Extracorporeal CO2 Removal Devices Market Size, Share & Opportunities to 2031

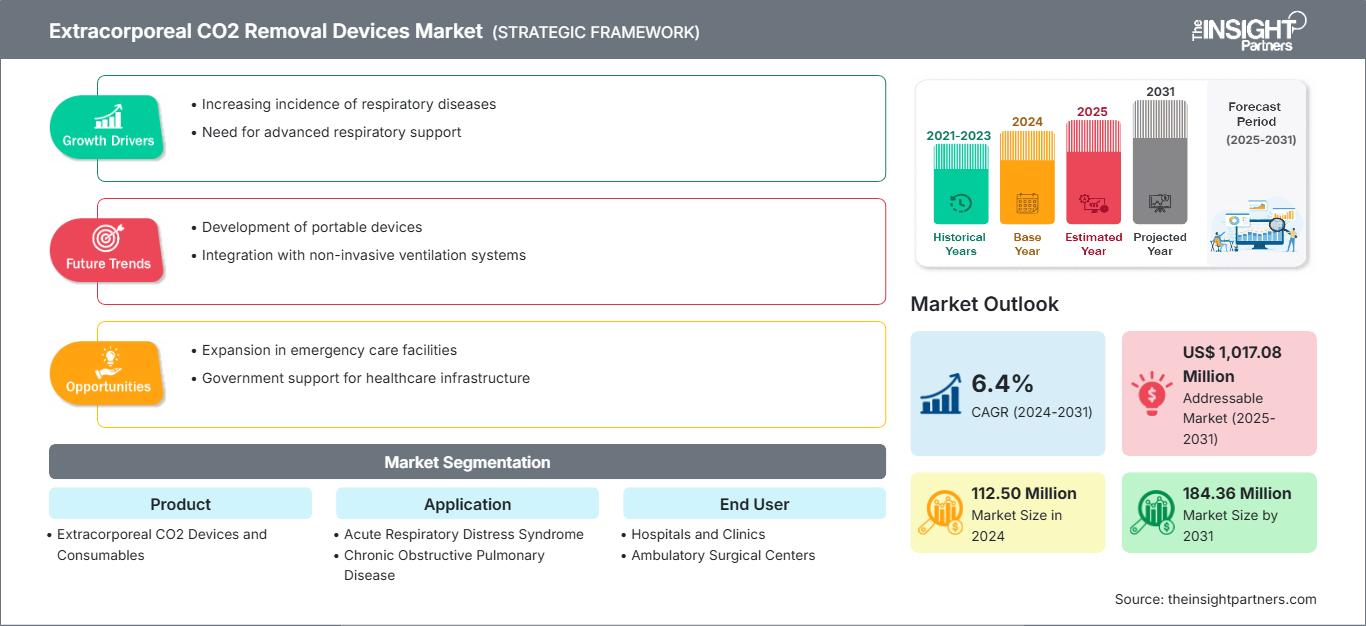

Extracorporeal CO2 Removal Devices Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Extracorporeal CO2 Devices and Consumables), Application (Chronic Obstructive Pulmonary Disease (COPD), Acute Respiratory Distress Syndrome (ARDS), and Others), End User (Hospitals and Clinics, Ambulatory Surgical Centers, and Others), and Geography

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Nov 2025

- Report Code : TIPMD00002259

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 221

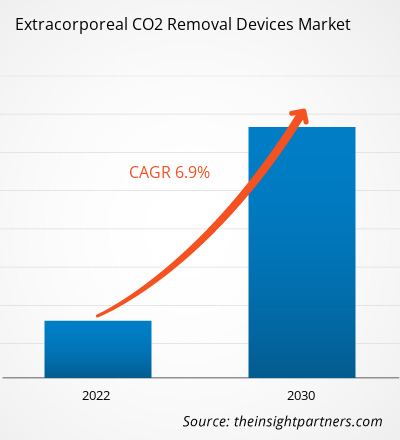

The extracorporeal CO2 removal devices market is projected to reach US$182.88 million by 2031 from US$112.50 million in 2024 and to register a CAGR of 7.3% during 2025–2031.

Extracorporeal CO2 Removal Devices Market Analysis

The rising prevalence of respiratory diseases, growing awareness of minimally invasive procedures, and increasing geriatric population drive market growth. Expansion into non-ICU settings will create ample opportunities for the extracorporeal CO2 removal devices market in the coming years.

