Carbon Fiber Market Growth, Trends, and Forecast by 2031

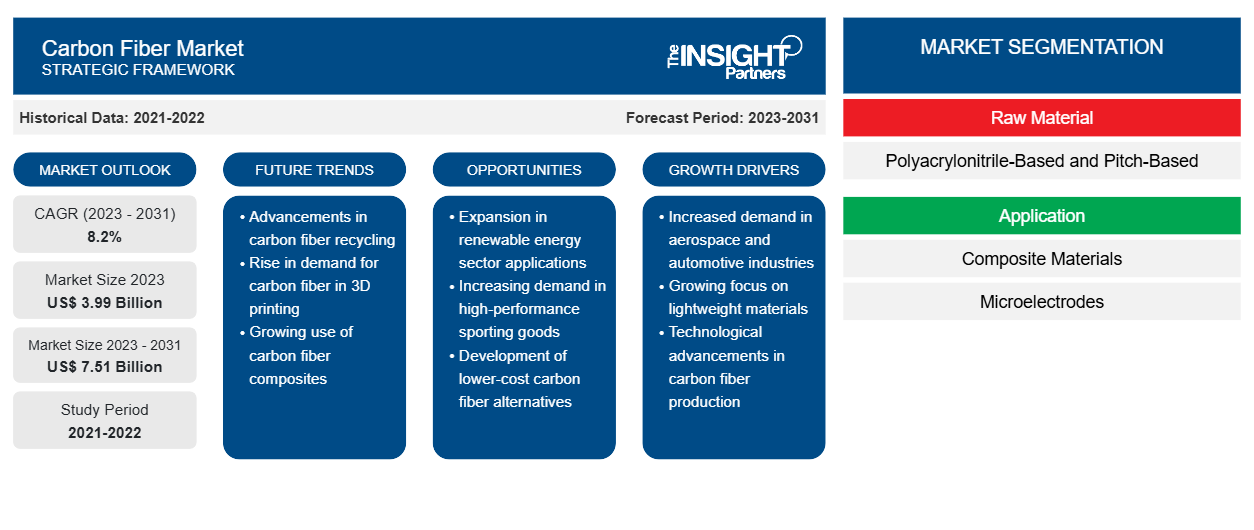

Carbon Fiber Market Size and Forecast (2021–2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Raw Material (Polyacrylonitrile-Based and Pitch-Based), Application (Composite Materials, Microelectrodes, and Others), End-Use Industry (Automotive, Aerospace & Defense, Building & Construction, Sporting Goods, Wind Energy, Textiles, Marine, and Others), and Geography

Historic Data: 2021-2022 | Base Year: 2023 | Forecast Period: 2024-2031- Report Date : Apr 2026

- Report Code : TIPRE00002830

- Category : Chemicals and Materials

- Status : Data Released

- Available Report Formats :

- No. of Pages : 150

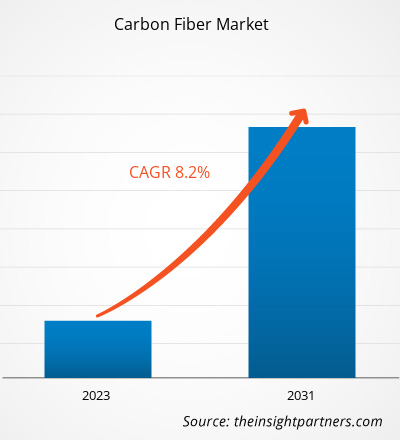

The carbon fiber market is expected to reach US$ 7.46 billion by 2031 from US$ 4.21 billion in 2023; it is anticipated to register a CAGR of 8.5% during the forecast period. The rising demand from aerospace, automotive, sports equipment, and industrial sectors is likely to bring new carbon fiber market trends in the future.

Carbon Fiber Market Analysis

Carbon fiber possesses remarkable mechanical strength, stiffness, and heat and chemical resistance. They are significantly lighter than steel or aluminum but exhibit relative or superior strength. This makes carbon fiber sought-after material in applications where weight reduction is crucial such as aerospace, automotive, sports equipment, and industrial sectors. The carbon fiber market is expected to continue to grow as industries across various sectors increasingly adopt carbon fiber composites to meet their need for lightweight, durable, and energy-efficient materials. Technological advancements in carbon fiber manufacturing processes and the development of cost-effective production techniques are also likely to contribute to the market expansion in the coming years.

Carbon Fiber Market Overview

Automotive manufacturers seek innovative and high-quality materials for the production of lightweight automotive components that have high mechanical and tensile strength. Carbon fiber is considered as one of the most suitable materials for lightweight automobile part production. Moreover, the carbon-fiber-reinforced composites are used as the essential material to substitute steel and aluminum parts that are heavier in weight and result in reduced fuel efficiency. The use of carbon fiber in the automobile industry has improved fuel efficiency, leading to energy conservation and minimizing carbon dioxide emissions. Leading automotive manufacturers are using carbon fiber for manufacturing components. For instance, a Airbus A350 unit consists of 52% carbon fiber-reinforced polymer (CFRP), whereas a BMW i3 unit has mostly CFRP chassis.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONCarbon Fiber Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Carbon Fiber Market Drivers and Opportunities

