Animal Feed Market Outlook and Strategic Insights by 2027

Animal Feed Market Forecast to 2027 - Analysis by Form (Pellets, Crumbles, Mash, Others); Livestock (Poultry, Ruminants, Swine, Aquaculture, Others); and Geography

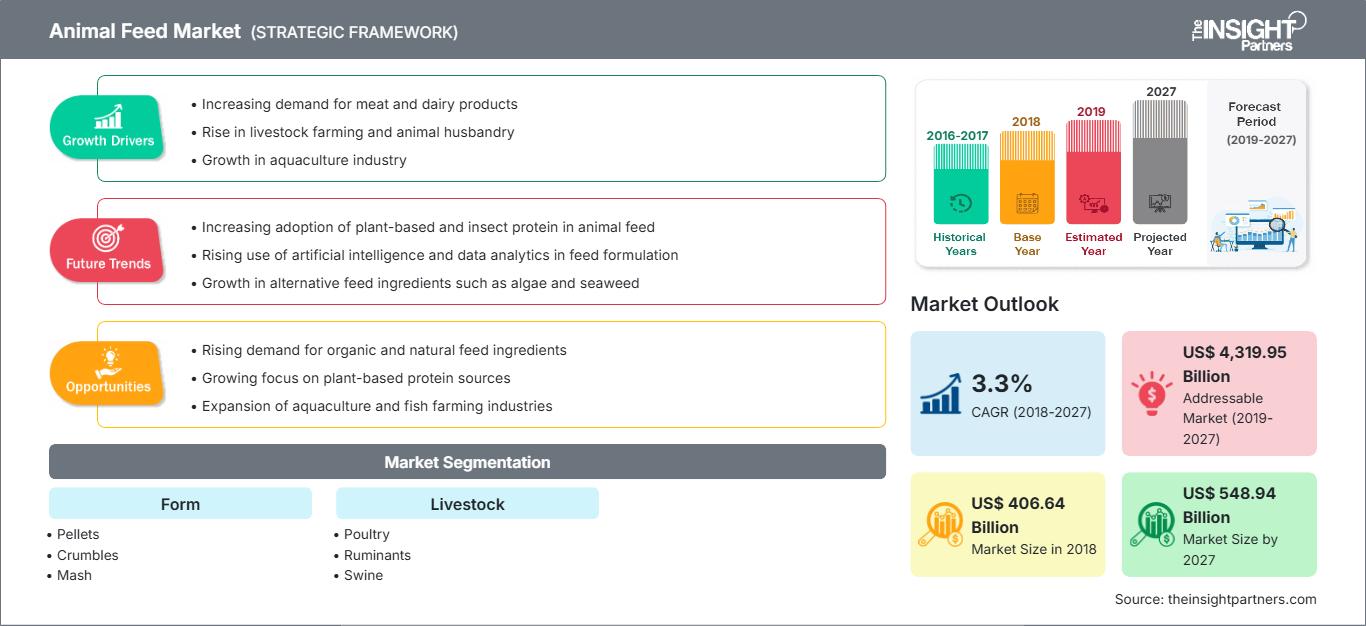

Historic Data: 2016-2017 | Base Year: 2018 | Forecast Period: 2019-2027- Status : Published

- Report Code : TIPRE00010192

- Category : Food and Beverages

- No. of Pages : 161

- Available Report Formats :

[Research Report] The animal feed market accounted for US$ 406,640.10 million in 2018 and is projected to reach US$ 548,936.55 million by 2027; it is expected to grow at a CAGR of 3.3% during the forecast period 2019-2027.

Animal feed is basically food items prepared for the consumption of livestock or poultry. These products are carefully produced and blended with several nutritional ingredients, which are essential to maintain the good health of animals. Some of the common feeds mostly include pasture grasses, cereal grains, hay & silage crops, and other by-products of food crops, including pineapple bran, brewers' grains, also sugar beet pulp. The animal feed industry mostly encompasses various sectors like cattle, poultry, and aquaculture.

The studied market in the North America region is expected to grow at the highest CAGR of 3.6% during the forecast period. The growth of the animal feed market in this region is mainly attributed to the huge and easy availability of raw materials required to produce animal feed. Transforming lifestyle and growing awareness of the consumers towards the health issue related to animals has significantly influenced the animal feed market in North America. With an increasing focus on animal health, the demand for animal feed in the region has increased substantially. The growing concern towards maintaining the health of animals with the rapid rise in animal farming and surging product innovations are some factors that are leading to an increase in demand for animal feed in the North American countries. All these factors are further propelling the market growth in this region.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONAnimal Feed Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 on Animal Feed Market

As of July 2021, the US, India, Brazil, Russia, Spain, France, the UK, Turkey, and Italy, were some of the worst affected countries in terms of confirmed cases and reported deaths. The COVID-19 is affecting economies and several industries in different countries due to lockdowns, travel bans, and business shutdowns. The shutdown of various manufacturing plants and factories has affected the global supply chains and also negatively impacted the manufacturing, delivery schedules, and sales of goods in the global market. In addition, the global travel bans further imposed by countries in Europe, Asia-Pacific, and North America are also affecting business collaborations as well as partnership opportunities.

