Automotive Airbags and Seatbelts Market Segments and Growth by 2028

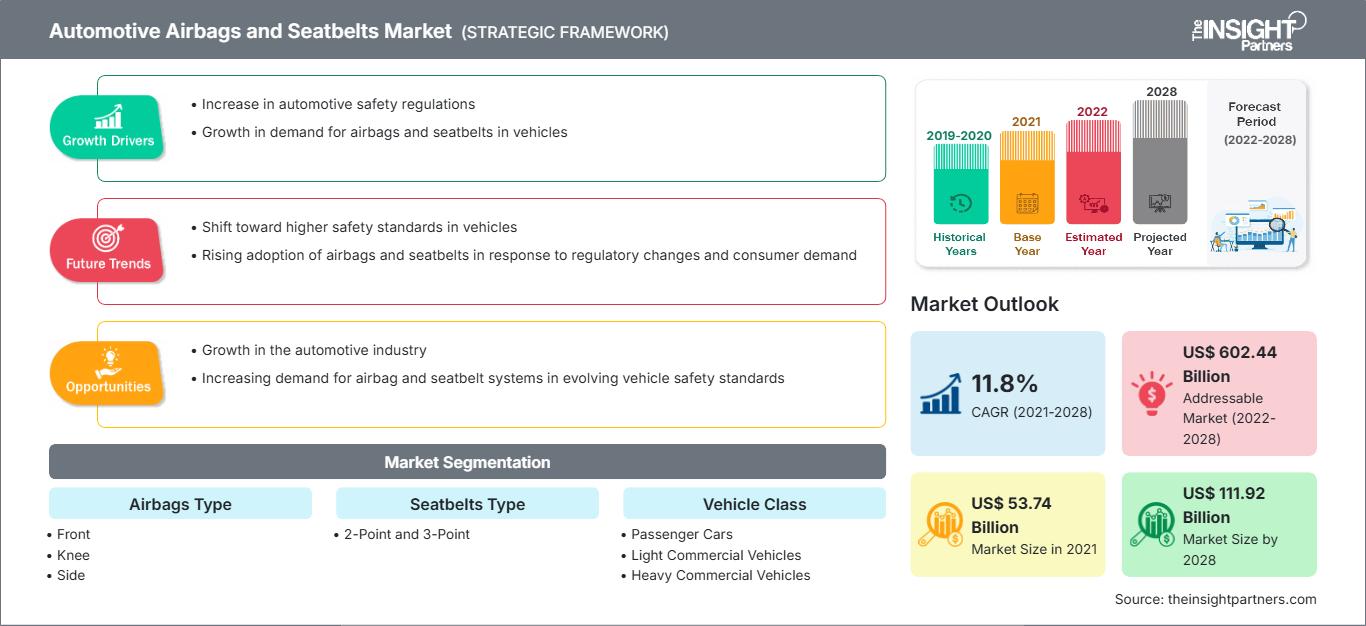

Automotive Airbags and Seatbelts Market Forecast to 2028 - Analysis By Airbags Type (Front, Knee, Side, and Curtain), Seatbelts Type (2-Point and 3-Point), and Vehicle Class (Passenger Cars, Light Commercial Vehicles, and Heavy Commercial Vehicles)

Historic Data: 2019-2020 | Base Year: 2021 | Forecast Period: 2022-2028- Report Date : Jul 2022

- Report Code : TIPRE00004618

- Category : Automotive and Transportation

- Status : Published

- Available Report Formats :

- No. of Pages : 178

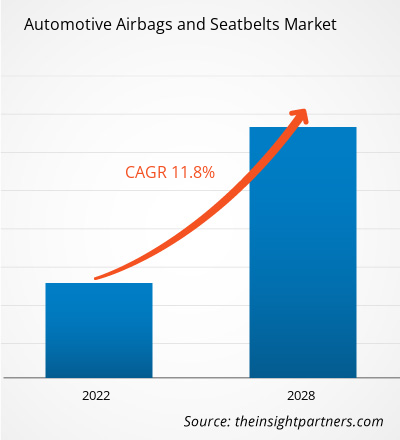

The automotive airbags and seatbelts market was valued at US$ 53,744.00 million in 2021 and is expected to reach US$ 1,11,917.12 million by 2028; it is estimated to register a CAGR of 11.8% from 2022 to 2028.

