Cardiovascular Devices Market Dynamics and Developments by 2031

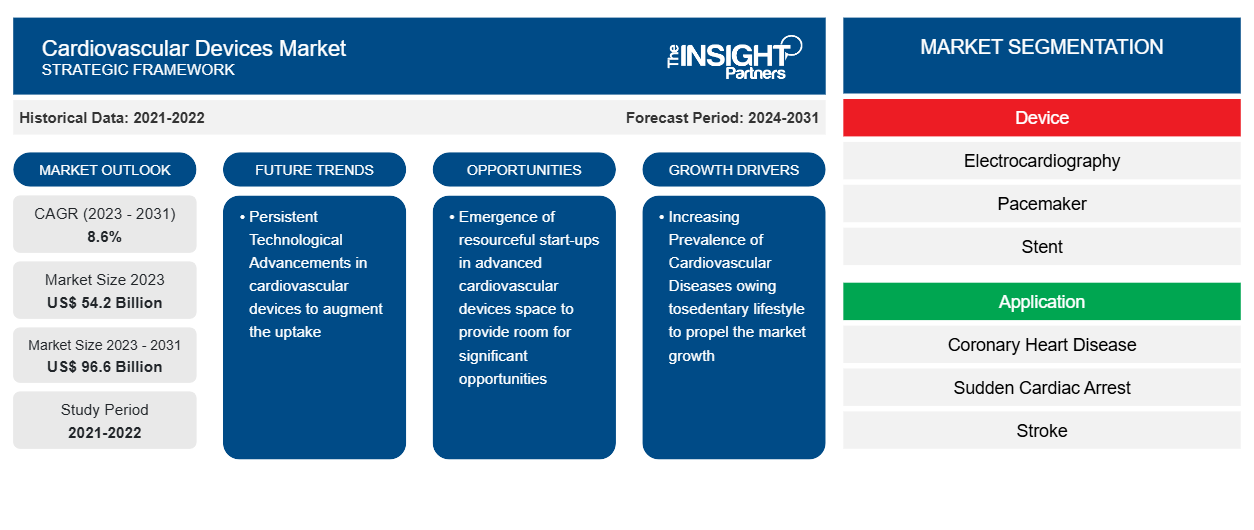

Cardiovascular Devices Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Device (Electrocardiography (ECG), Pacemaker, Stent, Defibrillator, Cardiac Catheter, Guidewire, Heart Valve, Event Monitor, Others), Application (Coronary Heart Disease, Sudden Cardiac Arrest, Stroke, Cerebrovascular Heart Disease, Others), End User (Hospitals, Ambulatory Surgery Centers, Cardiac Centers), and Geography

Historic Data: 2021-2022 | Base Year: 2023 | Forecast Period: 2024-2031- Report Date : Apr 2026

- Report Code : TIPHE100000826

- Category : Life Sciences

- Status : Data Released

- Available Report Formats :

- No. of Pages : 150

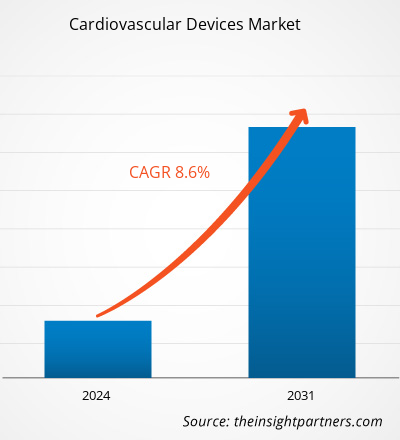

The cardiovascular devices market size is projected to reach US$ 96.6 billion by 2031 from US$ 54.2 billion in 2023. The market is expected to register a CAGR of 8.6% during 2023–2031. Continuous technological advancement will likely remain a key trend in the market.

Cardiovascular Devices Market Analysis

The cardiovascular devices market is estimated to grow owing to key driving factors such as increasing prevalence of cardiovascular diseases and rising number of product launches & approvals. Furthermore, regions such as Asia Pacific, the Middle East & Africa, and South Africa have opportunities for the cardiovascular devices market players to expand their presence by offering cost-effective products.

Cardiovascular Devices Market Overview

In the last decade, the world witnessed notable developments in cardiovascular devices, aiding physicians and patients with new approaches to managing atrial arrhythmias, ventricular arrhythmias, and ventricular atrial fibrillation, among other medical conditions. The growing prevalence of arrhythmia and other cardiovascular diseases (CVDs) is encouraging the introduction of improved cardiovascular devices. According to the World Health Organization (WHO), ~30 million people experience a stroke each year. The American Heart Association states that ~50% of all adults in the US have a type of CVD. In addition, it is anticipated that by 2035, over 130 million Americans, or 45.1% of the total population, will suffer from a cardiovascular disease. As per the American Heart Association (AHA) 2019 statistics, 121.5 million adults in the US, i.e., around half of the US adult population, suffer from CVD.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONCardiovascular Devices Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Cardiovascular Devices Market Drivers and Opportunities

