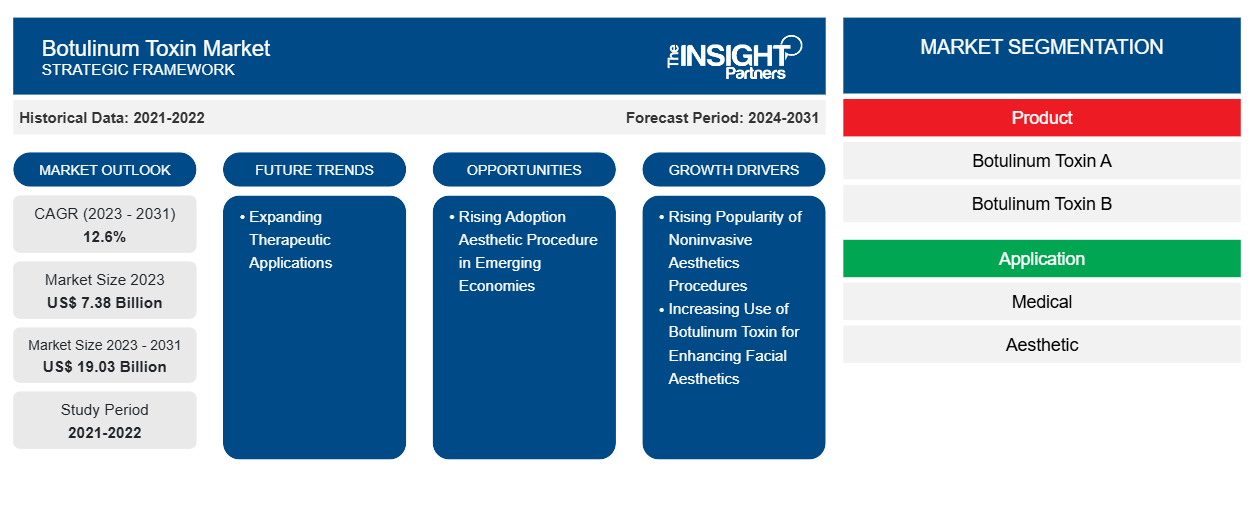

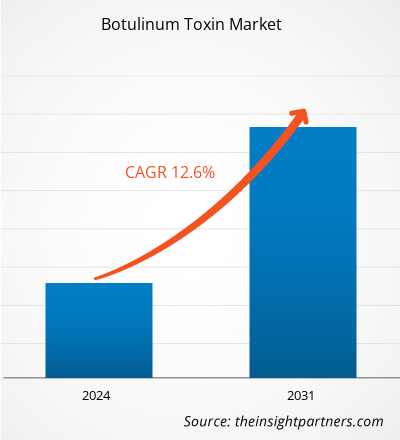

The botulinum toxin market is projected to grow from US$ 7.38 billion in 2023 to US$ 19.03 billion by 2031, recording a CAGR of 12.6% during 2023–2031. The report includes growth prospects owing to the current botulinum toxin market trends and their foreseeable impact during the forecast period.

Botulinum toxins are neurotoxins produced by bacteria named Clostridium botulinum. After the toxin is injected into a muscle, it blocks nerve signals to the muscle, thereby blocking its contraction and resulting in a reduction in unwanted facial lines or features. Botulinum toxin injections such as Botox and Dysport improve the appearance by relaxing the muscles that cause wrinkles. These injections also treat migraines, hyperhidrosis, overactive bladder, and eye problems. The botulinum toxin market size is likely to surge by 2031 owing to significant growth opportunities presented by developing countries.

Growth Drivers:

Increasing Use of Botulinum Toxin for Enhancing Facial Aesthetics Drives Botulinum Toxin Market

Cosmetic surgery and injectable botulinum toxin are among the most popular noninvasive rejuvenation procedures. According to the ISAPS, in 2020, the botulinum toxin treatment was the leading noninvasive cosmetic procedure performed worldwide. Moreover, botulinum toxin type A-based (BoNTA) facial cosmetic treatments are performed to improve the aesthetics of the upper and lower face. In the last decade, a facial rejuvenation procedure gained significant popularity over different types of traditional surgeries. According to the ISAPS, ~7.3 million botulinum toxin procedures were performed globally in 2020. Moreover, a total of 2.5 million minimally invasive cosmetic procedures involving botulinum toxin were performed in the US in 2020. Thus, an upsurge in the adoption of botulinum toxin in facial aesthetic procedures for both men and women from all age groups is driving the botulinum toxin market growth.

