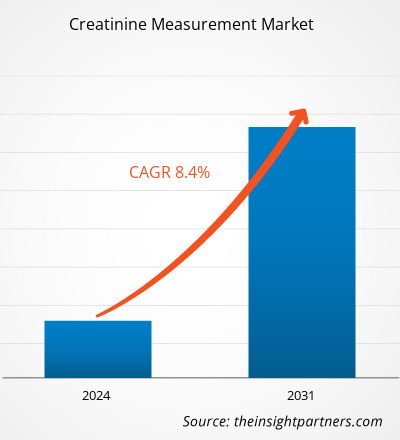

The Creatinine Measurement Market size is projected to reach US$ 982.51 million by 2031 from US$ 514.49 million in 2023. The market is expected to register a CAGR of 8.4% in 2023–2031. Point-of-care renal functioning testing will likely remain a key creatinine measurement market trend.

Creatinine Measurement Market Analysis

The aging population is vastly vulnerable to chronic kidney conditions. For instance, according to the research conducted by the American Diabetes Association in 2021, an estimated 38.4 million Americans, or 11.6% of the population, are suffering from diabetes. The percentage of Americans aged 65 and older remains high at approximately 30%. Diabetes in adults generates a higher risk of kidney failure. For instance, according to a study published by the National Kidney Foundation, an estimated 30.0% of diabetic patients suffer from kidney disease each year globally. Thus, the increasing geriatric population is expected to boost the creatinine measurement market growth over the forecast period.

Creatinine Measurement Market Overview

Creatinine measurement is an analysis method used to assess kidney function and diagnose kidney diseases. An elevated creatinine level in urine indicates kidney damage or diseases such as chronic kidney diseases or acute kidney injury. The market's growth is accredited to key driving factors such as the increasing incidence of chronic kidney diseases and the increasing geriatric population. However, the shift towards adopting new biomarkers is supposed to restrain the market's growth during the forecast years.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Creatinine Measurement Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Creatinine Measurement Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Creatinine Measurement Market Drivers and Opportunities

Increasing Prevalence of Chronic Kidney Diseases to Favor Market

As per the National Kidney Foundation, the worldwide occurrence of chronic kidney disease (CKD) is increasing. About 10% of the global population is adopted by CKD, and millions die each year because they do not have an approach to reasonable treatment. Over 2 million affected individuals receive treatment through dialysis or a kidney transplant. The majority are treated in only five developed countries—the US, Japan, Germany, Brazil, and Italy. These five developed countries serve only 12% of the world's population. According to the 2019 Global Burden of Disease study, chronic kidney diseases account for 15% of worldwide mortality.

Due to the growing dominance of chronic kidney diseases among the masses, it is widely recognized as a global health issue. According to the American Society of Nephrology (ASN), there are ongoing recent advances in molecular diagnostics that are making ways to manage patients who are suffering from kidney-related disorders. Therefore, increasing chronic kidney disorders coupled with the benefits of creatinine measurement to recognize the condition of kidneys will likely boost the demand for creatinine measurement devices during the forecast period..

Emerging Market in Developing Countries

The growing healthcare industry in developing economies of Asia Pacific builds better prospects for market players to expand their business. The huge patient base in these countries is generating demand for advanced diagnostic systems. For instance, according to the global burden of disease data, India has 18% of the world’s population; however, the country holds about 17% of the global burden of kidney diseases. Additionally, an increasing number of dialysis procedures represent the massive growth in the prevalence of renal diseases. Furthermore, according to estimates published by the Global Burden of Disease, China alone has 119.5 million renal disease patients. Thus, the rapidly growing incidence of kidney diseases coupled with the demand-supply gap in diagnostic tests is predicted to offer lucrative opportunities for growth of the market by 2031.

Creatinine Measurement Market Report Segmentation Analysis

Key segments that contributed to the derivation of the creatinine measurement market analysis are contaminants, technology, and food type.

- Based on products, the creatinine measurement market is divided into Kits and Reagents. The Kits segment held a larger market share in 2023.

- Based on type, the market is bifurcated Enzymatic Method and Jaffe's Kinetic Method. The enzymatic method segment held a larger market share in 2023.

- In terms of sample type, the market is segmented into Blood or Serum, and Urine. The blood or serum products segment dominated the market in 2023.

- By end users segment, the market is classified into hospitals, diagnostic laboratories, and other entities. The hospital segment dominated the market in 2023.

Creatinine Measurement Market Share Analysis by Geography

The geographic scope of the creatinine measurement market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

The creatinine measurement market in North America is significantly In North America, the creatinine measurement market is currently in the growth phase and experiencing exponential growth. Increasing geriatric population associated with the various kidney diseases, favorable reimbursement policies for dialysis, increasing healthcare expenditure, increasing growing number of hospitals and clinics offering creatinine measurement services, advancements in the technological developments, and the major presence of the key players in this market are among the factors is going to propelling the market growth.

In addition, favorable reimbursement scenario in the US is also driving the growth of the market by increasing the adoption of the urinary catheters during various surgical procedures. Several insurance companies provide reimbursement for laboratory services. Medicare provides reimbursements using either the Physician Fee Schedule (PFS) or the Clinical Laboratory Fee Schedule (CLFS), depending on the service. In addition, laboratories also provide services to beneficiaries of other government programs such as Medicaid, TRICARE and the Federal Employee Health Benefit Plan (FEHBP), as well as commercial plans.

Creatinine Measurement Market Regional Insights

The regional trends and factors influencing the Creatinine Measurement Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Creatinine Measurement Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Creatinine Measurement Market

Creatinine Measurement Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 514.49 Million |

| Market Size by 2031 | US$ 982.51 Million |

| Global CAGR (2023 - 2031) | 8.4% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Creatinine Measurement Market Players Density: Understanding Its Impact on Business Dynamics

The Creatinine Measurement Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Creatinine Measurement Market are:

- Siemens Healthcare Gmbh

- Abbott

- Thermo Fisher Scientific Inc.

- F. Hoffmann-La Roche Ltd

- Danaher (Beckman Coulter)

- Cayman Chemical

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Creatinine Measurement Market top key players overview

Creatinine Measurement Market News and Recent Developments

The creatinine measurement market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for innovations, business expansion, and strategies:

- In November 1, 2022, Creative Enzymes Launches Raw Materials for Manufacturing Diagnostic Kits. The raw materials provided by Creative Enzymes include enzymes for cholesterol reagent kit, creatine kinase assay kit, creatinine assay kit, free fatty acid assay kit, homocysteine assay kit, sialic acid kit, and triglyceride kit. The high-quality products always ensure rapid, reliable, and reproducible experiments. (Source: Creative Enzymes, Press Release)

- In March 2022, Nova Biomedical announces the launch of the Nova Max Pro Creatinine/eGFR Meter System in all CE countries. Nova Max Pro is an important new tool to improve kidney care through kidney function screening and early detection of kidney disease in point-of-care settings outside the hospital. (Source: Nova Biomedical, Press Release)

Creatinine Measurement Market Report Coverage and Deliverables

The “Creatinine Measurement Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering the following areas:

- Creatinine Measurement Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Creatinine Measurement Market trends

- Detailed PEST and SWOT analysis

- Creatinine Measurement market analysis covering key market trends, Global and regional framework, major players, regulations, and recent market developments.

- Creatinine MeasurementIndustry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments.

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

Get Free Sample For

Get Free Sample For