Bioplastics and Biopolymers Market Size and Competitive Analysis by 2030

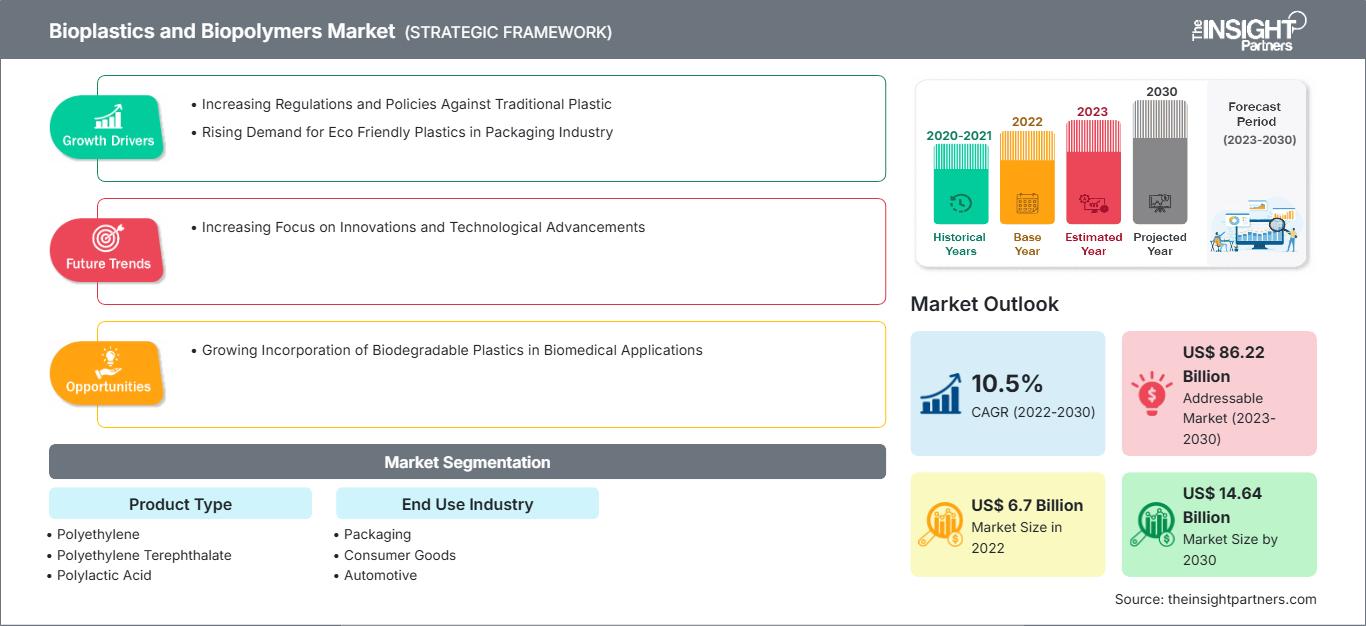

Bioplastics and Biopolymers Market Forecast to 2030 - Global Analysis by Product Type (Polyethylene, Polyethylene Terephthalate, Polylactic Acid, Polytrimethylene Terephthalate, Polybutylene Adipate Terephthalate, Polybutylene Succinate, Cellulose, Blends, and Others); End Use Industry (Packaging, Consumer Goods, Automotive, Textile, Building and Construction, Medical, Agriculture, and Others)

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030- Report Date : Aug 2023

- Report Code : TIPRE00005472

- Category : Chemicals and Materials

- Status : Published

- Available Report Formats :

- No. of Pages : 232

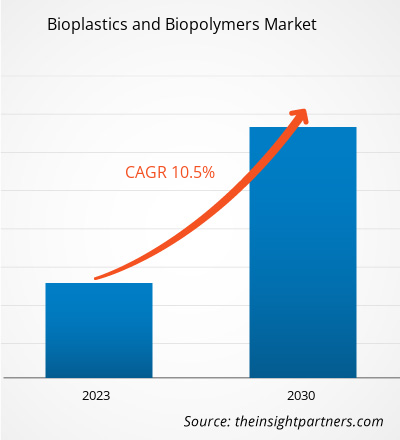

[Research Report] The bioplastics and biopolymers market was valued at US$ 6,703.53 million in 2022 and is projected to reach US$ 14,639.14 million by 2030; it is expected to register a CAGR of 10.5% from 2022 to 2030.