The key players in the automotive airbags and seatbelts market are expected to have lucrative opportunities in the coming years, owing to the growing initiatives for introducing regulatory standards related to vehicle safety. After the COVID-19 pandemic, a sharp increase in car sales and a significant rise in traffic accidents have become increasingly frequent and severe. At the same time, with the rapid development of science and technology, automotive technology has also been rapidly improved, and automotive safety technology has gradually become involved in all aspects of the car. As per the report published by National Highway Traffic Safety Administration (NHTSA), the traffic fatalities in 2021 had shown an increase of about 10.5% compared to reported fatalities in 2020. The estimated fatalities are the highest since 2005 and the largest annual percentage increase in the US's Fatality Analysis Reporting System’s history. Thus, the government agencies strongly emphasized on improving safety policies and standards, along with significant investment in reducing road accidents. For instance, in May 2022, the NHTSA approved US$ 740 million in funding for the 402 State and Community Grant Program, Section 1906 Racial Profiling Data Collection Grants, and Section 405 National Priority Safety Program. The European Commission is working on framing the regulatory standards for motor vehicles considering the safety of vehicle occupants and vulnerable road users. The European Commission planned to adopt updated UNECE regulations on seatbelts that requires seatbelt reminder systems in all front and rear seats on new cars from September 2019. Thus, such initiatives for introducing regulatory standards related to vehicle safety fuel the automotive airbags and seatbelts market growth.

The growing adoption of electric vehicles is the future trend in the automotive airbags and seatbelts market. As per the Global Electric Vehicle Outlook, sales of electric cars, including fully electric and plug-in hybrid vehicles, increased in 2021 to a new record of 6.6 million units. As per the same report, in China, electric car sales increased significantly in 2021 to 3.3 million, accounting for about half of the total global sales. EV sales also grew strongly in Europe by 65% to 2.3 million units, and sales in the US doubled to 630,000 units in 2021. In addition, supportive government regulations for electric vehicle charging stations further propel electric vehicle sales, thereby driving the demand for automotive airbags and seatbelts market. For instance, in June 2022, the US government proposed new standards for its program to build a national network of 500,000 electric vehicle charging stations by 2030. Furthermore, the government had introduced a plan to allocate US$ 5 billion to states to fund EV chargers by 2028. Thus, such growth prospects in EV industry is anticipated to drive the automotive airbags and seatbelts market over the forecast period.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONAutomotive Airbags and Seatbelts Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Automotive Airbags and Seatbelts Market

The COVID-19 outbreak dramatically impacted the global economy during its peak in 2020 in its initial days, and the crisis hampered the business activities in manufacturing industries. Before the COVID-19 outbreak, there were significant investment initiatives in developing electric vehicles to strengthen the demand for automotive airbags and seatbelts. During the initial days of the COVID-19 pandemic, the crisis significantly restricted all business deals, collaborations, and partnerships that disrupted the automotive airbags and seatbelts market. The emergence of the pandemic hampered the sales of vehicles in February 2020; furthermore, the sales dropped by 47% in the US and 80% in Europe by April. As per a report by Statista, global car sales dropped to 63.8 million in 2020 and registered a slow recovery in 2021 with 66 million sales. From 2021, market players witnessed mandatory regulations for deploying a specific number of airbags which incurs costs. This forced the car manufacturers to provide cars with added features of airbags and seatbelts at the same cost during the pandemic recovery period. The COVID-19 pandemic swiftly and severely impacted the globally integrated automotive industry. The pandemic disrupted the Chinese parts exports, large-scale manufacturing interruptions across Europe, and the closure of assembly plants in the US. All these factors are causing the automotive industry to decline in global demand for automotive vehicles. The COVID-19pandemic forced businesses to restructure their business models and strengthen strategies to achieve economies of scale. Therefore, although the global airbags and seatbelts market plummeted initially in 2020 due to the adverse impact of the COVID-19 pandemic and the related regulations, it achieved a strong recovery after the COVID-19 pandemic.

