GNSS Chips for Timing and Synchronization Market Size and Growth 2031

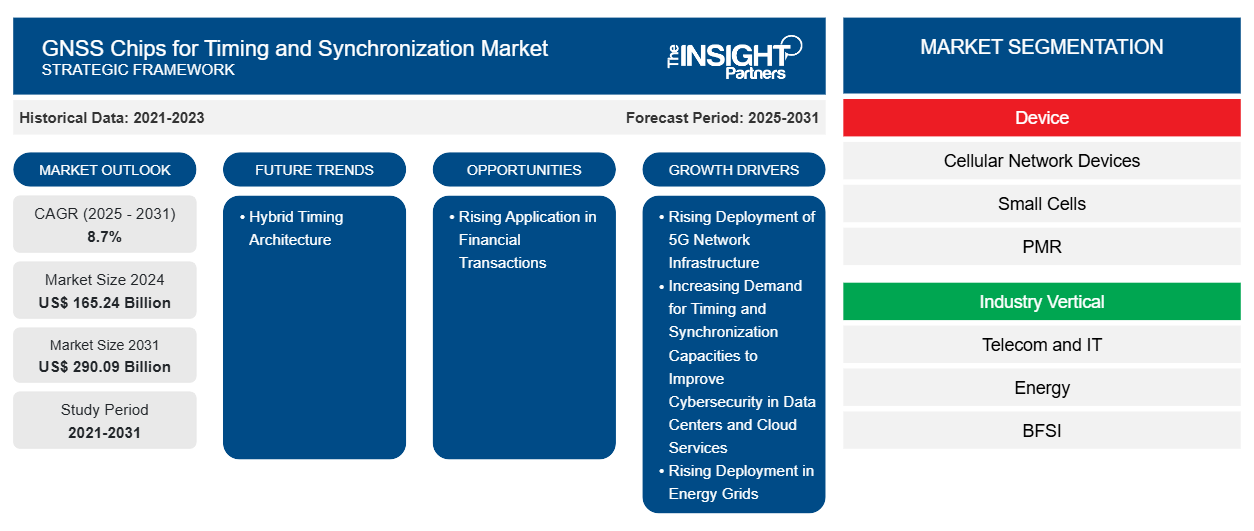

GNSS Chips for Timing and Synchronization Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: by Device (Cellular Network Devices, Small Cells, PMR (Public Mobile Radios), Phazor Measurement Units (PMU), and Others), Industry Vertical (Telecom and IT, Energy, BFSI, Consumer Electronics, Automotive and Transportation, and Others), and Geography

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Jul 2025

- Report Code : TIPRE00040972

- Category : Electronics and Semiconductor

- Status : Published

- Available Report Formats :

- No. of Pages : 211

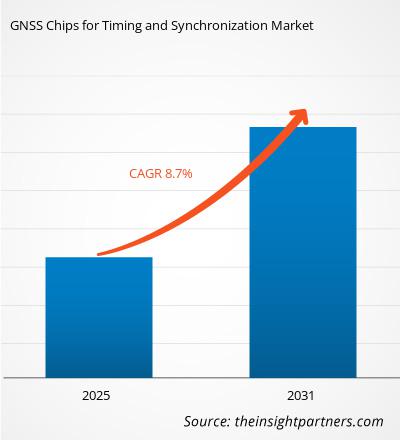

The GNSS chips for timing and synchronization market size is projected to reach US$ 290.09 million by 2031 from US$ 165.24 million in 2024. The market is expected to register a CAGR of 8.7% during 2025–2031. A hybrid timing architecture is likely to bring new trends into the market in the coming years.

