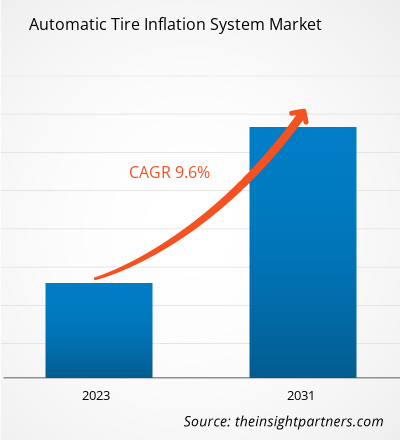

The automatic tire inflation system market size is projected to reach US$ 1,935.60 million by 2031 from US$ 927.45 million in 2023. The market is expected to register a CAGR of 9.6% in 2022–2031. Increasing electric vehicle sales with the surge in consumer awareness towards the tire pressure monitoring in the off-road and off-highway vehicles drives the market growth. According to the International Energy Agency, global electric vehicle sales reached 14 million in 2023 increased by 18% compared with 2022. China leading the market. China is projected to dominate and account for 70% of global electric bus sales in 2023.

Chinese companies are popular for delivering electric vehicles and have expanded their presence in Latin America and Europe. It signifies the growing demand by the Chinese manufacturers in these regional for sustainable transportation using the automatic tire inflation system drives the market growth. Off-road vehicles such as tractors and construction vehicles. Utility vehicles and others that use an automatic tire inflation system market growth. It improves fuel economy and enhances road safety by reducing tire expenditures, reduces downtime, and reduces maintenance costs. An automatic tire inflation system helps to maintain consistent tire pressure, which reduces costly downtime. It avoids tire blowouts, increases road safety, and improves environmental protection.

Automatic Tire Inflation System Market Analysis

An automatic tire inflation system (ATIS) is a technology that automatically maintains proper tire pressure without the need for manual intervention. It consists of valves, sensors, an air compressor, and other components integrated into the vehicle’s tire system. The sensors are used to monitor tire pressure, and automatically preset threshold. An automatic tire inflation system triggers the compressor to inflate the tire at the desired pressure. When the tire pressure exceeds the specified limit, the system releases air to prevent over-inflation. The automatic tire inflation system is driving by increasing off-road vehicle sales across the globe with the surge in the growing adoption of advanced technology to increase fuel efficiency. The automatic tire inflation system is used to improve the fuel efficiency of vehicles across the globe. The automatic tire inflation system is utilized in several commercial heavy-duty vehicles such as buses, vans, trucks, military vehicles , utility vehicles, industrial vehicles, and off-road equipment. This automatic tire inflation system is primarily used to increase safety, improve vehicle fuel efficiency, increase tire life, improve fuel efficiency, and maximize vehicle performance by ensuring maximum tire pressure. Rising demand for the inflated optimum pressure to lower the risk of blowouts, increase traction, and reduce overall tire wear and tear drives the market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Automatic Tire Inflation System Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Automatic Tire Inflation System Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Automatic Tire Inflation System Market Drivers and Opportunities

Increasing demand for demand for improving vehicles' fuel efficiency drives the market growth.

Tires have the largest expense for any fleet. Hence, it is important to keep it at the ideal pressure to maximize and improve its life. It reduces unplanned downtime, enhances fuel economy, and improves overall highway safety. According to the US Department of Energy, around 10% of under-inflated vehicle tires decrease fuel efficiency by 1%. Thus, it is important to adopt the automatic tire inflation system for semi-trucks and commercial heavy-duty vehicles that traverse thousands of kilometers annually. Inflated tires do not only wear out rapidly but also do not require more energy which drives the automatic tire inflation system market growth during the forecast period.

The automatic tire inflation system (ATIS) has helped several carriers and industrial vehicle owners to improve their bottom lines. These tire Inflator help to deliver high vehicle performance, reduces CO2 emission per dollar spent and any others.

