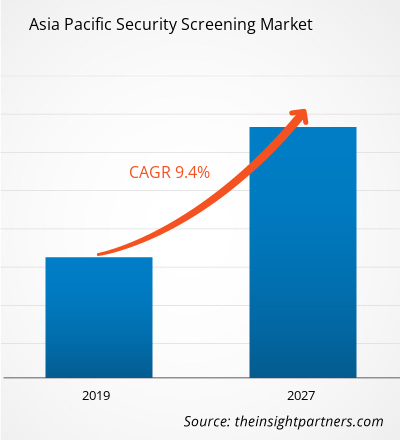

Security screening market in the Asia Pacific is expected to grow from US$ 2.40 Bn in 2018 to US$ 5.61 Bn by the year 2027 with a CAGR of 9.4% from the year 2019 to 2027.

The rise in the air passenger traffic has led to the expansion of airport infrastructure and increased cross-border transactions owing to rapid growth in the e-commerce industry are the key factors driving the growth of the security screening market. Moreover, the growth of the infrastructure sector in developing economies is anticipated to boost the security screening market growth in the near future. Construction & infrastructural development is considered to be one of the prime contributors to a country’s socio-economic development. The developing economies worldwide, including India, China, and Australia, among others, are experiencing a notable growth rate in commercial construction. This has resulted in the development of new commercial construction, including shopping malls, railway stations, commercial complexes, hotels, and hospitals, among others. Moreover, these economies are attracting FDIs for their infrastructural growth, which is further propelling the infrastructural development. Also, governments of China and Japan are investing heavily on the development of the infrastructural sector of other developing economies of Asia Pacific. For instance, China and Japan are investing in the infrastructure sector of the Philippines, Indonesia, Korea, Bangladesh, and Malaysia, among others. The growth in the infrastructure sector of these economies will further create a demand for enhanced security and deployment of X-ray scanners. This, in turn, is anticipated to propel the growth of security screening market.

Security screening market by product is classified into x-ray scanner, biometric systems, electromagnetic metal detector, and explosive trace detector. The x-ray scanner segment led the security screening market in the year 2018 with the highest market share and is expected to flourish its dominance during the forecast period. On the other hand, the electromagnetic metal detector segment has the second-highest market share in 2018 and is expected to have stable growth in the near future. In the present scenario, the electromagnetic metal detector is utilized to detect varied Products of metallic devices such as guns, bombs, brass knuckles, knives, and others for security purpose. To evade the occurrence of any unauthorized and illegal entry of the metallic objects along with the luggage bags of the individuals, the adoption of electromagnetic metal detector is rising. Moreover, adoption of electromagnetic metal detector is frequently rising at public spaces such as schools, transportation terminals, courts, and others. Also to protect world leaders, sports & cultural events.

China dominated the security screening market in 2018 and is expected to dominate the market with the highest share in the Asia Pacific region through the forecast period. The Chinese government is highly focused on the development of its infrastructure and has taken several measures to support the development. For instance, the country’s central government intensely pushed fiscal incentive in the form of infrastructure investments recently for sustaining economic growth. Also, China’s 13th Five Year Plan is focused on increasing investments in the country’s infrastructure. Further, the construction of the second international airport in Beijing is planned to be completed by 2019. The figure given below highlights the revenue share of the rest of Asia Pacific in the security screening market in the forecast period:

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

ASIA PACIFIC SECURITY SCREENING MARKET SEGMENTATION

By Product

- X-Ray Scanner

- Biometric Systems

- Explosive Trace Detector

- Electromagnetic Metal Detector

By Application

- Public Places

- Border Check point

- Government

- Airport

- Others

By Country

- Australia

- China

- India

- Japan

- South Korea

- Rest of APAC

Security screening Market - Companies Mentioned

- Aware, Inc.

- Anviz Global

- Analogic Corporation

- Astrophysics Inc.

- L3 Security & Detection Systems

- Magal Security Systems Ltd.

- Nuctech Company Limited

- OSI Systems, Inc.

- Smiths Detection Inc.

- Teledyne ICM (Teledyne Technologies Incorporated)

Asia Pacific Security Screening Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2018 | US$ 2.40 Billion |

| Market Size by 2027 | US$ 5.61 Billion |

| Global CAGR (2019 - 2027) | 9.4% |

| Historical Data | 2016-2017 |

| Forecast period | 2019-2027 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Underwater Connector Market

- Foot Orthotic Insoles Market

- Nurse Call Systems Market

- Print Management Software Market

- Airport Runway FOD Detection Systems Market

- Batter and Breader Premixes Market

- Aircraft MRO Market

- Smart Water Metering Market

- Social Employee Recognition System Market

- Latent TB Detection Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Australia, China, Japan, South Korea

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies

- Aware, Inc.

- Anviz Global

- Analogic Corporation

- Astrophysics Inc.

- L3 Security & Detection Systems

- Magal Security Systems Ltd.

- Nuctech Company Limited

- OSI Systems, Inc.

- Smiths Detection Inc.

- Teledyne ICM (Teledyne Technologies Incorporated)

Get Free Sample For

Get Free Sample For