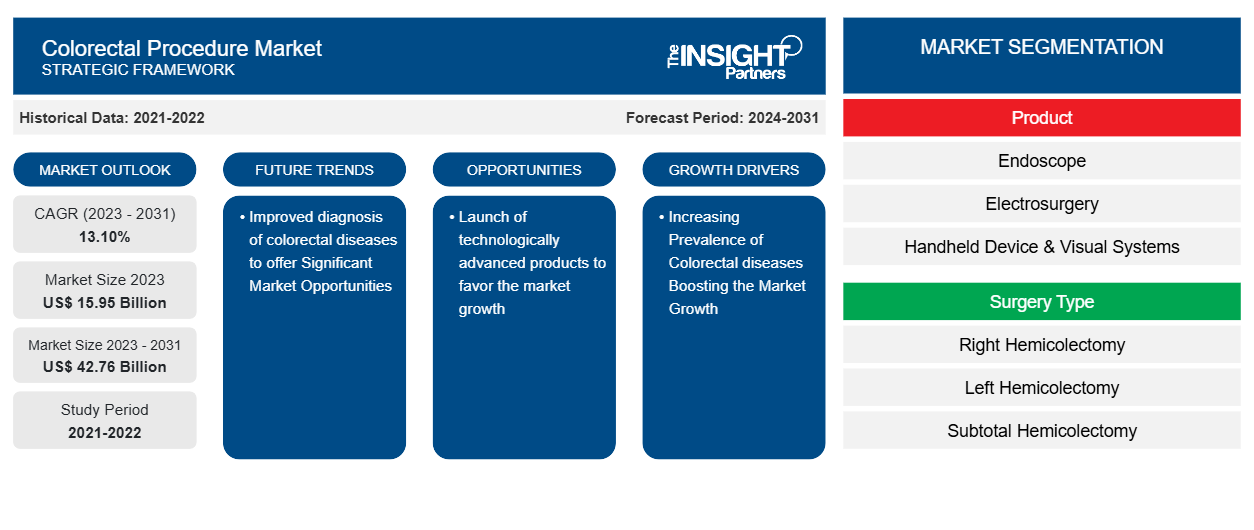

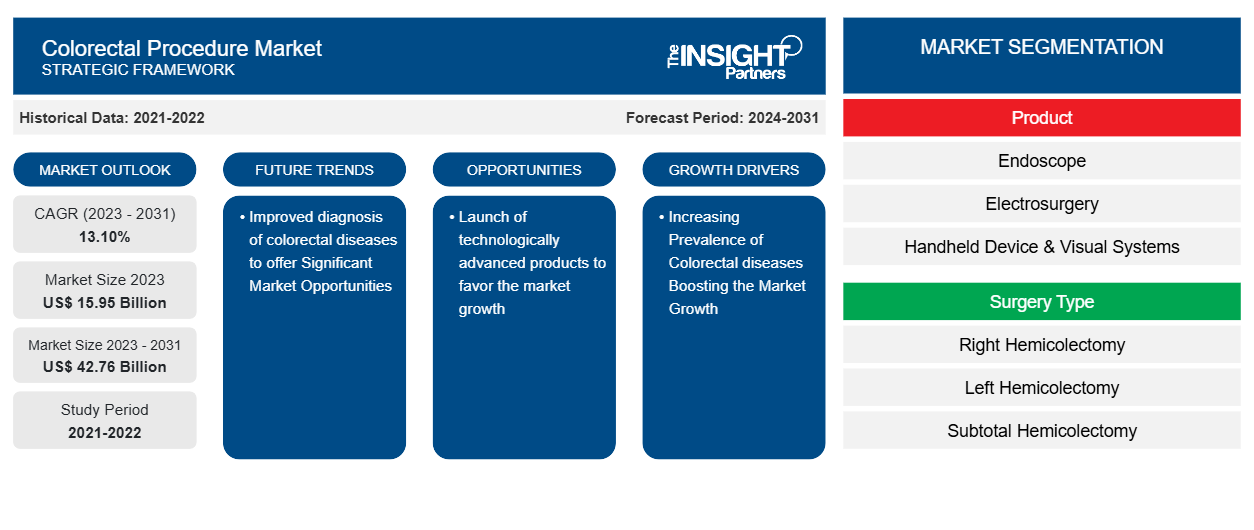

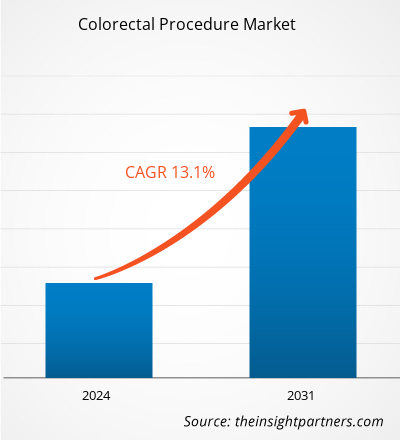

The colorectal procedure market size is projected to reach US$ 42.76 billion by 2031 from US$ 15.95 billion in 2023. The market is expected to register a CAGR of 13.10% during 2023–2031. Key factors that are fuelling the growth of the market are the increasing prevalence of colorectal cancer and new product launches. However, complications associated with colorectal procedures are expected to restrict the market growth during the forecast period.

Colorectal Procedure Market Analysis

One of the most prevalent and deadly tumours that develop in people when hereditary and environmental variables come together is colorectal cancer. With approximately 1.93 million cases worldwide in 2020, colorectal cancer ranks as the third most common kind of cancer, according to the World Health Organization (WHO). Additionally, colon cancer varies in incidence and mortality rates throughout the world; in 2020, colorectal cancer was the cause of approximately 916,000 deaths. It ranks second among cancers in women and third among cancers in males. For men, the lifetime risk of colorectal cancer is approximately 1 in 23, and for women, it is approximately 1 in 25. In 2018, there were approximately 95,55,027 cancer-related deaths reported, of which 8,80,792 were linked to colorectal cancer. Therefore, colorectal cancer was identified as the third most common cancer and the second most death-causing cancer globally.

A sizable portion of the North American population receives a colorectal cancer diagnosis. For example, the American Cancer Society and the Centers for Disease Control and Prevention (CDC) anticipate that 53,200 people in the US died from colorectal cancer in 2020 and 1.93 million adult cases of colon and rectal cancer were diagnosed. Cancer prevalence is comparable among European nations.

For instance, according to Cancer Research UK, 16,571 people in the UK died from bowel/colorectal cancer between 2016 and 2018. Additionally, the data points to around 42,880 new cases of colon cancer in the UK each year, or more than 110 patients every day.

Colorectal Procedure Market Overview