MARKET ANALYSIS

Bioplastics and biopolymers are produced or derived from living organisms, such as plants and microbes. The primary sources of biopolymers are renewable. Most of the biopolymers are biodegradable, which means they are capable of decomposing into carbon dioxide, methane, water, and inorganic compounds by the enzymatic action of microorganisms. The demand for bioplastics and biopolymers is growing due to the wide application of bioplastics, along with the rising demand for eco-friendly plastics in the packaging industry across the world.

GROWTH DRIVERS AND CHALLENGES

The increasing regulations and policies against traditional plastics has aided the bioplastics and biopolymers market growth. Government regulations and policies have shaped the bioplastics and biopolymers market. Recognizing the environmental impact of conventional plastics, many governments worldwide have implemented stringent measures to promote the production and use of sustainable alternatives. Several countries have introduced bans or restrictions on single-use plastics, such as plastic bags, straws, and cutlery. These policies aim to reduce plastic waste and encourage the adoption of bioplastics and biopolymers that are biodegradable and have a lower environmental footprint. In addition to bans, governments offer various incentives such as tax breaks, subsidies, grants, and research funding, as well as support mechanisms to promote the growth of the bioplastics industry. These incentives help reduce the cost of bioplastics, making them more competitive with conventional plastics. Thus, all these benefits have encouraged companies operating in the market to invest in research and development, scale up production, and bring innovative bioplastic products to the market. Governments are increasingly incorporating sustainability criteria into public procurement policies by prioritizing the use of biobased materials, including bioplastics and biopolymers, in government-funded projects, thus creating a significant demand for these materials. Further, regulatory frameworks are being established to ensure the quality and safety standards of bioplastics and biopolymers. Governments collaborate with industry associations and regulatory bodies to establish certification systems and standards for biodegradability, compostability, and environmental performance. These standards guarantee consumers, businesses, and industries that the plastics they use meet a certain criteria. Unlike conventional plastics, bioplastics require specialized collection, sorting, and processing systems due to their different properties and degradation characteristics. The existing waste management infrastructure is predominantly designed for traditional plastics, which often results in the availability of limited options for the proper disposal and recycling of bioplastics. Thus, these challenges are hindering the market expansion for bioplastics and biopolymers.

Customizee This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONBioplastics and Biopolymers Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

REPORT SEGMENTATION AND SCOPE

The "Global Bioplastics and Biopolymers Market Analysis to 2030" is a specialized and in-depth study with a major focus on the global bioplastics and biopolymers market trends and growth opportunities. The report aims to provide an overview of the global bioplastics and biopolymers market with detailed market segmentation by product type, end-use industry, and geography. The global bioplastics and biopolymers market has been witnessing high growth over the recent past and is expected to continue with this trend over the coming years. The report provides key statistics on the consumption of bioplastics and biopolymers worldwide along with their demand in major regions and countries. In addition, the report provides the qualitative assessment of various factors affecting the bioplastics and biopolymers market performance in major regions and countries. The report also includes a comprehensive analysis of the leading players in the bioplastics and biopolymers market and their key strategic developments. Several analyses on the market dynamics are also included to help identify the key driving factors, market trends, and lucrative bioplastics and biopolymers market opportunities that would, in turn, aid in identifying the major revenue pockets.

Ecosystem analysis and Porter’s five forces analysis further provide a 360-degree view of the global bioplastics and biopolymers market, which helps understand the entire supply chain and various factors affecting the market growth.

SEGMENTAL ANALYSIS

The global bioplastics and biopolymers market is segmented based on product type and end-use industry. Based on product type, the bioplastics and biopolymers market is segregated into polyethylene, polyethylene terephthalate, polylactic acid, polytrimethylene terephthalate, polybutylene adipate terephthalate, polybutylene succinate, cellulose, blends, and others. By end-use industry, the market is segmented as packaging, consumer goods, automotive, textile, building and construction, medical, agriculture, and others.

