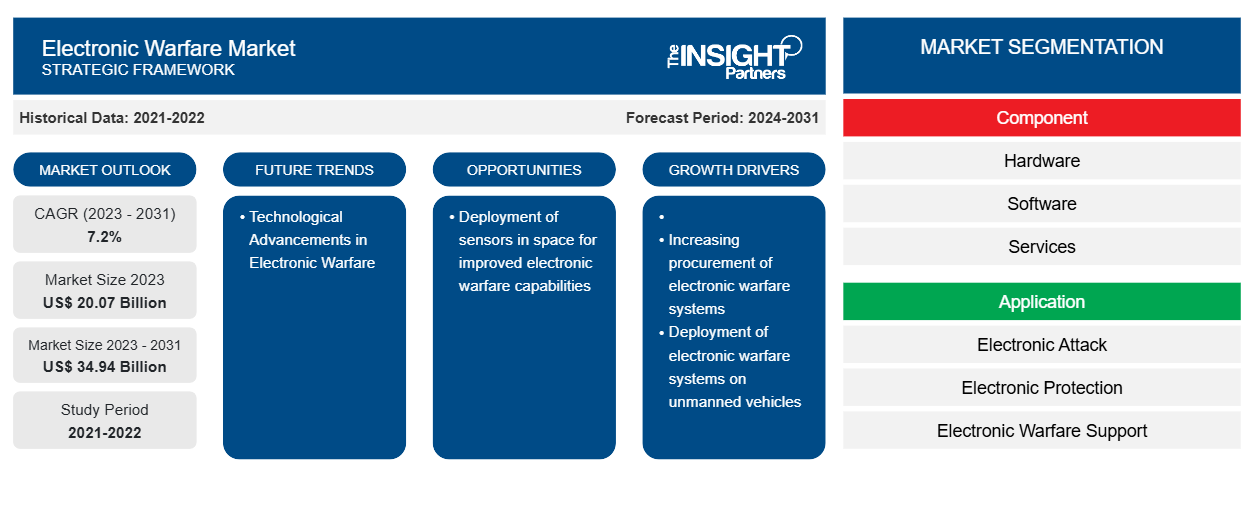

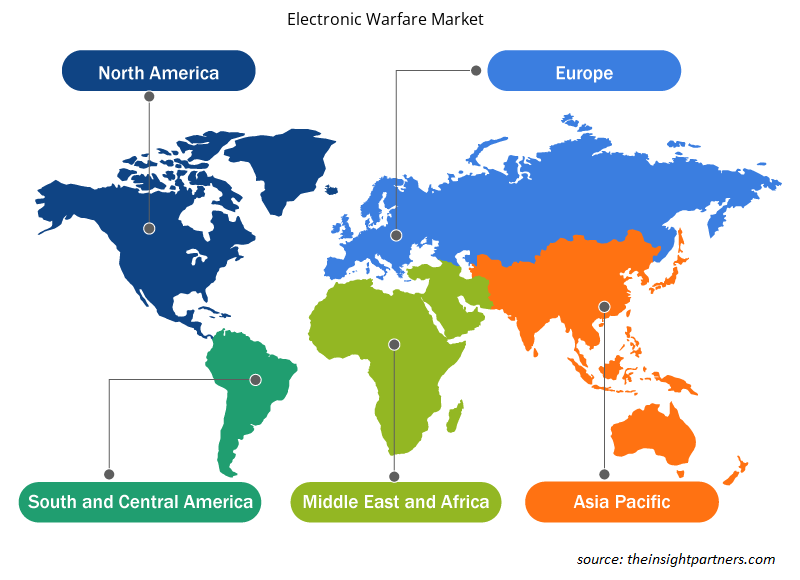

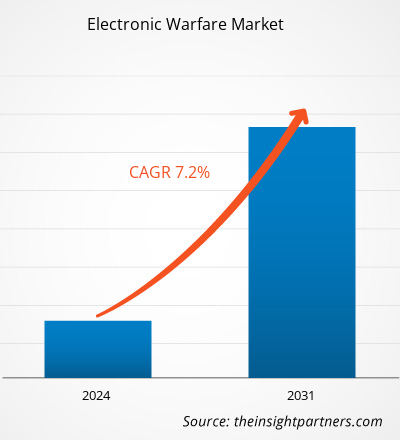

The electronic warfare market is expected to reach US$ 18.53 billion in 2024 and is expected to reach US$ 34.10 billion by 2031; it is estimated to record a CAGR of 9.4% from 2025 to 2031. Deployment of sensors in space for improved electronic warfare capabilities is likely to remain a key trend in the market.

