Automotive Bushing Technologies Market Share, Growth & Future Trends by 2034

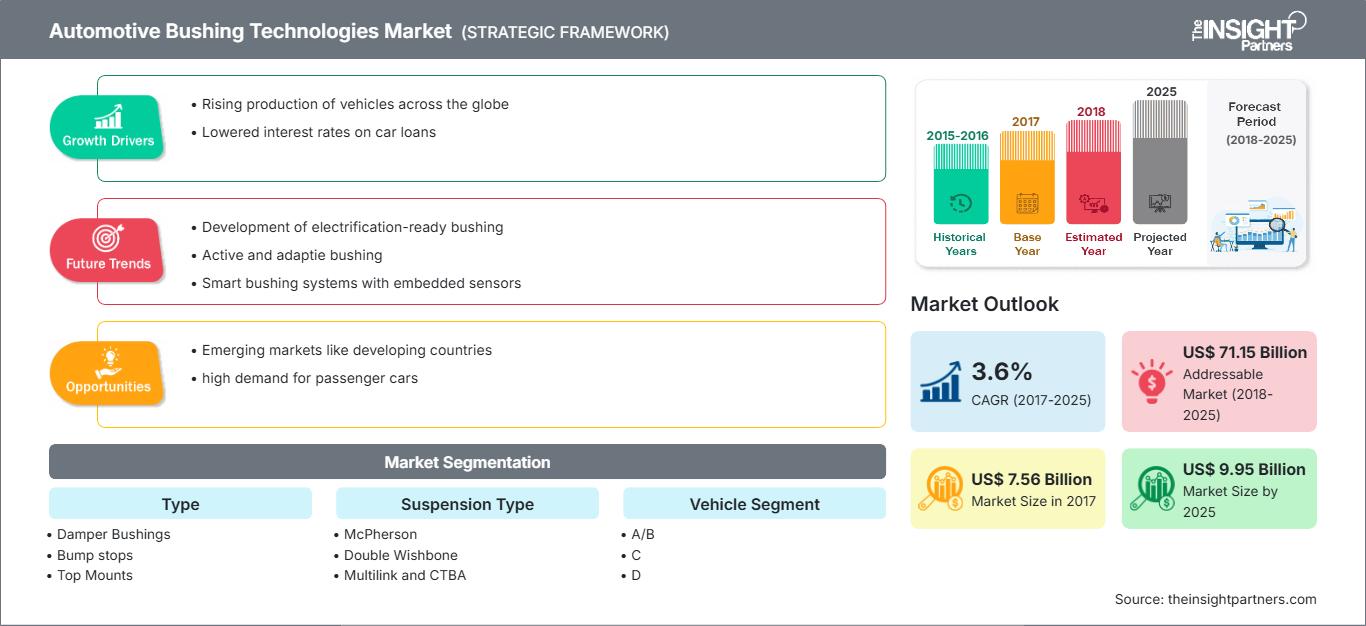

Automotive Bushing Technologies Market Size and Forecast (2021 - 2034), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Damper Bushings, Bump stops, Top Mounts, Suspension Arm Bushings, Subframe Bushings and PT Mounts); Suspension Type (McPherson, Double Wishbone, Multilink and CTBA); and Vehicle Segment (A/B, C, D, E, F and SUV (A, B, C, D and E))

Historic Data: 2021-2024 | Base Year: 2025 | Forecast Period: 2026-2034- Report Date : Mar 2026

- Report Code : TIPTE100000946

- Category : Automotive and Transportation

- Status : Upcoming

- Available Report Formats :

- No. of Pages : 150

The automotive bushing technologies market size is expected to reach US$15.29 billion by 2034 from US$7.56billion in 2025. The market is anticipated to register a CAGR of 7.97% during 2026–2034.

Automotive Bushing Technologies Market Analysis

The automotive bushing technologies market forecast indicates strong growth, driven by rising demand for enhanced ride comfort, noise and vibration reduction, and durability in modern vehicles. Increasing adoption of advanced suspension systems, electrification trends, and lightweight materials is reshaping the market landscape. OEMs and Tier-1 suppliers are investing in innovative bushing designs that integrate smart materials and predictive maintenance capabilities. Furthermore, the shift toward electric and hybrid vehicles is creating opportunities for bushings optimized for battery weight distribution and torque management. Strategic collaborations, R&D in elastomer composites, and integration of sensor-enabled bushings for real-time performance monitoring are expected to accelerate market expansion.

