Asia Pacific Specialty Hospitals Market Analysis and Forecast by Size, Share, Growth, Trends 2031

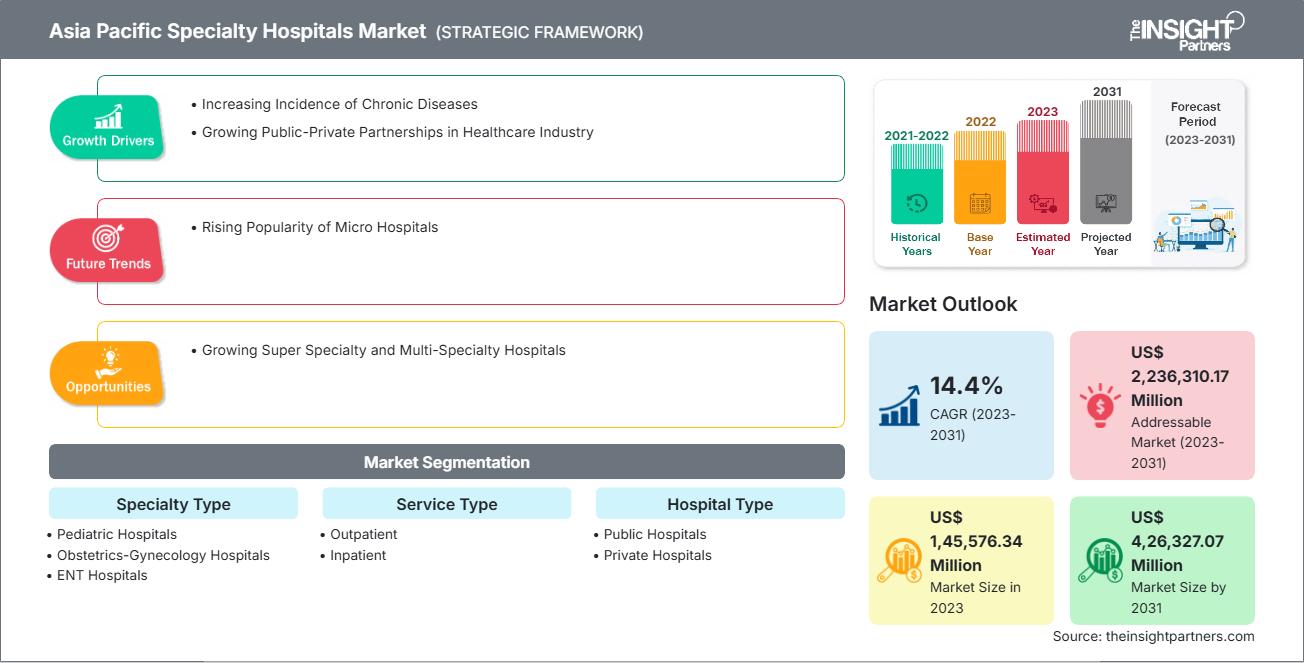

Asia Pacific Specialty Hospitals Market Size and Forecast (2021 - 2031), Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Specialty Type (Pediatric Hospitals, Obstetrics-Gynecology Hospitals, ENT Hospitals, Oncology Hospitals, Rehabilitation Hospitals, Orthopedic Hospitals, Neurology Hospitals, Cardiology Hospitals, IVF Hospitals, and Others), Service Type (Outpatient and Inpatient), and Hospital Type (Public Hospitals and Private Hospitals)

Historic Data: 2021-2022 | Base Year: 2023 | Forecast Period: 2023-2031- Status : Published

- Report Code : TIPRE00003323

- Category : Life Sciences

- No. of Pages : 117

- Available Report Formats :

The Asia Pacific specialty hospitals market was valued at US$ 1,45,576.34 million in 2023 and is expected to reach US$ 4,26,327.07 million by 2031; it is estimated to register a CAGR of 14.4% from 2023 to 2031.