Rising demand across different locations for sophisticated cancer diagnosis and treatments. The incidence of colorectal cancer is rising among Asian populations. For example, the International Agency for Research on Cancer & GLOBOCAN estimates that there will be around 1,009,400 new cases of colorectal cancer in Asia in 2020. In comparison to other Asia-Pacific nations, Japan, China, Malaysia, Singapore, Korea, and Turkey are seeing high incidence rates. Therefore, the global market for colorectal procedures is growing due to the increasing number of individuals who are suffering from the condition.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Colorectal Procedure Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Colorectal Procedure Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Colorectal Procedure Market Drivers and Opportunities

New Product Launched Favors Market Growth

The market for colorectal procedures is ascribed to frequent diagnostic tests and medical device launches. Prominent market players are involved in manufacturing, offering a wide range of devices that help reduce the burden of colorectal cancer and other associated indications such as colon polyps, Crohn’s disease, colitis, irritable bowel syndrome, and others. For instance, in April 2020, Olympus Corporation announced the launch of EVIS X1, which is the most advanced endoscopy. This system helps to improve the results from disorders of the stomach, colon, oesophagus, and bronchial diseases. The system has various features, such as extended depth of field (EDOF), red dichromatic imaging (RDI), texture and colour enhancement imaging (TXI), and narrow-band imaging (NBI). The launch of EVIS X1 strengthened Olympus leadership in endoscopy and in the medical device industry.

In July 2022, US Digestive Health (USDH), a network of top-rated gastrointestinal (GI) practices, announced the commercialization of AI-assisted colonoscopy screenings with the country’s largest installation of GI Genious Intelligent endoscopy modules. In real-time, it will help physicians identify hard-to-detect and potentially cancerous polyps. The launch of the device will give patients throughout southeastern, southwestern, and central Pennsylvania wide-ranging access to the innovative and its enhanced capability. Moreover, in September 2020, Olympus Corporation announced the launch of ENDO-AID, a cutting-edge platform powered by artificial intelligence (AI) that includes the endoscopy application ENDO-AID CADe (computer-aided detection) for the colon. This new AI technology-based platform enables the real-time display of automatically detected suspicious lesions and works in combination with the recently introduced EVIS X1. Thus, continuous developments and new product launches in colorectal-associated indications are driving the growth of the colorectal procedural market.