Automotive Bushing Technologies Market Overview

Automotive bushings are critical components in vehicle suspension and chassis systems, designed to absorb shocks, reduce vibrations, and enhance handling stability. They act as isolators between metal parts, improving ride comfort and minimizing noise transmission. Bushings are widely used in suspension arms, subframes, engine mounts, and steering systems across passenger cars, SUVs, and commercial vehicles. The market is influenced by trends such as electrification, lightweighting, and advanced NVH (Noise, Vibration, Harshness) control technologies. Emerging markets in the Asia Pacific and Latin America present significant growth opportunities due to rising vehicle production, urbanization, and consumer preference for premium comfort features.

Customizee This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONAutomotive Bushing Technologies Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Automotive Bushing Technologies Market Drivers and Opportunities

Market Drivers:

- Electrification and Advanced Suspension Systems: The global automotive industry is undergoing a rapid transition toward electric and hybrid vehicles, which introduces unique challenges for suspension systems. EVs typically have heavier battery packs, creating additional load on suspension components. Bushings must be engineered to handle these increased stresses while maintaining ride comfort and durability. Furthermore, advanced suspension architectures such as adaptive and active systems require bushings with superior flexibility and vibration-damping properties. This trend is pushing manufacturers to innovate with high-performance elastomers and composite materials that can withstand extreme torque variations and dynamic loads.

- Consumer Demand for Comfort and NVH Reduction: Modern consumers expect vehicles to deliver a smooth, quiet, and comfortable driving experience. Noise, Vibration, and Harshness (NVH) performance has become a critical differentiator for automakers, especially in premium and mid-segment vehicles. Bushings play a pivotal role in isolating vibrations and reducing noise transmission from the road and drivetrain to the cabin. As urbanization and traffic congestion increase, the demand for superior NVH control grows, compelling OEMs to adopt advanced bushing technologies that enhance ride quality without compromising handling performance.

- Regulatory Push for Safety and Emission Compliance: Stringent global regulations on vehicle safety, emissions, and fuel efficiency are influencing component design and material selection. Lightweight bushings contribute to overall vehicle weight reduction, improving fuel economy and extending EV range. Additionally, bushings that enhance suspension efficiency help maintain vehicle stability and safety under diverse driving conditions. Compliance with standards such as Euro 7 and CAFE norms is driving investment in innovative bushing solutions that combine durability, lightweighting, and recyclability.

Market Opportunities:

- Smart and Sensor-Integrated Bushings: The rise of connected and autonomous vehicles is creating demand for intelligent components that can provide real-time data on performance and wear. Sensor-integrated bushings enable predictive maintenance by monitoring parameters such as load, vibration, and temperature. This capability reduces downtime, enhances safety, and optimizes vehicle performance. Manufacturers that develop cost-effective smart bushings will gain a competitive edge as OEMs increasingly integrate IoT-enabled components into their platforms.

- Expansion in Emerging Markets: Regions such as Asia Pacific, Latin America, and Africa present untapped growth potential due to rising vehicle production, increasing disposable incomes, and urbanization. These markets are witnessing strong demand for affordable vehicles with improved comfort features. Localized manufacturing of bushings tailored to regional requirements—such as rugged designs for poor road conditions—can help suppliers capture significant market share. Additionally, aftermarket opportunities in these regions are expanding as vehicle ownership rises.

- Material Innovation and Sustainability: Sustainability is becoming a core focus for automotive suppliers. The development of eco-friendly elastomers, bio-based composites, and recyclable materials for bushings aligns with OEM sustainability goals and regulatory mandates. Lightweight bushings not only reduce vehicle weight but also improve fuel efficiency and EV range. Manufacturers investing in advanced material science and green technologies can differentiate themselves and cater to the growing demand for environmentally responsible automotive components.

Automotive Bushing Technologies Market Report Segmentation Analysis

By Type:

- Damper Bushings

- Bump Stops

- Top Mounts

- Suspension Arm Bushings

- Subframe Bushings

- PT Mounts

By Suspension Type:

- McPherson

- Double Wishbone

- Multilink

- CTBA

By Vehicle Segment:

- A/B

- C

- D

- E

- F

- SUV (A, B, C, D, and E)

By Geography:

- North America

- Europe

- Asia Pacific

- South & Central America

- Middle East & Africa

Automotive Bushing Technologies Market Regional Insights

The regional trends and factors influencing the Automotive Bushing Technologies Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Automotive Bushing Technologies Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Automotive Bushing Technologies Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2025 | US$ 7.56 Billion |

| Market Size by 2034 | US$ 15.29 Billion |

| Global CAGR (2026 - 2034) | 7.97% |

| Historical Data | 2021-2024 |

| Forecast period | 2026-2034 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Automotive Bushing Technologies Market Players Density: Understanding Its Impact on Business Dynamics

The Automotive Bushing Technologies Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Automotive Bushing Technologies Market top key players overview

Automotive Bushing Technologies Market Share Analysis by Geography

North America:

- Market Share: Holds a significant share due to advanced automotive manufacturing and high adoption of premium vehicles.

