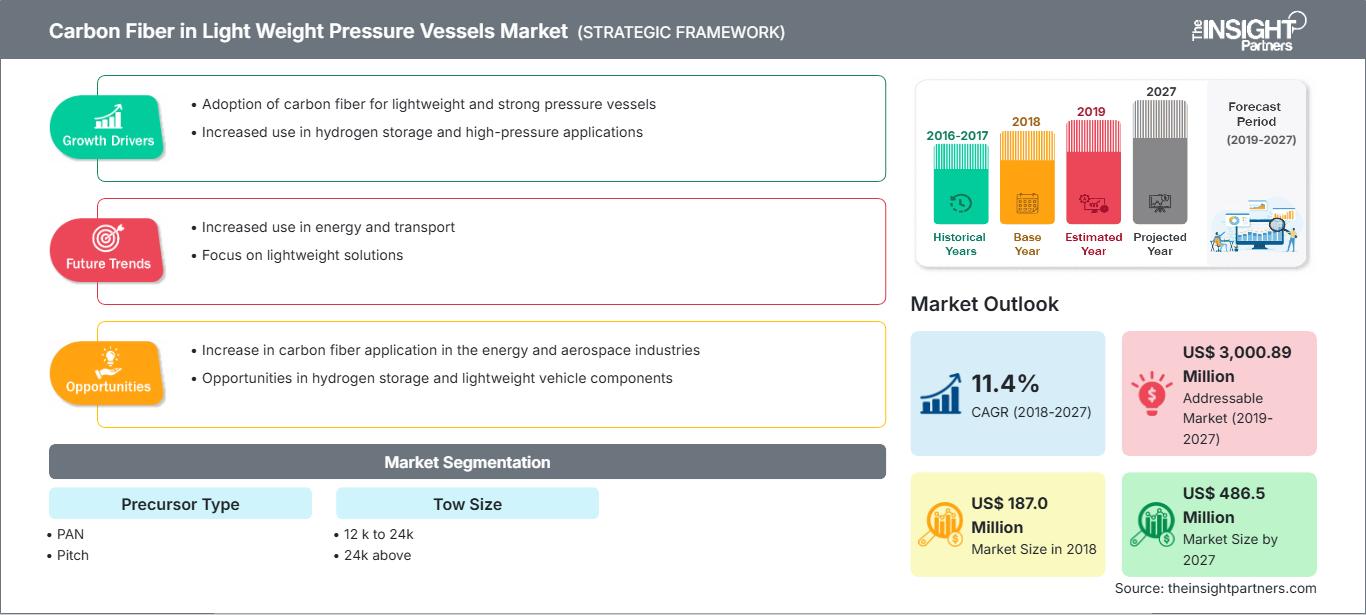

Carbon Fiber in Light Weight Pressure Vessels Market Size and Competitive Analysis by 2027

Carbon Fiber in Light Weight Pressure Vessels Market to 2027 - Industry Analysis and Forecasts by Precursor Type (PAN, Pitch), by Tow Size (12 k to 24k, 24k above), and Geography

Historic Data: 2016-2017 | Base Year: 2018 | Forecast Period: 2019-2027- Report Date : Aug 2019

- Report Code : TIPRE00006456

- Category : Chemicals and Materials

- Status : Published

- Available Report Formats :

- No. of Pages : 144

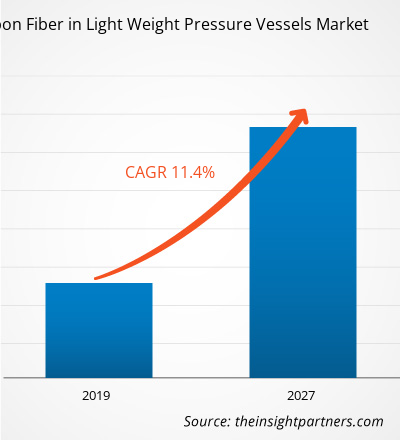

The global carbon fiber in light weight pressure vessels market accounted to US$ 187.0 Mn in 2018 and is expected to grow at a CAGR of 11.4% during the forecast period 2019 - 2027, to account to US$ 486.5 Mn by 2027.

APAC region is the fastest-growing region for carbon fiber-based pressure vessels, owing to increasing population and growing environmental concerns governments in countries such as India, China, and Japan coupled with the rising focus on energy-efficient and environmental friendly CNG vehicles. Moreover, the growing demand from the automotive industry is also expected to drive the growth of carbon fiber in light weight pressure vessels market in the region.

