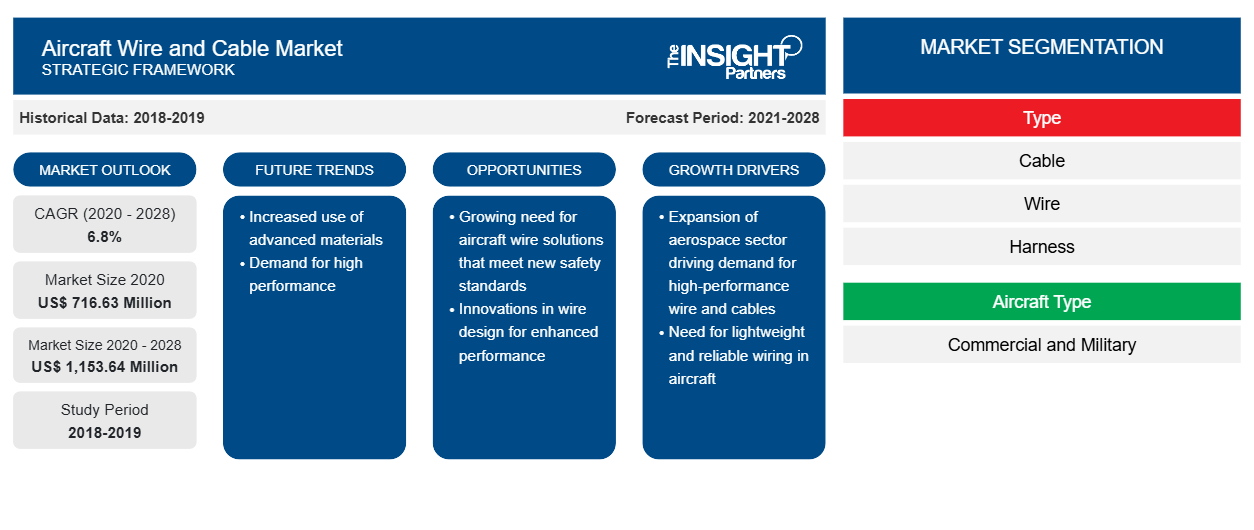

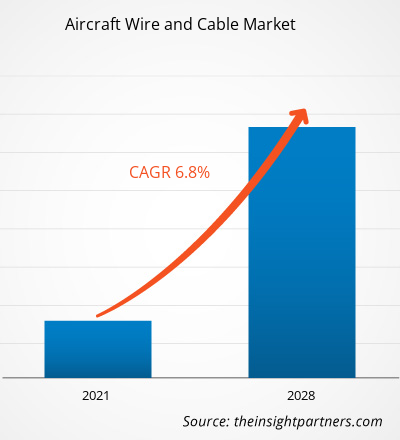

[Research Report] The global aircraft wire & cable market was valued at US$ 716.63 million in 2020 and is projected to reach US$ 1,153.64 million by 2028; it is expected to grow at a CAGR of 6.8% during the forecast period from 2021 to 2028.

