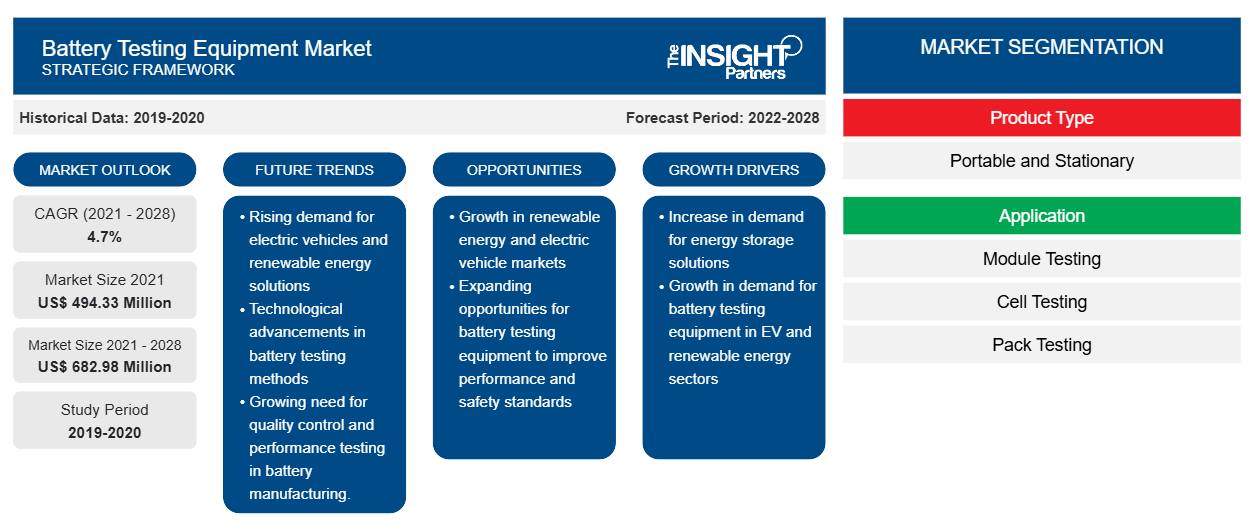

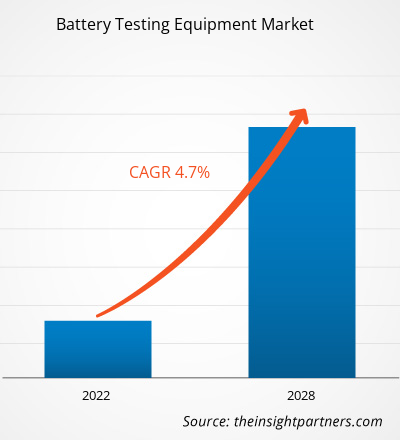

The battery testing equipment market was valued at US$ 494.33 million in 2021 and is projected to reach US$ 682.98 million by 2028; it is estimated to grow at a CAGR of 4.7% from 2021 to 2028.

Industries such as aerospace and defense, automotive, and healthcare are heavily investing in advanced technologies to strengthen their capabilities with advanced machinery and offer enhanced services to customers. Companies in the US, France, Sweden, the UK, and other countries are developing advanced battery testing equipment for their global customers. The rising procurement of advanced batteries by the US Army is also supporting the market growth. Furthermore, the development of eVTOLs and initiatives taken by governments of countries such as Germany, the UAE, and Singapore for developing urban air mobility infrastructure in these countries are expected to drive the growth of the battery testing equipment market players.

Elevating defense expenditure in countries such as the US, China, and India, and others is expected to drive the growth of the battery testing equipment market in the coming years. Developing countries, such as India, China, and Indonesia, focus on strengthening their military capabilities due to rising clashes across the borders shared with neighboring countries. The expanding manufacturing sectors in countries such as China and India are further propelling the battery testing equipment market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Battery Testing Equipment Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Battery Testing Equipment Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on North America Battery Testing Equipment Market Growth

The US is the most affected country in North America due to COVID-19. Many of the manufacturing facilities were either temporarily shut down or are operating with minimum staff; the supply chain of components and parts is disrupted; these are some of the critical issues faced by the North American manufacturers.

Since the US has a larger number of battery testing equipment, component manufacturers, and industries, the outbreak has severely affected each production and revenue generation. The lower number of manufacturing staff has resulted in lesser production quantity. On the other hand, the limited availability of raw materials and aerospace closing has also impacted the battery testing equipment market in the US. However, the rising military expenditure of the country and the growing development of electric vehicles by companies such as Tesla are expected to provide growth opportunities to the battery testing equipment market players in the near future.

