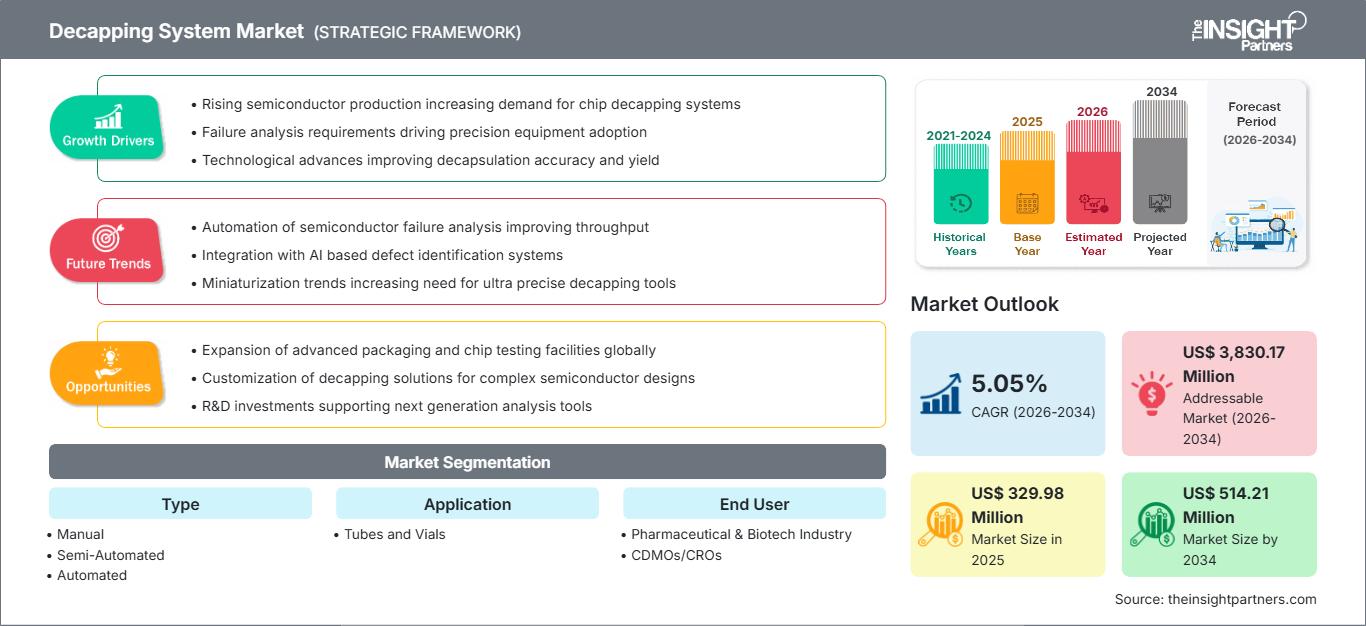

Decapping System Market Size, Growth & Future Trends by 2034

Decapping System Market Size and Forecast (2021 - 2034), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Manual, Semi-Automated, and Automated), Application (Tubes and Vials), and End User (Pharmaceutical & Biotech Industry, CDMOs/CROs, and Others)

Historic Data: 2021-2024 | Base Year: 2025 | Forecast Period: 2026-2034- Report Date : Mar 2026

- Report Code : TIPRE00018619

- Category : Life Sciences

- Status : Upcoming

- Available Report Formats :

- No. of Pages : 150

The decapping system market size is expected to go from US$ 329.98 Mn in 2025 to US$ 514.21 Mn in 2034. Further, leading the CAGR to be around 5.05% between 2026-2034

Decapping System Market Analysis

The decapping system market forecast indicates growth, owing to increased demand from the pharmaceutical and biotech industries for efficient sample preparation, as well as accelerated demand for vaccine‑egg decappers in the process industry.

Adoption of advanced decapping technology, both automated and semi‑automated, helps streamline the removal of protective caps or lids from specimen collection tubes and vials, reducing manual effort, improving throughput, and minimizing contamination risk. Further, rising R&D activities in biopharmaceuticals and the growing need for fluid handling systems contribute to market growth, as decapping systems are critical components in these workflows.

Decapping System Market Overview

A decapping system is a device used to remove protective caps or lids from containers such as tubes or vials. These systems are widely used in laboratories, pharmaceutical manufacturing, biotech workflows, and for vaccine‑egg decapping operations.

By automating decapping, which otherwise might be manual, repetitive, and time-consuming, decapping systems enhance operational efficiency, throughput, and sample integrity, making them critical in high-volume labs and manufacturing settings.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONDecapping System Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Decapping System Market Drivers and Opportunities

Market Drivers:

- Accelerated demand for vaccine egg decappers in the process and pharmaceutical industries, especially for vaccine production, is boosting demand for specialized decapping systems.

- Growing need for efficient and high-throughput decapping in laboratories and biopharmaceutical R&D to handle large volumes of specimen collection tubes and vials.

- Increasing adoption of laboratory automation and fluid‑handling workflows in pharmaceutical, biotech, and diagnostic sectors, decapping systems play a key role in sample prep and processing.

