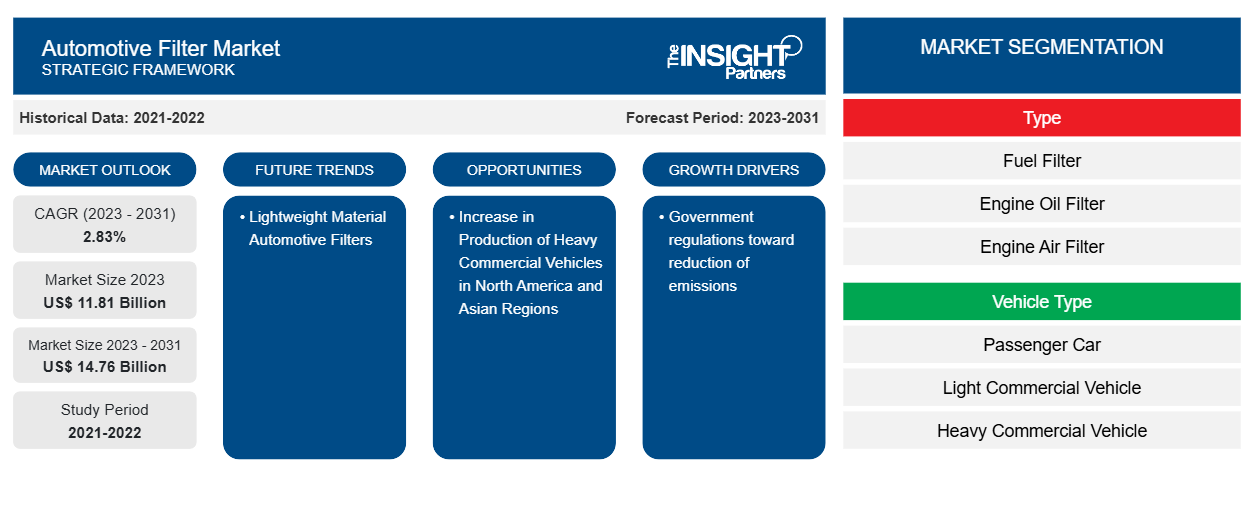

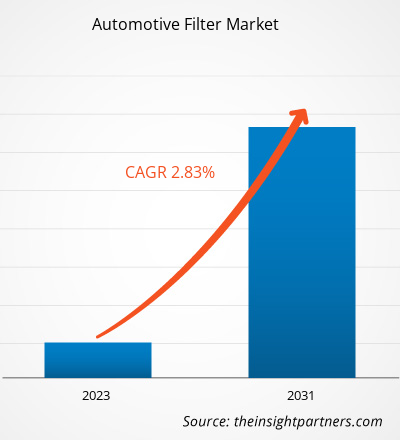

The Automotive filter market size is projected to reach US$ 14.76 billion by 2031 from US$ 11.81 billion in 2023. The market is expected to register a CAGR of 2.83% in 2023–2031. The increased government regulations as well as significant investment from leading filter manufacturers in emission reduction is propelling the growth of automotive filters market in the current scenario.

Automotive Filter Market Analysis

North American Free Trade Agreement (NAFTA) signed an agreement between the US, Canada, and Mexico. This agreement reduced majority tariff and non-tariff barriers for free trade and investment among these three countries. The agreement further helped to increase the trade and investment level across North American countries. North America is a well-developed economy and the individuals have high disposable incomes owing to the high per capita income of the country. The U.S. and Canada have a high density of commercial vehicles. Pertaining to the high disposable income among the end users, and North American Free Trade Agreement between the US, Canada, and Mexico has led the regions to experience a substantial rise in commercial vehicles. The constant rise in trucks, trailers, buses, and other heavy-duty vehicles is anticipated to catalyze the demand for automotive filters in North American countries.