Extracorporeal CO2 Removal Devices Market Overview

Extracorporeal CO₂ removal (ECCO₂R) devices are emerging medical technologies that are progressively being used in intensive care units for patients with acute respiratory failure, particularly those with ARDS and COPD.

The ECCO₂R apparatuses are systems that force oxygenated blood to be freed of carbon dioxide, enabling the ventilation settings to be lowered and thus reducing the lung damage caused by the ventilator.

The market for these products is techno-savvy and presents several innovations in membrane technologies, resulting in higher efficiency and safety. The leading market is North America, which generates ~40% of the total revenue, followed by Europe with 30%, and Asia Pacific with 20%. Asia Pacific is the fastest-growing region during the forecast period.

As for the most critical sectors, the devices are needed in hospitals and surgical centers, with hospitals being the major contributors to the market revenue in 2024.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONExtracorporeal CO2 Removal Devices Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Extracorporeal CO2 Removal Devices Market Drivers and Opportunities

Market Drivers:

- Rising Prevalence of Respiratory Diseases: Such situations as COPD, ARDS, and COVID-19 have become more frequent in recent years. As a result, the need for advanced respiratory support technologies such as extracorporeal CO2 removal devices has also increased.

- Growing Awareness of Minimally Invasive Procedures: Both patients and doctors prefer minimally invasive methods. Thus, the use of extracorporeal CO2 removal devices has been on the rise, which helps lower risks and achieve better results compared to traditional ventilation.

- Increasing Geriatric Population: The elderly population is more vulnerable to respiratory diseases, which increases the demand for novel treatments such as the use of extracorporeal CO2 removal for chronic and acute respiratory failure.

Market Opportunities:

- Rising Demand in Emerging Economies: Developing countries are facing an increase in respiratory diseases. They are upgrading their healthcare systems, which in turn is generating strong demand for affordable extracorporeal CO₂ removal (ECCO₂R) devices and broader adoption of the technology.

- Expansion into Non-ICU Settings: Innovations in small and simple-to-operate ECCO₂R equipment make the use of such devices possible beyond intensive care units, thus the facility's applications are growing in the departmental echelons of emergency, step-down, and specialized respiratory care units.

- Integration of ECCO₂R with Other Therapies: The use of ECCO₂R in conjunction with mechanical ventilation or renal replacement therapy leads to improved patient outcomes, providing the opportunity for comprehensive care in cases of multi-organ failure and complicated respiratory conditions.

Extracorporeal CO2 Removal Devices Market Report Segmentation Analysis

The extracorporeal CO2 removal devices market is divided into different segments to give a clearer view of how it works, its growth potential, and the latest trends. Below is the standard segmentation approach used in most industry reports:

By Product:

- Extracorporeal CO2 Devices: The setups are sophisticated, removing carbon dioxide from the blood of those with respiratory failure. Consequently, the need for ventilators is reduced, and the lungs are not as severely damaged by ventilation in intensive care units.

- Consumables: These are essential components, such as membranes, circuits, and cannulas, which are necessary for the device to function correctly. The recurring demand for them is the primary source of the company's revenue and a prerequisite for the safety and long-term continuation of the treatment.

By Application:

- Chronic Obstructive Pulmonary Disease (COPD): The setups are sophisticated, removing carbon dioxide from the blood of those with respiratory failure. Consequently, the need for ventilators is reduced, and the lungs are not as severely damaged by ventilation in intensive care units.

- Acute Respiratory Distress Syndrome (ARDS): These are essential components, such as membranes, circuits, and cannulas, necessary for the device to function correctly. The recurring demand for them is the primary source of the company's revenue and a prerequisite for the safety and long-term continuation of the treatment.

- Others: Leading to the inclusion of applications in asthma, cystic fibrosis, and post-operative respiratory failure, in which ECCO₂R is a source of supportive therapy for stabilization and prevention of the progression of invasive ventilation.

By End User:

- Hospitals and Clinics

- Ambulatory Surgical Centers

- Others

By Geography:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

The extracorporeal CO2 removal devices market in North America is expected to hold a significant market share. Factors such as the rising prevalence of respiratory diseases, growing awareness of minimally invasive procedures, and increasing geriatric population are likely to drive the market growth.

Extracorporeal CO2 Removal Devices Market Regional InsightsThe regional trends influencing the Extracorporeal CO2 Removal Devices Market have been analyzed across key geographies.

