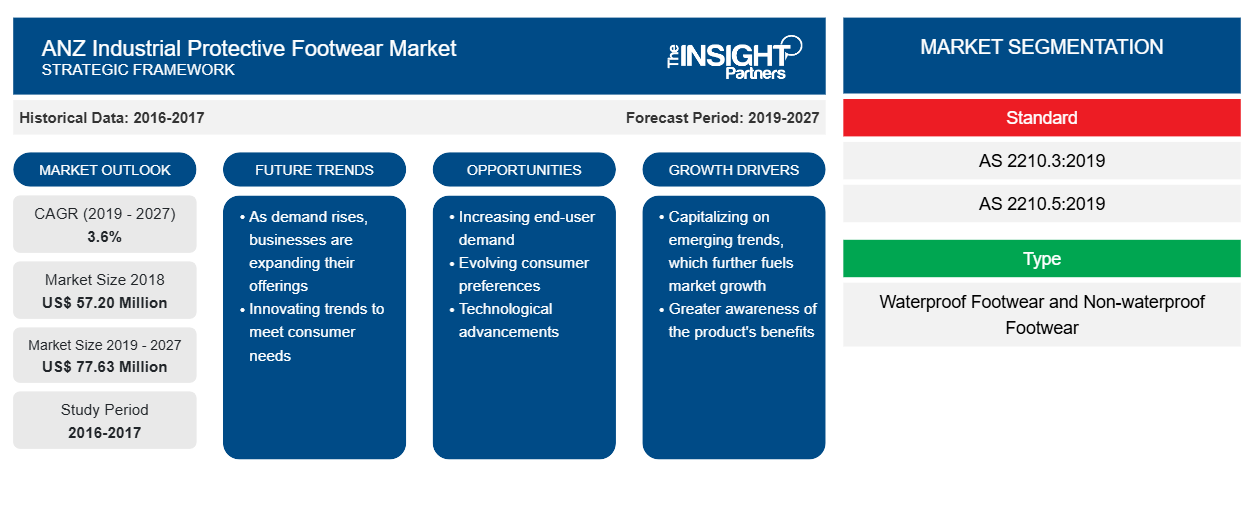

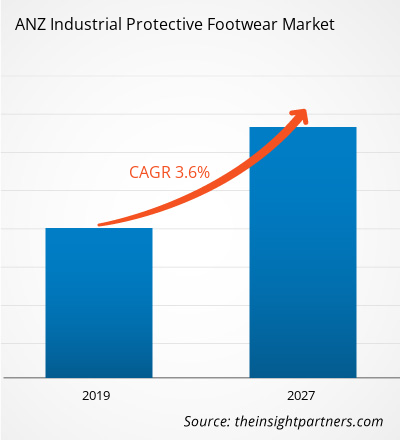

The ANZ industrial protective footwear market was valued at US$ 57.20 million in 2018 and is and is projected to reach US$ 77.63 million by 2027; it is expected to grow at a CAGR of 3.6% from 2019 to 2027.

Industrial protective footwear have provisions that protect the foot from compression, usually combined with a mid-sole plate to protect against punctures from below. Workers use these shoes to gain protection against falling objects, explosions, chemical products splattering, electrical contacts, and mechanic risks, crushing, etc., during work. Protective footwear is available in various shapes and sizes, and can maintain high durability as long as it is built with quality material and innovative technology. Innovative technologies in the footwear are underway to serve different functions such as slip resistance, reduction of foot fatigue and forefoot, and support for the arch and heel. Rising concerns and awareness regarding workplace safety among employees is driving demand for industrial protective footwear.

Non-deadly mishaps at work are those that mean in any event four full schedule long stretches of nonappearance from work (additionally called genuine mishaps at work). Lethal mishaps at work are those that lead to the death of the casualty within one year. To dodge the mishaps in the mechanical workplace, governments of Australia and New Zealand have laid severe guidelines for the utilization of modern defensive footwear. The demand for safety footwear is expected to increase in the emerging markets such as New Zealand and Papua New Guinea, due to rise in regulatory actions with the support from International Labor Organization (ILO). Moreover, the introduction of innovative technologies in safety footwear in the untapped regions result boosts the demand for footwear.

