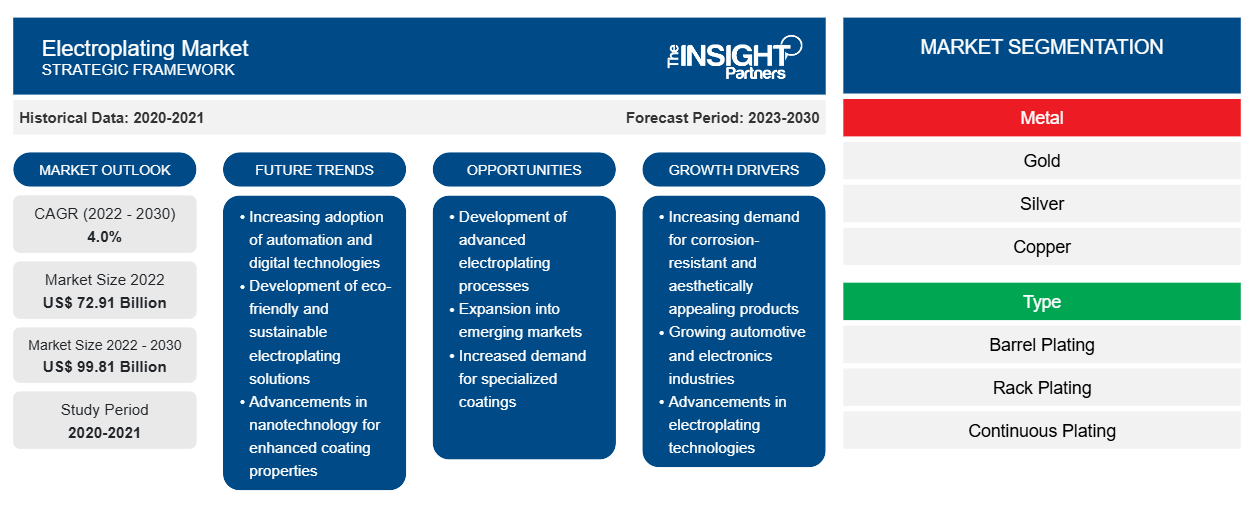

Electroplating Market Segments and Growth by 2030

Electroplating Market Size and Forecast (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Metal (Gold, Silver, Copper, Nickel, and Others); Type (Barrel Plating, Rack Plating, Continuous Plating, and Line Plating); End-Use Industry (Automotive, Electrical & Electronics, Aerospace & Defense, Medical, and Others)

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030- Report Date : Jan 2024

- Report Code : TIPRE00013635

- Category : Chemicals and Materials

- Status : Published

- Available Report Formats :

- No. of Pages : 173

[Research Report]

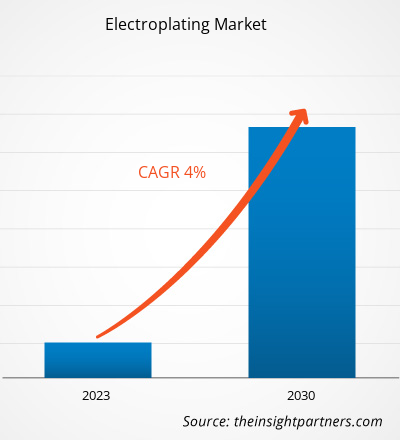

The electroplating market size is expected to grow from US$ 72,910.22 million in 2022 to US$ 99,807.73 million by 2030; it is estimated to register a CAGR of 4.0% from 2022 to 2030.MARKET ANALYSIS

Electroplating, or galvanic electrodeposition, is an electrochemical metal finishing process. In this process, metal ions dissolved in the solution are deposited on a substrate with the help of electricity. The process helps create a protective coating over the substrate, which offers resistance to corrosion and enhances the overall appearance of the product. Under the mechanism, the electric current passes through a solution of the dissolved metal ions and the metal object to be plated. The process is used to plate or coat several ferrous and nonferrous metal objects and plastics by using metals such as copper, tin, zinc, gold, palladium, platinum, silver, chromium, and aluminum. The production of automotive and electronics components requires an electroplating technique, which is further driving the global electroplating market.