Automotive Airbags and Seatbelts Market Insights

Growing Initiatives for Introducing Regulatory Standards Related to Vehicle Safety

The automotive industry is a pillar of the global economy. It plays a crucial role in a country's economy and helps build macroeconomic growth and stability in developed and developing countries, spanning many adjacent sectors. After the COVID-19 pandemic, a sharp increase in car sales and a significant rise in traffic accidents have become increasingly frequent and severe. At the same time, with the rapid development of science and technology, automotive technology has also been rapidly improved, and automotive safety technology has gradually become involved in all aspects of the car. As per the report published by National Highway Traffic Safety Administration (NHTSA), the traffic fatalities in 2021 had shown an increase of about 10.5% compared to reported fatalities in 2020. The estimated fatalities are the highest number since 2005 and the largest annual percentage increase in the US's Fatality Analysis Reporting System’s history. Thus, the government agencies strongly emphasized improving safety policies and standards and significant investment in reducing road accidents. For instance, in May 2022, the NHTSA approved US$ 740 million in funding for the 402 State and Community Grant Program, Section 1906 Racial Profiling Data Collection Grants, and Section 405 National Priority Safety Program. Thus, such initiatives for introducing regulatory standards related to vehicle safety are fueling the automotive airbags and seatbelts market growth.

Airbags Type-Based Market Insights

Based on airbags type, the automotive airbags and seatbelts market is segmented into front, knee, side, and curtain. Frontal airbag systems are increasingly being used for driver safety, making their use compulsory by regulatory bodies worldwide. Additionally, consumers are spending more on the safety features of their vehicles due to growing awareness about vehicle safety and increasing disposable income. Top manufacturers now equip their vehicles with side airbags (SABs) to lessen significant chest injuries in side-impact incidents. A new front-center airbag from Autoliv Inc. was introduced in 2019; it is positioned in the area between the driver and front-seat passenger, and it lowers the risk of chest, shoulder, and head injuries while also saving lives in side-impact collisions.

Automotive Airbags and Seatbelts Market Regional InsightsThe regional trends and factors influencing the Automotive Airbags and Seatbelts Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Automotive Airbags and Seatbelts Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Automotive Airbags and Seatbelts Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 53.74 Billion |

| Market Size by 2028 | US$ 111.92 Billion |

| Global CAGR (2021 - 2028) | 11.8% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Airbags Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Automotive Airbags and Seatbelts Market Players Density: Understanding Its Impact on Business Dynamics

The Automotive Airbags and Seatbelts Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Automotive Airbags and Seatbelts Market top key players overview

Seatbelts Type -Based Market Insights

Based on

seatbelts type

, the automotive airbags and seatbelts market is segmented as 2-point and 3-point. The 3-point segment is expected to hold a larger portion of automotive airbags and seatbelts market share owing to its advantageous features. The Indian government will soon require automakers to install three-point seatbelts in every seat, including the middle one in the back. Lap belts have been determined to be less safe than three-point seatbelts. In the event of an accident, the new regulation is anticipated to increase passenger security generally. A draught notification that requires automakers to provide a minimum of six airbags in cars that can seat up to eight passengers was authorized by the Ministry of Road Transport and Highways.The players operating in the automotive airbags and seatbelts market adopt strategies such as mergers, acquisitions, and market initiatives to maintain their positions in the market. A few developments by key automotive airbags and seatbelts market players are listed below:

- In February 2022, Autoliv, Inc., announced its collaboration with Nuro, an autonomous vehicle company to provide higher safety features with exterior airbag to Nuro's latest third-generation vehicle

- In April 2021, Continental AG developed new features for its airbag control units. The company aimed to make use of signals from control units and develop functions for faster airbags deployment, particularly in a side crash.

The global automotive airbags and seatbelts market is segmented based on airbags type, seatbelts type, and vehicle class. Based on airbags type, the automotive airbags and seatbelts market is segmented into front, knee, side, and curtain. In terms of seatbelts type, the automotive airbags and seatbelts market is segmented into 2-point and 3-point. Further, based on vehicle class, the automotive airbags and seatbelts market is segmented into passenger cars, light commercial vehicles, and heavy commercial vehicles.

Autoliv, ZF Friedrichshafen AG, TOYODA GOSEI Co., Ltd., Joyson Safety Systems, and Continental AG are the key automotive airbags and seatbelts market players considered for the research study. In addition, several other significant automotive airbags and seatbelts market players have been studied and analyzed in this research report to get a holistic view of the global automotive airbags and seatbelts market and its ecosystem.

Frequently Asked Questions

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For