Adoption of Lightweight Turbine Blades in Wind Energy Industry Bolsters Carbon Fiber Market Growth

There has been a notable surge in the installation of wind farms with the growing preference to utilize renewable resources. Large tracts of land and coastal areas in different countries are allocated for wind turbine operations. Carbon fibers play an important role in the wind energy industry. Wind turbine manufacturers, nowadays, produce more efficient longer and lightweight blades using advanced composite materials such as carbon fibers. Extending the length of turbine blades enables greater energy generation. Large blades are typically designed with a key focus on stiffness and tip deflection. Nonetheless, the high stiffness of carbon fiber contributes to lower blade deflection. Thus, large turbine blades made from composite carbon fibers allow a larger tower diameter for a given blade-to-tower clearance. Carbon fiber is also used in the spar cap, which is the backbone of the blade.

Carbon fibers are proven to be an effective alternative to glass fibers in wind turbine designs due to their higher stiffness and lower density compared to glass fibers, thus, allowing the thinner, stiffer and lighter blades. However, blades made of carbon fiber exhibit relatively low damage tolerance, compressive strength, and ultimate strain. Therefore, carbon fibers are most commonly used in the fabrication of wind turbine blades. Companies such as Vestas Wind Systems A/S and Gamesa Technology Corp use carbon fiber in selective structural parts of blades and take the advantage of the lighter weight blades throughout the turbine system. Light blades require less robust turbine and tower components, eventually resulting in the reduction of overall costs. Thus, an upsurge in the use of lightweight turbine blades in the wind energy industry bolsters the demand for carbon fiber, thereby bolstering the market growth.

Rising Demand for Carbon Fiber in 3D Printing to Generate Growth Opportunities

In the recent years, 3D printers have gathered attention as a multi-product small-volume production technology. 3D printing carbon fiber is the most popular additive manufacturing technology. Carbon fiber-reinforced plastics are added to the 3D printing filaments to improve the elasticity and strength of the printed parts. These composite materials have much higher strength than metals, irrespective of their lower weight than metals. Additionally, carbon fibers can be mixed with plastic resins to fortify the mechanical properties of 3D printed parts. 3D printing using carbon fiber-reinforced composites is among the most sought-after additive manufacturing technologies. Additive manufacturing technology is gaining immense traction due to its advantages such as potential cost reductions, higher part complexity, functional integration. Carbon fibers are used to develop 3D printing materials for racing cars, construction materials, sports equipment, drones, daily-use products, etc. Some major businesses are focused on launching carbon fiber-based 3D-printed composites.

Carbon Fiber Market Report Segmentation Analysis

Key segments considered to present the carbon fiber market analysis are product and end use.

- Based on raw material, the carbon fiber market is segmented into polyacrylonitrile-based and pitch-based. The polyacrylonitrile-based segment held a larger market share in 2023.

- By application, the carbon fiber market is segmented into composite materials, microelectrodes, and others. The composite materials segment held the largest market share in 2023.

- By end-use industry, the carbon fiber market is categorized into automotive, aerospace & defense, building and construction, sporting goods, wind energy, textiles, marine, and others. The automotive segment held the largest share of the market in 2023.

Carbon Fiber Market Share Analysis, by Geography

The geographic scope of the carbon fiber market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

Asia Pacific has dominated the carbon fiber market. The high disposable income of people in Asia Pacific is surging the sales for commercial and passenger vehicles, bolstering the need for vehicles. Additionally, increasing investments by leading automotive OEMs and rising EV manufacturing capabilities in Asia Pacific are propelling the demand for conventional and electric vehicles in the region. The growth of the vehicle components manufacturing industry in Asia Pacific is attributed to the growing automotive industry in the region. Carbon fiber is widely used in manufacturing of composites for vehicle. Thus, with the growing automotive industry, the demand for carbon fiber is also increasing across the region.

Carbon Fiber

Carbon Fiber Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 4.21 Billion |

| Market Size by 2031 | US$ 7.46 Billion |

| Global CAGR (2024 - 2031) | 8.5% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Raw Material

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Carbon Fiber Market Players Density: Understanding Its Impact on Business Dynamics

The Carbon Fiber Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Carbon Fiber Market News and Recent Developments

The carbon fiber market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for carbon fiber:

- Toray Industries, Inc. announced today that it has developed TORAYCA T1200 carbon fiber, the world’s highest strength at 1,160 kilopound per square inch (Ksi). This new offering will move us forward to reducing environmental footprints by lightening carbon-fiber-reinforced plastic materials. This fiber also opens a new performance frontier for strength-driven applications. Its potential applications range from aerostructures and defense to alternative energy and consumer products. (Source: Toray Advanced Composites, Press Release, 2023)

- SGL Carbon will present a new 50k carbon fiber at JEC World 2023. The new SIGRAFIL C T50-4.9/235 carbon fiber will match the high strength requirements for common pressure vessel designs and exhibits a high elongation capacity. It also enables further applications in market segments that require high strength and elongation. (Source: SGL Carbon, Press Release, 2023)

Carbon Fiber Market Report Coverage and Deliverables

The "Carbon Fiber Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed Porter's Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For