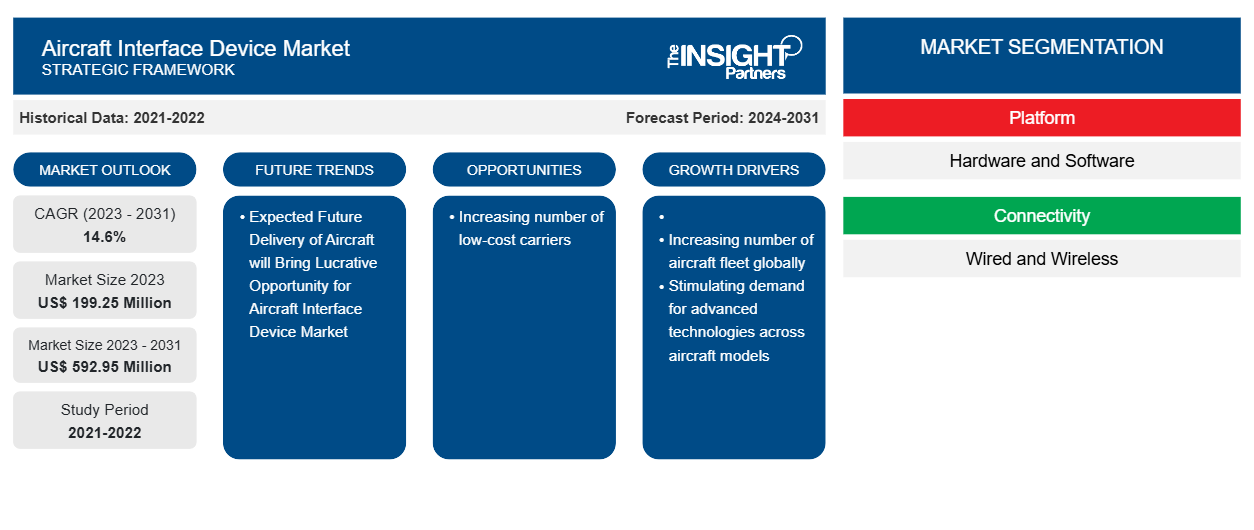

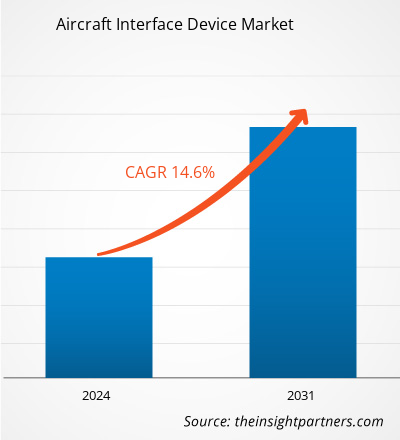

The aircraft interface device market size is projected to reach US$ 592.95 million by 2031 from US$ 199.25 million in 2023. The market is expected to register a CAGR of 14.6% during 2023–2031. Increasing number of low-cost airline/carriers is likely to remain key trends in the market.

Aircraft Interface Device Market Analysis

The major stakeholders in the global aircraft interface device market include component manufacturers, aircraft interface device manufacturers and aircraft manufacturers and MRO service providers. An aircraft interface device is made up of various components which are procured by the system manufacturers from a huge base of component manufacturers. These component manufacturers supply the base parts to the global aircraft interface device market players. The aircraft interface device manufacturers are engaged in manufacturing of advance interface devices for commercial and military aircrafts for various transmitting data between the aircraft and ground staffs. Some of the major players operating in the market include Boeing, Collins Aerospace., Honeywell International Inc., and Teledyne Controls LLC., amongst others. The end users of the global aircraft interface device market include aircraft manufacturers and MRO services providers. The rise in demand for aircraft for both commercial and military purposes are rising the demand for aircrafts, thereby influencing the growing demand for AID. Similarly, the rising modernization of aircraft ad demand for other avionic services are increasing the demand for AIDs across MRO service providers as well.

