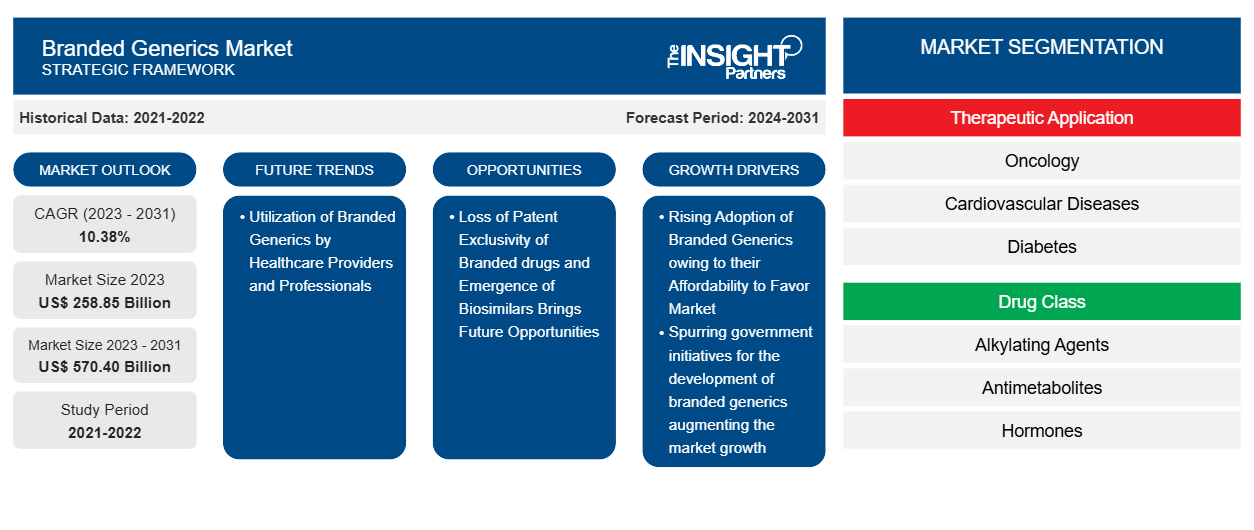

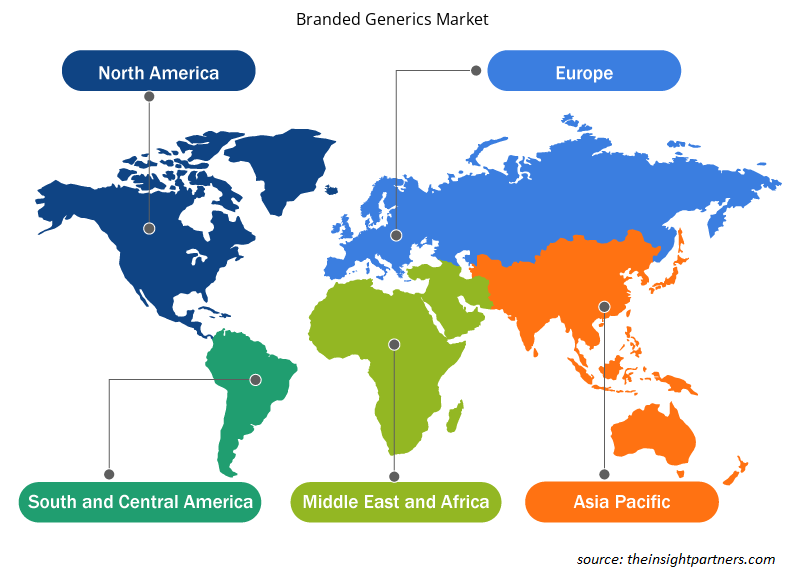

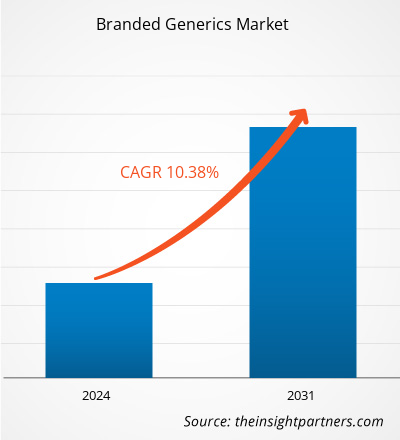

The branded generics market size is projected to reach US$ 570.40 billion by 2031 from US$ 258.85 billion in 2023. The market is expected to register a CAGR of 10.38% during 2023–2031. The rising utilization of branded generics by healthcare providers and professionals is likely to remain a key trend in the market.

