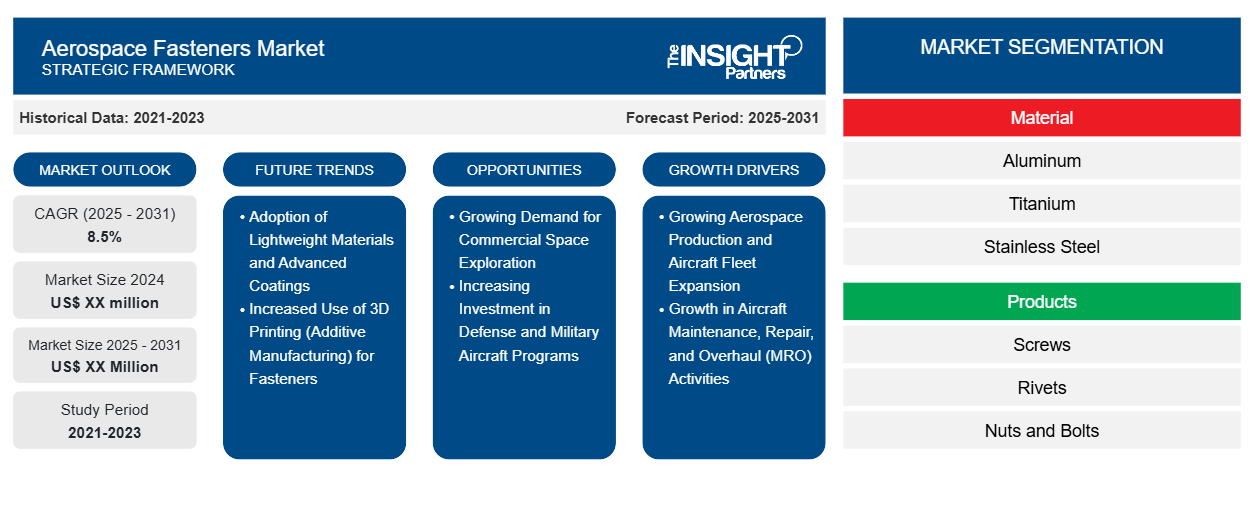

Aerospace Fasteners Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: ByMaterial Type (Superalloys, Aluminum, Stainless Steel, Titanium, and Others), Application (Airframe, Engine, Interiors, and Others), Aircraft Type (Fixed Wing and Rotary Wing), Product Type (Screws, Rivets, Nut or Bolts, and Others), and Geography

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : May 2025

- Report Code : TIPRE00024654

- Category : Aerospace and Defense

- Status : Published

- Available Report Formats :

- No. of Pages : 245

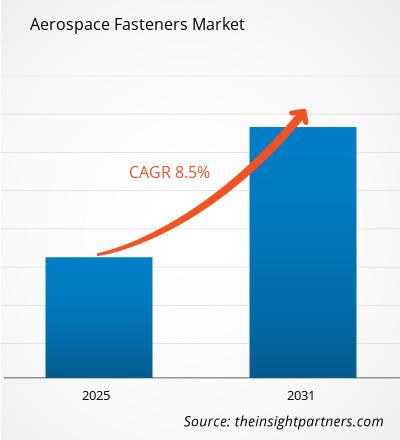

The aerospace fasteners market size is projected to reach US$ 6,161.15 million by 2031 from US$ 4,044.12 million in 2024. The market is expected to register a CAGR of 6.0% during 2025–2031. The retrofitting of older aircraft fleets is likely to bring new trends in the market in the coming years.

Aerospace Fasteners Market Analysis

The air passenger traffic is expanding, driving the airlines to mount their flight movements and commence new aircraft. Aircraft MRO activities are fundamental in maintaining component accessibility, consistency, and quality. Airline operators depend on MRO services to ensure the safety of the aircraft and improve fuel efficiency.

The demand for the maintenance and repair of aircraft parts is witnessing a surge in Asia Pacific. Growth in the aviation industry can be more concentrated in China and India. Countries in the Rest of Asia Pacific, including Singapore and Malaysia, are expected to be the major contributors to the aircraft MRO services sector growth.

The rising investment to expand aircraft fleets across Europe and North America contributes to the growth of the aerospace fasteners market in these regions. In addition, an increase in government initiatives to finance or invest in military and defense aircraft to enhance safety and strengthen the defense sectors of these regions. The growth of the tourism industry in India, Indonesia, Thailand, and Singapore fuels the demand for aircraft fleets.