Electronic Warfare Market Analysis

The major stakeholders in the global electronic warfare market ecosystem include raw material (hardware & component) providers, electronic warfare manufacturers, government organizations, regulatory bodies, and end customers. Component and hardware providers provide various components & parts to electronic warfare manufacturers. Some of the key electronic warfare manufacturers included in this report include L3Harris Technologies, Inc., Raytheon Technology Corporation, Lockheed Martin Corporation, Saab Ab, BAE Systems Plc, Thales Group, Northrop Grumman Corporation, Cobham Plc (Eaton), Leonardo Spa, And Textron. The key players operating in this market are constantly engaging in the development of electronic warfare systems.

Electronic Warfare Market Overview

System integrators play a vital role in installing the electronic warfare at the required locations. System integrators are tasked with integrating these electronic warfare systems into a networked capability and conducting field trials to demonstrate and test the integration and effects of EW systems. Some of these stakeholders include government organizations and regulatory bodies various countries Department of Defense (DOD) such as United States Department of Defense (DoD, USDOD or DOD), Ministry of Defense of the Russian Federation, Ministry of National Defense People's Republic of China, Israel's Ministry of Defense, India Ministry of Defense, German Federal Ministry of Defense (BMVG), UK Ministry of Defense (MOD or MoD) among others.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Electronic Warfare Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Electronic Warfare Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Electronic Warfare Market Drivers and Opportunities

Deployment of Electronic Warfare Systems on Unmanned Vehicles

Armed forces and non-state groups employ unmanned aerial systems. The tiniest commercial drones can be weaponized and used to cause catastrophic damage. Finding strategies to defeat the weaponized drones as their use spreads across the battlefield is a top issue. Electronic communications and technologies are critical for autonomous and remotely driven vehicles. As the number of duties delegated to unmanned systems grows, the demand for counter-unmanned aerial systems (UAS) and electronic warfare (EW) technologies to counter them also grows. Unmanned aerial vehicles have become an important feature of armed forces worldwide. Transforming surveillance and imagery data has become easier by deploying electronic warfare devices on unmanned platforms. Various unmanned EW missions benefit from integrating unmanned systems with communication jammers or electronic surveillance equipment. Furthermore, unmanned EW planes do not require people, lowering the chance of human casualties. As a result of these advantages, countries including the US, India, and China plan to purchase and deploy additional UAVs in their military forces.

Technological Advancements in Electronic Warfare

In the information age battlespace, next-generation fighters will encounter a drastically new electronic warfare and electronic intelligence environment. Rapid technological advancements will significantly impact 21st-century conflicts because advanced systems will provide increased situational awareness; better threat assessment; and more accurate, timely, automated matching of active signals with the resources of widely distributed libraries. Within a dispersed virtual environment, operators and analysts will be able to collaborate in real-time. They will configure, launch, and control highly efficient software agents to efficiently and swiftly complete geographically distributed activities and complicated analyses within a dynamic operational context.

Exciting new possibilities are developing due to developments in information technology, piquing the interest of military officials and leading to requirements that take advantage of the latest technologies while driving even more technological advancements. The electronic warfare tools are fast developing and the Pentagon, which is the headquarter for United States defense is also preparing ahead for the country’s future military usage from the standpoint of operational war fighting.

Electronic Warfare Market Report Segmentation Analysis

Key segments that contributed to the derivation of the electronic warfare market analysis are component, application, and product type.

- Based on component, the electronic warfare market is divided into hardware, software, and services. The hardware segment held a larger market share in 2023.

- Based on application, the electronic warfare market is segmented into electronic attack, electronic protection, and electronic warfare support. The electronic warfare support segment held a larger market share in 2023.

- By product type, the market is segmented into countermeasure systems, jammers, sensor systems, weapons systems, and others. The sensor systems segment held the largest share of the market in 2023.