Aircraft Interface Device Market Overview

The aircraft interface devices are gaining significant prominence over the years since the inception of the technology. The airframers are integrating aircraft interface devices on their modern fleets. The airlines or the aircraft operators are also retrofitting aircraft interface devices on their existing models in order to facilitate smooth and seamless real-time data transfer. The increasing trend of aircraft production and retrofitting of aircraft interface devices on the existing models are the two key reasons behind the growth of aircraft interface devices market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Aircraft Interface Device Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Aircraft Interface Device Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Aircraft Interface Device Market Drivers and Opportunities

Increasing Number of Aircraft Fleet Globally

There has been significant growth in the commercial aviation industry in the past decade. The airlines in the developed and developing nations are ordering a high number of aircraft to meet the constantly rising air travel demand. Owing to the continuously growing disposable income among the global population, the need for air travel is also increasing rapidly. Commercial air traffic is anticipated to maintain a constant growth rate, despite various challenges, such as rising aviation fuel costs and technical faults causing accidents. However, these challenges are overcome by the increasing number of passengers, which leads to more aircraft across the globe.

Growing Demand for Wireless AIDs

Wireless AIDs are much lighter in weight than wired AIDs and omit the risks associated with loose interconnection and timely wiring maintenance. This factor attracts several commercial airlines to adopt the advanced AIDs and enhance their fleet operations, which poses a significant opportunity for the industry players operating in the aircraft interface device market. Moreover, installing these wireless AIDs is simpler than their wired counterparts, thereby increasing the interest in opting for the wireless AIDs among airlines and military forces. Thus, the growing trend of adopting and equipping aircraft with wireless AIDs poses a substantial growth opportunity for the aircraft interface device market during the forecast period. This influences the global aircraft interface manufacturers to develop new products as per the client's requirements. For instance, during the National Business Aviation Association Convention in Las Vegas, Nevada, in October 2021, Avionica, LLC—one of the world's leading providers of connected aircraft solutions for powering secure data and communications for the aviation industry, will unveil its latest product innovation, the miniAID. The miniAID is a service that delivers aircraft data to pilots in a fast and wireless manner, allowing them to optimize their operations. These factors will further contribute to the demand for wireless AIDs over the forecast period.

Aircraft Interface Device Market Report Segmentation Analysis

Key segments that contributed to the derivation of the aircraft interface device market analysis are platform, connectivity, and aircraft type.

platform (hardware and software), connectivity (wired and wireless), fit type (line fit and retrofit), and aircraft type (fixed wing and rotary wing)

- Based on type, the aircraft interface device market is divided into hardware and software. The hardware segment held a larger market share in 2023.

- By connectivity, the market is segmented into wired and wireless. The wired segment held the largest share of the market in 2023.

- In terms of aircraft type, the market is bifurcated into fixed wing and rotary wing. The The fixed wing segment held a significant share of the market in 2023.