Automotive Filter Market Overview

The global automotive filters market is expected to witness promising growth during the forecast period of 2023 to 2031. As disposable income is increasing, the premium and luxury car segment is witnessing impressive growth in sales, which is one of the major factors driving the market growth. In addition to these factors, the rising number of stringent regulations and compliance requirements are also expected to drive the demand.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Automotive Filter Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Automotive Filter Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Automotive Filter Market Drivers and Opportunities

Government regulations toward reduction of emissions

The automotive filters are developed and designed to restrict the entry of fine dirt particles such as exhaust fumes, pollens, bacteria, and others into the automotive carburetor and engine. The application of these filters further reduces the air pollutants that are emitted by the automotove engines, which results in, extends the service life of the vehicle, and reduces the maintenance cost. The emission bodies and governments around the world are imposing stringent emission laws for the vehicles that releases hazardous gases such as carbon monoxide (CO), nitrogen oxide (NOx), hydrocarbons (HC), and others. For instance, the Environmental Protection Agency (EPA) in the U.S. has amended standards such as fuel economy standards for the LCVs and national program for greenhouse gas emissions (GHG).

In addition, drivers, in today's time, feel the impact of increasing oil prices every day at the pump, due to which the gasoline is becoming considerably expensive and the call for effective solutions for reducing fuel consumption is growing stronger. Some of the leading filter manufacturers have developed unique and wide-ranging seal-based solution for emissions reduction in utility vehicles and passenger. For instance, Freudenberg Filtration Technologies SE & Co. KG has developed the Filtration Technologies that contribute to the effective reduction of CO2 emissions through its fully synthetic micronAir engine intake air filters that help in protecting valuable resources. Further, the increasing pressure losses of engine intake air filters are leading to increased energy demand at the same output and as filter resistance increases owing to dust deposits, the fuel consumption and CO2 emissions are also increasing. Thus, high-performance filter media, engine air filter offer outstanding filtration properties and energy efficiency values which are further ensuring reduction in emission from the vehicles.

Automotive Filter Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Automotive filter market analysis are type, and vehicle type.

- Based on type, the automotive filter market is subsegmented into fuel filter, engine oil filter, engine air filter, cabin air filter, coolant air filter, steering oil filter. The engine air filter segment held a larger market share in 2023.

- Based on vehicle type, the electric powertrain market is categorized into passenger car, light commercial vehicle, heavy commercial vehicle. The passenger cars segment held the largest share of the market in 2023.

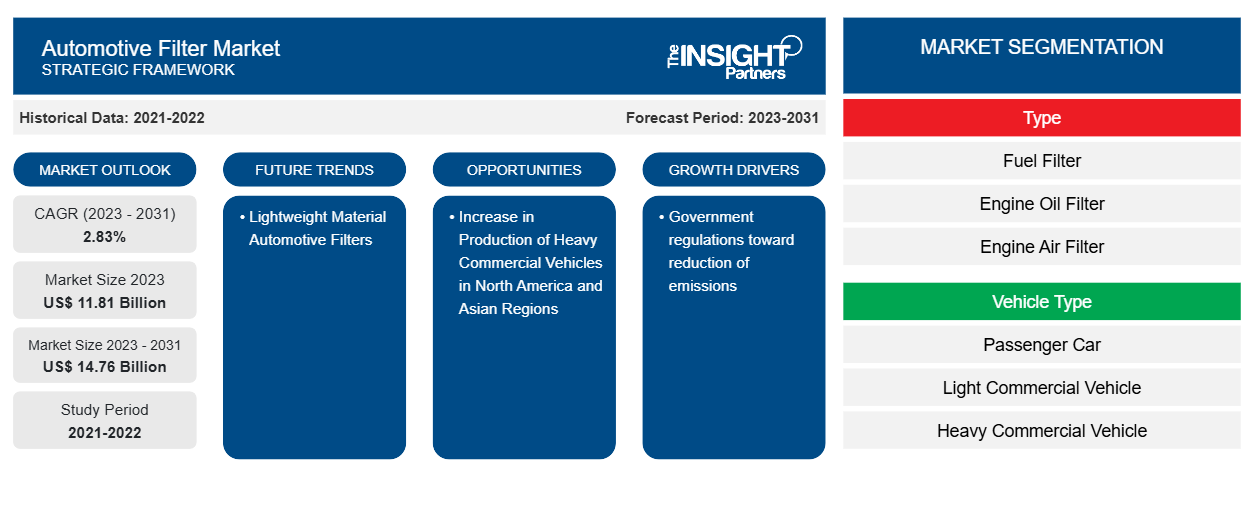

Automotive Filter Market Analysis by Geography

The geographic scope of the Automotive filter market report is mainly divided into five regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America.