Market Insights – Battery Testing Equipment Market

Growing Demand for Transportation to Drive the

Due to the increasing disposable income of people in developing economies, such as China, India, South Korea, and others, the demand for vehicles has increased. According to the Society of Indian Automobile Manufacturers (SIAM), passenger vehicle sales in India increased by 26.45% from September 2019 to September 2020. Factors such as increasing investments by prominent vehicle manufacturing companies and favorable government norms regarding vehicle manufacturing across Asia Pacific are expected to drive the growth of the battery testing equipment market in the region. Further, initiatives undertaken by the governments of countries such as Vietnam to expand its automotive industry are also expected to drive the battery testing equipment market size.

Product Type-Based Insights

Based on product type, the battery testing equipment market is segmented into portable battery testing equipment and stationary battery testing equipment. The stationary battery testing equipment segment led the battery testing equipment market with a market share of 54.1% in 2020. The stationery battery testing is performed for a capacity test when the battery is new as part of the acceptance test, for impedance testing to establish baseline values for the battery, and to repeat the above testing process within 2 years for the warranty of the battery. The testing process checks the impedance quarterly on valve-regulated lead-acid (VRLA) cells and performs capacity tests at every 25% expected service life.

Application-Based Insights

Based on application, the battery testing equipment market is segmented into module testing, cell testing, and pack testing. The cell testing segment led the market in 2020. The cell stress tests are performed to evaluate the response to electrical, environmental, and mechanical stresses, among others. Cell testing provides a long battery life and simulates complex real-world test profiles. Moreover, cell testers are designed for performing tests on lithium-ion batteries, electrical double-layer capacitors (EDLC), and lithium-ion capacitors (LIC). This is anticipated to boost the battery testing equipment market size.

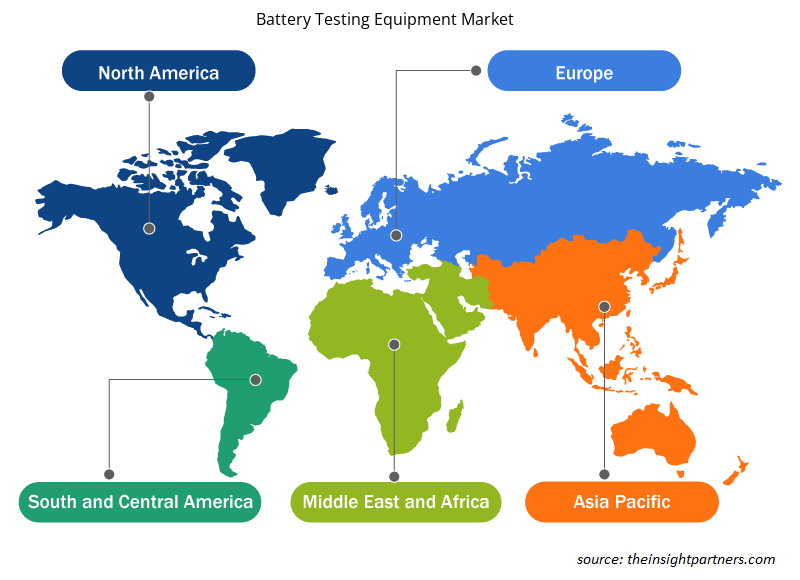

Based on geography, the battery testing equipment market is segmented into five major regions, namely, North America, Europe, APAC, MEA, and SAM. In 2020, North America held the largest revenue share, followed by Europe and APAC, respectively. The market in APAC is expected to grow at the fastest CAGR of 5.8% from 2020 to 2028. Arbin Instruments, Century Yuasa Batteries Pty Ltd., Chauvin Arnoux, Chroma Systems Solutions, Inc., DV Power, Extech Instruments, Megger, Midtronics, Inc., Storage Battery Systems, LLC, and Xiamen Tmax Battery Equipments Limited are among the key players in the ecosystem that were profiled during this market study.

Battery Testing Equipment Market Regional Insights

The regional trends and factors influencing the Battery Testing Equipment Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Battery Testing Equipment Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Battery Testing Equipment Market

Battery Testing Equipment Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 494.33 Million |

| Market Size by 2028 | US$ 682.98 Million |

| Global CAGR (2021 - 2028) | 4.7% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Battery Testing Equipment Market Players Density: Understanding Its Impact on Business Dynamics

The Battery Testing Equipment Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Battery Testing Equipment Market are:

- Arbin Instruments

- Chroma Systems Solutions, Inc.