Growing Medical Device Industry in Emerging Economies Offers Opportunities in Developing Regions

The rapidly growing medical device industry in developing countries in the Asia Pacific is creating better opportunities for market players to expand their geographical footprint and product offerings. This is a substantial reason for the growth of the medical device industry. According to India Brand Equity Foundation (IBEF) statistics, in 2020, India was the largest importer of medical devices worldwide. The Indian medical device industry imports ~75-80% of medical devices, with exports at ~US$ 2.1 billion in 2019 and is expected to grow at a CAGR of 29.7% to reach about US$ 10 billion in 2025. Moreover, India has a huge pool of scientists and engineers who have the potential to grow the healthcare industry remarkably.

Major market players focus on emerging markets such as Singapore and China as they have many colorectal cancer patients and growing medical tourism. As per the Australian Institute of Health and Welfare, over ~15,540 new cases of colorectal cancer were diagnosed in 2021. Moreover, as per the Malaysia Healthcare Travel Council, in 2019, over 1.22 million healthcare travellers visited Malaysia for healthcare purposes. The low cost of treatment and incorporation of new technologies to provide less waiting time for procedures in the Asia Pacific region are likely to boost the number of surgeries, which ultimately increases the demand for colorectal procedures.

Thus, the increasing medical tourism and the growing medical device industry in emerging countries are expected to boost the global colorectal procedural market growth; it is anticipated to provide lucrative growth opportunities to the players in the market during the forecast period.

Colorectal Procedure Market Report Segmentation Analysis

Key segments that contributed to the derivation of the colorectal procedure market analysis product, surgery type, Indication, and end user.

- Based on product, the colorectal procedure market is divided into endoscope, electrosurgery, handheld device & visual systems, sealing & stapling devices, ligation clips & dilators & speculas, cutter & shears, accessories, and others. The self-endoscope segment held the most significant market share in 2023.

- By surgery type, the market is categorized into type right hemicolectomy, left hemicolectomy, subtotal hemicolectomy, low anterior resection, abdomino-perineal resection, and others. The subtotal hemicolectomy segment held the largest share of the market in 2023.

- Based on Indication, the colorectal procedure market is divided into colon polyps, Crohn's disease, colorectal cancer, colitis, irritable bowel syndrome, and others. The irritable bowel syndrome segment held the most significant market share in 2023.

- By end user, the market is segmented into hospitals & clinics, surgery centers, and others. The Hospital & Clinics segment held the largest share of the market in 2023.

Colorectal Procedure Market Share Analysis by Geography

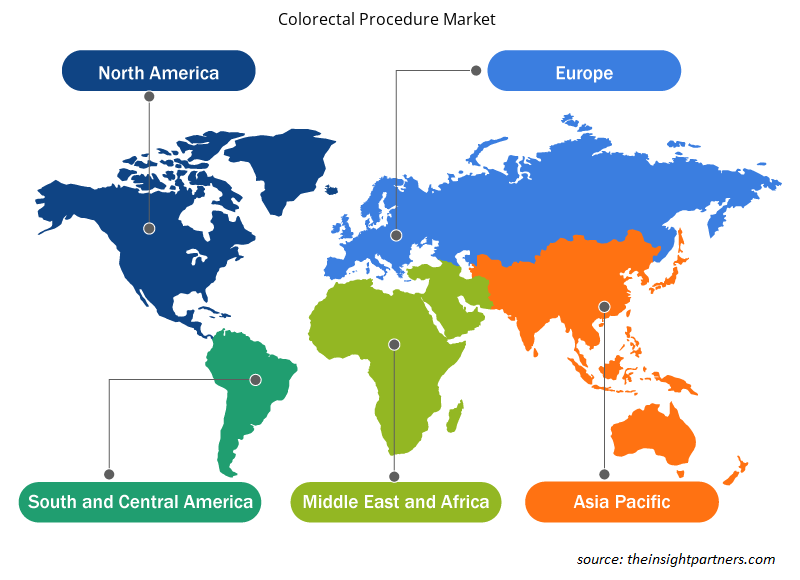

The geographic scope of the colorectal procedure market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

