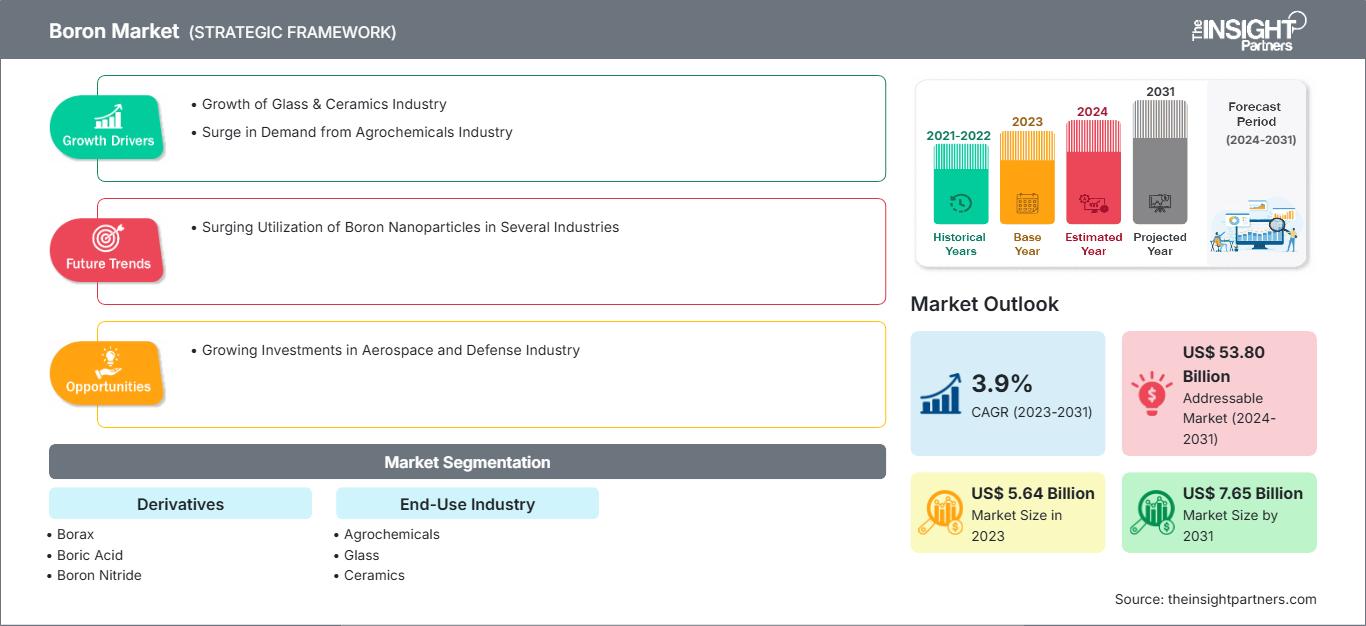

Boron Market Segments, Size, and Growth by 2031

Boron Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Derivative (Borax, Boric Acid, Boron Nitride, Boron Carbide, Boron Oxide, and Others), End-Use Industry (Agrochemicals, Glass, Ceramics, Detergents, Pharmaceuticals, Electrical & Electronics, and Others), and Geography

Historic Data: 2021-2022 | Base Year: 2023 | Forecast Period: 2024-2031- Report Date : Jul 2024

- Report Code : TIPRE00005834

- Category : Chemicals and Materials

- Status : Published

- Available Report Formats :

- No. of Pages : 198

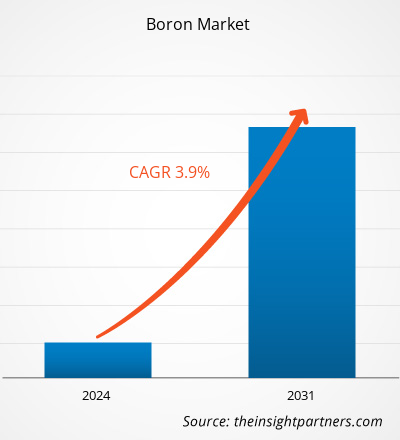

The boron market size is projected to reach US$ 7.65 billion by 2031 from US$ 5.64 billion in 2023. The market is expected to register a CAGR of 3.9% during 2023–2031. Expansion of boron applications across glass & ceramics and agrochemicals industries is likely to remain one of the key trends in the market.

Boron Market Analysis

Boron oxide is used in the glass industry for the manufacturing of borosilicate glass, known for its low thermal expansion. Boron nitride is an advanced ceramic material, synthetically produced and available in powder form. It offers thermal conductivity and thermal shock resistance. Boron is a key micronutrient with a wide scope of applications in the agrochemical industry, as it promotes the growth and health of plants. In 2023, Markab Capital invested US$ 180 million to build a civil aircraft manufacturing facility in the UAE by signing an agreement with Super Jet International. The first production phase included an annual production capacity of 10–15 aircraft. Such investments in the development of lightweight aircraft structures are likely to create numerous opportunities for the market players in the coming years.