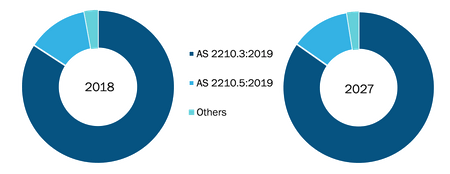

Based on standard, the ANZ industrial protective footwear market is segmented into AS 2210.3:2019, AS 2210.5:2019, and others. Based on type, the market is segmented into waterproof footwear and non-waterproof footwear. By Application, the ANZ industrial protective footwear market is segmented into manufacturing, construction, oil and gas, chemicals, food, mining, pharmaceuticals, agriculture, and transportation.

The COVID-19 pandemic first began in Wuhan (China) in December 2019, and since then, it has spread around the globe at a fast pace. The outbreak has affected economies and industries due to imposed lock downs, travel bans, and business shutdowns. It is anticipated to considerably affect the global textile, leather, clothing and footwear manufacturing industries. Constrained logistics, travel restrictions, and labor shortage have made it difficult for manufacturers in ANZ to deliver goods. In addition, international trade and supply disruptions in textile, leather,clothing, and footwear landscape are likely limit the industrial protective footwear industry in these countries.

ANZ Industrial Protective Footwear Market

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

Adoption of Stringent Regulatory Framework

Lack of knowledge regarding workplace safety and health hazards is a major issue faced by workers. To raise health and safety awareness, many government and nongovernment organizations are introducing various programs and campaigns related to health and safety of workers. For instance, the Occupational Safety and Health Act (OSHA) has teamed up with various health and safety organizations to come up with unique ideas and solutions through the Workplace Innovator Award campaign. Several associations such as the International Labour Organization (ILO) are engaged in the development of regulations and safety standards to ensure the public safety, health, and amenity. ILO brings together governments, employers, and workers of almost 187 countries, including countries in ANZ, to set labor standards, develop policies, and devise programs promoting decent work for all women and men at workplace. In addition, there are few national associations such as Standards Australia, and Department of Mines, Industry Regulation and Safety of Government of Western Australia that have developed their own and issued the internationally aligned safety standards to reduce accidents and uncertainties in industries. The Standards Australia, a leading independent, nongovernmental, and not-for-profit standards organization in Australia, works as representatives of the International Organization for Standardization (ISO) and International Electrotechnical Commission (IEC); it provide the mandate standards for employee safety at workplace in Australia. These organizations guide industries such as construction, oil & gas, construction, and manufacturing and mandate the use of protective gears, including safety shoes, on the work floor. Thus, adoption of stringent regulatory framework for industrial safety standards has supported the growth of protective equipment such as protective footwear.

Standard-Based Market Insights

Based on standard, the ANZ industrial protective footwear market is segmented into AS 2210.3:2019, AS 2210.5:2019, and others. In 2018, the AS 2210.3:2019 segment led the industrial protective footwear market with the largest share, and the market for the footwear complying with this standard is expected to grow at a higher CAGR during the forecast period. AS 2210.3:2019 safety standards are similar to European safety standard EN ISO 20345.EN ISO 20345, also known as “EN ISO 20345 Personal Protective Equipment – Safety Footwear” sets standards or minimum requirement for protection of worker foot in the industrial working environment. The AS 2210.3:2019 standard focuses on the heel area on boots; height of upper, pressure, and bump impact resistance of toe cap; minimum length of footwear; water vapor permeability and water vapor number of upper; and thickness and abrasion resistance of out sole. Footwear, in accordance with AS 2210.3:2019, is intended to protect the wearer from falling or rolling objects, and bumps; it is also meant to refrain users from walking into sharp or pointed objects and hot and cold substances. Rapid developments in industries such as construction, manufacturing, mining, and oil & gas has led to increase in number of manufacturing stages and protocols, which compels plant operators to prioritize worker safety.

ANZ Industrial Protective Footwear Market, by Standard – 2018 and 2027

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Type-Based Market Insights

Based on type, the ANZ industrial protective footwear market is segmented into waterproof footwear and non-waterproof footwear. In 2018, the non-waterproof footwear segment led the industrial protective footwear market with a larger share. Non-waterproof footwear is general-purpose safety footwear used in various industries such as manufacturing, construction, oil and gas, chemicals, food, mining, pharmaceuticals, and transportation. It is specifically designed to safeguard the feet from falling objects, fatigue, burns, cutting, and electrical hazards.