GNSS Chips for Timing and Synchronization Market Analysis

The growing need for accurate timing in data centers, power grids, financial networks, and telecommunications is propelling the GNSS chips for timing and synchronization market. This requirement intensifies with the introduction of 5G networks, as the dependability and ultra-low latency of these networks rely on synchronization at the millisecond level. The integration of GNSS with edge computing and the Internet of Things is creating significant opportunities, as precise timing is necessary for real-time data transfer. Developments in multifrequency GNSS technology and anti-jamming capabilities further support the use of GNSS chips in critical infrastructure. Industry standards and government regulations also prompt investments toward reliable and verifiable timing sources. Further, the accelerating digital transformation across the world, particularly in smart cities and autonomous systems, renders GNSS-based timing solutions ready for wider use in commercial and industrial settings.

GNSS Chips for Timing and Synchronization Market Overview

The GNSS is a network of satellites that transmit positioning and timing data to receivers, which combine these data with sensor inputs to determine location, speed, and altitude. The accuracy of GNSS chips depends on the number of visible satellites and signal quality. As a result, several governments are attempting to deploy regional constellations to improve navigation and mapping. China, Russia, the US, India, Japan, and the European Union have all developed and operationalized their own GNSS, offering competitive alternatives in the global market. The demand for GNSS chips used in timing and synchronization is growing steadily due to the increasing need for precise timekeeping in critical infrastructure. Key sectors such as telecommunications, particularly with the rollout of 5G networks, require highly accurate timing performance to ensure synchronization at base stations and ensure low-latency communications. Similarly, power grids use GNSS-based timing for grid stability and fault detection via Phazor measurement units (PMUs). The financial sector also demands nanosecond-level synchronization for high-frequency trading and regulatory compliance.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONGNSS Chips for Timing and Synchronization Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

GNSS Chips for Timing and Synchronization Market Drivers and Opportunities

Rising Deployment in Energy Grids

In the energy industry, the importance of time synchronization is increasing since it guarantees accurate coordination among different power grid components. The grid's dependability is highly reliant on this synchronization, which makes fault management, event tracking, and effective communication possible. Maintaining precise time synchronization is essential to maximizing performance and preserving grid stability as the grid integrates sophisticated technologies (such as smart grids) and renewable energy sources.

Phazor measurements units (PMUs) are used in network automated protection systems (wide area measurement systems/wide area control systems) as a source of timing and synchronization data for both automatic protection (for future usage) and network monitoring (for present use). At the PMU level, automatic protection demands a high degree of precision and redundancy. PMUs are placed in distant power network nodes, and GNSS receivers are used for internal time references. Energy project developers, utility firms, energy asset producers, financiers, government agencies, energy dealers, and supply chain managers are considered main stakeholders in the energy sector. These stakeholders utilize space data to audit environmental regulations and policies, develop and monitor assets, and obtain an edge by acquiring general knowledge.

Rising Applications in Financial Transactions

Financial services require strong IT networks and systems that need a high degree of availability, security, and dependability. For synchronization and timestamping, GNSS is utilized to record quotes or occurrences chronologically. Various advantages of using GNSS in financial transactions are mentioned below:

- Enhanced security: GNSS-based timestamping makes transactions impenetrable, and it also maintains precise documentation of transactions.

- Greater dependability: GNSS offers a trustworthy timing source, lowering the possibility of mistakes or disagreements.

- Compliance: Financial organizations can adhere to regulatory obligations with the use of GNSS-based timestamping.

Timing and synchronization solutions are necessary for timestamping financial transactions. Regulators demand incredibly accurate time stamps for each transaction to ensure safe trades, eliminate fraud, and prevent consumer data alteration. In the US alone, financial transactions incurring tremendous losses of trillions of dollars occur annually. Most time systems in the financial industry are still based on the network time protocol (NTP) method. Time synchronization is performed within the exchange, data center, and member units through LAN connections. The reference clock is usually sourced from a GNSS signal together with a rubidium atomic clock. Thus, rising applications of GNSS chips in financial transactions are expected to present significant opportunities for the growth of the GNSS chip for timing and synchronization market.

GNSS Chips for Timing and Synchronization Market Report Segmentation Analysis

Key segments that contributed to the derivation of the GNSS chips for timing and synchronization market analysis are device and industry vertical.