Continuous Technological Advancement

The rapidly increasing prevalence of CVDs is raising the demand for technically advanced devices for diagnosing and treating patients with effective and efficient care. For instance, in October 2022, The US FDA approved Medtronic plc's request to broaden the labeling of a cardiac lead. This lead allows patients to obtain necessary therapy without running the risk of consequences like cardiomyopathy that might arise from using more conventional pacing methods. Several cardiovascular device players have succeeded in introducing products supporting transcatheter aortic valve replacement (TAVR) procedures. The TAVR technology is steadily and rapidly advancing, and procedures for the percutaneous mitral valve are being performed across Europe. Technological advancements in the medical industry also simplify using stem cell therapy, robotic sleeves, implantable defibrillators, 3D bioprinted heart tissue, and AI algorithms in treating CVDs.

Untapped Potential of Emerging Economies

The rise in the incidence of cardiovascular conditions in developing countries is ascribed to the shift in lifestyles and adoption of modernized facilities, leading to an increase in the prevalence of other health conditions associated with CVDs. The modernization of residential, commercial, and corporate facilities has lowered the need for physical activities among people; in contrast, stress levels among people are rising due to various personal and social factors, which are driving the prevalence of CVDs in developing countries. Moreover, these countries are bringing significant developments in healthcare facilities and services based on technological advancements.

China, India, the US, and Russia together contributed to 50% of this death count in 2015. For example, structural heart disease treatments are in the initial stage of development in regions such as Asia Pacific and the Middle East & Africa. For instance, in India, KIMS Hospitals. Telangana provides services for structural heart diseases. Thus, regions such as Asia Pacific, the Middle East & Africa, and South Africa have opportunities for the cardiovascular devices market players to expand their presence by offering cost-effective products.

Cardiovascular Devices Market Report Segmentation Analysis

Key segments that contributed to the derivation of the cardiovascular devices market analysis are product and end user.

- Based on device, the cardiovascular devices market is segmented into event monitor, electrocardiography (ECG), pacemaker, stent, defibrillator, cardiac catheter, guidewire, heart valve, event monitor, others. The event monitor segment held a largest market share in 2023.

- Based on application, the cardiovascular devices market is segmented by coronary heart disease, sudden cardiac arrest, stroke, cerebrovascular heart disease, others. The coronary heart disease segment held a largest market share in 2023.

- Based on end user, the cardiovascular devices market is segmented by hospitals, ambulatory surgery centers, and cardiac centers. The hospitals segment held a largest market share in 2023.

Cardiovascular Devices Market Share Analysis by Geography

The geographic scope of the cardiovascular devices market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

In North America, the US is the largest market for medical imaging informatics. US is the largest market for cardiovascular devices at a global level. The market's growth is attributed to increasing product development and growing government support to enhance heart treatment. Cardiac arrhythmias, or irregular heart rhythms, can cause chest pain and fainting and may lead to sudden cardiac death or stroke. According to the American Heart Association, 835,000 Americans are discharged from hospital care with cardiac arrhythmia diagnoses each year.1 More than 2.2 million Americans experience atrial fibrillation each year, a type of cardiac arrhythmia that is associated with an increased risk for stroke. Heart disease is the top cause of death in the United States for both men and women, as well as for members of the majority of racial and ethnic groups, according to the Centers for Disease Control and Prevention (CDC). Based on the information provided, one person dies from cardiovascular illness every 36 seconds, and heart disease accounts for 1 in 4 deaths, meaning that about 655,000 Americans pass away from heart disease annually. Numerous initiatives are being implemented as a result of the rising risk of heart disease.

Cardiovascular Devices

Cardiovascular Devices Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 54.2 Billion |

| Market Size by 2031 | US$ 96.6 Billion |

| Global CAGR (2023 - 2031) | 8.6% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Device

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Cardiovascular Devices Market Players Density: Understanding Its Impact on Business Dynamics

The Cardiovascular Devices Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Cardiovascular Devices Market News and Recent Developments

The Cardiovascular Devices Market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the cardiovascular devices market are listed below:

- GE Healthcare launched its first ‘Made in India’, ‘AI-powered’ Cath lab - Optima IGS 320 to advance cardiac care in India. Built at Wipro GE Healthcare’s new factory, launched under the PLI (production-linked incentive) scheme in Bengaluru, the Cath lab leverages the GE proprietary AutoRight technology. Powered by Edison, AutoRight is the first neural network-based interventional image chain. AutoRight features Artificial Intelligence that automatically optimizes image and dose parameters in real-time, enabling clinicians to focus their attention and expertise on patients. (Source: GE Healthcare, Company Website, September 2022)

Cardiovascular Devices Market Report Coverage and Deliverables

The “Cardiovascular Devices Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Cardiovascular devices market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Cardiovascular devices market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Cardiovascular devices market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the cardiovascular devices market

- Detailed company profiles

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For