Application-Based Market Insights

Based on application, the ANZ industrial protective footwear market is segmented into manufacturing, construction, oil and gas, chemicals, food, mining, pharmaceuticals, agriculture and transportation. In 2018, the construction segment led the industrial protective footwear market with the largest share and is expected to continue its dominance during the forecast period. Protective footwear is extensively used in the construction sector as the workers are subject to high risk of meeting with accidents at construction sites. Lifting of heavy objects and transportation are common tasks at these sites. Various objects, including sharp nails, fallen on ground, greasy and oil surfaces making them slippery are among the common causes of severe injuries on the job. Various types of protective footwear used in the construction sector include metatarsal shoes, steel toe capped shoes, slip-resistant footwear, and metal instep shoes. Growing adoption of health and safety practices to reduce workplace fatalities drives the demand for industrial protective footwear for construction workers in ANZ.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

ANZ Industrial Protective Footwear Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

The key players operating in market are Bata Industrials Australia, Blundstone Australia, Dewalt, Dunlop, and Honeywell Safety Products. These players have adopted product launch, agreement & partnership, business expansion, and product innovations as their key strategies to increase their market share. Among these, product launches and partnerships are the prominent strategies adopted by the key players to remain competitive in the market.

ANZ Industrial Protective Footwear Market, by Standard

- AS 2210.3:2019

- AS 2210.5:2019

- Others

ANZ Industrial Protective Footwear Market,by Type

- Waterproof Footwear

- Non-waterproof Footwear

ANZ Industrial Protective Footwear Market, by Application

- Construction

- Manufacturing

- Mining

- Oil and Gas

- Chemicals

- Food

- Pharmaceuticals

- Agriculture

- Transportation

Company Profiles

- Bata Industrials Australia

- Blundstone Australia

- Dewalt

- Dunlop

- Oliver Footwear

- Honeywell Safety Products

- Redback Boots

- Safeworx

- Skellerup

- Steel Blue

ANZ Industrial Protective Footwear Market Regional Insights

The regional trends and factors influencing the ANZ Industrial Protective Footwear Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses ANZ Industrial Protective Footwear Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for ANZ Industrial Protective Footwear Market

ANZ Industrial Protective Footwear Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2018 | US$ 57.20 Million |

| Market Size by 2027 | US$ 77.63 Million |

| Global CAGR (2019 - 2027) | 3.6% |

| Historical Data | 2016-2017 |

| Forecast period | 2019-2027 |

| Segments Covered |

By Standard

|

| Regions and Countries Covered | Australia and New Zealand

|

| Market leaders and key company profiles |

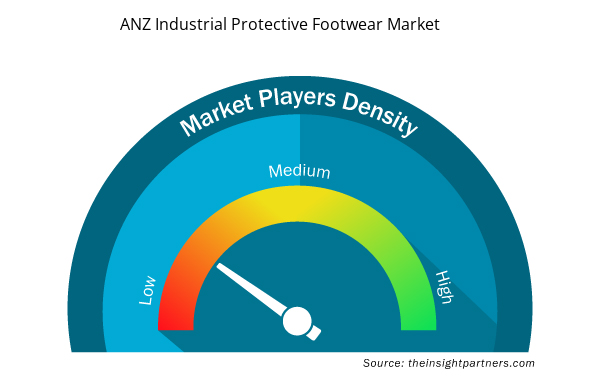

ANZ Industrial Protective Footwear Market Players Density: Understanding Its Impact on Business Dynamics

The ANZ Industrial Protective Footwear Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the ANZ Industrial Protective Footwear Market are:

- BataIndustrials Australia

- BlundstoneAustralia

- Dewalt

- Dunlop

- OliverFootwear

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the ANZ Industrial Protective Footwear Market top key players overview

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Standard, Type, Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Australia, China, Japan, South Korea

Trends and growth analysis reports related to Consumer Goods : READ MORE..

TheList of Companies - ANZ Industrial Protective Footwear Market

- BataIndustrials Australia

- BlundstoneAustralia

- Dewalt

- Dunlop

- OliverFootwear

- HoneywellSafety Products

- RedbackBoots

- Safeworx

- Skellerup

- SteelBlue

Get Free Sample For

Get Free Sample For