Growing Public-Private Partnerships in Healthcare Industry Boosts Asia Pacific Specialty Hospitals Market

A public-private partnership (PPP) is a cooperative arrangement between two or more public and private hospitals. There is a lack of medical infrastructure in public hospitals; hence, partnership with the private sector has emerged as a new avenue to eradicate insufficiencies. The approach also includes developing private specialty hospitals on public land that allow a certain number of beds/treatments available to publicly funded patients. For instance, in India, the Government of Punjab and Max Healthcare Institute entered into a PPP and are setting up a super specialty healthcare facility for cancer and trauma care. The partnership focuses on providing healthcare services for cancer and trauma care in Mohali, Punjab. According to the partnership, Max Healthcare Institute Ltd (private provider) shall construct and manage the Greenfield super specialty hospital for a period of 50 years (concession period); and the Government of Punjab shall provide the land required for the hospital to Max Healthcare Institute Ltd, who will provide the healthcare services. Max Healthcare Institute Ltd will pay the Government of Punjab an upfront consideration and 5% of the total revenue as an annual concession fee.

PPP hospitals offer benefits such as improved access and reach, improved equity, better efficiency, opportunity to regulate, accountability, improved quality/rational practice, and augmented resources- funds technology. Owing to these benefits, such partnerships are increasing in the healthcare sector, boosting the specialty hospitals market growth.

Asia Pacific Specialty Hospitals Market Overview

The need for specialized services that provide cutting-edge medical care is growing as more people are able to afford better healthcare. As a result, it is projected that growing demand for specialty care hospitals will propel the market growth. For instance, a study carried out in China between 2011 and 2021 found that, of 4,156 participants, only 6.1% preferred private hospitals, while the remaining 93.9% preferred general public hospitals, specialized public hospitals, or community hospitals (Health Policy, 2023). Further, the emergence of cutting-edge technologies in specialty hospitals expands their treatment facilities, which fuels the market growth. For example, in September 2024, Concord Medical Services Holdings Limited-a Chinese healthcare provider with expertise in cancer treatment, research, education, and prevention-announced that its PRC subsidiary, Guangzhou Concord Cancer Center, which provides comprehensive cancer care services, had acquired the license to procure large medical equipment for its proton equipment.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONAsia Pacific Specialty Hospitals Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Asia Pacific Specialty Hospitals Market Segmentation Analysis:

The Asia Pacific specialty hospitals market is categorized into types, service type, hospital type, and country.

Based on types, the Asia Pacific specialty hospitals market is segmented into pediatric hospitals, obstetrics-gynecology hospitals, ENT hospitals, oncology hospitals, rehabilitation hospitals, orthopedic hospital, neurology hospital, cardiology hospitals, IVF hospitals, and others. The neurology hospital segment held the largest market share in 2023.

In terms of service type, the Asia Pacific specialty hospitals market is bifurcated into outpatient and inpatient. The inpatient segment held a larger market share in 2023.

By hospital type, the Asia Pacific specialty hospitals market is bifurcated into public hospital and private hospital. The private hospital segment held a larger market share in 2023.

By country, the Asia Pacific specialty hospitals market is segmented into China, Japan, India, Australia, South Korea, Singapore, Malaysia, and the Rest of Asia Pacific. China dominated the Asia Pacific specialty hospitals market share in 2023.

Asia Pacific Specialty Hospitals Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 1,45,576.34 Million |

| Market Size by 2031 | US$ 4,26,327.07 Million |

| CAGR (2023 - 2031) | 14.4% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Specialty Type

|

| Regions and Countries Covered |

Asia Pacific

|

| Market leaders and key company profiles |

|

Asia Pacific Specialty Hospitals Market Players Density: Understanding Its Impact on Business Dynamics

The Asia Pacific Specialty Hospitals Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Company Profiles

Advanced Specialty Hospitals; Encompass Health Corporation; Icahn School of Medicine at Mount Sinai; Indiana University Health, Inc.; Kindred Healthcare, LLC; Memorial Sloan Kettering Cancer Center; Select Medical Holdings Corp; Stanford Health Care; Steward Health Care System LLC; Universal Health Services Inc; Vibra Healthcare, LLC; Brigham and Women's Hospital; Cleveland Clinic; Community Health Systems Inc; HCA Healthcare; Johns Hopkins Medicine (Wilmer Eye Institute); McLean Hospital; and NYU Langone Hospitals are some of the leading companies operating in the specialty hospitals market.

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For