Electric Trucks Market Insights, Growth, and Forecast (2025-2034)

Electric Trucks Market Size and Forecast (2021 - 2034), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Propulsion (BEV, PHEV, and FCV), Vehicle Type (LCV and Medium & HCV), Range (Less than 200 Miles and More than 200 Miles), Level of Automation (Semi-Autonomous and Fully Autonomous)

Historic Data: 2021-2024 | Base Year: 2025 | Forecast Period: 2026-2034- Report Date : Mar 2026

- Report Code : TIPRE00025913

- Category : Automotive and Transportation

- Status : Upcoming

- Available Report Formats :

- No. of Pages : 150

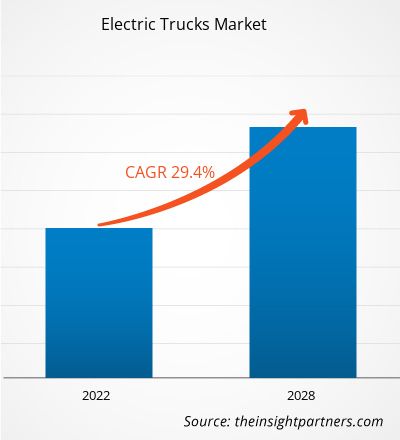

The electric trucks market size is expected to reach US$119.43 million by 2034 from US$12.51 million in 2025. The market is anticipated to register a robust Compound Annual Growth Rate (CAGR) of 28.5% during the forecast period of 2026–2034.

Electric Trucks Market Analysis

The electric trucks market forecast indicates robust growth supported by increasingly stringent global emission regulations; rapid development with regard to battery technology and energy storage solutions; and increasing usage among zero-emission vehicles within key verticals such as logistics, transportation, and e-commerce. Market expansion is being heavily facilitated by government incentives and corporate sustainability goals, which are accelerating fleet electrification efforts worldwide. Original Equipment Manufacturers (OEMs) are responding by investing heavily in research and development to improve vehicle range, expand the charging infrastructure ecosystem, and integrate advanced autonomous and telematics capabilities to set electric trucks up as central components of future sustainable logistics chains.

Electric Trucks Market Overview

Electric trucks are defined as commercial vehicles that range from light-duty vans to heavy-duty articulated vehicles, powered fully or partially by an electric drivetrain, using energy stored on board in batteries or provided by fuel cells. In particular, these provide huge advantages, including significant reductions in greenhouse gas emissions, noise pollution, and much lower operating costs compared to conventional diesel trucks. Applications are growing across a wide range of areas, including urban logistics, last-mile delivery, and regional haul transport to specialized construction sectors. The growth of the global market is underpinned at its core by ambitious targets for decarbonization, the reduction in the cost of battery packs, and, strategically, the emergence of hydrogen fuel-cell technology as a practical solution to meet serious demands for heavy-duty, long-haul transportation.

Customizee This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONElectric Trucks Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Electric Trucks Market Drivers and Opportunities

Market Drivers:

- Strict Emission Norms and Global Decarbonization Targets: Zero-emission mandates for commercial fleets are being enacted with increasing stringency by governments across the globe, especially within urban areas and along key transportation corridors. Such regulatory pressure is making it obligatory for logistics providers and fleet operators alike to make a rapid switch from fossil fuel-powered vehicles to their sustainable electric counterparts in as short a time frame as possible.

- Rising Fuel Costs and Demand for Cost-Efficient Logistics: The volatility and high cost of traditional fuels make the Total Cost of Ownership (TCO) of electric trucks increasingly attractive. The lower maintenance requirements and cheaper per-mile energy consumption offered by electric platforms provide a strong financial incentive for large-scale fleet modernization and efficiency gains.

- Technological Advancements in Battery Density and Charging Infrastructure: Continuous innovation in lithium-ion and solid-state battery technology is rapidly improving energy density, directly extending the vehicle range. At the same time, the deployment of MCS and dedicated high-power charging infrastructure is hugely mitigating range anxiety and making electric trucks fit for medium- and long-haul operations.

Market Opportunities:

- Expansion in Emerging Markets with Supportive EV Policies: Emerging economies, particularly those in Asia-Pacific and Latin America, represent significant untapped markets. Government subsidies, favorable regulatory frameworks, and rapidly growing e-commerce sectors in these regions are creating massive opportunities for electric truck manufacturers to scale operations and market share.

- Integration of Autonomous Driving and Advanced Telematics: The convergence of electric powertrain technology with autonomous driving systems offers a revolutionary opportunity. OEMs are currently piloting semi-autonomous and fully autonomous electric trucks that could further reduce operating costs, enhance driver safety, and efficiently use capacity in freight movement.

- Accelerated Development of Hydrogen Fuel Cell Trucks: The limitations of battery weight and charging time in heavy-duty, long-haul applications are being addressed by Hydrogen Fuel Cell Vehicles (FCV). FCVs offer quick refueling and extended range, making them an ideal and highly lucrative market opportunity for zero-emission inter-city and cross-country trucking.

