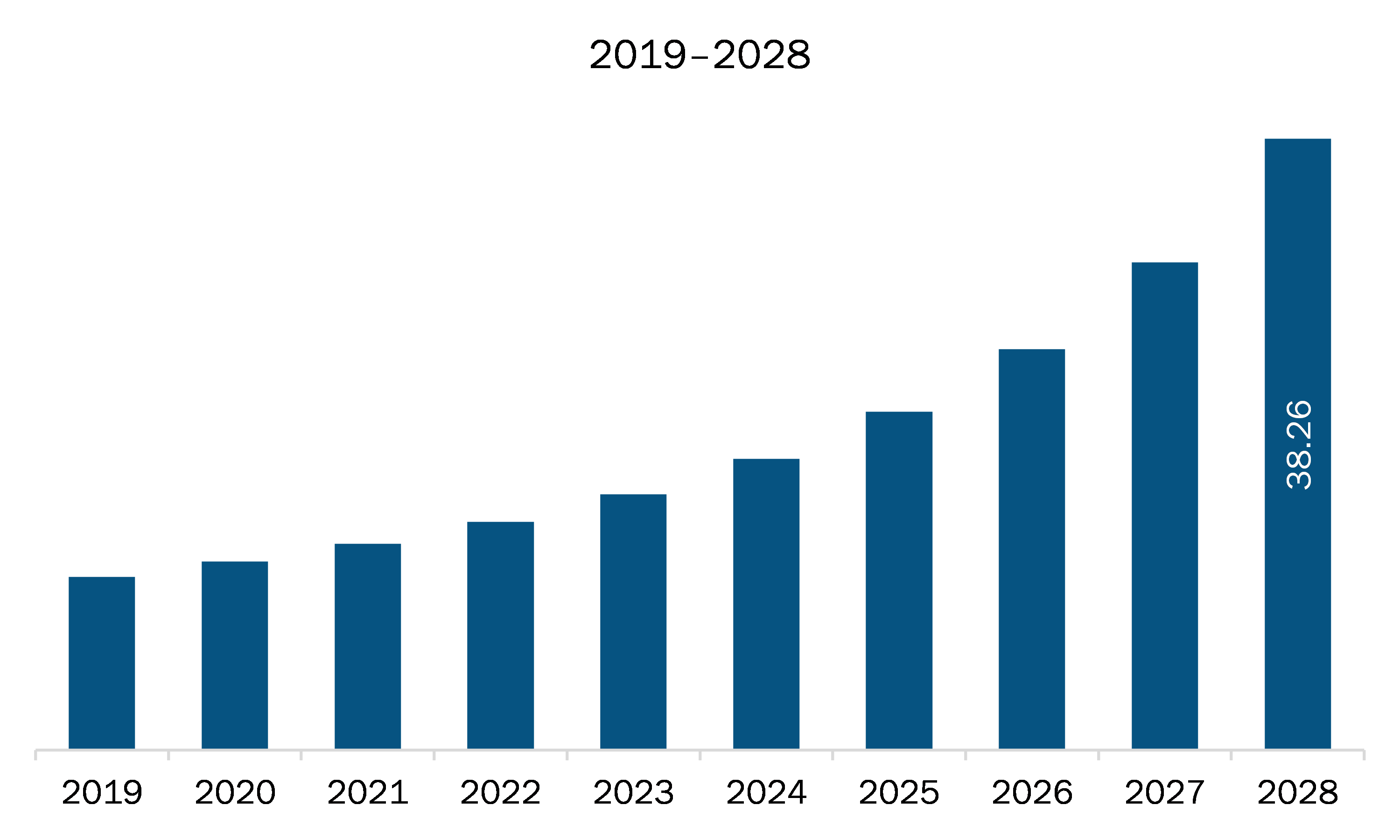

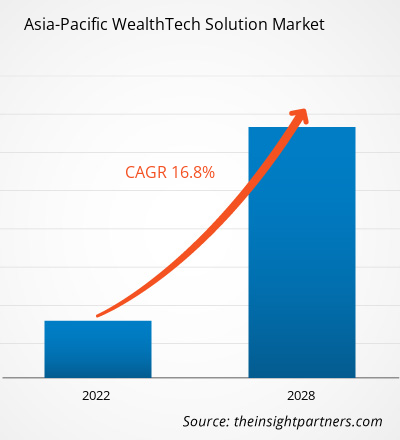

The wealthtech solution market in APAC is expected to grow from US$ 12.89 billion in 2021 to US$ 38.26 billion by 2028; it is estimated to grow at a CAGR of 16.8% from 2021 to 2028.

Cloud-based financial analytics getting popular is the major factor driving the growth of the APAC wealthtech solution market. With the digital transformation, the use of the cloud-based platform as these platforms deployed with simplicity in less time and at low deployment costs. Further, developed countries have matured internet infrastructure, while it is flourishing in several developing countries, which is a major factor contributing to the enhanced access of cloud-based platforms to end users. Financial analytics helps banking sectors to provide enhanced customer experience and risk management assistance. Cloud is emerging as a better alternative for banking and other financial service providers to store data and applications, and access advanced software applications through the internet. It helps synchronize enterprise operations and break down operational and data silos. Moreover, cloud-based financial analytics helps build resilient operations, drive business innovation, enhance IT security, and scale computing costs as needed. Therefore, the growing need of cloud-based financial analytics in the banking sector and other financial firms is bolstering the demand for WealthTech solutions. The companies offering financial analytics include FinMason, Inc.; WealthTechs Inc.; BlackRock, Inc.; and Synechron.

APAC is characterized by the presence of developing countries, positive economic outlook, high industrial presence, and huge population. All these factors make APAC a major region for the growth of various markets, including wealthtech solution. The lockdown of various plants and factories in all economies of the region due the COVID-19 pandemic is affecting the global supply chains and negatively impacting the manufacturing, delivery schedules, and sales of various products and services. Disruptions in units have stopped investments in start-ups, thereby negatively impacting the market growth. However, with lockdowns being lifted in several countries, wealthtech start-ups are likely to witness investments.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the APAC wealthtech solution market. The APAC wealthtech solution market is expected to grow at a good CAGR during the forecast period.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

APAC WealthTech Solution Market Segmentation

APAC WealthTech Solution Market – By Component

- Solution

- Services

APAC WealthTech Solution Market – By End User

- Banks

- Wealth Management Firms

- Others

APAC WealthTech Solution Market – By Organization Size

- Large Enterprises

- Small and Medium-Sized Enterprises

APAC WealthTech Solution Market – By Deployment Mode

- Cloud-Based

- On-Premises

APAC WealthTech Solution Market, by Country

- Australia

- China

- India

- Japan

- South Korea

- Rest of APAC

APAC WealthTech Solution Market - Companies Mentioned

- 3rd-eyes analytics AG

- BlackRock, Inc.

- InvestCloud, Inc.

- InvestSuite

- Synechron

- Valuefy

- Wealthfront Inc.

Asia-Pacific WealthTech Solution Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 12.89 Billion |

| Market Size by 2028 | US$ 38.26 Billion |

| Global CAGR (2021 - 2028) | 16.8% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Technology, Media and Telecommunications : READ MORE..

- 3rd-eyes analytics AG

- BlackRock, Inc.

- InvestCloud, Inc.

- InvestSuite

- Synechron

- Valuefy

- Wealthfront Inc.

Get Free Sample For

Get Free Sample For