- Key Drivers:

- Strong demand for SUVs and luxury vehicles

- Integration of advanced suspension systems

- Regulatory compliance for safety and NVH standards

- Trends: Adoption of sensor-enabled bushings and lightweight elastomer materials.

Europe:

- Market Share: Dominated by premium car manufacturers and stringent emission norms.

- Key Drivers:

- Electrification and EV adoption

- Focus on lightweighting for fuel efficiency

- High R&D investment in NVH technologies

- Trends: Use of sustainable elastomers and predictive maintenance solutions.

Asia Pacific:

- Market Share: Fastest-growing region due to rising vehicle production and urbanization.

- Key Drivers:

- Surge in mid-segment and SUV sales

- Government incentives for EV adoption

- Expansion of local automotive manufacturing hubs

- Trends: Localization of bushing production and integration with smart suspension systems.

Central & South America:

- Market Share: Emerging region with a growing automotive aftermarket.

- Key Drivers:

- Increasing demand for affordable vehicles

- Growth in aftermarket replacement parts

- Rising urban mobility trends

- Trends: Cost-effective bushing designs and aftermarket-focused innovations.

Middle East & Africa:

- Market Share: Developing market with high growth potential in commercial vehicles.

- Key Drivers:

- Infrastructure development is driving vehicle demand.

- Growing preference for durable suspension systems

- Expansion of automotive assembly plants

- Trends: Adoption of heavy-duty bushings and elastomer composites for harsh environments.

Automotive Bushing Technologies Market Players Density: Understanding Its Impact on Business Dynamics

The market is moderately competitive, with global and regional players focusing on innovation, material science, and integration capabilities. Differentiation strategies include:

- Advanced NVH control technologies

- Lightweight and eco-friendly elastomer materials

- Sensor-enabled bushings for predictive maintenance

- Partnerships with OEMs for EV-specific solutions

Opportunities and Strategic Moves:

- Expansion into emerging markets with localized production

- Investment in smart bushing technologies

- Collaboration with EV manufacturers for specialized designs

- Development of recyclable and sustainable materials

Major Companies Operating in the Automotive Bushing Technologies Market Are:

- BOGE Rubbers & Plastics

- Continental AG

- Cooper-Standard Holdings Inc.

- Federal-Mogul LLC

- Hyundai Polytech India

- Nolathane

- Paulstra SNC

- SumiRiko AVS Germany GmbH

- Tenneco Inc.

Disclaimer: The companies listed above are not ranked in any particular order

Automotive Bushing Technologies Market News and Recent Developments

- In April 2025, Tenneco's Clevite Elastomers business showcased its advanced portfolio of NVH and thermal isolation solutions for EVs and other automotive applications during Auto Shanghai 2025. The company highlighted its expertise in Automotive Bushing Technologies, including bushings, component mounting systems, and suspension links designed to meet stringent performance, durability, and weight requirements. Engineering teams from China and North America demonstrated optimized designs addressing complex NVH and thermal isolation challenges, with several solutions featuring lightweight plastic and aluminum mounts to comply with OEM weight standards.

- In August 2024, Continental announced the launch of the Conti Urban HA 5, a tire designed specifically for urban transportation. The company emphasized that urban transport operators faced challenges such as varying road conditions, frequent stops, heavy traffic, and the growing use of electric buses. To meet these demands, Continental highlighted its expertise in Automotive Bushing Technologies alongside tire innovations, ensuring durability, safety, and efficiency for modern urban mobility solutions.

Automotive Bushing Technologies Market Report Coverage and Deliverables

The "Automotive Bushing Technologies Market Size and Forecast (2021–2034)" report provides a detailed analysis of the market covering below areas:

- Automotive Bushing Technologies Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Automotive Bushing Technologies Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Automotive Bushing Technologies Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the Automotive Bushing Technologies Market

- Detailed company profiles

Frequently Asked Questions

Asia Pacific is the fastest-growing region, driven by rising vehicle production and urbanization.

2. Eco-friendly elastomer composites

3. Lightweight materials for EV platforms

1. Electrification and advanced suspension systems

2. Consumer demand for comfort and NVH reduction

3. Regulatory push for safety and emission compliance

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For