Electric Trucks Market Report Segmentation Analysis

The electric trucks market share is analyzed across various segments to provide a clearer understanding of its structure, growth potential, and emerging trends in technology and application. Below is the standard segmentation approach used in most industry reports:

By Propulsion:

- Battery Electric Vehicle (BEV

- Plug-in Hybrid Electric Vehicle (PHEV

- Fuel Cell Vehicle (FCV)

By Vehicle Type:

- Light Commercial Vehicles (LCV)

- Medium & Heavy Commercial Vehicles (HCV)

By Range:

- Less than 200 Miles

- More than 200 Miles

By Level of Automation:

- Semi-Autonomous

- Fully Autonomous

By Geography:

- North America

- Europe

- Asia Pacific

- South & Central America

- Middle East & Africa

Electric Trucks Market Regional Insights

The regional trends and factors influencing the Electric Trucks Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Electric Trucks Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Electric Trucks Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2025 | US$ 12.51 Million |

| Market Size by 2034 | US$ 119.43 Million |

| Global CAGR (2026 - 2034) | 28.5% |

| Historical Data | 2021-2024 |

| Forecast period | 2026-2034 |

| Segments Covered |

By Propulsion

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Electric Trucks Market Players Density: Understanding Its Impact on Business Dynamics

The Electric Trucks Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Electric Trucks Market top key players overview

Electric Trucks Market Share Analysis by Geography

Asia-Pacific is expected to grow fastest in the coming years. Emerging markets in South & Central America and the Middle East & Africa also possess many untapped opportunities for electric truck providers to expand their footprint. The electric trucks market shows a different growth trajectory in each region due to factors such as regulatory environments, available infrastructure, and domestic OEM manufacturing strength. Below is a summary of market share and trends by region:

1. North America

- Market Share: Holds the largest market share in revenue terms due to strong governmental EV incentives and the rapid development of specialized charging infrastructure, particularly in the US and Canada.

- Key Drivers: The implementation of IRA tax credits for commercial clean vehicles, driving immediate purchase decisions.

- Trends: A significant trend involves the adoption of megawatt charging (MCS) technology to support the electrification of heavy-duty, long-haul freight corridors.

2. Europe

- Market Share: Commands a major share, heavily driven by its ambitious CO₂ reduction targets and the proliferation of urban low-emission zones (LEZ).

- Key Drivers: The binding mandates of the EU Green Deal and stringent CO₂ standards for heavy-duty vehicles.

- Trends: There is a concentrated effort on developing a hydrogen corridor across the continent to support long-haul and cross-border FCV trucking.

3. Asia-Pacific

- Market Share: The fastest-growing region, led by China, which dominates the market in terms of volume and local manufacturing capacity.

- Key Drivers: Aggressive government subsidies and supportive EV policies (e.g.,

- Trends: Integration of AI-driven telematics for fleet optimization and massive investment in localized, high-volume battery manufacturing (including BYD's Blade battery technology).

4. South and Central America

- Market Share: An emerging market characterized by increasing demand for efficient urban logistics and last-mile delivery services.

- Key Drivers: Favorable tax structures for commercial EV imports in certain countries (e.g., Chile, Brazil).

- Trends: The market is predominantly focused on the adoption of cost-effective BEV solutions tailored for short-haul and city delivery applications.

5. Middle East and Africa

- Market Share: A nascent adoption market with strong growth potential, primarily driven by massive infrastructure and diversification investments in key economies.

- Key Drivers: Investment in renewable energy-powered charging solutions.

- Trends: Early-stage hydrogen truck pilots are being deployed in logistics centers, leveraging the region's vast solar energy resources for green hydrogen production.

Electric Trucks Market Players Density: Understanding Its Impact on Business Dynamics

High Market Density and Competition

The electric trucks market is intensely competitive, featuring a dynamic mix of established Global OEMs (such as Daimler, AB Volvo, and PACCAR) and highly innovative emerging EV startups (including Rivian, Tesla, and Nikola). The competition is global, with Asian giants like BYD dominating the Light Commercial Vehicle (LCV) segment, especially in the Asia-Pacific region. This crowded and competitive environment compels vendors to differentiate through key strategic areas:

- Advanced Battery Technology and Range Optimization: Developing proprietary, high-density battery packs to achieve competitive long-haul ranges.

- Hydrogen Fuel Cell Development for Heavy-Duty Applications: Investing in FCV platforms to capture the lucrative Class 8 (heavy-duty) segment requiring extended range and fast refueling.

- Autonomous Driving Integration and Fleet Management Solutions: Offering advanced, integrated telematics and automated driving features to lower fleet operational costs and enhance safety.

- Scalability and Global Supply Chain Efficiency: Establishing resilient battery and component supply chains to meet rapidly increasing production targets.

Major Companies Operating in the Electric Trucks Market:

- AB Volvo – Sweden

- BYD Company Ltd – China

- Daimler AG – Germany

- PACCAR Inc. – United States

- Navistar, Inc. – United States

- FAW Group Co., Ltd. – China

- Scania – Sweden

- Proterra Inc. – United States

- Rivian – United States

Disclaimer: The companies listed above are not ranked in any particular order.

Electric Trucks Market News and Recent Developments

- AB Volvo announced new electric truck models for urban and regional transport.: AB Volvo introduced the FL 16–18 t BEV with full air suspension and multiple chassis configurations, alongside FM low-entry and FMX BEV rigid platforms. The company also unveiled the FH 6×4 BEV tractor with up to 540 kWh battery packs, targeting long-haul operations.

- BYD delivered its 100th Class 8 electric truck in the US and launched a global pickup.: BYD celebrated the delivery of its 100th 8TT battery-electric truck to Anheuser-Busch in Oakland, reinforcing its zero-emission logistics strategy. The company also launched the BYD Shark pickup in Mexico and introduced its Super e-Platform with Megawatt Flash Charging technology, enabling ultrafast 1 MW charging for heavy-duty vehicles.

Electric Trucks Market Report Coverage and Deliverables

The "Electric Trucks Market Size and Forecast (2021–2034)" report provides a detailed analysis of the market covering the following areas:

- Electric Trucks Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Electric Trucks Market trends, as well as market dynamics such as drivers, restraints, and key opportunities.

- Detailed PEST and SWOT analysis to assess the macroeconomic and internal competitive environment.

- Electric Trucks Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the Electric Trucks Market.

- Detailed company profiles of key industry participants.

Frequently Asked Questions

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For