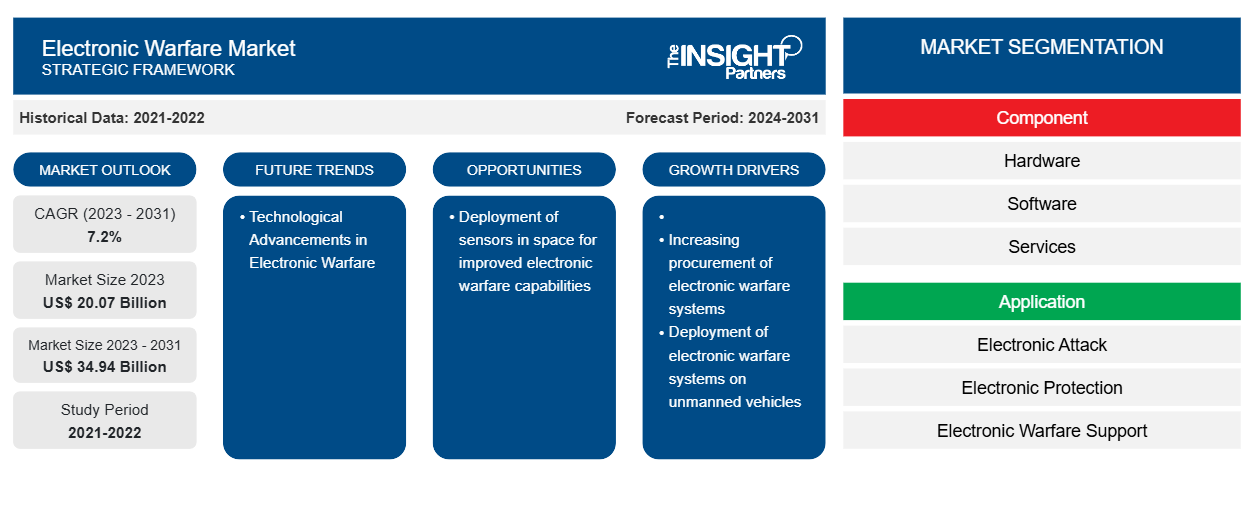

Electronic Warfare Market Share Analysis by Geography

The geographic scope of the electronic warfare market report is mainly divided into five regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America has dominated the market in 2023 followed by Europe and Asia Pacific. Further, Asia Pacific is likely to witness highest CAGR in the coming years. Global military forces no longer have the authority to restrict or refuse freedom of access to activities in space. On the international market, knowledge of space systems and the methods to defeat them is becoming increasingly available. Nations can possess or acquire the capability to disrupt or destroy an adversary's space systems by targeting their satellites in orbit, their ground and space communication nodes, or ground nodes that command the satellites if they so desire. Anti-satellite weapons, denial and deception tactics, jamming, usage of tiny satellites, hacking, and nuclear detonation are just a few examples of existing capabilities that can deny, disrupt, or physically destroy space systems and the terrestrial facilities that use and operate them.

Electronic Warfare Market Regional Insights

The regional trends and factors influencing the Electronic Warfare Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Electronic Warfare Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Electronic Warfare Market

Electronic Warfare Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 18.53 Billion |

| Market Size by 2031 | US$ 34.10 Billion |

| Global CAGR (2025 - 2031) | 9.4% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Electronic Warfare Market Players Density: Understanding Its Impact on Business Dynamics

The Electronic Warfare Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Electronic Warfare Market are:

- L3Harris Technologies, Inc.

- Raytheon Technologies Corporation

- Lockheed Martin Corporation

- Saab AB

- BAE Systems

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Electronic Warfare Market top key players overview

Electronic Warfare Market News and Recent Developments

The electronic warfare market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the electronic warfare market are listed below:

The United States Navy awarded Raytheon, an RTX (NYSE: RTX) Business, an $80 million contract in a down select to prototype Advanced Electronic Warfare, or ADVEW, for the F/A-18 E/F Super Hornet. This prototype will be considered as a replacement for the existing AN/ALQ-214 integrated defensive electronic countermeasure and AN/ALR-67(V)3 radar warning receiver with a consolidated solution that will deliver superior electronic warfare capabilities to the backbone of the Navy's carrier air wing. (Source: Raytheon Technologies Corp, Press Release, Dec 2023)

- L3Harris Technologies submitted a proposal this month for the U.S. Navy’s Next Generation Jammer – Low Band (NGJ-LB) competition. L3Harris won the original contract in December 2020 with an “Outstanding” technically evaluated solution that led to a protest by a competitor. The program includes prototype development and deliveries of tactical jamming pods designed to modernize the EA-18G Growler’s Electronic Warfare (EW) capability. (Source: L3Harris Technologies, Press Release, Aug 2023)

Electronic Warfare Market Report Coverage and Deliverables

The “Electronic Warfare Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Electronic warfare market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Electronic warfare market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed porter’s five forces analysis

- Electronic warfare market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the electronic warfare market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Component, Application, and Product Type

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

What is the expected CAGR of the electronic warfare market?

The electronic warfare market is likely to register of 9.4% during 2023-2031.

What would be the estimated value of the electronic warfare market by 2031?

The estimated value of the electronic warfare market by 2031 would be around US$ 34.10 billion.

What are the future trends of the electronic warfare market?

Deployment of sensors in space for improved electronic warfare capabilities is one of the major trends of the market.

Which are the leading players operating in the electronic warfare market?

L3Harris Technologies, Inc., Raytheon Technologies Corporation, Lockheed Martin Corporation, Saab AB, BAE Systems, Thales Group, Northrop Grumman Corporation, Cobham Limited, Leonardo SpA, and General Dynamics are some of the key players profiled under the report.

What are the driving factors impacting the electronic warfare market?

Increasing procurement of electronic warfare systems and deployment of electronic warfare systems on unmanned vehicles are some of the factors driving the growth for electronic warfare market.

Which region dominated the electronic warfare market in 2023?

North America region dominated the electronic warfare market in 2023.

Get Free Sample For

Get Free Sample For