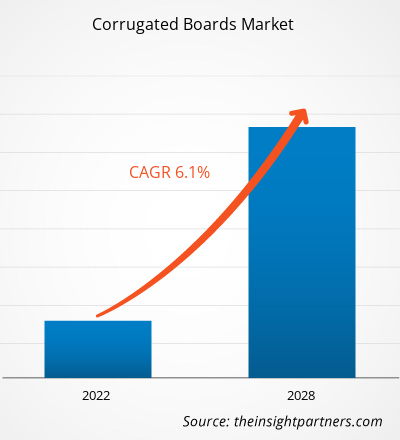

[Research Report] The corrugated boards market was valued at US$ 127,139.07 million in 2021 and is projected to reach US$ 192,153.31 million by 2028; it is expected to grow at a CAGR of 6.1% from 2021 to 2028.

Corrugated packaging involves the packaging of various goods, such as food and beverage products, consumer durables, and electronics and electrical appliances, in corrugated boxes for secondary transportation. The use of corrugated board for packaging is a cost-effective and adaptable packaging technique for protecting, preserving, and transporting a variety of items. Corrugated boards are suitable for application in a variety of industries, such as food & beverages, consumer durables, electrical and electronics, paper, chemicals, personal care and home products, agriculture, forestry, fishing, and plastic and rubber products.

In 2020, Asia-Pacific held the largest share of the global corrugated boards market and is estimated to register the highest CAGR in the market during the forecast period. In Asia-Pacific, there has been an increase in the consumption of corrugated boards in various industries, such as food & beverages, electronics, and e-commerce. The rise in awareness regarding sustainable and cost-effective corrugated board packaging solutions, which are used in the transportation of products, and various initiatives by the government to ban plastic packaging in several Asian countries would boost the demand for corrugated boards in the region in the coming years. Also, an increase in awareness about the environment propels the demand for greener packaging solutions, which is driving the growth of corrugated boards market. In addition, the rise in the demand for electronic goods, automotive parts, home care, and beauty & personal care products from domestic and international markets is fueling the demand for corrugated boxes, thereby driving the corrugated board market growth. The e-commerce industry is growing at a rapid pace in the region. One of the main e-commerce retailers, Amazon is using corrugated board boxes for the principal packaging and rely on plastic packaging for individual items in Asia-Pacific. In Thailand, the increasing concerns related to packaging wastes are likely to compel government to make regulations that prompts the citizens to adopt environment-friendly options, such as folding cartons or corrugated boxes, as a viable choice for packaging, which would provide growth opportunities for the corrugated boards market in the region during the forecast period.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Corrugated Boards Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Corrugated Boards Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Corrugated Boards Market

Many sectors, such as the chemicals & materials industry, faced unprecedented challenges due to the COVID-19 pandemic. The implementation of COVID-19 safety protocols led to the shortage of raw material and labor, shutdown of factories, and other operational difficulties. Therefore, companies involved in the manufacturing of packaging products faced a contraction in sales during the initial months of the pandemic. The e-commerce sector witnessed a significant demand for various products, such as packaged food and beverages, groceries, daily essentials, consumer durable goods, owing to the shutdown of offline stores. With the rapidly growing e-commerce sector, even in the COVID-19 pandemic, there was a significant demand for corrugated boards from the e-commerce sector to package and transfer various goods. However, due to shortage of raw materials and shutdown of manufacturing units due to extended nationwide lockdowns, there was a huge demand and supply gap, which negatively impacted the corrugated boards market growth. Moreover, due to slowdown in logistics operations, the packaging industry faced a significant loss.

Businesses are gaining ground as the governments of various countries eased out the previously imposed restrictions. Moreover, the introduction of COVID-19 vaccine has eased out the situation, leading to a rise in business activities across the world. Moreover, logistics companies involved in the transportation of daily essential goods and food and beverage products propelled the demand for corrugated boards. Thus, the global corrugated boards market is expected to grow significantly in the coming years. The COVID-19 pandemic has spurred the development of the e-commerce industry. It has given customers access to a wide range of products, such as essential goods, convenience products, and safety goods. It has also allowed businesses to continue operating despite limitations and restrictions imposed on various industrial and transportation activities. The e-commerce industry has significantly contributed to the revival of logistics operations, which, in turn, is expected to bolster the growth of the corrugated boards market in the coming years.