Branded Generics Market Analysis

Branded generics are sold under a brand name without a patent. They can be developed by a generic drug firm or the original manufacturer and marketed after the original drug's patent expires. An Abbreviated New Drug Application (ANDA) is submitted for regulatory approval, and it must be therapeutically equivalent to the original drug. Their launch benefits brand name companies as they can be produced with existing expertise, do not require separate FDA approval and can be launched before the patent expires without legal obstacles. Rising penetration of branded generics in the market and spurring government initiatives for the development of branded generics are expected to favor the growth of the market.

Branded Generics Market Overview

Major companies have been implementing various organic as well as inorganic strategies which have promoted its growth in the market. For instance, in April 2021, WEX Pharmaceuticals Inc. announced that two clinical trials on tetrodotoxin (TTX) had been published in a special issue of the Toxins Journal. The safety study of cardiovascular applications, "Safety, Tolerability, Pharmacokinetics, and Concentration-QTc Analysis of Tetrodotoxin: A Randomized, Dose Escalation Study in Healthy Adults," was included in the special edition of the Toxins Journal. The Asia Pacific market is driven by rising investments from international players in China and India, improving government support for the development of branded generics in countries such as China, growing usage of branded generics, and advancing healthcare infrastructure in the region. Therefore, the region holds vast potential for the branded generics market players to grow during the forecast period.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Branded Generics Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Branded Generics Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Branded Generics Market Drivers and Opportunities

Rising Penetration of Branded Generics to Favor Market

As per the report released by VOXEU, branded generics are cheaper alternatives to other drugs. The utilization of branded generics has increased among the population due to cost savings provided by the healthcare system and the ability to make investments in tomorrow's new medicines. According to a report published by the International Generic and Biosimilar Medicine Association (IGBA) in May 2021, generics account for 60-80% of all medicine volume sales in major global markets, with even higher levels in some countries (e.g., more than 90% in the US, over 80% in Australia, more than 90% in India, and ~ 85% in Jordan). The industry's ability to maintain cost-effective prices, combined with scale, has allowed the industry to expand the reach and access of various therapies worldwide significantly. For example, within a year of the launch of generic antivirals for hepatitis C, the number of people who started treatment increased by 50%. Therefore, expanding the penetration of generics is the major driver of global branded generics' market share.

Proclivity Towards Personalized Medicine Brings Future Opportunities

Precision medicine is advancing healthcare by tailoring treatment to each person's unique genetic makeup. This approach, also known as individualized medicine or genomic medicine, uses genetics and genomics to provide better disease prevention, more accurate diagnoses, safer drug prescriptions, and more effective treatments for various health conditions. Branded generics offer the same pharmacological effects and are cost-effective. These advantages of branded generics make them a better option for personalized treatments. For instance, according to an article published in the American Society for Clinical Pharmacology & Therapeutics (ASCPT) in 2023, a study comparing the effectiveness of generic clopidogrel and its brand-name counterpart for treating patients with acute myocardial infarction (AMI) found that the generic version was equally effective as the brand-name medication in terms of cardiovascular and bleeding outcomes. This signifies that the utilization of generic drugs in personalized treatment has a positive impact, and the personalized medicine approach is likely to bring lucrative opportunities for the branded generic market.

Branded Generics Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Branded Generics market analysis are therapeutic application, drug class, formulation type, and distribution channel.

- Based on therapeutic application, the branded generics market is segmented into oncology, cardiovascular diseases, gastrointestinal diseases, diabetes, neurology, dermatology diseases, analgesics & anti-inflammatory, and others. The others segment held the largest market share in 2023.