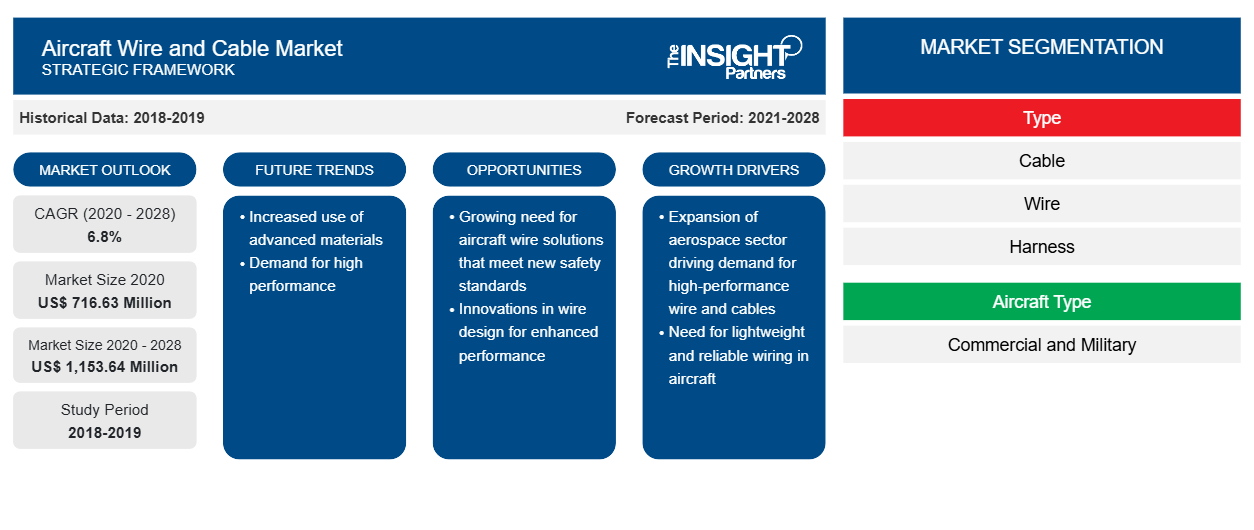

The aircraft wire & cable market is broadly segmented into five major regions—North America, Europe, APAC, MEA, and SAM. In terms of market share, the North America region dominated the aircraft wire & cable market in 2020. The North America region witnesses presence of multi-national companies engaged in the business of providing aircraft wire & cable, which makes it a leading and dominant region of aircraft wire & cable market in 2020. Factors such as availability of technological capabilities, infrastructure support, R&D, and technical professional, among other factors have contributed toward the significant consolidation of the aircraft wire & cable market share in North America.

Impact of COVID-19 Pandemic on Aircraft Wire & Cable Market

According to the latest situation report of World Health Organization (WHO), the US, India, Brazil, Russia, the UK, France, Spain, and Italy are some of the worst affected countries due to the COVID-19 outbreak. The outbreak first began in Wuhan (China) in December 2019, and since then, it has spread at a fast pace across the globe. The COVID-19 crisis affects the industries worldwide, and the global economy adversely affected in 2020 and likely in 2021. The pandemic has disturbed aircraft wire & cable businesses and suppliers around the globe. Market players experienced disruptions to their operations, and it is likely to have consequences till mid-2021. Until the outbreak of COVID-19, the aerospace industry was experiencing substantial growth in terms of production and services, despite huge backlogs from the aircraft manufacturers; the global aviation industry witnessed a significant rise in the number of passenger counts, an increase in aircraft procurement (both commercial and military), as well as rise growth in MRO activities.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Aircraft Wire and Cable Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Aircraft Wire and Cable Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insight- Aircraft Wire & Cable Market.

The rapid expansion of the aviation sector globally and the growing adoption of advanced technologies for the smooth functioning of aircraft supplement the growth of the market significantly. Besides, the presence of robust aircraft manufacturers, such as Boeing and Airbus, and growing disposable incomes in developing countries and are among the factors driving the demand for these aircraft wires and cables.

The growing defense expenditure across significant economies, such as the US, China, India, Russia, and Saudi Arabia, is expected to drive the aircraft wires & cables market in the coming years. In addition, the increasing technological developments, growing investments in research and development (R&D) by aircraft original equipment manufacturers (OEMs), and rising demand for air transportation are propelling the growth of the aerospace & defense sector, which is subsequently driving the aircraft wires & cables market growth.

Type Segment Insights

Based on type, the wire segment is the most demanding segment in the market and the same segment is expected to dominate the market in terms of market share. However, with the rise in adoption of cables for various functions, the cables segment is foreseen to be the fastest growing segment in the aircraft wire & cable market.

Aircraft Type Segment Insights

Based on aircraft types, the global aircraft wire & cable market is segmented into commercial and military. Due to the remarkable growth in number of commercial aircraft deliveries, the commercial aircraft type is expected to dominate the market in terms of market share during the forecast period.

Fit Type Segment Insights

Based on fit type, the global aircraft wire & cable market is dominated by line fit segment, which held the majority of the market share in the year 2020 and is anticipated to continue its dominance during the forecast period in the global aircraft wire & cable market.

Application Segment Insights

Based on application, the aircraft wire & cable market is dominated by power transfer segment, which held the largest market share in 2020 and is anticipated to continue its dominance during the forecast period in the global aircraft wire & cable market.

The market players focus on new product innovations and developments by integrating advanced technologies and features in their products to compete with the competitors.

- In 2020, Harbour Industries LLC declared that it has approved manufacturer for several low-loss coax and high-speed data cables used on Lockheed Martin’s F-35 Lighting II 5th generation fighter aircraft.

- In 2020, TE Connectivity (TE) introduced its new Mini-ETH single pair ethernet system for commercial aircraft.

- In 2019, Carlisle Companies Incorporated acquired 100% of the shares of Draka Fileca SAS from Prysmian SpA

Aircraft Wire & Cable Aircraft Wire and Cable Market Regional Insights

The regional trends and factors influencing the Aircraft Wire and Cable Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Aircraft Wire and Cable Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Aircraft Wire and Cable Market

Aircraft Wire and Cable Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2020 | US$ 716.63 Million |

| Market Size by 2028 | US$ 1,153.64 Million |

| Global CAGR (2020 - 2028) | 6.8% |

| Historical Data | 2018-2019 |

| Forecast period | 2021-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Aircraft Wire and Cable Market Players Density: Understanding Its Impact on Business Dynamics

The Aircraft Wire and Cable Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Aircraft Wire and Cable Market are:

- Axon Enterprise, Inc.