Boron Market Overview

Borates are naturally occurring minerals containing boron and have several important characteristics such as metabolizing, bleaching, buffering, dispersing, and vitrifying properties. Boron mining involves a series of steps for the extraction of low-cost and high-grade minerals. Boron derivatives such as borax, boric acid, boron carbide, and boron oxide are used across several end-use industries. Boric acid or hydrogen borate is used in antiseptics, insecticides, flame retardants, glass, and ceramics. Its properties enhance the durability, heat resistance, and clarity of glass and ceramics. Fertilizer manufacturers incorporate boron into products to improve crop yields. Boron compounds are used in the production of household and industrial cleaning products due to their whitening and stain-removing properties. Borax naturally occurs in evaporite deposits extracted through surface as well as underground mining.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONBoron Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Boron Market Drivers and Opportunities

Rapid Growth of Glass & Ceramics Industry

Borates are used in the insulation of fiberglass, whereas glass wool contains 4–7% borates. In addition, boric oxide is used to manufacture high-quality handmade decorative ware. A cesium borosilicate glass is used to protect solar cells on satellites from the harmful radiation encountered in space. The rapid development of thin film transistor liquid crystal displays (TFT LCD) has been enhanced by the use of specialized borosilicate glasses. Borates are used in the production of sealed headlights, lamp covers, halogen bulbs and fluorescent tubes, designed for high electrical resistance, strength, chemical durability, and thermal shock resistance. Thus, the growth of the glass & ceramics industry is one of the major drivers of the boron market.

Growing Investments in Aerospace & Defense Industry

Boron fibers and boron carbide are high-strength and low-weight materials used in aerospace structures. The growing use of lightweight materials in the aerospace & defense industries is driving the demand for boron. Boron compounds such as boron nitride can withstand high temperatures, thereby having applications in heat shields, thermal protection systems, and other high-temperature applications. Boron is used as a dopant in semiconductors to improve the properties of advanced electronics utilized in the aerospace & defense industry. The aerospace manufacturing industry in Canada significantly produces aircraft components for commercial use, supported by funding from the government. According to the report by the International Trade Association, the government of Canada provided support of US$ 1.36 billion to the aerospace sector during 2021–2022 through the Federal Strategic Innovation Fund. Thus, the rising investments in the aerospace & defense industry are expected to create lucrative opportunities for the boron market growth during the forecast period.

Boron Market Report Segmentation Analysis

Key segments that contributed to the derivation of the boron market analysis are derivatives and end-use industry.

- Based on derivatives, the boron market is segmented into borax, boric acid, boron nitride, boron carbide, boron oxide, and others. The boron nitride segment held the largest market share in 2023.

- In terms of end-use industry, the market is categorized into agrochemicals, glass, ceramics, detergents, pharmaceuticals, electrical & electronics, and others. The glass segment held a significant share of the market in 2023.

Boron Market Share Analysis by Geography

The geographic scope of the boron market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

In 2023, Europe dominated the market for boron. The glass industry is one of the largest manufacturing industries in Europe. According to data published by the European Commission, Europe is the world's largest glass producer, with a market share of approximately one-third of total world production. Europe is a diverse market with several developed and developing economies, such as Germany, France, Italy, the UK, Spain, and Russia. The region has several major glass manufacturers, such as Saint-Gobain, Schott, and AGC Inc. The manufacturers are involved in the strategic expansion and product development to meet the rising demand for glass from end-use industries. For instance, in February 2022, AGC Inc. invested ~US$ 10.57 million in its laminating line to be installed in its Osterweddingen Plant (Germany).

Europe is recognized for its pharmaceutical manufacturing, with Germany, France, Switzerland, and Italy being the major producers in the region. In the pharmaceutical industry, boron is used in eye care products, as boron retains moisture, controls pH, and relieves irritants. Therefore, increasing consumption of boron across several industries, such as renewable energy, glass & ceramics, and pharmaceuticals, boosts the boron market growth in Europe.

Boron Market Regional Insights

The regional trends and factors influencing the Boron Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Boron Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Boron Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 5.64 Billion |

| Market Size by 2031 | US$ 7.65 Billion |

| Global CAGR (2023 - 2031) | 3.9% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Derivatives

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Boron Market Players Density: Understanding Its Impact on Business Dynamics

The Boron Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Boron Market top key players overview

Boron Market News and Recent Developments

The boron market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the boron market are listed below:

- 5E Advanced Materials, Inc, announced the launch of commercial production of boric acid at the 5E Boron America’s Complex. (Source: 5E Advanced Materials/Press Release/April 2024)

- Compagnie de Saint Gobain SA announced a new line of pigmented boron nitride coatings, CeraGlide Azure. (Source: Compagnie de Saint Gobain SA/Press Release/November 2023)

- Compagnie de Saint Gobain SA in collaboration with Haydale Group entered into a collaboration agreement to develop advanced surface chemistries for boron nitride powders. (Source: Compagnie de Saint Gobain SA/Press Release/September 2023)

Boron Market Report Coverage and Deliverables

The “Boron Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Boron market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Boron market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter’s Five Forces analysis and SWOT analysis

- Boron market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the boron market

- Detailed company profiles

Frequently Asked Questions

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For