Opportunities:

- Expansion in emerging markets (especially within the Asia Pacific), where growth in pharmaceutical manufacturing, biotech, and lab infrastructure may drive uptake of decapping systems. (Given the global report, geography coverage includes Asia-Pacific.)

- Demand for automated decapping solutions (as opposed to manual), automated systems offer time savings, higher throughput, and consistent performance.

- Potential demand increase due to rising requirements for sample traceability, safety, contamination prevention, and standardized lab workflows globally, which may push labs to upgrade from manual to semi‑ or fully automated decapping systems. (This aligns with broader market trends for lab automation.

Decapping System Market Report Segmentation Analysis

By Type:

- Manual

- Semi‑Automated

- Automated

By Application:

- Tubes

- Vials

By End‑Use Industry:

- Pharmaceutical & Biotech Industry

- CDMOs / CROs

By Geography:

- North America

- Europe

- Asia Pacific

- South & Central America

- Middle East & Africa

Decapping System Market Regional Insights

The regional trends and factors influencing the Decapping System Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Decapping System Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Decapping System Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2025 | US$ 329.98 Million |

| Market Size by 2034 | US$ 514.21 Million |

| Global CAGR (2026 - 2034) | 5.05% |

| Historical Data | 2021-2024 |

| Forecast period | 2026-2034 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Decapping System Market Players Density: Understanding Its Impact on Business Dynamics

The Decapping System Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Decapping System Market top key players overview

Decapping System Market Share Analysis by Geography

North America, the Largest market in 2022, was valued at US$137.19 million. Growth is driven by high demand for sampling facilities, biopharmaceutical tubing, and the adoption of automated decapping systems in labs and manufacturing.

Europe, growing steadily, demand supported by pharmaceutical and biotech industries, diagnostic labs, and increased acceptance of automated decapping solutions.

Asia Pacific, expected to grow at a favorable pace, fueled by rising pharmaceutical manufacturing, expansion of biotech and research labs, and increased investments in lab infrastructure across countries like India, China, Japan, etc.

South & Central America, an Emerging market with growth potential as labs and pharmaceutical manufacturing facilities adopt decapping technologies.

The Middle East & Africa represent additional prospective growth regions, though currently smaller share compared to North America, Europe, and the Asia Pacific.

Decapping System Market Players Density: Understanding Its Impact on Business Dynamics

This competitive environment pushes vendors to differentiate through:

- Automation: more automated decapping solutions that improve throughput and reduce manual labor.

- High‑throughput capabilities: essential for vaccine production, large-scale laboratories, and biopharma manufacturing.

- Reliability and sample integrity: vital for biotech, pharmaceutical, and diagnostic applications where contamination or sample error is unacceptable.

- Customization & flexibility: accommodating different container types (tubes, vials), cap types (screw, push), and high-volume processing.

Opportunities and strategic moves for players include:

- Partnering with biopharma manufacturers, contract research organizations (CROs), and diagnostic labs to provide end-to-end sample‑preparation automation solutions.

- Investing in R&D to introduce next‑gen decapping systems with higher throughput, automation, ergonomic design, and integration with broader lab automation/ workflow systems.

- Expanding presence in emerging markets (Asia Pacific, South America, MEA) where demand for lab infrastructure and pharmaceutical manufacturing is rising.

Major vendors identified in the market include:

- Hamilton Co

- LVL technologies GmbH & Co KG

- Micronic Holding BV

- Sarstedt AG and Co KG

- Thermo Fisher Scientific Inc

- Azenta Inc

- Dominique Dutscher SAS

- Cole‑Parmer Instrument Co LLC

- Agilent Technologies Inc

Other players analyzed during the course of research are:

- BioMicroLab

- Brooks Life Sciences

- ACG Worldwide

- IMA Group

- Marchesini Group

Decapping System Market: News and Recent Developments

- Growing demand for vaccine‑egg decappers in the process industry has been identified as a key driver, especially for vaccine production, an important application fueling market expansion.

- Continuous launches and innovations of decapping devices, from manual to semi‑automated to fully automated systems, are contributing to market dynamism and improved adoption in labs and biotech/pharma industries.

Decapping System Market Report Coverage and Deliverables

The “Decapping System Market Size and Forecast (2021–2034)” report provides a detailed analysis covering:

- Global, regional, and country-level market size and forecast for all key segments (by type, application, end user, geography)

- Market trends, market dynamics (drivers, opportunities, restraints), and recent developments in decapping technologies

- Industry landscape and competitive analysis: key market players, their positioning, and strategies

- Segmental breakdown and detailed segmentation analysis (type, application, end user, geography)

- Market size (value) and likely volume projections, with scope for customization per region or use-case (tubes, vials, pharmaceutical labs, CDMOs, etc.)

Frequently Asked Questions

2. Growing need for efficient, high-throughput decapping in labs and R&D, reducing manual tasks, and boosting sample processing efficiency.

3. Rising adoption of automation and fluid‑handling workflows in biotech, pharma, and diagnostic sectors.

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For