- The GNSS chip for timing and synchronization market, by device, is segmented into cellular network devices, small cells, PMR (public mobile radios), Phazor measurement units (PMU), and others. The others segment held the largest share of the GNSS chip for timing and synchronization market in 2024.

- The global GNSS chip for timing and synchronization market, by industry vertical, is segmented into telecom and IT, energy, BFSI, consumer electronics, automotive and transportation, and others. The telecom and IT segment held the largest share of the GNSS chip for timing and synchronization market in 2024.

GNSS Chips for Timing and Synchronization Market Share Analysis by Geography

The geographic scope of the GNSS chips for timing and synchronization market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East and Africa, and South and Central America.

North America held a significant market share in 2024. The North America GNSS chip for timing and synchronization market is segmented into the US, Canada, and Mexico. With the power systems evolving to accommodate mounting demands and greater reliance on renewable energy, the GNSS chip for time and synchronization market is experiencing strong growth, driven by the urgent need for accurate, real-time coordination across modernized grid infrastructure. Countries in the region are focused on grid modernization. For example, in May 2024, the Biden-Harris Administration launched the Federal-State Modern Grid Deployment Initiative to accelerate improvements to the electric transmission and distribution network, which are critical to meeting the country’s objectives for affordable, clean, reliable, and resilient power. With grid stakeholders facing challenges such as interconnection delays, line congestion, and increased reliability risks posed by extreme weather, highly precise time synchronization enabled by GNSS technology is essential for managing distributed energy resources, improving grid stability, and ensuring seamless integration of clean energy solutions. The importance of GNSS chips is also increasing in a smarter, more resilient grid, which drives the GNSS chip for time and synchronization market in the region.

GNSS Chips for Timing and Synchronization

GNSS Chips for Timing and Synchronization Market Regional Insights

The regional trends and factors influencing the GNSS Chips for Timing and Synchronization Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses GNSS Chips for Timing and Synchronization Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

GNSS Chips for Timing and Synchronization Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 165.24 Billion |

| Market Size by 2031 | US$ 290.09 Billion |

| Global CAGR (2025 - 2031) | 8.7% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Device

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

GNSS Chips for Timing and Synchronization Market Players Density: Understanding Its Impact on Business Dynamics

The GNSS Chips for Timing and Synchronization Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

GNSS Chips for Timing and Synchronization Market News and Recent Developments

The GNSS chips for timing and synchronization market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the GNSS chips for timing and synchronization market are listed below:

- Protempis (formerly Trimble's Time and Frequency Division) announced that it is providing its industry-leading dual-band timing receiver Res720 embedded module for OCP-TAP's open-sourced time card reference design. The Res720 GNSS embedded timing module is an ideal solution for data centers, 5G Open RAN/XHaul, smart grid, industrial automation, and SATCOM networks. It provides unparalleled performance with 5 nanosecond timing accuracy, along with dual-band GNSS support and anti-jamming/anti-spoofing capabilities. (Source: Protempis, Press Release, June 2022)

- LOCOSYS Technology announced the launch of three new high-performance GNSS/RTK satellite positioning modules: the SO-1612-15, SO-1612-1N, and SOR-1612. These modules utilize Sony's latest CXD 5610GF chip, delivering exceptional positioning accuracy and stability as well as supporting multiple global satellite systems—including GPS (US), GLONASS (Russia), Galileo (Europe), and BeiDou (China). They are specifically designed to support the latest QZSS signals (L1 C/B), enhancing positioning accuracy and reliability in Japan and Asia Pacific. (Source: LOCOSYS Technology, Press Release, August 2024)

GNSS Chips for Timing and Synchronization Market Report Coverage and Deliverables

The "GNSS Chips for Timing and Synchronization Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- GNSS chips for timing and synchronization market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- GNSS chips for timing and synchronization market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- GNSS chips for timing and synchronization market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the GNSS chips for timing and synchronization market

- Detailed company profiles

Frequently Asked Questions

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For