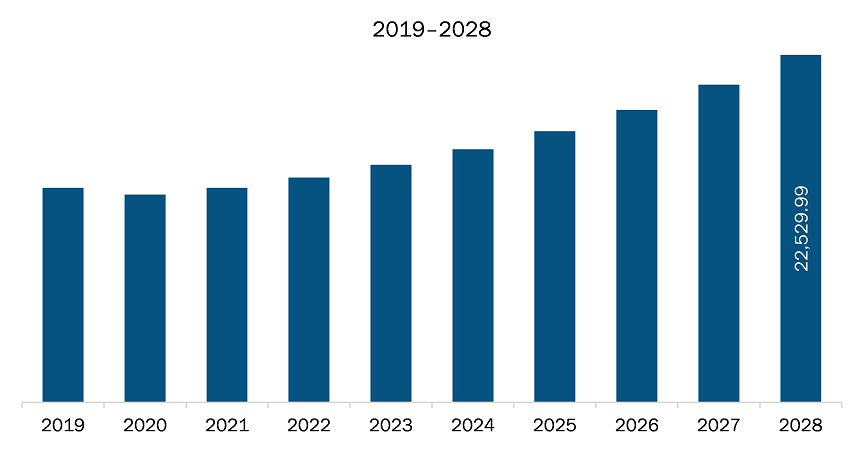

The commercial vehicle transmission oil pump and transmission system market in Asia Pacific is expected to grow from US$ 13,918.39 million in 2021 to US$ 22,529.99 million by 2028; it is estimated to grow at a CAGR of 7.1% from 2021 to 2028.

Transmission for electric vehicles is utilized to transfer mechanical power from an electric traction motor to the wheels. Most of the electric cars are equipped with single-speed transmissions, which are sufficient for efficient operation in today's world. However, several vehicle types benefit from the usage of a multi-speed transmission. Furthermore, many of the major manufacturers in the EV transmission market are developing multi-speed transmission sailing operations and load shifting capabilities for electric vehicles to launch them shortly. To follow government rules regarding emission limits and future fuel usage, the development of electric vehicles is gaining traction at a rapid pace. Apart from the traction motor, the transmission or gearbox in the drive system is another critical component in an electric vehicle's power performance. Electric vehicles require enough power to overcome road load when driving. The wheel axle driving force curve and the road load curve can examine the acceleration and maximum speed performance of electric vehicles. Furthermore, it has been discovered that by using a multi-speed transmission with a different gear ratio, the motor's performance range can be enlarged (with massive torque at low speed and with the high rotate speed at high speed). As a result, an electric vehicle with transmission performs better on the road than the one with a single ratio gearbox. It can lower the motor's power requirements and improve the electric vehicle's performance. Thus, the gearbox is a better option for enhancing the vehicle's performance. For instance, Eaton's EV transmissions use the same proven, reliable, and efficient lay shaft architecture as automated manual transmissions (AMTs). Still, they don't have a clutch, and the traction motor synchronizes shifts. Lightweight countershaft gearboxes with a range of torque Asia Pacifies and electric gearshift actuation enable smaller electric motors in the EV transmissions. Thus, transmission system for commercial electric vehicle provides a lucrative opportunity to the market.

Due to the increasing number of COVID-19 confirmed cases in India and other countries across Asia Pacific, the region is greatly affected by the COVID-19 pandemic. The region homes the largest population across the world, which is imposing greater risk to a large number of individuals. Further, China is a world leader in many global brands. According to the Organization for Economic Co-operation and Development (OECD), the pandemic affected major economies of the region, such as China, India, South Korea, and Vietnam, and these countries experienced a decline in industrial growth during the first two quarters of 2020. In 2020, the COVID-19 outbreak functioned as a major drag on the automotive parts and components business, as supply chains were disrupted by trade restrictions and consumption fell because of government-imposed lockdowns across the world. India witnessed a decline in the automobile sector in terms of demand due to subsequent lockdowns to control the spread of the novel coronavirus virus. The disruption in the supply chain and the closing of manufacturing industries hampered the sales of automobiles and their components. However, with the introduction of the COVID-19 vaccine in the region, the impact on the supply chain side of the market is currently minimal due to the resumption of automobile companies’ operations in various countries of Asia Pacific. The region is set to lead the post-pandemic growth in the commercial vehicle transmission oil pump and transmission system market.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the Asia Pacific commercial vehicle transmission oil pump and system market. The Asia Pacific commercial vehicle transmission oil pump and transmission system market is expected to grow at a good CAGR during the forecast period.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Asia Pacific Commercial Vehicle Transmission Oil Pump and Transmission System Market Segmentation

Asia Pacific Commercial Vehicle Transmission Oil Pump and Transmission System Market – By Offering

- Transmission Oil Pump

- Transmission System

Asia Pacific Commercial Vehicle Transmission Oil Pump and Transmission System Market – By Oil Pump Product Type

- Fixed Displacement Pump

- Variable Displacement Pump

Asia Pacific Commercial Vehicle Transmission Oil Pump and Transmission System Market – By Oil Pump Type

- Vane Type

- Gear Type

- Rotor Type

Asia Pacific Commercial Vehicle Transmission Oil Pump and Transmission System Market – By Transmission Type

- Manual Transmission

- Automatic Transmission

- Automated Manual Transmission

Asia Pacific Commercial Vehicle Transmission Oil Pump and Transmission System Market – By Vehicle Type

- MCV (Class III and Class VI)

- HCV (Class VII to Class VIII)

Asia Pacific Commercial Vehicle Transmission Oil Pump and Transmission System Market – By Powertrain Type

- Internal Combustion Engine

- Electric

- Hybrid

Asia Pacific Commercial Vehicle Transmission Oil Pump and Transmission System Market – By Country

- China

- Japan

- India

- South Korea

- Australia

- Rest of APAC

Asia Pacific Commercial Vehicle Transmission Oil Pump and Transmission System Market –Companies Mentioned

- Allison Transmission Holding INC

- Daimler AG

- Eaton Group

- Mack Trucks

- Scania

- Sinotruk (Hong Kong) Limited

- Shaanxi Fast Auto Drive Co. Ltd.

- Volvo AG

- Voith GmbH & Co. KGaA

- ZF Friedrichshafen AG

- Hyundai Transys

- Mahle GmbH

- Concentric AB

- SHW AG

- BorgWarner Inc.

- Scherzinger Pumpen GmbH & Co. KG

- SLPT

- Vitesco Technologies

- Qijiang Gear Transmission Co., Ltd.

- Fuxin Del Auto Parts Co., Ltd.

- Zhejiang Wanliyang Co., Ltd.

Asia Pacific Commercial Vehicle Transmission Oil Pump and Transmission System Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 13,918.39 Million |

| Market Size by 2028 | US$ 22,529.99 Million |

| CAGR (2021 - 2028) | 7.1% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Offering

|

| Regions and Countries Covered |

Asia-Pacific

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For