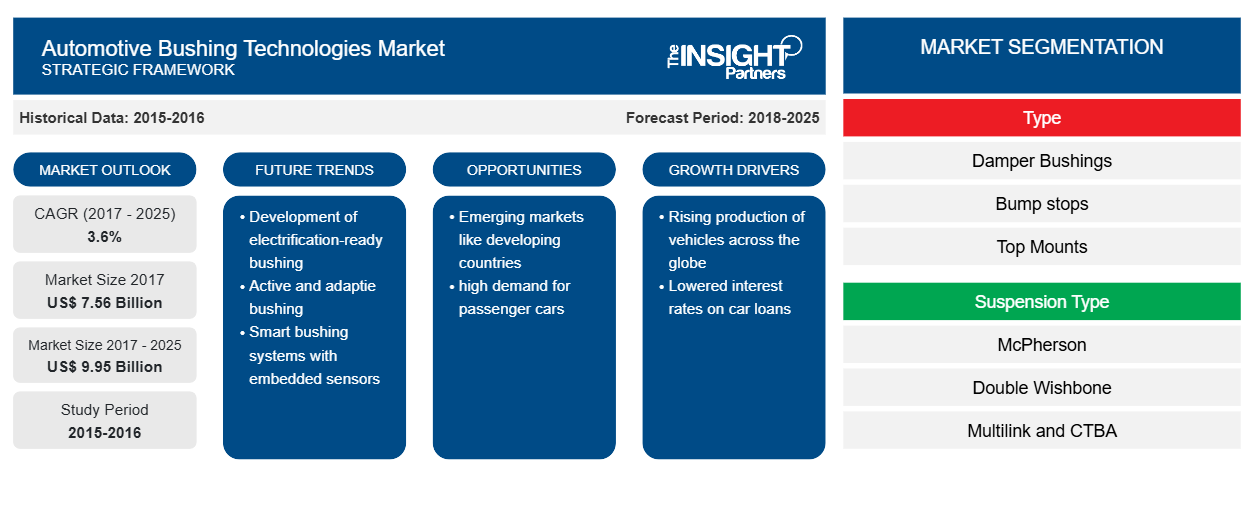

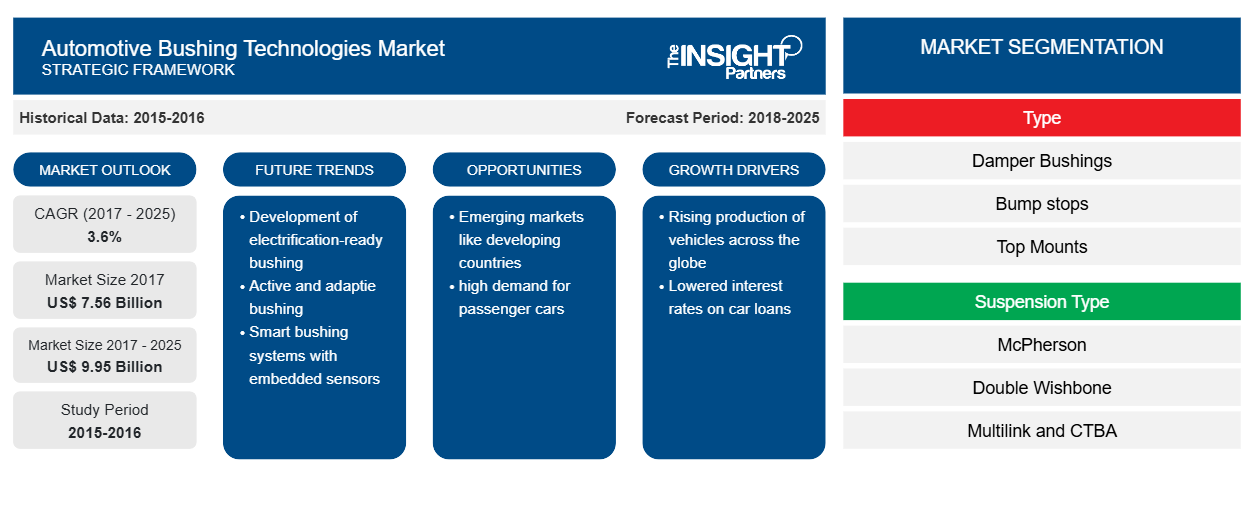

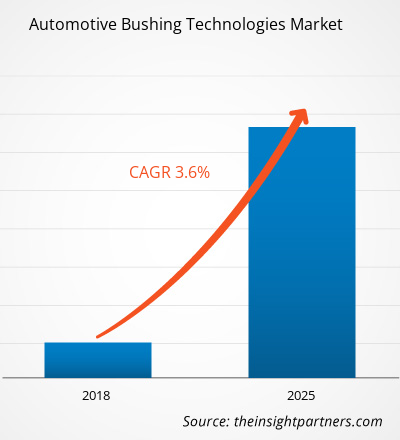

The Automotive Bushing Technologies market was valued at US$ 7560.6 Mn in 2017 and is projected to reach US$ 9947.2 Mn in 2025; it is expected to grow at a CAGR of 3.6% from 2017 to 2025.

A passenger car consists of a numerous metal component that ensure the proper and smooth functioning of the cars on roads that are smooth as well as a bit rocky in nature. A suspension system plays a critical role in ensuring a smooth ride for the occupants of the car. These solid suspension parts are linked to each other and transmit energy when the vehicle is on the move. Bushings are small components that are typically made of rubber or polyurethane material and act as isolators to the noise and vibrations that are transmitted by the solid metal suspension parts. These bushings enable reduction in the vibrations and noise and thereby ensure a smooth & comfortable ride for the passengers. Functions of bushing include vibration isolation, provide cushioning and also reduce the friction between solid metal parts in the vehicle. Typically, bushings are applied inside a car wherever there are metal joints and mounts are needed. Alternator bushings, control arm bushings, shock absorber mountings, sway bar links, transmission shifters, motor mounts and sub-frame mounts are some of the most commonly used bushings in passenger cars. Depending upon the life span of bushings, their replacement also becomes and essential task for the car owners.

Automotive bushings are found inside a car at places where there are joints connecting two solid metal parts. Bushings are used to cushion the movement between these two solid parts and enable in absorbing shocks and vibrations. They reduce the energy transmitted amongst the different components while the vehicle is into operation. A passenger car consists of a numerous component such as the engine, transmission, suspension systems, control arms, roll rods that are sources of noise and vibrations while a vehicle moves. These noise and vibrations are a result of the energy transmitted between the solid metal parts and are troublesome for the occupant of the car.