- By drug class, the market is segmented into antimetabolites, hormones, antihypertensive, alkylating agents, lipid-lowering drugs, antidepressants, antipsychotics, antiepileptics, and others. The others segment held the largest share of the market in 2023.

- Based on formulation type, the branded generics market is segmented into oral, parenteral, topical, and others. The oral segment held the largest market share in 2023.

- In terms of distribution channels, the market is categorized into hospitals, retail pharmacies, online pharmacies, and drug stores. The retail pharmacies segment held a significant share of the market in 2023.

Branded Generics Market Share Analysis by Geography

The geographic scope of the Branded Generics market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America has dominated the market. The generic drug utility has increased the share of pharmaceutical spending. According to an article published in the National Library of Medicine (NLM), over 90 % of pharmaceutical drug prescriptions in the US are currently dispensed as generic drugs. As per the report published by the Food and Drug Administration (FDA) in 2020, First generics are essential to public health; 72 first generic drugs received FDA approval in 2020. In addition, the FDA estimated that branded generic drugs have helped the healthcare system save US$ 2.2 trillion in the past decade. Due to rising utilization of branded generics in the region, North America held the largest share in 2023. Asia Pacific is projected to register the highest CAGR in the coming years.

Branded Generics Market Regional Insights

The regional trends and factors influencing the Branded Generics Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Branded Generics Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Branded Generics Market

Branded Generics Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 258.85 Billion |

| Market Size by 2031 | US$ 570.40 Billion |

| Global CAGR (2023 - 2031) | 10.38% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Therapeutic Application

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Branded Generics Market Players Density: Understanding Its Impact on Business Dynamics

The Branded Generics Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Branded Generics Market are:

- Hetero

- Aspen Holdings

- Sandoz International GMBH

- Par Pharmaceuticals, INC

- Dr. Reddy's Laboratories

- AstraZeneca PLC

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Branded Generics Market top key players overview

Branded Generics Market News and Recent Developments

The Branded Generics market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes essential corporate publications, association data, and databases. A few of the developments in the Branded Generics market are listed below:

- Novartis’Sandoz launched a generic version of AbbVie’s Combigan, a combo eye drop used to treat elevated eye pressure in the U.S. As the most-dispensed branded combo glaucoma medication, the originator reeled in $373 million in U.S. sales in 2021. With the launch, the company is expanding its eye drug offerings. (Source: Sandoz, Company Website, April 2022)

- GSK agreed to acquire Sierra Oncology, a California-based, late-stage biopharmaceutical company focused on targeted therapies for the treatment of rare forms of cancer, for US$ 55 per share of common stock in cash, representing an approximate total equity value of US$ 1.9 billion (£1.5 billion). (Source: GlaxoSmithKline plc., Press Release, April 2022)

Branded Generics Market Report Coverage and Deliverables

The “Branded Generics Market Size and Forecast (2021–2031)” report provides a comprehensive breakdown of the market covering the areas:

- Branded Generics market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Branded Generics market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Branded Generics market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Branded Generics market

- Detailed company profiles

Frequently Asked Questions

Which region dominated the branded generics market in 2023?

North America dominated the branded generics market in 2023.

What are the driving factors impacting the branded generics market?

Factors such as the rising penetration of branded generics in the market and spurring government initiatives for the development of branded generics are driving the branded generics market growth.

What are the future trends of the branded generics market?

The rising utilization of branded generics by healthcare providers and professionals is a future trend in the market.

Which are the leading players operating in the branded generics market?

Hetero, Aspen Holdings, Sandoz International GMBH, Par Pharmaceuticals, INC, Dr. Reddy's Laboratories, AstraZeneca PLC, Sanofi, Lupin, Bausch Health Companies Inc., GlaxoSmithKline plc., Teva Pharmaceutical Industries Ltd, Mylan N.V are some leading players operating in the branded generics market.

What would be the estimated value of the branded generics market by 2031?

The branded generics market is estimated to reach US$ 934.57 million by 2031.

What is the expected CAGR of the branded generics market?

The branded generics market is anticipated to grow at a CAGR of 11.20% during 2023-2031.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

Get Free Sample For

Get Free Sample For