Nonsurgical Procedures, by Country, 2021

Nonsurgical Procedures | Worldwide | US | Brazil | Japan | Mexico | Italy | Germany | Turkey | Argentina | India | Greece |

Botulinum Toxin | 7,312,616 | 2,520,000 | 542,520 | 458,749 | 266,928 | 129,720 | 306,296 | 229,346 | 158,900 | 99,384 | 76,626 |

Source: The International Society of Aesthetic Plastic Surgery (ISAPS), 2021

Although botulinum treatment is approved worldwide to treat eyelid and throat spasms, reduce facial wrinkles, and control excessive sweating, the toxin may cause serious side effects that can be life-threatening. Common side effects of botulinum toxin treatments are mentioned below.

- Patients face problems in speaking, swallowing, or breathing due to the weakening of associated muscles. These side effects can be severe and result in mortality.

- Spread of botulinum toxin to body areas other than the injection site causes severe symptoms. These ill effects include the loss of strength and muscle weakness, blurred vision, double vision, drooping eyelids, trouble saying words clearly, hoarseness or change or loss of voice, loss of bladder control, trouble swallowing, and difficulty breathing.

- Other side-effects of botulinum toxin include upper respiratory tract infection. Children receiving botulinum treatment for urinary incontinence may experience urinary tract infections and bacteria in the urine. Other side effects in adults treated for urinary incontinence include painful urination, apart from urinary tract infections.

Botox has a boxed warning. A boxed warning is an official alert from the Food and Drug Administration (FDA) regarding potentially harmful side effects of a medication. Spreading of Botox outside of the injection site may result in symptoms identical to those of botulism. Further, headache or flu-like symptoms, crooked smile, and dry eyes are the other major side effects of botulinum toxin. Such harmful side effects limit the adoption of botulinum toxin treatment, thereby hampering the botulinum toxin market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Botulinum Toxin Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Botulinum Toxin Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The botulinum toxin market analysis is performed by considering the following segments: product, application, and end user.

Segmental Analysis:

By product, the botulinum toxin market is bifurcated into botulinum toxin A and botulinum toxin B. The botulinum toxin A segment held a larger botulinum toxin market share in 2023. It is anticipated to register a higher CAGR of 12.7% during 2023–2031. Botulinum toxin type A is a purified form that has a wide range of applications and a favorable safety profile. It is used to block the release of acetylcholine in the treatment of chronic sialorrhea, spasticity, and dystonia, as well as in various cosmetic applications.

By application, the botulinum toxin market is bifurcated into medical and aesthetic. The medical segment held a larger market share in 2023, and it is anticipated to register a higher CAGR of 13.3% during 2023–2031. The market for the medical segment is further categorized into chronic migraine, muscle spasm, overreactive bladder, hyperhidrosis, and others. Also, the market for the aesthetic segment is subsegmented into frown lines/glabellar, forehead lines, crow’s feet, square jaw/masseter, and others. Botulinum toxin is a neurotoxin used to treat and manage various medical conditions, including chronic migraine, spastic disorders, cervical dystonia, and detrusor hyperactivity. Medical applications of botulinum toxin include chronic migraine, muscle spasms, overreactive bladder, and hyperhidrosis.

The botulinum toxin market, by end user, is segmented into specialty and dermatology clinics, hospitals and clinics, and others. The specialty and dermatology clinics segment held the largest market share in 2023. It is anticipated to register the highest CAGR of 13.4% during the forecast period.