Market Insights

Rising demands from automotive and industrial applications provides an opportunity for the carbon fiber in light weight pressure vessels market growth

The carbon fiber offers high modulus and specific strength, high fatigue strength, high stiffness, high pressure withstanding capacity, lower thermal expansion coefficient, corrosion-resistance, and other beneficial properties, which makes them useful in pressure vessels for automotive and other industrial applications. Also, the rising demands of lightweight materials, along with government initiatives to reduce the harmful gas emissions, and to increase the fuel efficiency is expected to drive the carbon fiber in light weight pressure vessels market in automotive applications.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONCarbon Fiber in Light Weight Pressure Vessels Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Growing application of carbon fiber based pressure vessels in fuel cell vehicles will create growth opportunities for the global carbon fiber in light weight pressure vessels market

The global carbon fiber in light weight pressure vessels market is expected to experience growing demands of carbon fibers in tightened vessels for the storage of high-pressure hydrogen gas. The carbon fiber is considered as the best option for the production of reliable and safe pressure vessels as it has the capability to hold the high pressure of hydrogen owing to which the global automotive manufacturers are increasingly involved in the development of fuel cell vehicles, as well as respective national governments are also providing infrastructure construction support for the production of fuel cell vehicles.

Precursors Insights

On the basis of precursors, the global carbon fiber in light weight pressure vessels market has been segmented into Polyacrylonitrile (PAN) and pitch. The Polyacrylonitrile (PAN) segment led the global carbon fiber in a lightweight pressure vessels market. Polyacrylonitrile (PAN) is carbon fiber that contains approximately 68% of carbon and is one of the most widely used precursors for carbon fibers. PAN is polymerized from acrylonitrile (AN) by the commonly used inhibitors such as azo compounds and peroxides through the polymerization process. The rising demand for carbon fiber in the light-weight pressure vessels has led to an upsurge to the manufacturing and production of PAN as it is one of the most widely used precursors.

Tow Size Insights

The global carbon fiber in light weight pressure vessels market by tow size has been segmented into 12k To 24k and above 24K. The 12k To 24k segment accounted for the largest share in the global carbon fiber in light weight pressure vessels market. The heavy and stiff nature of 12k to 24k tow size carbon fibers proves to be beneficial in the military and scientific equipment applications which are a major factor contributing to the growth and expansion of the 12K to 24K tow size carbon fiber all over the globe. Some of the major key players who manufacture the 12K to 24K carbon fiber are Toray Composite Materials America, Inc., Teijin Limited, SGL group among many others.

Carbon Fiber in Light Weight Pressure Vessels

Carbon Fiber in Light Weight Pressure Vessels Market Regional InsightsThe regional trends and factors influencing the Carbon Fiber in Light Weight Pressure Vessels Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Carbon Fiber in Light Weight Pressure Vessels Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Carbon Fiber in Light Weight Pressure Vessels Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2018 | US$ 187.0 Million |

| Market Size by 2027 | US$ 486.5 Million |

| Global CAGR (2018 - 2027) | 11.4% |

| Historical Data | 2016-2017 |

| Forecast period | 2019-2027 |

| Segments Covered |

By Precursor Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Carbon Fiber in Light Weight Pressure Vessels Market Players Density: Understanding Its Impact on Business Dynamics

The Carbon Fiber in Light Weight Pressure Vessels Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Merger and acquisition, investment scenario new product development and others were observed as the most adopted strategies in global carbon fiber in light weight pressure vessels market. Few of the recent developments in the global carbon fiber in light weight pressure vessels market are listed below:

- 2019 : Teijin Limited agreed to acquire Renegade Materials Corporation (Renegade) through which Teijin aims at strengthening its carbon fiber and intermediate materials businesses to maintain its position as a leading provider of solutions for aerospace applications.

- 2018 : Toray Industries Inc. entered into an agreement with Koninklijke Ten Cate B.V. to purchase all shares of its subsidiary TenCate Advanced Composites Holding B.V. This acquisition was expected to produce substantial synergies by combining the product lineup of the latter with the range of carbon fiber alongwith polymer technologies.

- 2017 : Hexcel launched MAXIM, which is a new Government supported by £7.4 million in research and development of carbon fiber fabrics and expanded its manufacturing facility in Leicester.

GLOBAL CARBON FIBER IN LIGHT WEIGHT PRESSURE VESSELS MARKET SEGMENTATION

By Precursors

- Polyacrylonitrile (PAN)

- Pitch

By Tow Size

- 12k to 24k

- Above 24k

By Geography

-

North America

- U.S.

- Canada

- Mexico

-

Europe

- Germany

- France

- Italy

- UK

- Russia

- Rest of Europe

-

Asia Pacific

- Australia

- China

- India

- Japan

- South Korea

- Rest of Asia Pacific

-

Rest of World

- Brazil

- Argentina

- Rest of South America (SAM)

Company Profiles

- HYOSUNG CORPORATION

- Solvay

- Formosa Plastics Corporation

- Toray Industries, Inc

- Teijin Limited

- SGL Carbon

- Mitsubishi Chemical Corporation

- Kureha Corporation

- Hexcel Corporation

- Dowaksa

Frequently Asked Questions

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For