Market Insights

Rapid Expansion of Online Retail

E-commerce platforms have gained a significant momentum across the world owing to the rising investments by businesses in the expansion of their geographic reach through diverse distribution channels, along with the growth of the industrial sector. As a result, direct-to-consumer deliveries have surged by 20-times or more than standard distribution. Moreover, online retailers have experienced a significant growth in the past several years owing to technological innovations, which has propelled the demand for corrugated packaging products. The COVID-19 pandemic has aggravated the growth of online retail due to social distancing being mandated at public places and restrictions enacted on conducting face-to-face commerce. As per an article published by The Rio Times in March 2021, revenues generated from e-commerce distribution channels rose by 41% in 2020, with more than 194 million orders placed by Brazilian consumers in the year. This is considered as the highest recorded percentage increase in Brazil since 2007. According to Eurostat, 70% of the European population were e-shoppers in 2020, which was 60% in 2016. Therefore, the growth of the e-commerce industry propels the demand for advanced packaging solutions, such as corrugated boards, across the world.

Application Insights

Based on application, the corrugated boards market is segmented into food and beverage, e-commerce, consumer durables, electrical and electronics, and others. The food and beverage segment accounted for the largest market share in 2020, whereas the e-commerce segment is expected to register the highest CAGR in the market during the forecast period. In the food & beverages industry, corrugated boards are frequently utilized in the packaging and transportation of various food products. They are used to manufacture cartons and boxes that offer a firm cushion while transporting and handling various items, such as fresh fruits and vegetables, meat products, eggs, and bakery products, and they are one of the safest and most hygienic packaging options available in the market. Corrugated boards are clean and hygienic since they are manufactured at high temperatures. The boards maintain optimum moisture levels and prevent bacteria from growing, making them ideal for shipping perishable foods. This factor is expected to fuel the demand for corrugated boards from the food & beverages packaging industry in the coming years.

A few players operating in the corrugated boards market are IRANI PAPEL E EMBALAGEM S.A.; Smurfit Kappa; Klabin S.A.; WestRock Company; International Paper; Arcor; Klingele Papierwerke GmbH & Co. KG; Papeles y Conversiones de México; Mondi; and NIPPON PAPER INDUSTRIES CO., LTD.

Corrugated Boards Market Regional Insights

The regional trends and factors influencing the Corrugated Boards Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Corrugated Boards Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Corrugated Boards Market

Corrugated Boards Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 127.14 Billion |

| Market Size by 2028 | US$ 192.15 Billion |

| Global CAGR (2021 - 2028) | 6.1% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Application

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Corrugated Boards Market Players Density: Understanding Its Impact on Business Dynamics

The Corrugated Boards Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Corrugated Boards Market are:

- IRANI PAPEL E EMBALAGEM S.A.

- Smurfit Kappa

- Klabin S.A.

- WestRock Company

- International Paper

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Corrugated Boards Market top key players overview

Report Spotlights

- Progressive industry trends in the corrugated boards market to help players develop effective long-term strategies

- Business growth strategies adopted by developed and developing markets

- Quantitative analysis of the corrugated boards market from 2019 to 2028

- Estimation of global demand for corrugated boards

- Porter’s five forces analysis to illustrate the efficacy of buyers and suppliers operating in the industry

- Recent developments to understand the competitive market scenario

- Market trends and outlook as well as factors driving and restraining the growth of the corrugated boards market

- Assistance in decision-making process by highlighting market strategies that underpin commercial interest, leading to the market growth

- The size of the corrugated boards market size at various nodes

- Detailed overview and segmentation of the market, as well as the corrugated boards industry dynamics

- Size of the corrugated boards market in various regions with promising growth opportunities

Corrugated Boards Market – by Application

- Food and Beverage

- E-commerce

- Consumer Durables

- Electrical and Electronics

- Others

Company Profiles

- IRANI PAPEL E EMBALAGEM S.A.

- Smurfit Kappa

- Klabin S.A.

- WestRock Company

- International Paper

- Arcor

- Klingele Papierwerke GmbH & Co. KG

- Papeles y Conversiones de México

- Mondi

- NIPPON PAPER INDUSTRIES CO., LTD.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, Chile, China, Colombia, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Asia-Pacific is estimated to register the fastest CAGR in the market over the forecast period. In Asia Pacific, there has been an increase in the consumption of corrugated board in various industries such as food and beverage, electronics and e-commerce. The rise in awareness regarding sustainable and cost-effective corrugated board packaging solutions, which can be used in transportation of products will boost the demand for corrugated board in the region. Along with this, an increase in awareness about the environment is expected to result in increased demand for greener packaging solutions driving the market growth. Various initiatives taken by the government to ban plastic packaging in several Asian countries are also expected to accelerate product consumption. In accordance with this, the rise in the demand for electronic goods, automotive parts, home care, and beauty & personal care products, from domestic and international markets, is leading to an increase in demand for corrugated boxes, thereby driving the corrugated board market growth.

