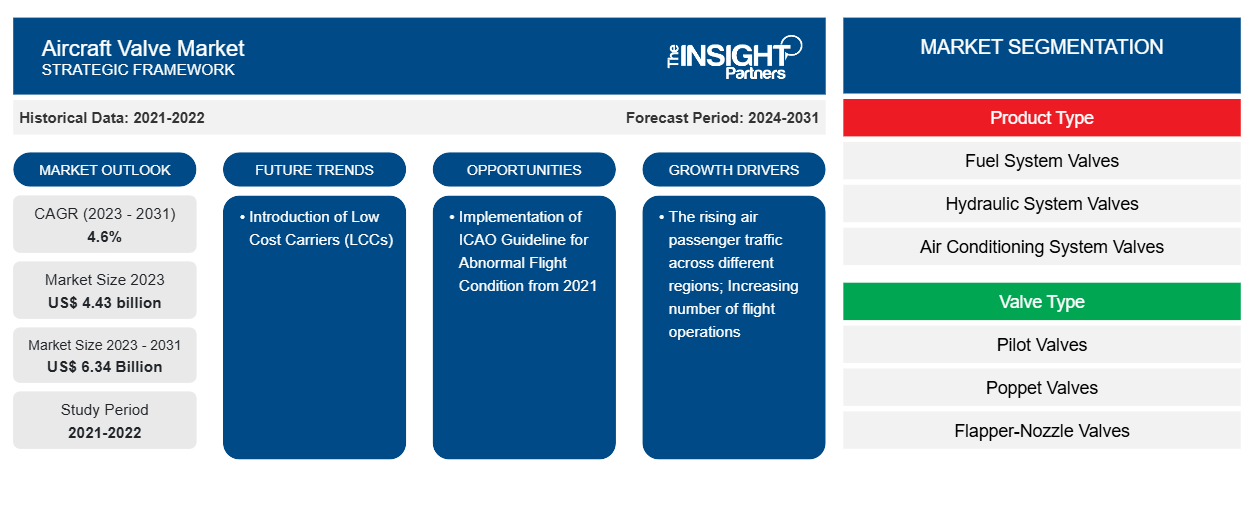

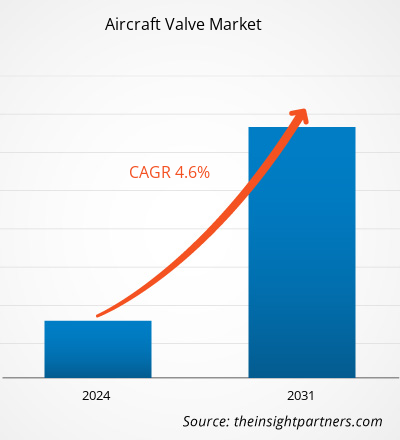

The Aircraft Valve Market size is projected to reach US$ 6.34 billion by 2031 from US$ 4.43 billion in 2023. The market is expected to register a CAGR of 4.6% in 2023–2031.

One of the major trends in the aircraft valve market includes the demand generated from MRO operations due to the rise in the number of aircraft operations globally. In addition, the rise in several old-aged aircraft fleets that require regular maintenance is another major factor likely to drive the market for aircraft valves market from 2023 to 2031.

Aircraft Valve Market Analysis

The aerospace and defense industry across the globe encompasses several numbers of well-established aircraft original equipment manufacturers (OEMs) accounting substantially large market share in the respective aircraft market. Since there is the availability of a large number of aircraft valve manufacturers in the market, small as well as big brands, the aircraft manufacturers have a substantial bargaining power to procure aircraft valves with high quality at a competitive price. As a result, the bargaining power of buyers in the aircraft valve market is inclined towards buyers due to their functional requirements and the presence of a substantial number of suppliers. Moreover, the bargaining power of the buyers is expected to remain high during the forecast period owing to the development of OEM components and aircraft components.

Aircraft Valve Market Overview

Increasing procurement of new aircraft and rising demand for MRO services by end users in both commercial and military sectors are expected to drive the market demand of aircraft valves in the coming years. Several aircraft valve manufacturers are focusing on the procurement of components from raw material suppliers and supplying the assembling valves in a system to aircraft OEMs and MROs. Aircraft OEMs include companies such as Boeing, Airbus, and Universal Helicopters, which further integrate these aircraft valves in their aircrafts and supply them to both commercial and military end-users. MROs such as AAR Corporation and Lufthansa Technik offer various maintenance, repair & overhaul services to these end users. The growth of the aircraft valve market is due to some of the below key factors:

- The rising civil aircraft and helicopter deliveries

- The rising number of contracts for military aircraft and helicopters

- Growth in aircraft MRO industry

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Aircraft Valve Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Aircraft Valve Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Aircraft Valve Market Drivers and Opportunities

Increasing Airplane Deliveries Worldwide

The constantly rising number of aircraft deliveries is one of the major factors driving the growth of the aircraft valves market globally. For instance, two of the major aircraft giants i.e., Boeing and Airbus delivered around 1,263 commercial aircraft in 2023 compared to 1,141 commercial aircraft in 2022. Further, the rising procurement of military aircraft is another major factor supporting the integration of valves in the aviation industry.

Growth in the Aviation MRO Sector is Likely to Provide Future Opportunities

The growing aircraft MRO industry is likely to generate huge opportunities for market vendors during the forecast period. This is further assisted by the rising global aircraft fleet which is generating constant demand for MRO operations due to continuous flight operations. Further, the need for regular maintenance checks for existing operational aircraft fleets is further likely to generate new demand for aircraft valves in the coming years.