These noise and vibrations lead to disturbance for the driver of the car and also lead to unpleasant car ride experience for the occupants of the vehicle. These disturbances and irritations can also lead to road accidents as they cause distractions to the driver while driving. Developed road infrastructures enable for smoother rides however, a rocky road causes numerous movements between the metal components. A need for smoother rides on the roads thus creates demands for products that help in isolation of the noises and vibrations caused by the metal components. Automotive bushings drastically reduce the transfer of vibration and noise to the passengers of the car as they dampen and absorb this energy. Bushing manufacturers are presented with certain Noise Vibration Harshness standards to meet and thus enable a pleasant and smoother ride for the car occupants. Automotive bushings were considered to be the most overlooked suspension components in the passenger cars. However, with gaining importance for fuel efficiencies while driving and surging demands for smoother rides have translated into healthy growth for bushing products in the passenger cars. Bushings being used as products that are used to isolate the vibrations and noises and reduce the energy being transmitted to the vehicle occupants by damping them have gained significant importance in the modern times.The car manufacturers today are concerned with meeting the Noise Vibration Harshness (NVH) standards as every moving part of the vehicle produces some sort of noise. Therefore, a vehicle comes with a number of bushings fitted at places which are sources of nose generations while on the move. Majority of these bushings are fitted near or around the suspension systems of the vehicle. Depending upon various parameters different types of bushings are sold in the market. The critical parameters for identifying the appropriate bushing include cost of the bushing, durability & lifespan of the bushing, feel performance to the vehicle occupant on the road, performance of the bushing, NVH rating and installation & maintenance complexities.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Automotive Bushing Technologies Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Automotive Bushing Technologies Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