Aerospace Fasteners Market Overview

The adoption of aerospace fasteners is driven by the growing number of commercial, passenger, and combat aircraft worldwide. The changing modern warfare scenario has driven governments of countries to allocate substantial funds and financial aid toward defense and military air forces. The rising defense expenditure budget indicates the government's emphasis on procuring advanced combat aircraft to fulfill the mounting requirement for security, which is propelling the demand for aerospace fasteners. In 2022, the US government and Lockheed Martin finalized the contract for the production and delivery of up to 398 F-35s for US$ 30 billion. In 2023, the US secured a US$ 12 billion sale of Apache attack helicopters to Poland. Under this deal, Poland is expected to receive 96 units of AH-64E Apache attack helicopters from Boeing.

The increasing number of orders of narrow-body and wide-body aircraft in the commercial aircraft segment fuels the growth of the aerospace fasteners markets in North America, Europe, and Asia Pacific. In 2023, the overall general aviation shipments increased when compared to 2022. The shipments and preliminary aircraft deliveries accounted for US$ 28.3 billion, recording an increase of ~3.3%. As per the General Aviation Manufacturers Association data, in 2023, airplane shipments witnessed a rise compared to 2022. Piston airplane deliveries increased by ~11.8%, with 1,682 units; business jet deliveries increased to 730 units from 712, and turboprop airplane deliveries surged by ~9.6%, with 638 units. The value of airplane deliveries was US$ 23.4 billion in 2023, an increase of ~2.2% from 2022.

Customizee This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONAerospace Fasteners Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Aerospace Fasteners Market Drivers and Opportunities

Benefits Associated with the Utilization of Titanium Fasteners in the Aerospace Industry

Titanium fasteners are the most common alloy used in the aerospace industry. These fasteners are obtained from titanium alloys, often with aluminum and vanadium as primary alloying elements, to enhance strength and other desirable properties. Their high strength-to-density ratio makes them stronger and lighter than steel. Also, its corrosion resistance and high-temperature performance make it the perfect choice for the aerospace industry. Due to their high tolerance to extreme temperatures and pressures, they are used in landing gear, jet engines, fan blades, engine blades, shafts, fuselages, wings, and propellers. Titanium fasteners, in pin or nut form, are used to join components in aircraft assemblies. Since they are 40% lighter than any other component, the demand for lightweight parts has driven the adoption of titanium fasteners globally.

Titanium's ability to withstand extreme temperatures enhances its application in the harshest service conditions. It maintains its structural capability under intense heat, a critical requirement for parts that must withstand the scorching temperatures of jet engines or the heat generated by the friction of atmospheric reentry. Conversely, the resistance to cryogenic temperatures makes it an indispensable component in space exploration, where the abysmal cold of outer space presents a key challenge. In naval aircraft, titanium is the preferred material for structures, landing gear, and fasteners to withstand the corrosive nature of sea fog and the marine atmosphere.

Increasing Number of MRO Activities in Emerging Economies

The growing aviation industry is fueling the demand for airline MRO services. Developing economies, especially countries in Asia Pacific, are concentrating on expanding MRO services to commercial and military aircraft companies. Major aircraft MRO businesses in the Asia Pacific are MTU Maintenance; Guangzhou Aircraft Maintenance Engineering Co., Ltd. (GAMECO), China; and ExecuJet Haite Aviation Services China Co., Ltd. Spending on aviation infrastructure, economic evolution, and surging passenger count boost the adoption of aircraft maintenance services. The rising number of middle-class travelers—especially in Singapore, China, and India—is contributing to air travel evolution and increasing the need for aircraft maintenance services in the region. Malaysia, Singapore, and Thailand generate a large amount of revenue from aviation MRO services owing to well-established MRO hubs. Airbus, GE Aviation, and Rolls-Royce have a significant presence in Singapore. According to the Wisconsin Economic Development Corporation (WEDC), Singapore is home to 120 aerospace companies, which accounts for one-quarter of the MRO service sector in Asia Pacific. Fasteners ensure the structural safety and integrity of aircraft during maintenance activities. Thus, the soaring emphasis on aircraft maintenance, repair, and overhaul (MRO) services across emerging nations drives the growth of the aerospace fasteners market.

