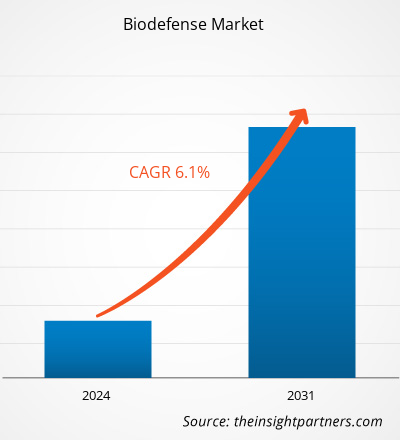

The biodefense market size in 2021 stood at US$ 12.37 billion and is projected to reach US$ 21.62 billion by 2031. The market is expected to register a CAGR of 6.1% in 2023–2031. Big data and artificial intelligence techniques offer huge possibilities for performing technical assessments of the risk and possibility of different biothreats and an unparalleled opportunity for mapping disease outbreaks. Thus, predictive analytics can help to reshape the biodefense industry, serving as a key biodefense market trends.

Biodefense Market Analysis

The lethal and naturally occurring viruses can now be easily modified to cause even more harm due to recent scientific advancements in the field of genetic engineering and biotechnology. Growing recognition of the potentially disastrous effects of biological attacks and outbreaks has increased the demand for biodefense solutions. Worldwide, governments are making significant investments in biodefense capabilities, which are supporting the market's expansion. Technological developments and a growing emphasis on research and development have also resulted in the launch of sophisticated and innovative biodefense solutions. The evolution of biodefense solutions is propelled by technological innovations such as synthetic biology, genomics, and data analytics, which provide improved capacities for identifying, characterizing, and mitigating biological threats. In addition, partnerships between governmental, defense, and commercial organizations have supported the development of comprehensive biodefense strategies and boosted market expansion.

Biodefense Market Overview

Biodefense refers to the range of activities and technologies that aim to restore the biosecurity of a country that is or may be, subject to biological threats or infectious diseases. It helps counter the potential risks associated with pandemics, bioterrorism, and other biological emergencies. The federal government in the US coordinates programs and sets up budgets to prevent, respond, and take action against biological disasters. The US biological defense program, also known as the National Biodefense Strategy, entails collective efforts by numerous levels of the government in association with private bodies and other stakeholders for the conduction of biodefense activities. In addition, the National Collaborating Centre for Infectious Diseases is an organization in Canada that aims to provide recent information on emerging infectious diseases to policymakers, public health practitioners, health inspectors, and others through webinars, podcasts, online resources, and publications. Thus, the efforts and initiatives undertaken by the government to strengthen the biodefense system are likely to support the market growth during the forecast period.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Biodefense Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Biodefense Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Biodefense Market Drivers and Opportunities

Presence of Favourable Government Initiatives to Drive the Market Growth

Governments in developed nations take a variety of actions and adopt preventative steps to withstand bioterrorism attacks. The government constantly maintains supplies of vaccines and bio-threat-detecting tools to protect the public. This is attributed to rising federal financing, technical breakthroughs, and growing public awareness. The presence of major players is also encouraging for the market. In 2018, the US government released the National Biodefense Strategy and Implementation Plan, the National Security Strategy, the National Defense Strategy, and the National Counterterrorism Strategy, and the National Counter WMD Strategy, all of which include biosecurity and biodefense.

Moreover, in emerging markets such as India, several facilities, such as the Defense Research and Development Organization, are developing defensive measures to combat biological attacks. Significant efforts are being made to prepare the military force for a biological attack. In the past two decades, there has been a continuing increase in the focus on spreading awareness about bioterrorism across all nations, along with various proposals and meetings to fight such threats, which is one of the major reasons driving the demand for biodefense. The initiatives of governments globally open a window of chance for companies involved in the biodefense sector, thereby driving market growth.

Enhanced Adoption of Technologies to Favor Market Growth

Increased adoption of technologies, such as gene chips for pathogen detection in forensic division, database management systems, advanced detector hardware in biodefense-related drug development, and nanotechnology, is being successfully used to strengthen biological defense techniques. Most of these technologies are employed either independently or jointly to design and develop various biodefense tools. The technology that is currently the most significant to biodefense is closely related to genetic engineering, a technology based on the artificial manipulation and transfer of genetic material. At the same time, gene therapy could be effectively used to cure various diseases. Many predict that future bioweapons could be designer bioweapons, and this technology could play a very important role in finding cures for many diseases unknown at present. Recent advances in molecular biology and genetic engineering have led to new vaccine development strategies and are likely to create considerable growth opportunities for the biodefense market in the future.