In APAC, China is the largest market owing to its leading automotive market. Also, the growing automotive component sales will propel the demand for automotive filters. The increasing technological adoption and increasing demand for using unpowered trailers and caravans would accelerate the automotive filter market growth. Furthermore, the automotive vehicle demand in APAC, together with the growing passenger cars and commercial vehicle production in China and other countries, would enable the automotive filter manufacturers to increase their presence in this region.

Automotive Filter Market Regional Insights

The regional trends and factors influencing the Automotive Filter Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Automotive Filter Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Automotive Filter Market

Automotive Filter Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 11.81 Billion |

| Market Size by 2031 | US$ 14.76 Billion |

| Global CAGR (2023 - 2031) | 2.83% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

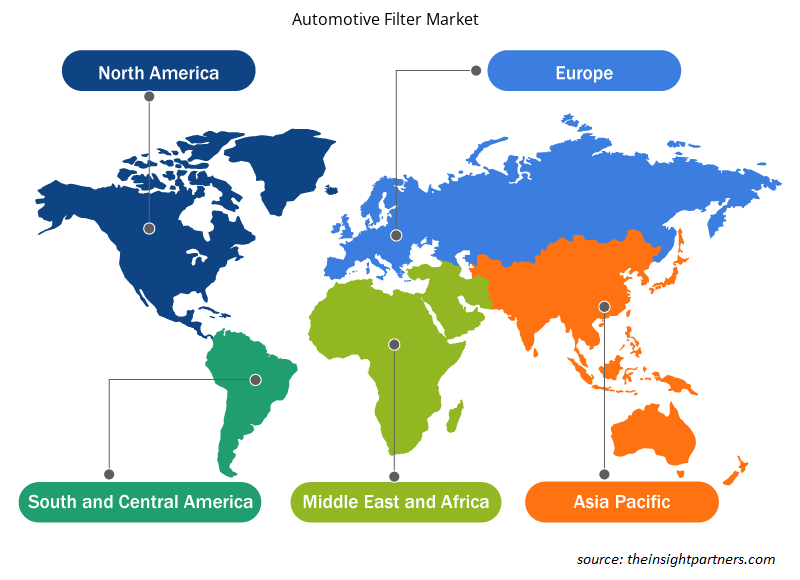

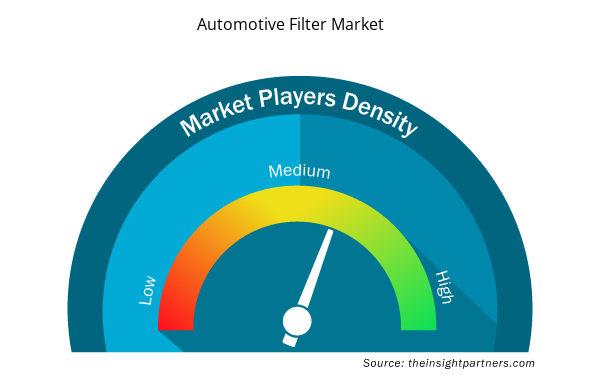

Automotive Filter Market Players Density: Understanding Its Impact on Business Dynamics

The Automotive Filter Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Automotive Filter Market are:

- A.L. Filter

- ACDelco Inc.

- Denso Corporation

- Donaldson Company Inc.

- Freudenberg Filtration Technologies SE & Co. KG, K&N Engineering, Inc.

- MANN+HUMMEL GMBH

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Automotive Filter Market top key players overview

Automotive Filter Market News and Recent Developments

The automotive filter market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for automotive filter market and strategies:

- On April 2024, Ahlstrom introduced a new dual-layer filter media technology, available globally, that represents a leap forward in filtration and is a perfect solution to comply with future market needs. The dual-layer design offers up to double dust holding capacity compared to the single-layer design, as each layer serves a distinct purpose to optimize the overall retention of particles in the depth of the material. (Source: DJI, Press Release/Company Website/Newsletter)

- On April 2023, Ahlstrom introduces a new range of renewable and sustainable filtration solutions for automotive applications. Ahlstrom ECO™ is a technology supporting the increasing sustainability demands of the global transportation market and offering a new choice for filter manufacturers. (Source: Flyability, Press Release/Company Website/Newsletter)

Automotive Filter Market Report Coverage and Deliverables

The “automotive filter market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed Porter’s Five Forces analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles with SWOT analysis

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type ; Vehicle Type

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, South Africa, South Korea, Turkey, United Kingdom, United States

Get Free Sample For

Get Free Sample For