Rising adoption and development of advanced technologies-based sensors for maintaining tire pressure are expected to create ample opportunity for market growth.

The integration of various sensors to monitor tire pressure is expected to create ample opportunity for market growth during the forecast period. Several key players are developing advanced technologies based on automatic pressure systems in order to maintain fuel efficiency. For instance, in April 2023, BFGoodrich Tires launched ActivAir, a new tire inflation system that allows off-roaders to maintain their tire pressure without human intervention. ActivAir is an integrated system that enables drivers to adjust tire pressure as per their requirements.

Automatic Tire Inflation System Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Automatic Tire Inflation System Market analysis are type, platform, application, and end-user.

- Based on type, the automatic tire inflation system market has been divided into continuous tire inflation and central tire inflation. The continuous tire inflation segment holds the largest share in 2023. This is primarily owing to increasing demand for continuous inflation by commercial vehicle owners.

- Based on vehicle type, the global automatic tire inflation system market is divided into passenger cars and commercial vehicles. The commercial vehicles segment held a larger market share in 2023.

Automatic Tire Inflation System Market Share Analysis by Geography

The geographic scope of the automatic tire inflation system market report is mainly divided into five regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America will dominate the automatic tire inflation system market in 2023. The North American region includes the US, Canada, and Mexico. According to the North America’s Council for Freight Efficiency, the automatic tire inflation system adoption rate in tractors increased by 168% increase in 2023, while stand-alone system adoption of tire pressure monitoring systems (TPMS) declined by 18% in the same year.

Asia Pacific automatic tire inflation system market is driven by increasing demand from off-highway vehicles and a surge in demand by commercial vehicle owners. Increasing sales of commercial vehicles across China, India, and Japan is a major driving factor for the automatic tire inflation system market growth during the forecast period.

Automatic Tire Inflation System Market Regional Insights

The regional trends and factors influencing the Automatic Tire Inflation System Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Automatic Tire Inflation System Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Automatic Tire Inflation System Market

Automatic Tire Inflation System Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 927.45 Million |

| Market Size by 2031 | US$ 1,935.60 Million |

| Global CAGR (2023 - 2031) | 9.6% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Automatic Tire Inflation System Market Players Density: Understanding Its Impact on Business Dynamics

The Automatic Tire Inflation System Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Automatic Tire Inflation System Market are:

- Aperia Technologies, Inc.

- Bridgestone Corporation

- Continental AG

- Goodyear Tire & Rubber Company

- Meritor, Inc.

- Michelin Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Automatic Tire Inflation System Market top key players overview

Automatic Tire Inflation System Market News and Recent Developments

The Automatic Tire Inflation System Market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for Automatic Tire Inflation System market and strategies:

- In November 2023, Chinese drone maker DJI unveiled two new drone models that can be applied in multiple scenarios to make agricultural production easier. The T60 agricultural drone can be used in various fields, including farming, forestry and aquaculture, with functions such as farmland spraying and aerial seeding. The T25P drone, meanwhile, is a lightweight model that is more flexible and convenient for operating on scattered and small plots. (Source: DJI, Press Release/Company Website/Newsletter)

- In March 2024, Flyability announces a new UT probe for the Elios 3 to empower greater access and safety in non-destructive testing across industries. (Source: Flyability, Press Release/Company Website/Newsletter)

Automatic Tire Inflation System Market Report Coverage and Deliverables

The “Automatic Tire Inflation System Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed Porter’s Five Forces analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles with SWOT analysis

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Boat Sails Market

- Heavy Commercial Vehicle Air Brake Systems Market

- Heavy Commercial Vehicle Clutch Market

- Electric Vehicle Heat Pump Systems Market

- Event Logistics Market

- Industrial Vehicles Market

- Motorsport Transmission Market

- Automotive Telematics Market

- Third Party Logistics Market

- Low Speed Electric Vehicle Market

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

Get Free Sample For

Get Free Sample For