Aerospace Fasteners Market Report Segmentation Analysis

The key segments contributing to the derivation of the aerospace fasteners market analysis are material type, application, aircraft type, and product type. Based on material type, the aerospace fasteners market is segmented into superalloys, aluminum, stainless steel, titanium, and others. The titanium segment held the largest market share in 2024. By application type, the aerospace fasteners market is segmented into airframes, engines, interiors, and others. The airframe segment held the largest market share in 2024. As per aircraft type, the aerospace fasteners market is segmented into fixed-wing and rotary-wing. The fixed-wing segment held the largest market share in 2024. Per product type, the aerospace fasteners market is segmented into screws, rivets, nuts/bolts, and others. The nut/bolts segment held the largest market share in 2024.

Aerospace Fasteners Market Share Analysis by Geography

The geographic scope of the aerospace fasteners market report is divided into four main regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America. The global aerospace fasteners market is categorized into North America, Asia Pacific, Europe, the Middle East & Africa, and South America. North America accounts for the largest market share of 35.1% in 2024 and is projected to register a CAGR of 5.5% during the forecast period. The presence of several manufacturers and suppliers of stainless steel and superalloy fasteners in North America and Europe drives the market growth. TriMas, Precision Castparts Corp., Howmet Aerospace Inc., LISI Aerospace SAS, Saturn Fasteners, Inc., National Aerospace Fasteners Corp., and Raychin Limited are key players based in North America, Europe, and Asia Pacific.

In June 2024, Airbus' A330-900 flight-test aircraft—MSN1795/F-WTTN—flew to Toluca in Mexico and then to La Paz in Bolivia. The test was a part of Airbus's high-altitude test campaign. Airbus is focusing on increasing production of the A350 and A330neo and working on the potential launch of an A330neo-based freighter. Airbus supplied 735 commercial aircraft in 2023, which is a ~11% increase from 2022. Airbus accounted for overall 2,319 orders of commercial aircraft, comprising 1,835 A320 Family and 300 A350 Family aircraft. In 2023, Boeing delivered a total of 528 aircraft, including 396 Boeing 737 jets and 73 Dreamliners. In May 2024, IndiGo collaborated with Embraer, ATR, and Airbus to order ~100 smaller planes as it targets to widen its regional network. Also, the demand for stainless steel and superalloy fasteners in the aerospace sector is growing owing to the rising number of new aircraft fleet production and increasing MRO services.

The Middle East and Africa, as well as South America are key contributors to the aerospace fasteners market growth. According to the Federal Aviation Administration in the Middle East, the aviation industry is experiencing annual growth of 10%. Countries in Africa are experiencing growth in the aviation industry as the number of air passengers increases due to progress in liberalizing air transport agreements. IATA forecasts that annual passenger numbers will increase by ~5.9% over the next 20 years, representing more than 300 million additional air passengers compared to 2019. Governments in the Middle East and Africa are realizing the potential of implementing advanced components in aircraft and are focusing on improving the quality of components.

Aerospace Fasteners Market Regional Insights

The regional trends and factors influencing the Aerospace Fasteners Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Aerospace Fasteners Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Aerospace Fasteners Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 4,044.12 Million |

| Market Size by 2031 | US$ 6,161.15 Million |

| Global CAGR (2025 - 2031) | 6.0% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Material Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Aerospace Fasteners Market Players Density: Understanding Its Impact on Business Dynamics

The Aerospace Fasteners Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Aerospace Fasteners Market top key players overview

Aerospace Fasteners Market News and Recent Developments

The aerospace fasteners market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the aerospace fasteners market are listed below:

- TriMas announced the completion of the previously announced acquisition of the aerospace business of GMT Gummi-Metall-Technik GmbH (“GMT”). Based in Germany, GMT’s aerospace division (“GMT Aerospace”) develops and manufactures a wide range of tie-rods and rubber-metal anti-vibration systems for commercial and military aerospace applications. GMT Aerospace is now part of the TriMas Aerospace group. (TriMas, Press Release, February 2025)

- MEIDOH Co. Ltd. acquired Pilgrim Screw Corp., d.b.a. Pilgrim Aerospace Fasteners. (MEIDOH Co. Ltd, Press Release, January 2024)

- Genesys Industries announced that the company has acquired 100% of F3 Aerospace (F3). Genesys expects the acquisition to be accretive to its earnings within 3 months of closing. This transaction will create equity value in-line with our long-term objectives. (Genesys Industries, Press Release, September 2024)

Aerospace Fasteners Market Report Coverage and Deliverables

The "Aerospace Fasteners Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Aerospace fasteners market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Aerospace fasteners market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter’s Five Forces and SWOT analysis

- Aerospace fasteners market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, market share analysis of prominent players, and recent developments for the aerospace fasteners market

- Detailed company profiles

Frequently Asked Questions

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For