Aircraft Interface Device Market Share Analysis by Geography

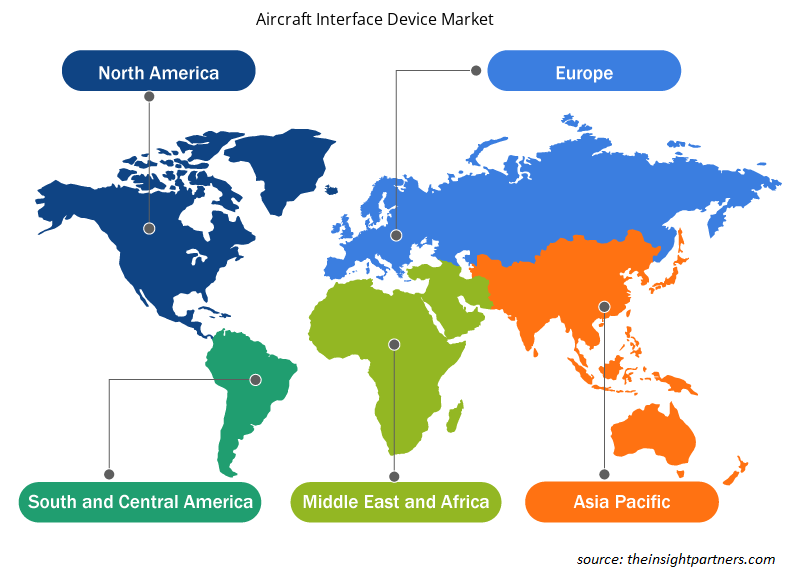

The geographic scope of the aircraft interface device market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America dominated aircraft interface device market in 2023. North America is the most prominent region in the current market, owing to the presence of a significant number of players operating in the market and being awarded by various airlines globally to retrofit their existing aircraft with AIDs. Further, the research and development investments of robust AIDs are maximum in the region, which is also a catalyzer for the aircraft interface device market in North America. Moreover, the US Department of Defense (DoD) invests substantial amounts in developing and adopting advanced avionics, facilitating the aircraft interface device market growth in the region. However, during the forecast period, the market attractiveness is foreseen to shift from North America to Asia Pacific due to the increasing procurement of newer aircraft and retrofitting activities among the airlines.

Aircraft Interface Device Market Regional Insights

The regional trends and factors influencing the Aircraft Interface Device Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Aircraft Interface Device Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Aircraft Interface Device Market

Aircraft Interface Device Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 199.25 Million |

| Market Size by 2031 | US$ 592.95 Million |

| Global CAGR (2023 - 2031) | 14.6% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Platform

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Aircraft Interface Device Market Players Density: Understanding Its Impact on Business Dynamics

The Aircraft Interface Device Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Aircraft Interface Device Market are:

- Boeing

- Collins Aerospace

- Honeywell International Inc.

- Teledyne Controls LLC.

- Thales Group

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Aircraft Interface Device Market top key players overview

Aircraft Interface Device Market News and Recent Developments

The aircraft interface device market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the aircraft interface device market are listed below:

- Raytheon Technologies' (NYSE: RTX) today announced a Collins Aerospace's InteliSight Aircraft Interface Device will be installed on more than 200 of JetBlue's Airbus A320s. The device captures, records, stores, encrypts, and securely transmits aircraft data to Collins' robust and secure cloud platform, GlobalConnect. (Source: Raytheon Technologies, Press Release, May 2023

- American Airlines has signed a sizeable agreement with Airbus for multiple avionics systems and airframe upgrades on 150 A320ceo family of aircraft in its in-service fleet. (Source: American Airlines, Press Release, April 2024)

Aircraft Interface Device Market Report Coverage and Deliverables

The “Aircraft Interface Device Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Aircraft interface device market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Aircraft interface device market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed porter’s five forces analysis

- Aircraft interface device market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the aircraft interface device market

- Detailed company profiles

Frequently Asked Questions

Which region dominated the aircraft interface device market in 2023?

North America dominated the aircraft interface device market in 2023.

What are the driving factors impacting the aircraft interface device market?

Increasing number of aircraft fleet globally and stimulating demand for advanced technologies across aircraft models are some of the major factors driving the growth of the market.

What are the future trends of the aircraft interface device market?

Increasing number of low-cost carriers is one of the major trends in the market.

Which are the leading players operating in the aircraft interface device market?

Boeing, Astronics Corporation, Collins Aerospace, Carlisle Interconnect Technologies, Anuvu, Honeywell International Inc, SCI Technology Inc, Teledyne Technologies, and Viasat Inc are some of the key players operating in the market.

What would be the estimated value of the aircraft interface device market by 2031?

The aircraft interface device market is likely to reach US$ 592.95 million by 2031.

What is the expected CAGR of the aircraft interface device market?

The aircraft interface device market is likely to register a CAGR of 14.6% during 2023-2031.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Aircraft MRO Market

- Helicopter Hoists Winches and Hooks Market

- Fixed-Base Operator Market

- Aerospace Fasteners Market

- Aerospace Stainless Steel And Superalloy Fasteners Market

- Aircraft Floor Panel Market

- Military Optronics Surveillance and Sighting Systems Market

- Smoke Grenade Market

- Airport Runway FOD Detection Systems Market

- Artillery Systems Market

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

Get Free Sample For

Get Free Sample For