Explosion-Proof Equipment Market Size and Competitive Analysis by 2031

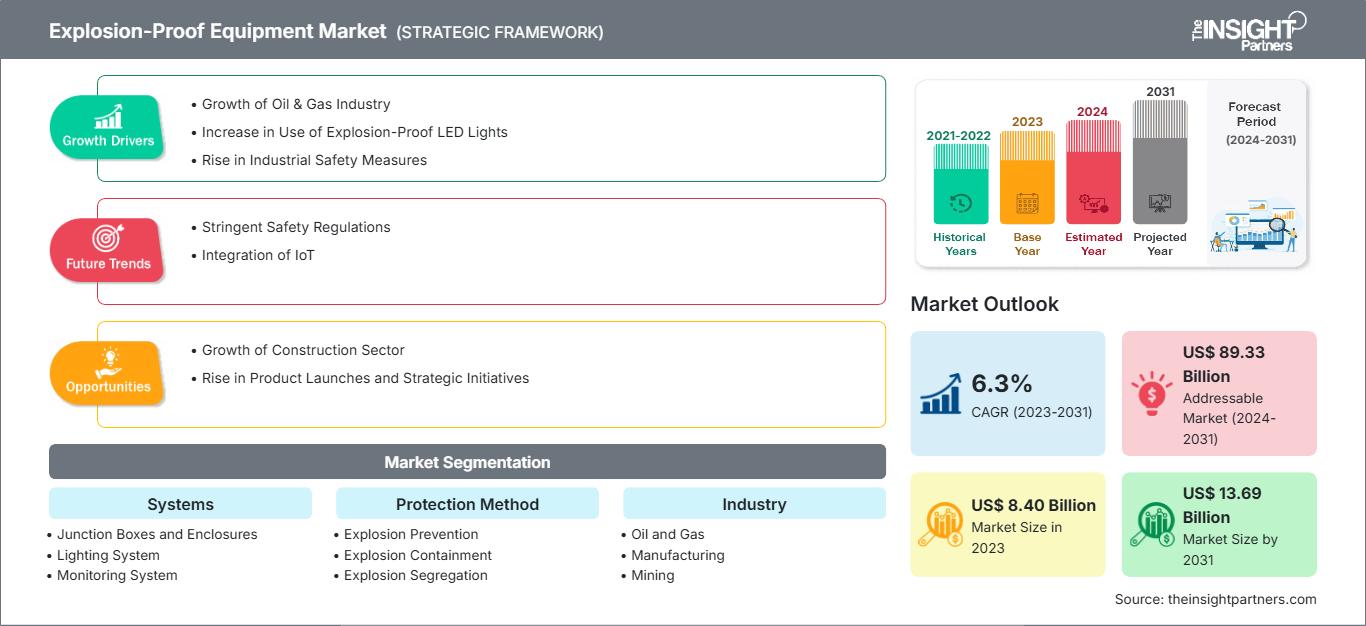

Explosion-Proof Equipment Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Systems [Junction Boxes and Enclosures, Lighting System, Monitoring System (Cameras, Data Loggers, Sensors, and Others), Signaling Devices, Automation System, Cable Glands, HVAC Systems, and Others], Protection Method (Explosion Prevention, Explosion Containment, and Explosion Segregation), Industry (Oil and Gas, Manufacturing, Mining, Chemical and Petrochemical, Energy and Power, Pharmaceutical, Water and Wastewater Management, and Others), and Geography

Historic Data: 2021-2022 | Base Year: 2023 | Forecast Period: 2024-2031- Report Code : TIPTE100000620

- Category : Electronics and Semiconductor

- No. of Pages : 239

- Available Report Formats :

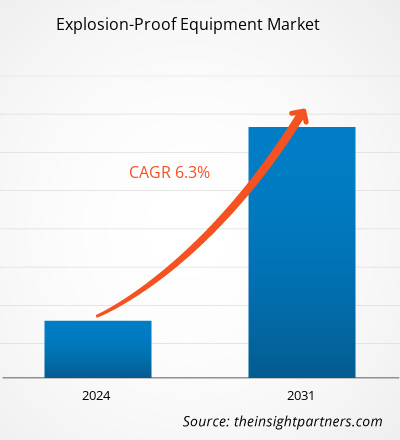

The explosion-proof equipment market size is expected to reach US$ 13.69 billion by 2031 from US$ 8.40 billion in 2023. The market is estimated to record a CAGR of 6.3% from 2023 to 2031. Integration of IoT is likely to remain a key market trend.