Based on product type, the blends segment accounted for a significant bioplastics and biopolymers market share. Polymer blending is an efficient and economical method utilized in the biopolymers industry to develop new materials with improved properties. The physical and mechanical properties of blends can be tuned by choosing the suitable polymers, varying the composition of the blend, and preparation conditions. In terms of end0use industry, the packaging segment led the bioplastics and biopolymers market with the largest market share. Bioplastics and biopolymers have various applications in the food service and catering sectors as a packaging material. Bioplastic packaging options include bags for agricultural foils, nursery products, horticultural products, wrappings, loose-fill foam, food containers, and film wrappings. Additionally, bioplastics are utilized as alternatives to conventional fossil fuel-based plastics and are widely used in food contact materials. Common biopolymers utilized for packaging purposes include cellulose, starch, chitosan, PHA, PCL, and PLA.

REGIONAL ANALYSIS

The report provides a detailed overview of the global bioplastics and biopolymers market with respect to five major regions—North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA) and South & Central America. Asia Pacific accounted for a significant share of the market and was valued at more than US$ 2,500 million in 2022. Factors such as the growth of the packaging industry, governments’ policies encouraging the adoption of environment-friendly products, rising environmental concerns, and growing investments by key market players are driving the bioplastics and biopolymers market growth in the region. Europe is also expected to witness considerable growth valued at over US$ 3,500 million by 2030, owing to the increasing consumer preference to use bioplastics and biopolymers packaging material over synthetic plastic packaging as it can be decomposed with food. Furthermore, in North America, there has been a widespread usage of bioplastics primarily in food packaging applications. This has created lucrative opportunities in bioplastics and biopolymers market. The bioplastics and biopolymers market in North America is augmented to grow at CAGR of around 10% during the forecast period.

INDUSTRY DEVELOPMENTS AND FUTURE OPPORTUNITIES

Partnership, acquisitions, and new product launches were found to be the major strategies adopted by the players operating in the global bioplastics and biopolymers market.

- In April 2023, BASF SE announced to establish compounding capacities for its certified compostable biopolymer ecovio in Shanghai, China.

- In March 2023, Saudi Basic Industries Corp partnered with Stella McCartney Beauty and three renowned French plastic converters companies (Texen, Leygatech, and STTP Emballage) to create cosmetics containers using its renewable polymers.

The regional trends and factors influencing the Bioplastics and Biopolymers Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Bioplastics and Biopolymers Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Bioplastics and Biopolymers Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 6.7 Billion |

| Market Size by 2030 | US$ 14.64 Billion |

| Global CAGR (2022 - 2030) | 10.5% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Bioplastics and Biopolymers Market Players Density: Understanding Its Impact on Business Dynamics

The Bioplastics and Biopolymers Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Bioplastics and Biopolymers Market top key players overview

IMPACT OF COVID/IMPACT OF GEOPOLITICAL SCENARIO/IMPACT OF RECESSION

Lockdowns, travel restrictions, and business shutdowns due to the COVID-19 pandemic adversely affected economies and industries in various countries of North America, Europe, Asia Pacific (APAC), South & Central America, and the Middle East & Africa (MEA). The crisis disturbed global supply chains, manufacturing activities, delivery schedules, and essential and nonessential product sales. Various companies announced possible delays in product deliveries and a slump in future sales of their products in 2020. Further, the international travel bans imposed by various governments in Europe, Asia Pacific, and North America forced several companies to discontinue their collaboration and partnership plans. All these factors hampered the chemicals & materials industry in 2020 and early 2021, thereby restraining the growth of various markets related to this industry, including the bioplastics and biopolymers market.

Before the COVID-19 outbreak, the bioplastics and biopolymers market was mainly driven by the rising demand from packaging, consumer goods, automotive, and building & construction industries. However, in 2020, various industries had to slow down their operations due to disruptions in value chains caused by the shutdown of national and international boundaries. The COVID-19 pandemic disrupted the supply chain of key raw materials and disturbed manufacturing processes due to restrictions imposed by government authorities in various countries. However, the economies revived their operations. The previously postponed manufacturing projects were resumed, further providing an opportunity for the biocomposite market players to regain normalcy.

COMPETITIVE LANDSCAPE AND KEY COMPANIES

Arkema SA, BASF SE, Mitsui Chemicals Inc, Cardia Bioplastics Australia Pty Ltd, Braskem SA, Saudi Basic Industries Corp, Corbion NV, Mitsubishi Chemical Holdings Corp, Novamont SpA, and Eastman Chemical Co. are among the key players operating in the bioplastics and biopolymers market.

Frequently Asked Questions

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For