- Harbour Industries, LLC

- Draka

- Glenair, Inc.

- HUBER+SUHNER

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Aircraft Wire and Cable Market top key players overview

The global aircraft wire & cable market has been segmented as follows:

Aircraft Wire & Cable Market– By Type

- Cable

- Wire

- Harness

Aircraft Wire & Cable Market– By Aircraft Type

- Commercial

- Military

Aircraft Wire & Cable Market– By Fit Type

- Line Fit

- Retrofit

Aircraft Wire & Cable Market– By Application

- Power Transfer

- Data Transfer

- Flight Control System

- Avionics

- Lighting

Aircraft Wire & Cable Market- By Region

North America

- US

- Canada

- Mexico

Europe

- France

- Germany

- Italy

- UK

- Russia

- Rest of Europe

Asia Pacific (APAC)

- China

- India

- South Korea

- Japan

- Australia

- Rest of APAC

Middle East and Africa (MEA)

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

South America (SAM)

- Brazil

- Argentina

- Rest of SAM

Aircraft Wire & Cable Market– Companies Profiles

- Axon Enterprise, Inc.

- Harbour Industries, LLC

- Draka

- Glenair, Inc.

- HUBER+SUHNER

- A.E. Petsche Company

- AMETEK Inc.

- Amphenol Corporation

- Carlisle Companies Incorporated

- Collins Aerospace, a Raytheon Technologies Corporation Company

- TE Connectivity Ltd.

- W. L. Gore and Associates, Inc.

- PIC Wire & Cable

- Nexans

- Radiall

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type , Aircraft Type , Fit Type , Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

What factors are providing opportunities for aircraft wire & cable market?

Economic growth, increasing passengers, and growing aviation infrastructure spending across APAC are the factors driving the growth of the aircraft MRO industry in the region. According to the International Air Transport Association, the total number of new passengers would increase over the next 20 years. It would further increase the demand for MRO activities for upgrading the aircraft fleet. Rising middle-class travelers, especially in APAC: countries, such as India, China, and Singapore, is the main factor contributing to air travel growth, subsequently increasing the need for aircraft MRO services in APAC. The governments in the countries mentioned above and other emerging economies support the growth of aviation MRO services, as it is a crucial strategy to support the economic goals by focusing on enhancing the aircraft MRO activities. The constantly evolving MRO activities pose a potential opportunity for the aircraft wires and cables manufacturers and distributors to market their products to various MRO service providers in the emerging economies.

Which factor is driving the aircraft wire & cable market?

The global aviation industry is growing at an unprecedented rate, recording substantial number of production volumes of military and commercial aircraft fleet. In the past few years, the commercial aircraft fleet has seen tremendous growth due to the influx of new low-cost carriers (LCCs) and fleet expansion strategies adopted by the full-service carriers (FSCs). Commercial aviation industry is predicted to upsurge in the near future due to the rising air travel passengers and aircraft procurement. Air passenger traffic in North America, Europe, and APAC: has been surging with time, which is compelling the demand for commercial aircraft. Thus, the growth in demand for commercial aircraft is one of the key factors driving the aircraft wire & cable market.

Which region led the aircraft wire & cable market?

The North America region led the aircraft wire & cable market. The North American region comprises of the US, Canada and Mexico, it is characterized by high disposable individual incomes, higher standards of living, and rapid technological advancements in the arena of aerospace engineering. North America has the largest fleet of commercial and defense aircrafts in the world. Boeing and Bombardier are the two largest North American multinational manufacturers of commercial aircraft. General Dynamics Corporation, Honeywell International Inc., and Raytheon Technologies Corporation are among the major aircraft component suppliers that have their bases in the North American region. Further, the presence of some of the major defense aircraft suppliers such as Lockheed Martin Corporation, Northrop Grumman Corporation, and General Dynamics Corporation presents a tremendous opportunity for the market players to look upon. Huge volumes of commercial and military fleets in operations in the domestic as well as international arena coupled with a high average passenger mile flown value in the region propel the requirements for aircraft components.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - Aircraft Wire and Cable Market

- Axon Enterprise, Inc.

- Harbour Industries, LLC

- Draka

- Glenair, Inc.

- HUBER+SUHNER

- A.E. Petsche Company

- AMETEK Inc.

- Amphenol Corporation

- Carlisle Companies Incorporated

- Collins Aerospace, a Raytheon Technologies Corporation Company

- TE Connectivity Ltd.

- W. L. Gore and Associates, Inc.

- PIC Wire & Cable

- Nexans

- Radiall

Get Free Sample For

Get Free Sample For