Extracorporeal CO2 Removal Devices Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 112.5 Million |

| Market Size by 2031 | US$ 182.88 Million |

| Global CAGR (2025 - 2031) | 7.3% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Extracorporeal CO2 Removal Devices Market Players Density: Understanding Its Impact on Business Dynamics

The Extracorporeal CO2 Removal Devices Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Extracorporeal CO2 Removal Devices Market Share Analysis by Geography

Asia Pacific is expected to grow the fastest in the next few years. Emerging markets in South and Central America, the Middle East, and Africa also offer many untapped opportunities for extracorporeal CO2 removal devices providers to expand.

The extracorporeal CO2 removal devices market grows differently in each region, owing to the recommendations of regulatory agencies and medical guidelines for extracorporeal CO2 removal devices. Below is a summary of market share and trends by region:

1. North America

- Market Share: Holds a significant portion of the global market

- Key Drivers: Region leading the way owing to an advanced health care system, high prevalence of COPD and ARDS, strong reimbursement support, and early adoption of innovative critical care technologies such as ECCO₂R.

- Trends: Miniaturization and Portability

2. Europe

- Market Share: Substantial share due to increasing prevalence of pain conditions

- Key Drivers: Stable healthcare systems, support for clinical research, and the increasing number of older adults contributed to the widespread use of ECCO₂R, particularly in Germany, the UK, France, and other Western European countries.

- Trends: Integration with Artificial Intelligence and Machine Learning

3. Asia Pacific

- Market Share: Fastest-growing region with rising market shares every year

- Key Drivers: The market is experiencing rapid growth owing to improved healthcare access, increased burden of respiratory diseases, and heightened investments in critical care technologies in China, India, Japan, and Southeast Asia.

- Trends: Innovations in ECCO₂R Devices

4. South and Central America

- Market Share: Growing market with steady progress

- Key Drivers: Region in transition with increasing awareness of the need for advanced respiratory care; however, still constrained by the lack of proper infrastructure and low-income levels. Government programs and private partnerships support the market expansion.

- Trends: Technological developments in respiratory devices

5. Middle East and Africa

- Market Share: Although small, but growing quickly

- Key Drivers: Slowly increasing usage of ECCO₂R due to a higher healthcare budget, mainly in Gulf countries, while the majority of Africa is still struggling with problems of access and affordability.

- Trends: Growth in Respiratory Products

Extracorporeal CO2 Removal Devices Market Players Density: Understanding Its Impact on Business Dynamics

High Market Density and Competition

Competition is strong due to established players such as Medtronic Plc, Fresenius Medical Care AG & Co KGaA, and Baxter International Inc. Regional and niche providers such as Aferetica s.r.l., ESTOR S.P.A. add to the competitive landscape across different regions.

This high level of competition urges companies to stand out by offering:

- Advanced products

- Value-added services such as customization and sustainable solutions

- Competitive pricing models

- Compliance with regulatory guidelines

Opportunities and Strategic Moves

- Companies are spending more on research and development, which drives innovation in detection technologies. This also improves the sensitivity and specificity, addressing specific eye health issues in different regions.

- Manufacturers will likely focus on local production to cut costs and strengthen supply chains, especially in high-volume markets such as India.

Other companies analyzed during the course of research:

- Toray Medical Co., Ltd.

- ALung Technologies, Inc.

- Hemovent GmbH

- MicroPort Scientific Corporation

- Abiomed, Inc.

- Braile Biomedica

- Drägerwerk AG & Co. KGaA

Extracorporeal CO2 Removal Devices Market News and Recent Developments

- Medtronic receives CE Mark for VitalFlow ECMO System, ushering in a new era of critical care in Europe Medtronic plc announced a significant advancement in its mission to transform critical care. The VitalFlow Extracorporeal Membrane Oxygenation (ECMO) System has officially received CE (Conformité Européenne) Mark approval in Europe. This milestone signals a significant leap forward in delivering seamless, life-saving support to the most fragile patients.

- Fresenius Medical Care is taking the next step in extracorporeal life support with Xenios 2.0 Fresenius Medical Care’s heart & lung business unit, Xenios AG, introduces the all-new Xenios 2.0. This system enables healthcare professionals to take the next step in extracorporeal life support (ECLS). It can be used for the full range of ECLS treatments, from neonatal to adult patients, and is approved in accordance with the new Medical Device Regulation (MDR).

Extracorporeal CO2 Removal Devices Market Report Coverage and Deliverables

The "Extracorporeal CO2 removal devices Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Extracorporeal CO2 removal devices market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Extracorporeal CO2 removal devices market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Extracorporeal CO2 removal devices market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Extracorporeal CO2 removal devices market

- Detailed company profiles

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For