The US, Canada, and Mexico comprise the three segments of the North American market for colorectal procedures. This region's market is growing because colorectal cancer is one of the top five most common frequently diagnosed malignancies in the US. According to predictions from the American Cancer Society, there will be roughly 45,000 new cases of rectal cancer and over 106,000 new cases of colorectal cancer, respectively, around the nation in 2022. Despite the fact that colorectal cancer is more common in older persons, patients are growing among younger adults. A colectomy, sometimes referred to as a colon resection, is a surgical removal of the colon's or intestine's affected portion. It is advised to get this operation for bowel blockage brought on by ulcerative colitis, bleeding, infection, or distortion of scar tissue, trauma, hereditary polyposis, cancer, or precancerous polyps. Over 600,000 surgical procedures are carried out yearly to treat colon illnesses in the United States. The American Cancer Society reports that 90% of cases of localized rectal cancer and 91% of cases of localized colon cancer will still be alive after five years. In general, the fatality rates from colorectal cancer have been declining with better screening and treatment over the past 20 years. It is stated by the Centers for Disease Control and Prevention there was a minor but notable rise in colorectal cancer among people 45 to 54 years old.

Colorectal Procedure Market Regional Insights

The regional trends and factors influencing the Colorectal Procedure Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Colorectal Procedure Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Colorectal Procedure Market

Colorectal Procedure Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 15.95 Billion |

| Market Size by 2031 | US$ 42.76 Billion |

| Global CAGR (2023 - 2031) | 13.10% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Colorectal Procedure Market Players Density: Understanding Its Impact on Business Dynamics

The Colorectal Procedure Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Colorectal Procedure Market are:

- Ethicon (Johnson & Johnson Services, Inc.)

- Medtronic plc

- Colospan Ltd

- SAFEHEALB

- Braun Melsungen AG

- Cardinal Health Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Colorectal Procedure Market top key players overview

Colorectal Procedure Market News and Recent Developments

The colorectal procedure market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the colorectal procedure market are listed below:

- Medtronic announced final findings from a randomized, international, multi-center center that confirmed the effectiveness of the GI Genius intelligent endoscopy module, which uses AI as an aid in detecting colorectal polyps during colonoscopy, potentially helping to prevent colorectal cancer. (Source: Medtronic PLC, News Latter, May 2022)

- B.Braun Medical Inc. launched its new Introcan Safety IV Catheter with one-time blood control that ensures clinicians are protected by a truly automatic passive safety device. Introcan Safety 2 helps to reduce clinician and patient's exposure to blood with its one-time Blood Control Septum, which is designed to restrict the flow of blood from the catheter hub after needle removal until the first connection of a Luer access device. The newly launched Introcan Safety 2 will allow clinicians to experience passive needlestick prevention and a reduced risk of exposure to blood borne pathogens when removing the introducer needle from the Introcan Safety 2. This is all achieved with a product similarly sized to the widely popular Introcan Safety Catheter. (Source: B. Braun Melsungen AG, News Latter, July 2022)

Colorectal Procedure Market Report Coverage and Deliverables

The “Colorectal Procedure Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Colorectal procedure market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Colorectal procedure market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Colorectal procedure market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the colorectal procedure market

- Detailed company profiles

Frequently Asked Questions

Which region dominated the colorectal procedure market in 2023?

North America dominated the colorectal procedure market in 2023

What are the driving factors impacting the colorectal procedure market?

Major factors such as the increasing prevalence of colorectal cancer and new product launches boost the market growth.

What are the future trends of the colorectal procedure market?

Development and launch of new advance products will likely remain a key trend in the market.

Which are the leading players operating in the colorectal procedure market?

Ethicon (Johnson & Johnson Services, Inc.), Colospan Ltd, SAFEHEALB, Medtronic, Braun Melsungen AG, Cardinal Health Inc., Boston Scientific Corporation, CooperSurgical, Inc., Olympus Corporation.

What is the expected CAGR of the colorectal procedure market?

The market is expected to register a CAGR of 13.10% from 2023 to 2031.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

I wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA, MANAGING DIRECTOR, PineCrest Healthcare Ltd.The Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

Yukihiko Adachi CEO, Deep Blue, LLC.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Strategic Planning

- Investment Justification

- Identifying Emerging Markets

- Enhancing Marketing Strategies

- Boosting Operational Efficiency

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

Get Free Sample For

Get Free Sample For