Rise in the production of vehicles worldwide

Globally, the trend of urbanization is growing at an exponential growth rate. Due to this, the average disposal income of the population staying in urban cities is also increasing, allowing them to enhance their lifestyles. The number of passenger cars operated worldwide is therefore bolstering, further creating a demand for production of passenger cars to cater to the ever increasing demands. The production of vehicles has witnessed a steady growth in the post-recession era since the year 2010. There was a steady rise in the demand for new passenger cars post-recession in the advanced as well as developing economies of the world. Also, lowered interest rates on loans favored the much needed growth of the automobile industry. Over the last 7 or 8 years, the passenger car production has consistently witnessed a growth close to 2% year-on-year.

Type-Based Market Insights

The global automotive bushing technologies market has been sub divided based on type into; damper bushings, bum-stops, top mounts, suspension arm bushings and PT Mounts. The PT Mounts segment has been further sub-divided into engine bushings, roll-rod bushings and transmission bushings. These different types of bushings are integrated into the different parts of a car at interfaces of connection of two metal parts. As the bushings are used in order to cushion the movements between two metal parts, they help eventually in absorbing shocks and vibrations that a driver as well as the passenger feels behind the wheels.

Suspension Type -Based Market Insights

The global automotive bushing technologies market has been sub divided based on suspension type into; McPherson, Double Wishbone, Multilink, Coupled Torsion Beam Axle, milling, cutting & processing and PT Mounts. A suspension system is responsible for the safety of vehicle during the movement of vehicle and most essentially on the rough and rocky terrains. Sufficient pressure of airs in the tires, cushioning of the seats, and padding of few components alone aren’t enough for providing resistance to shocks that are encountered on the driveways. Hence, the role of a suspension system in damping the shocks and absorbing it becomes extremely critical. Suspension systems provide stability as well as riding comfort to the vehicle occupants.

Vehicle – Based Market Insights

The European automakers have established a classification standard for the passenger cars which is based on the mass of the vehicle and area of the vehicle parameters. The classification is widely used in Europe. With increasing number of passenger cars globally, automakers have found it convenient to classify cars as per the Euro Car Segment in order to streamline certain car models. Along with simplifying the classification, this scheme also reduces the number of categories. The classification of passenger cars is done into Class A/B, Class C, Class D, Class E, Class F and SUV segment.

Product development is the commonly adopted strategy by companies to expand their product portfolio. Vibracoustic GmbH, BOGE GmbH, Continental AG, Tenneco Inc., and Federal Mogul LLC, among others are the key players implementing strategies to enlarge the customer base and gain significant share in the global Automotive Bushing Technologies market, which in turn permits them to maintain their brand name. A few of the recent key developments are:

- In 2018, With an integrated fluid system, the company’s hydraulic bushings products offer exceptional load resistance around 1,230 N to 3,000 N. These Hydro Bushings can be used in commercial vehicles as engine and cab mounts.

- In 2018, Tenneco entered into an agreement with Freightliner to supply Control Torque bushings for its Cascadia Class 8 Tractor. These Control Torque bushings demonstrate low torsional breakaway and high conical stiffness.