Due to the Covid-19 pandemic, the food and beverage industry is also facing huge losses, which is further impacting the world economy. It has further disrupted the transportation system and disrupted the supply of raw materials. The disruptive value chain has had a negative impact on the raw material supply, which, in turn, is impacting the growth of the animal feed market. However, as the economies are planning to revive their operations, the demand for animal feed is presumed to rise since consumers are buying products through online retailers. In addition, the animal feed manufacturing companies are also taking some safety measures to fight the coronavirus, which include limiting direct contact with delivery persons & visitors, strengthening & communicating proper hygiene practices, and conducting complete sanitations & eliminating personnel contact during shift changes. With all these factors, it can be presumed that in post-pandemic times, the demand for these products will take a hike.

Market Insights

Increasing Demand for Protein Rich Animal Feed

The industrialization of animal farming has mainly led to a rise in demand for protein-rich animal feed ingredients, which has also increased the feed conversion rate. Industrially farmed livestock are chiefly fed on concentrates prepared from cereal & vegetable protein, including soybean meals, mainly to assist them in gaining weight also to produce protein-rich meat. Farm animals mainly depend on proteins as well as other elements as the building blocks essential for good growth. Proteins in animal feeds are an excellent source of energy, minerals such as calcium & phosphorus, and essential amino acids including lysine & methionine. The growing awareness towards the health benefits of proteins on animal health has further created substantial demand for protein feeds, including animal protein meals, fish meals, bone meals, feather meals, blood meals, and other protein meals & feeds. As livestock and farm animals highly contribute to the global food supply chain, the demand for protein-rich and nutritious animal feeds is presumed to grow in the forecast period. The constantly burgeoning demand for protein-rich animal feeds to promote growth in livestock at all stages of life is anticipated to drive the overall animal feed market.

Form Insights

Based on form, the global animal feed market is segmented into pellets, crumbles, mash, and others. In 2018, the pellets segment dominated the animal feed market. Livestock, including cattle, cows, pigs, camels, sheep, deer, rabbit, alpaca, etc., are grown for their meat, leather, fur, milk, eggs, and wool. Many of this livestock can further be fed with pellet form of feed because feed pellets include higher nutrition density, more comprehensive nutrition, and higher economic benefits. These pallets can also be digested, absorbed, plus conserved better by these animals and also they are easier to store & transport compared to traditional roughage. Generally, livestock feed pellets have four types, including pure forage (grass) feed pellets, concentrated feed pellets, complete diet feed pellets, and premix feed pellets. Feed pallets can be produced by utilizing a grinding machine that can crush the maize & soya bean meal or other ingredients into a fine powder; then, the fine powder can further mix with the wheat bran, bone meal, microelement, vitamin, and other raw materials to make the complete feed mesh.

Livestock Insights

The animal feed market, based on livestock, is segmented into poultry, ruminants, swine, aquaculture, and others. Poultry segment held the largest share in 2018. Poultry is domesticated birds utilized for farming by humans for their eggs & their meat. These birds typically belong to the members of the superorder Galloanserae, including chickens, duck, geese, quails, turkeys, and others. Poultry feed is basically food for farm poultry, including ducks, geese, chickens, and other domestic birds. The common ingredients utilized in poultry feed are whole maize, maize germ, soya beans, cottonseed cake, sunflower, or fish meal. In addition to that, farmers add several feed additives such as micronutrients, minerals, and vitamins to ensure their chicken has a balanced feed that meets their daily nutrient requirements. Since farming became more specialized, many farmers prefer to provide nutritionally complete poultry feed to the poultry. Modern poultry feeds are mainly prepared of grain, protein supplements like soybean oil meal, mineral supplements, as well as vitamin supplements.

Mergers and acquisitions, and research and development are the commonly adopted strategies by companies to expand their footprints worldwide, which is further impacting the size of the market. The players present in the animal feed market have been implementing the abovementioned strategies to expand their customer base and gain significant share in the global market, which also enables them to maintain their brand name globally.

Animal Feed Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2018 | US$ 406.64 Billion |

| Market Size by 2027 | US$ 548.94 Billion |

| Global CAGR (2018 - 2027) | 3.3% |

| Historical Data | 2016-2017 |

| Forecast period | 2019-2027 |

| Segments Covered |

By Form

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Animal Feed Market Players Density: Understanding Its Impact on Business Dynamics

The Animal Feed Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Report Spotlights

- Progressive industry trends in the global animal feed market to help players develop effective long-term strategies

- Business growth strategies adopted by companies in developed and developing markets

- Quantitative analysis of the global animal feed market from 2017 to 2027

- Estimation of global animal feed demand generated by various industries

- PEST analysis to illustrate the efficacy of buyers and suppliers operating in the animal feed ecosystem

- Recent developments to understand the competitive market scenario and global animal feed demand

- Market trends and outlook, coupled with factors driving and restraining the growth of the global animal feed market

- Insights to help in decision-making process by understanding strategies which underpin commercial interest with regard to the animal feed market growth globally

- Global animal feed market size at various nodes of the market

- Detailed overview and segmentation of the global animal feed market, as well as the animal feed industry dynamics

- Global animal feed market size in various regions with promising growth opportunities

Animal Feed Market – By Form

- Pellets

- Crumbles

- Mash

- Others

Animal Feed Market – By Livestock

- Poultry

- Ruminants

- Swine

- Aquaculture

- Others

Company Profiles

- Archer Daniels Midland Co.

- Cargill Inc.

- Evonik Industries AG

- ForFarmers NV

- Land O'Lakes, Inc.

- Guangdong Haid Group Co. Ltd

- New Hope Group Co. Ltd

- Nutreco NV

- Perdue Farms, Inc.

- Charoen Pokphand Foods Plc

Frequently Asked Questions

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For