- Ametek Scientific Instruments

- Biologic

- Bitrode Corporation

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Battery Testing Equipment Market top key players overview

Players operating in the battery testing equipment market are mainly focused on the development of advanced and efficient products and collaborations.

- In 2021, Keysight Technologies, Inc. and Proventia Oy collaborated to improve electric vehicle (EV) battery test solutions.

- In 2021, Chroma launched an E-Scooter fast charging testing system to help CHAdeMO Association check electric vehicle charging interface stimulators. In line with the international growth of the EV industry, it is also going to help define the Protocol Check Sheet for fast charging test standards for two-wheeled EVs.

Frequently Asked Questions

What trends are expected to drive the demand for various battery testing equipment?

The Animatronics is the process of manufacturing and operating lifelike robots that are used for entertainment or films; whereas, robotics is the process of designing, constructing, and operating robots. Batteries are used in these systems as they offer numerous benefits such as smooth movement of robots, enhanced safety, greater precision, and longer system life. The growing adoption of robots and animatronics in various industries, such as automobile, entertainment, manufacturing, agriculture, and aerospace and defence, it is expected to drive the growth of the battery testing equipment market.

Which region is expected to dominate the battery testing equipment market in the forecast period?

North America is expected to hold the largest share of the battery testing equipment market in the coming years as it includes a few of the world's fastest-growing and leading economies. The North American battery testing equipment market is segmented into the US, Canada, and Mexico. High disposable incomes and technological advancements have been propelling the growth of the consumer electronics industry. With the rising integration of lithium-ion batteries in consumer electronics, the adoption of battery testing equipment will increase to analyze the battery life and leakage of the aqueous solution from the battery, among others.

Which product type is expected to dominate the market during the forecast period ?

The several technologically advanced solutions to maintain its global image. The global consumer goods sector is witnessing a constant rise in the adoption of advanced technologies such as smartphones, laptops, smart TVs, and smart wearable systems that are embedded with different types of batteries. With an increasing demand for the above-mentioned products, the battery testing procedure becomes crucial for enhancing the battery life, which, in turn, fuels the adoption of battery testing equipment. The stationary battery testing equipment segment led the battery testing equipment market in 2020.

Which component is expected to dominate the market in the forecast period?

The battery testing equipment market was dominated by the stationary battery testing equipment segment, which accounted to 53.7% in 2020 and is estimated to account for 51.5% market revenue share by 2028. Component providers/suppliers provide various components/parts such as fuse, powerful embedded controllers and speed fans among others hardware components to battery testing equipment manufacturers.

What are the reasons behind battery testing equipment market growth?

The battery testing equipment systems are used in various applications, including module testing, cell testing, and pack testing. Various industries such as aerospace and defence, automotive, healthcare, and others are heavily investing in advanced technologies to strengthen their capabilities with advanced machinery and offer enhanced services to customers. Companies present in countries such as the US, France, Sweden, the UK, and others are developing advanced battery testing equipment for the global market. The rising procurement of advanced batteries by the US Army is supporting the market growth.

What are market opportunities for battery testing equipment market?

Increasing Adoption of battery testing equipment in Healthcare, due to the ongoing COVID-19 pandemic, the demand for medical instruments, such as ventilators, diagnostic equipment, and other critical care devices, has increased across the world. Therefore, prominent battery testing equipment companies are offering continuous support and services owing to the growing demand in the healthcare industry. As these situations of battery failures in hospitals are mission-critical the batteries are discarded even when they are still usable. Therefore, continuous testing and maintenance are required to reduce battery wastage and ensure battery and equipment safety. Hence, the growing demand for medical equipment and the need to reduce battery wastage is expected to provide growth opportunities to the market.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - Battery Testing Equipment Market

- Arbin Instruments

- Chroma Systems Solutions, Inc.

- Ametek Scientific Instruments

- Biologic

- Bitrode Corporation

- Digatron Power Electronics GmbH

- EA Elektro-Automatik

- HEiNZINGER

- HORIBA FuelCon GmbH

- KEYSIGHT TECHNOLOGIES, INC.

- PEC

- Webasto Group

- NH Research, Inc.

- Maccor Inc.

- Unico, LLC

Get Free Sample For

Get Free Sample For