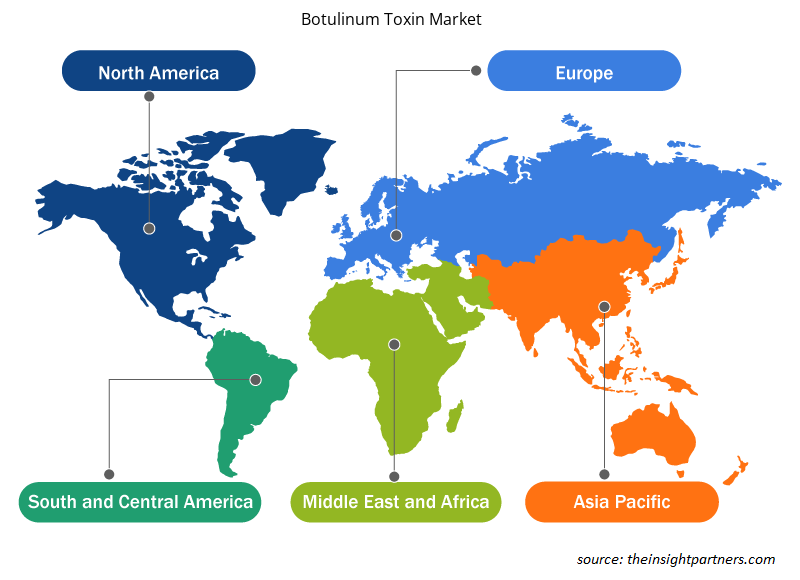

Regional Analysis:

The scope of the botulinum toxin market report includes North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America. In 2023, North America accounted for the largest botulinum toxin market share. Market growth in this region is driven by increasing numbers of nonsurgical or minimally invasive cosmetic procedures performed in the abovementioned countries. Reduction of facial wrinkles with botulinum toxin injections is the most performed cosmetic procedure in the US. It is one of the most common entry-level procedures for clinicians willing to incorporate aesthetic treatments into their practice. According to the International Society of Aesthetic Plastic Surgery (ISAPS), nearly 2.5 million botulinum toxin procedures were performed in the US in 2021. The treatment of frown lines and crow's feet by the FDA-approved botulinum toxin treatment methods for cosmetic indications and horizontal forehead wrinkles provide predictable results, alongside exhibiting fewer side effects and high patient satisfaction. BOTOX Cosmetic/Vistabel by Allergan, Dysport/Azzalure by Galderma and Ipsen, Xeomin/Bocouture by Merz, and Jeuveau by Evolus (manufactured only by Daewoong for the US) are among the commercially available botulinum toxin products in the country. The US FDA has approved BOTOX Cosmetic for people from the age range of 18–65.

Europe occupies a significant position in the global botulinum toxin market, and it is expected to record a strong growth rate during the forecast period. The market growth in the region is mainly attributed to product developments by botulinum toxin companies and an upsurge in the awareness of modern beauty standards among people from all age groups in European countries such as Germany, the UK, France, and Italy. In addition, advancements in healthcare systems are likely to propel the demand for botulinum toxin across the region in the coming years.

Botulinum Toxin Market Regional Insights

The regional trends and factors influencing the Botulinum Toxin Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Botulinum Toxin Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Botulinum Toxin Market

Botulinum Toxin Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 7.38 Billion |

| Market Size by 2031 | US$ 19.03 Billion |

| Global CAGR (2023 - 2031) | 12.6% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Botulinum Toxin Market Players Density: Understanding Its Impact on Business Dynamics

The Botulinum Toxin Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Botulinum Toxin Market are:

- AbbVie Inc.,

- Merz Pharma,

- Medytox,

- Ipsen Pharma,

- Galderma,

- Revance Therapeutics Inc.,

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Botulinum Toxin Market top key players overview

Competitive Landscape and Key Companies:

The botulinum toxin market forecast can help stakeholders in this marketplace plan their growth strategies. AbbVie Inc., Merz Pharma, Medytox, Ipsen Pharma, Galderma, Revance Therapeutics Inc., Lanzhou Institute of Biological Products Co Ltd, Evolus Inc, Hugel Inc, and Aquavit are among the prominent companies profiled in the botulinum toxin market report. These companies focus on developing new technologies, upgrading existing products, and expanding their geographic presence to meet the growing consumer demand worldwide. As per company press releases, below are a few recent developments:

- In January 2024, Medytox, Inc. announced the formation of Luvantas, Inc. as its wholly owned North American subsidiary. Luvantas is a new medical aesthetics company committed to bringing innovative solutions to the North American market. It is working with Medytox to seek approval for its upcoming NivobotulinumtoxinA to introduce it into the US and Canada.