Based on application, the consumer durables segment held the second-most leading share in the global corrugated boards market in 2020. Consumer durables are a type of consumer goods that do not wear out quickly; as a result, they do not require frequent replacements. This category includes products such as furniture, sports equipment, and jewelry, among others. The packaging of such goods becomes particularly vital as they must arrive in pristine condition to the consumer. These items are frequently heavy and subject to mishandling during transportation. Moreover, these goods are susceptible to damages such as dents and scratches, affecting their appearance. As a result, the packaging is relatively difficult. The use of corrugated boards in the packaging of consumer durables protects them against damage and ensures safe transportation. Corrugated cartons and boards provide adequate protection from shock and vibration to the consumer durable goods in transit and warehousing. Manufacturers use thick-walled corrugated boards laminated with a plastic film to prevent the goods from moisture, scratches, and other damages. The increasing population and rising disposable income are driving the sales of consumer durables which is eventually driving the demand for corrugated boards from the consumer durables application segment.

On the basis of application, the food and beverage segment is leading the corrugated boards market in 2020. In the food and beverage industry, corrugated boards are frequently utilized in the packaging and transportation of various food products. They are used to manufacture cartons and boxes that offer a firm cushion while transporting and handling fresh fruits and vegetables, meat products, eggs, and bakery products, among other items, and they are one of the safest and most hygienic packaging options available in the market. Corrugated boards are clean and hygienic since they are manufactured at high temperatures. They maintain optimum moisture levels and prevent bacteria from growing, making them ideal for shipping perishable foods. This factor is expected to leverage the demand for corrugated boards from the food and beverage packaging industry in the forthcoming years.

Based on application, the e-commerce segment is expected to grow at the fastest CAGR from 2021 to 2028. E-commerce businesses primarily rely on logistics operations since delivering products to end customers is one of the primary components of their operations. Faster and shorter demand cycles necessitate increased flexibility and agility in e-commerce logistics. Corrugated boxes have been the backbone of e-commerce, enabling safe, flexible, and convenient transportation of various products worldwide. Moreover, as corrugated boards are inexpensive, they lower the packaging and transportation costs of logistics companies, thereby reducing the expenses of e-commerce retailers. Corrugated boxes can resist the rigors of transportation while protecting products in transit from damage. They have been widely used in the transportation of an array of products, from groceries to electronics. Thus, the rapidly growing e-commerce industry and growing utilization of corrugated boxes in e-commerce operations are the factors bolstering the demand for corrugated boards.

The major players operating in the corrugated boards market are IRANI PAPEL E EMBALAGEM S.A., Smurfit Kappa, Klabin S.A., WestRock Company, International Paper, Arcor, Klingele Papierwerke GmbH & Co. KG, Papeles y Conversiones de México, Mondi, and NIPPON PAPER INDUSTRIES CO., LTD.

In 2020, Asia Pacific held the largest revenue share of the global corrugated boards market and is also expected to register the highest CAGR during the forecast period. Rising urbanization, rapidly emerging e-commerce sector, changing retail landscape, and increasing requirement for flexible packaging solutions from the food and beverage industry across the region are some of the crucial factors driving the growth of corrugated boards market. Moreover, growing prevalence of food delivery services owing to changing lifestyles of consumers in Asia-Pacific is also projected to further propel the market growth over the forecast period. Various initiatives taken by the government to ban plastic packaging in several Asian countries are also expected to accelerate product consumption. In accordance with this, the rise in the demand for electronic goods, automotive parts, home care, and beauty & personal care products, from domestic and international markets, is leading to an increase in demand for corrugated boxes, thereby driving the corrugated board market growth. The e-commerce industry is growing at a rapid pace in the recent years. One of the main e-commerce retailers, Amazon is using corrugated board boxes for the principal packaging and rely on plastic packaging for individual items in the Asia Pacific region. This factor is potentially propelling the growth of corrugated boards market across Asia-Pacific.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Corrugated Board Market

- IRANI PAPEL E EMBALAGEM S.A.

- Smurfit Kappa

- Klabin S.A.

- WestRock Company

- International Paper

- Arcor

- Klingele Papierwerke GmbH & Co. KG

- Papeles y Conversiones de México

- Mondi

- NIPPON PAPER INDUSTRIES CO., LTD

Get Free Sample For

Get Free Sample For