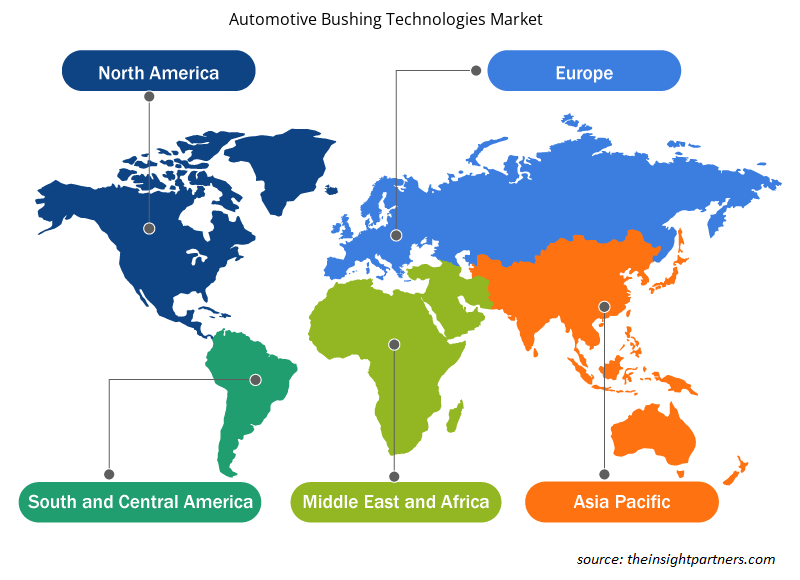

Automotive Bushing Technologies Market Regional Insights

The regional trends and factors influencing the Automotive Bushing Technologies Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Automotive Bushing Technologies Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Automotive Bushing Technologies Market

Automotive Bushing Technologies Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2017 | US$ 7.56 Billion |

| Market Size by 2025 | US$ 9.95 Billion |

| Global CAGR (2017 - 2025) | 3.6% |

| Historical Data | 2015-2016 |

| Forecast period | 2018-2025 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Automotive Bushing Technologies Market Players Density: Understanding Its Impact on Business Dynamics

The Automotive Bushing Technologies Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Automotive Bushing Technologies Market are:

- BOGE Rubbers & Plastics

- Continental AG

- Cooper-Standard Holdings Inc.

- Federal-Mogul LLC

- Hyundai Polytech India

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Automotive Bushing Technologies Market top key players overview

Automotive Bushing Technologies Market Segmentation:

By Type

- Damper Bushings

- Bump stops

- Top Mounts

- Suspension Arm Bushings

- Subframe Bushings

- PT Mounts

By Suspension Type

- McPherson

- Double Wishbone

- Multilink and CTBA

By Vehicle Segment

- A/B, C, D, E, F

- SUV (A, B, C, D and E)

Company Profiles

- Vibracoustic GmbH

- BOGE GmbH

- Continental AG

- Tenneco Inc.

- Federal Mogul LLC

- Cooper Standard Holdings Inc.

- Hyundai Polytech India

- Nolathane, Paulstra SNC

- Sumiriko AVS Germany GmbH

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Oxy-fuel Combustion Technology Market

- Electronic Shelf Label Market

- Pharmacovigilance and Drug Safety Software Market

- Skin Tightening Market

- Compounding Pharmacies Market

- Occupational Health Market

- Virtual Production Market

- Data Center Cooling Market

- Aircraft Wire and Cable Market

- Customer Care BPO Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type ; Suspension Type ; and Vehicle Segment )

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada, Mexico, UK, Germany, Spain, Italy, France, India, China, Japan, South Korea, Australia, UAE, Saudi Arabia, South Africa, Brazil, Argentina

Trends and growth analysis reports related to Automotive and Transportation : READ MORE..

The List of Companies

1. BOGE Rubbers & Plastics

2. Continental AG

3. Cooper-Standard Holdings Inc.

4. Federal-Mogul LLC

5. Hyundai Polytech India

6. Nolathane

7. Paulstra SNC

8. SumiRiko AVS Germany GmbH

9. Tenneco Inc.

10. Vibracoustic GmbH

Get Free Sample For

Get Free Sample For