Aircraft Valve Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Aircraft Valve Market analysis are product type, valve type, aircraft type, end user, and geography.

- Based on product type, the Aircraft Valve Market has been divided into fuel system valves, hydraulic system valves, air conditioning system valves, lubrication systems valves, and others. The fuel system valves segment held a larger market share in 2023.

- By valve type, the market has been segmented into pilot valves, poppet valves, flapper-nozzle valves, and others. The poppet valves segment held the largest share of the market in 2023.

- In terms of aircraft type, the market has been segregated into fixed-wing and rotary-wing. The fixed-wing segment dominated the market in 2023.

- In terms of end-users, the market has been bifurcated into OEMs and MRO. The OEMs segment dominated the market in 2023.

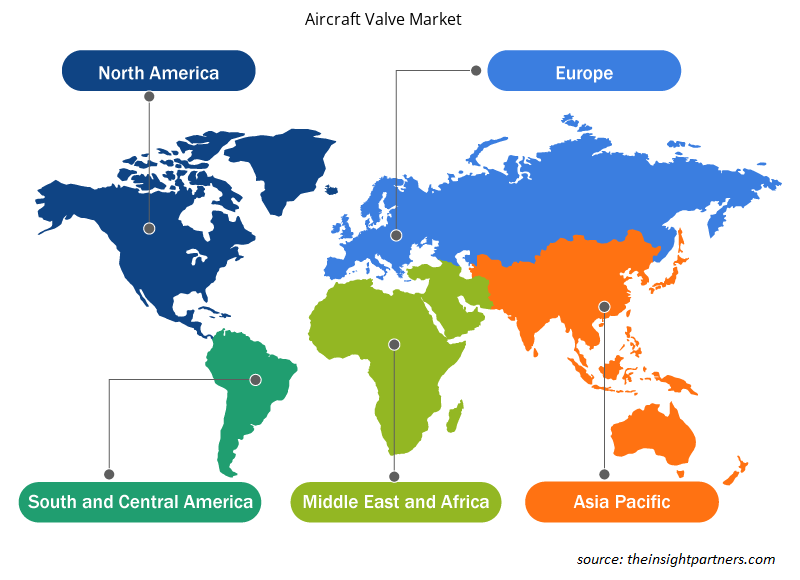

Aircraft Valve Market Share Analysis by Geography

The geographic scope of the Aircraft Valve Market report is mainly divided into five regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America has dominated the Aircraft Valve Market in 2023, whereas, the Asia Pacific region is likely to witness significant growth during the forecast period. The growth in air passenger traffic, the demand from airlines to replace their aging fleet, and rising aircraft order backlog are among the major growth drivers for the aircraft valve market in North America. Owing to this factor, airplanes are widely preferred means of transport for domestic travel by the North American population. This has translated into higher air passenger traffic in the region. The high passenger traffic demands are being proficiently supported by the strong economic conditions in the North American region that have resulted in increased consumer spending on travel. Thus, the demands increase in the manufacturing of aircrafts, which further demands the integration of aircraft valves in the aircrafts.

Aircraft Valve Market News and Recent Developments

The Aircraft Valve Market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for aircraft valve market and strategies:

- In September 2022, Parker Hannifin Corporation, the global leader in motion and control technologies, announced that it had completed its acquisition of Meggitt PLC for approximately US$ 7.8 billion. (Source: Parker Hannifin Corporation, Press Release/Company Website/Newsletter)

- On May 2023, Triumph Group Inc, and Moog Inc entered into a five-year agreement to provide maintenance, repair, and overhaul (MRO) solutions for Boeing 787 landing gear and cargo door actuation control systems through the Moog Total Support Program (MTS) for an Asia Pacific operator who has more than 40 Boeing 787's in service. (Source: Triumph Group Inc, Press Release/Company Website/Newsletter)

Aircraft Valve Market Regional Insights

The regional trends and factors influencing the Aircraft Valve Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Aircraft Valve Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Aircraft Valve Market

Aircraft Valve Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 4.43 Billion |

| Market Size by 2031 | US$ 6.34 Billion |

| Global CAGR (2023 - 2031) | 4.6% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Aircraft Valve Market Players Density: Understanding Its Impact on Business Dynamics

The Aircraft Valve Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Aircraft Valve Market are:

- Raytheon Technologies Corp

- Crissair Inc

- Eaton

- Honeywell International Inc

- ITT Inc

- Moog Inc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Aircraft Valve Market top key players overview

Aircraft Valve Market Report Coverage and Deliverables

The “Aircraft Valve Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed Porter’s Five Forces analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles with SWOT analysis

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Aircraft MRO Market

- Helicopter Hoists Winches and Hooks Market

- Fixed-Base Operator Market

- Aerospace Fasteners Market

- Aerospace Stainless Steel And Superalloy Fasteners Market

- Aircraft Floor Panel Market

- Military Optronics Surveillance and Sighting Systems Market

- Smoke Grenade Market

- Airport Runway FOD Detection Systems Market

- Artillery Systems Market

Testimonials

I wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA, MANAGING DIRECTOR, PineCrest Healthcare Ltd.The Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

Yukihiko Adachi CEO, Deep Blue, LLC.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Strategic Planning

- Investment Justification

- Identifying Emerging Markets

- Enhancing Marketing Strategies

- Boosting Operational Efficiency

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

- Raytheon Technologies Corp

- Crissair Inc

- Eaton

- Honeywell International Inc

- ITT Inc

- Moog Inc

- Woodward Inc

- Parker Hannifin Corporation

- Safran Group

- Triumph Group Inc

Get Free Sample For

Get Free Sample For