- In March 2024, Hugel, a medical aesthetics company, received US FDA approval for Letybo injection (letibotulinumtoxinA-wlbg) for the treatment of Glabellar Lines.

- In October 2022, Hugel resubmitted the Biologics License Application (BLA) to the US FDA for its botulinum toxin called Botulax for the treatment of glabellar lines. Hugel received a Complete Response Letter (CRL) from the US FDA in March 2022 after submitting the BLA for Botulax (50 and 100 units) to advance into the US market. The company sent supplemental documents and data based on requests set out in the CRL and resubmitted the BLA to the US FDA. After the approval, Hugel entered into the US market in the first half of 2023.

- In February 2022, Merz Therapeutics invested up to US$ 3 million to expand its strategic partnership with Vensica Therapeutics, Israel. This investment followed the strategic license and collaboration agreement signed in 2021. Merz thus executed its contractual agreement to participate in Vensica’s Series C financing round and invest in the start-up.

Frequently Asked Questions

Which product segment is dominating the botulinum toxin market?

The botulinum toxin market, based on product, is bifurcated into botulinum toxin A and botulinum toxin B. The botulinum toxin A segment held a larger market share in 2023, and it is anticipated to register a higher CAGR during 2023–2031.

Which country is dominated the botulinum toxin market?

US holds the largest market share in botulinum toxin market. Facial wrinkle reduction with botulinum toxin injections is the most performed cosmetic procedure in the US. It is one of the most common entry-level procedures for clinicians willing to incorporate aesthetic treatments into their practice. According to the ISAPS, nearly 2.5 million botulinum toxin procedures were performed in the US in 2021. BOTOX Cosmetic/Vistabel by Allergan, Dysport/Azzalure by Galderma and Ipsen, Xeomin/Bocouture by Merz, and Jeuveau by Evolus (manufactured only by Daewoong for the US) are among the commercially available botulinum toxin products in the country. The US FDA has approved BOTOX Cosmetic for people from the age group of 18–65.

Which end user segment is dominating the botulinum toxin market?

The botulinum toxin market by end user, is categorized into specialty and dermatology clinics, hospitals and clinics, and others. The specialty and dermatology clinics segment held the largest market share in 2023.

Which application segment is dominating the botulinum toxin market?

The botulinum toxin market by application is bifurcated into medical and aesthetic. The medical segment held the largest botulinum toxin market share in 2023 and is anticipated to register the highest CAGR of 13.3% during 2023–2031.

Who are the major players in the botulinum toxin market?

The botulinum toxin market majorly consists of the players such as AbbVie Inc., Merz Pharma, Medytox, Ipsen Pharma, Galderma, Revance Therapeutics Inc., Lanzhou Institute of Biological Products Co Ltd, Evolus Inc, Hugel Inc, and Aquavit.

What is botulinum toxin?

Botulinum toxins are neurotoxins produced by bacteria named Clostridium botulinum. After the toxin is injected into a muscle, it blocks nerve signals to the muscle, thereby blocking its contraction and resulting in a reduction in unwanted facial lines or features. Botulinum toxin injections such as Botox and Dysport improve the appearance by relaxing the muscles that cause wrinkles. These injections also treat migraines, hyperhidrosis, overactive bladder, and eye problems..

What are the driving factors for the botulinum toxin market across the globe?

The factors that are driving growth of the market are the rising popularity of non-invasive aesthetics procedures and increasing use of botulinum toxin for enhancing facial aesthetics.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

I wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA, MANAGING DIRECTOR, PineCrest Healthcare Ltd.The Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

Yukihiko Adachi CEO, Deep Blue, LLC.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Strategic Planning

- Investment Justification

- Identifying Emerging Markets

- Enhancing Marketing Strategies

- Boosting Operational Efficiency

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - Botulinum Toxin Market

- F. Hoffmann-La Roche Ltd

- Becton Dickinson and Co

- ARKRAY Inc

- Sysmex Partec GmbH

- Fujirebio Europe NV

- bioMerieux SA

- Cepheid

- Meril Life Sciences Pvt Ltd

- QIAGEN NV

- OraSure Technologies Inc

Get Free Sample For

Get Free Sample For