Biodefense Market Report Segmentation Analysis

Key segments that contributed to the derivation of the biodefense market analysis are by product.

- Based on product, the biodefense market is divided into anthrax, smallpox, botulism, radiation/nuclear, others. The anthrax segment held the largest market share in 2023 and is anticipated to register the highest CAGR during the forecast period.

Biodefense Market Share Analysis by Geography

The geographic scope of the biodefense market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America has dominated the biodefense market. Biological threats occurring to humans, animals, and environment are among the most serious issues faced by the US and its national community. As the biological threat continues to increase, the US is focused on strengthening its capabilities and considering preparation for biothreats and bioterrorism as one of the critical aspects of national security. A significant focus on national security, a well-established healthcare system, and robust research and development capabilities favor the market’s growth in the region. Due to strong and proactive government activities, partnerships with industry players, and a high degree of preparedness against bioterrorism threats, the region has seen significant investments in biodefense technology, including therapeutics, vaccines, and detection systems.

Biodefense strategies undertaken by organizations, such as BARDA, NIAID, CDC, ASPR, and the FDA, are contributing to the region’s growth. Significant funding by the US military and civilian agencies for biodefense is also one of the key factors responsible for the region's highest revenue share.

Asia Pacific is anticipated to grow with the highest CAGR in the coming years. Due to expanding R&D investments, the significance of biodefense, and the growing threat of dangerous biological materials that cause emergencies are supporting the market growth in the region. The region's high susceptibility to infectious diseases and large population have also increased demand for biodefense products and technologies, coupled with the presence of sophisticated healthcare infrastructure.

Biodefense Market Regional Insights

The regional trends and factors influencing the Biodefense Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Biodefense Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Biodefense Market

Biodefense Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 12.37 Billion |

| Market Size by 2031 | US$ 21.62 Billion |

| Global CAGR (2023 - 2031) | 6.1% |

| Historical Data | 2021-2023 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Biodefense Market Players Density: Understanding Its Impact on Business Dynamics

The Biodefense Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Biodefense Market are:

- Bavarian Nordic

- Alnylam Pharmaceuticals, Inc.

- SIGA Technologies

- Emergent BioSolutions Inc.

- Cleveland Bio Labs

- Dynavax Technologies

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Biodefense Market top key players overview

Biodefense Market News and Recent Developments

The biodefense market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for biodefense and strategies:

- In February 2022, Appili Therapeutics Inc. announced funding of over US$ 10 million from the US Department of Defense, via the Joint Science and Technology Office of the Defense Threat Reduction Agency, to advance the company’s biodefense vaccine candidate, ATI-1701, a potential first-in-class vaccine candidate to prevent infection with Francisella tularensis. The funding is expected to boost the company's presence and increase growth in the biodefense market. (Source: Appili Therapeutics, Press Release, 2022)

- In September 2022, Emergent BioSolutions Inc. completed its definitive agreement with Chimerix, Inc. to acquire Chimerix's exclusive global rights to TEMBEXA (brincidofovir), the first oral antiviral approved by the US Food and Drug Administration (FDA) for the treatment of smallpox in all age groups. (Source: Emergent BioSolutions Inc., News Release, 2022)

- In July 2023, Emergent BioSolutions Inc. received approval from the US FDA for CYFENDUS (Anthrax Vaccine Adsorbed, Adjuvanted), previously known as AV7909, for post-exposure prophylaxis of disease following suspected or confirmed exposure to Bacillus anthracis in individuals 18 to 65 years of age when administered in conjunction with recommended antibacterial drugs. (Source: Emergent BioSolutions Inc., News Release, 2023)

Biodefense Market Report Coverage and Deliverables

The “Biodefense Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

I wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA, MANAGING DIRECTOR, PineCrest Healthcare Ltd.The Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

Yukihiko Adachi CEO, Deep Blue, LLC.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Strategic Planning

- Investment Justification

- Identifying Emerging Markets

- Enhancing Marketing Strategies

- Boosting Operational Efficiency

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

- Bavarian Nordic

- Alnylam Pharmaceuticals, Inc.

- SIGA Technologies

- Emergent BioSolutions Inc.

- Cleveland Bio Labs

- Dynavax Technologies

- Elusys Therapeutics, Inc.

- Soligenix

- Altimmune

- Pluristem

Get Free Sample For

Get Free Sample For