Explosion-Proof Equipment Market Analysis

The explosion-proof equipment market is experiencing substantial growth. This growth is attributed to the growth in the oil & gas industry. Explosion-proof equipment plays a crucial role in the oil and gas industry. Manufacturers produce and rigorously test explosion-proof assets to combat the high probability of ignition. Moreover, factors such as the increasing use of explosion-proof LED lights and growing industrial safety measures are driving the market. Additionally, the construction sector has been witnessing a decent growth rate in the recent time. Governments of various countries are taking initiatives to support the construction industry, increasing the demand for explosion-proof equipment. The rise in product launches and strategic initiatives is anticipated to drive the market. New products often incorporate the latest technology, improving safety and efficiency. This can attract new customers and encourage existing ones to upgrade their equipment. Also, the integration of IoT is expected to fuel the market growth. Construction, manufacturing, and mining industries tend to have the highest incident/accident rates. There are various risks associated with working in hazardous areas. To cater to this problem, the adoption of explosion-proof equipment is increasing worldwide, further fueling the market growth.

Explosion-Proof Equipment Market Overview

Explosion-proof equipment include products, devices, and solutions installed to inhibit sparks that can lead to an explosion. Installing these products in hazardous locations ensures better productivity and increased safety. Incorporating automation and monitoring systems ensures efficient tracking and detection, along with monitoring the functioning of the equipment. These systems help detect leaks of hazardous gases, accidental explosions, or any other complications during production. This provides added safety to the personnel, machinery, and surroundings. The designing and examination of explosion-proof equipment are controlled as per the NEC and ATEX/IEC standards, which create the production of equipment based on the zone/class/group/division.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONExplosion-Proof Equipment Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Explosion-Proof Equipment Market Drivers and Opportunities

Increase in Use of Explosion-Proof LED Lights

During the initial stages of LED lights, the LED solutions were expensive. Over the years, manufacturers have developed innovative and cost-effective technologies in order to lower the price of LED solutions. Increasing awareness of energy efficiency among end users and growing government regulations restricting certain energy sources are resulting in additional demand for energy-efficient products. Further, the market is going through a transition from traditional lighting technology systems to connected lighting systems based on user requirements. The shift in the market toward innovative technologies is supporting the LED market growth.

Companies in the market are engaged in launching explosion-proof LEDs. For instance, in January 2023, ARCHON Industries Inc. revealed its new explosion-proof light: EX20-100. The company indicated that the EX20-100 luminaire is designed to continuously illuminate process vessels, tanks, distillation columns, and other industrial items in hazardous and nonhazardous areas. Built with a high-power CREE COB LED and a proven LED driver for ultimate reliability, EX20-100 provides high-grade optics for exceptional performance.

As easy availability and energy efficiency are the key benefits of explosion-proof LED lighting, its demand is increasing in the market. These lighting systems have simpler maintenance requirements than fluorescent and other conventional lighting solutions. The increase in awareness of energy efficiency among end users and stringent regulations imposed by governments to favor certain energy sources propel the demand for energy-efficient products. The demand for lighting systems is rapidly evolving from traditional lighting technology to connected lighting systems with the surging popularity of handheld lighting. Thus, the increasing use of explosion-proof LED lights is driving the explosion-proof equipment market growth globally.

Rise in Product Launches and Strategic Initiatives

The rise in the number of product launches and strategic initiatives can provide several opportunities for the explosion-proof equipment market. New products often incorporate the latest technology, improving safety and efficiency. This can attract new customers and encourage existing ones to upgrade their equipment. Additionally, new strategic initiatives will help the company expand its product portfolio and geographical footprint.

Various companies in the market are engaged in launching new products and strategic initiatives.

- In March 2024, Axis Communications launched the world's first explosion-protected thermometric camera specifically designed and certified for use in Zone and Division 2 hazardous locations. The new camera enables remote temperature monitoring to optimize operational efficiency, with a detection range that can extend into Zone and Division 1 hazardous locations.

- In June 2024, Fuji Electric launched the EXV1000-7W 10 HP explosion-proof blower. The model is a direct drive single-stage blower with a motor defined as explosion proof: T4(T3C): Class 1, Div.1, Group C, D, with a UL certificate, and equipped with a motor suitable for explosion-proof requirements. It provides the same high quality, reliability, and durability as Fuji Electric's standard products and is similar in design to its standard 10 HP blower.

Thus, the rise in product launches and strategic initiatives is anticipated to fuel the explosion-proof equipment market growth in the coming years.

Explosion-Proof Equipment Market Report Segmentation Analysis

Key segments that contributed to the derivation of the explosion-proof equipment market analysis are systems, protection method, and industry.

- Based on systems, the market is segmented into junction boxes and enclosures, lighting system, monitoring system, signaling devices, automation system, cable glands, HVAC systems, and others. The monitoring system segment is subsegmented into data loggers, cameras, sensors, and others. The cable glands segment dominated the market in 2023.

- Based on protection method, the market is segmented into explosion prevention, explosion containment, and explosion segregation. The explosion prevention segment dominated the market in 2023.

- In terms of industry, the explosion-proof equipment market is segmented into manufacturing, pharmaceutical, mining, oil & gas, water and wastewater, chemical & petrochemical, energy & power, and others. The manufacturing segment dominated the market in 2023.

Explosion-Proof Equipment Market Share Analysis by Geography

- The explosion-proof equipment market is segmented into five major regions: North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South & Central America. North America dominated the market in 2023, followed by Europe and APAC.

- The North America explosion-proof equipment market is growing significantly due to the rising number of oil and gas projects. For instance, according to the US Energy Information Administration, crude oil production in the US, including condensate, averaged 12.9 million barrels per day (b/d) in 2023, breaking the previous US and global record of 12.3 million b/d, set in 2019. Average monthly US crude oil production established a monthly record high in December 2023 at more than 13.3 million b/d. The crude oil production record in the US in 2023 is unlikely to be broken in any other country in the near term because no other country has reached a production capacity of 13.0 million b/d. This can demand more crude oil plants in the country. Thus, with the increase in oil and gas projects in the US, the industry needs to employ a greater number of workers and operators in the factories. This is increasing the need for explosion-proof equipment in these hazardous areas.

Explosion-Proof Equipment Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 8.40 Billion |

| Market Size by 2031 | US$ 13.69 Billion |

| Global CAGR (2023 - 2031) | 6.3% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Systems

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Explosion-Proof Equipment Market Players Density: Understanding Its Impact on Business Dynamics

The Explosion-Proof Equipment Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Explosion-Proof Equipment Market News and Recent Developments

The explosion-proof equipment market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the explosion-proof equipment market are listed below:

- Larson Electronics announced the release of an explosion-proof motor for use in Class I, Divisions 1 and 2 hazardous locations. This 1.5-horsepower motor is compatible with 230 V AC single-phase 60 Hz and offers 7.8 FLA. This unit is Class F insulation rated and features a NEMA 56H motor frame that can be installed with industrial systems through an integrated mounting foot.

(Source: Larson Electronics, Press Release, March 2024)

- Larson Electronics announced the release of an explosion-proof LED exit sign with emergency battery backup for use in Class I, Divisions 1 and 2 hazardous locations. This exit sign is equipped with a 1.1-watt LED lamp and offers a 3-hour runtime. This unit features a self-diagnostic system and 8" letters for marking emergency exits. This sign is multi-voltage capable and offers three mounting options.

(Source: Larson Electronics, Press Release, March 2024)

Explosion-Proof Equipment Market Report Coverage and Deliverables

The "Explosion-Proof Equipment Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering the areas mentioned below:

- Explosion-proof equipment market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Explosion-proof equipment market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Explosion-proof equipment market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the explosion-proof equipment market

- Detailed company profiles

Frequently Asked Questions

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For