GROWTH DRIVERS AND CHALLENGES

Expansion of the electronics and automotive industries and high demand from various end users bolster the electroplating market growth. Electroplating has prevented manufacturers from spending high amounts on expensive metals to provide efficient and aesthetics-wise products. With the advent of electroplating, most of the manufacturers rely on comparatively lower cost metals and later perform electroplating on the product with other metals to give better protection from corrosion. Also, the advent of innovative electroplating technologies such as nanotechnology and dry plating methods has meant that the efforts of industry players to reduce their environmental footprint and improve waste management are being materialized. The major demand for electroplating is seen in the electrical and electronics industries. Rising demand for wires and semiconductors across the world due to the rise in adoption of IoT propels the global electroplating market growth. Increasing penetration of television, refrigerators, smartphones, washing machines, laptops, and other consumer electronics products favors the growth of the global electroplating market. Rising preference to lead a comfortable lifestyle and increasing disposable income boost the global automotive industry, which is directly helping the electroplating market to reach new heights. Furthermore, rising demand for electroplating from aerospace and defense applications for providing proper finishing to the machinery is anticipated to foster the market growth of electroplating. The finishing mainly involves the process of coating metal that sticks to the surface of the material and provides a protective bond. Moreover, the process provides corrosion resistance, electrical conductivity, heat resistance, and friction wear to the machinery in the defense industry. Therefore, rising demand for electroplating in the defense industry propels the market growth. However, several governments and authorities are imposing certain regulations on the electroplating industry to curb the emission of harmful chemicals along with gases that are released into the atmosphere throughout the electroplating process. This is likely to become a key restraint for the global electroplating market. With the advantages of various types of electroplating comes the adverse aftermath of high pollution caused by these processes. The electroplating industry is constantly engaging with hazardous materials, which are harmful to humans and the environment.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONElectroplating Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

REPORT SEGMENTATION AND SCOPE

The "Global Electroplating Market Forecast to 2030" is a specialized and in-depth study with a significant focus on market trends and opportunities. The report aims to provide an overview of the market with detailed market segmentation on the basis of metal, type, end use industry, and geography. The global electroplating market has witnessed significant growth over the past few years and is expected to continue this trend during the forecast period. The report provides key statistics on the use of electroplating worldwide, along with their demand in major regions and countries. It also provides a qualitative assessment of various factors affecting the market performance in major regions and countries. The report also includes a comprehensive analysis of the leading market players and their key strategic developments. Several analyses on the market dynamics are also included to help identify the key driving factors, market trends, and lucrative opportunities that would, in turn, aid in identifying the significant revenue pockets.

Further, ecosystem analysis and Porter’s five forces analysis provide a 360-degree view of the global electroplating market, which helps understand the entire supply chain and various factors affecting the market growth.

SEGMENTAL ANALYSIS

The global electroplating market analysis is segmented on the basis of metal, type, and end use industry. In terms of metal, the market is segmented into gold, silver, copper, nickel, and others. Based on type, the market is segregated into barrel plating, rack plating, continuous plating, and line plating. By end-use industry, the market is segmented into automotive, electrical & electronics, aerospace & defense, medical, and others.

Based on metal, the nickel segment held a significant global electroplating market share in 2022. Nickel plating is a hard-wearing, decorative finish that can be applied to various materials. It produces a brilliant, lustrous finish that ages over time to produce a slightly yellow color. By type, the barrel plating segment held the largest market share in 2022. Barrel plating is a method used to flatten large groups of small parts. In this process, the components are placed inside a barrel filled with an electrolyte solution. The electroplating process proceeds while the barrel is rotated, stirring the parts in such a way that they receive even finishes consistently. Based on end use industry, the electrical and electronics segment led the market with a significant market share in 2022. The electrical & electronics industry is considerably reliant on electroplating service providers as it helps increase product lifespan and makes it more resilient.

REGIONAL ANALYSIS

The global electroplating market report provides a detailed overview of the electroplating market size with respect to five major regions—North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South & Central America. APAC accounted for a significant global electroplating market share and was valued at ~US$ 44 billion in 2022. China is a major contributor to the market growth in this region. North America is also expected to witness notable growth, reaching ~US$ 13 billion by 2030. Furthermore, in Europe, there has been a widespread use of electroplating. The electroplating market forecast in Europe is expected to report a CAGR of ~4% from 2022 to 2030.

INDUSTRY DEVELOPMENTS AND FUTURE OPPORTUNITIES

Partnerships, acquisitions, and new product launches are a few prominent strategies adopted by the players operating in the global electroplating market.

In November 2023, Alleima AB, a global manufacturer of high-value-added products in advanced stainless steels and special alloys, announced its plans to expand its operations in Switzerland to meet the growing demand for plated components.

In 2020, Schlötter announced cooperation with Italtecno srl. to expand its portfolio of galvanic specialty chemicals and to offer sales and service for processes for aluminium surface treatment in the future.

Electroplating Market Regional InsightsThe regional trends and factors influencing the Electroplating Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Electroplating Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Electroplating Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 72.91 Billion |

| Market Size by 2030 | US$ 99.81 Billion |

| Global CAGR (2022 - 2030) | 4.0% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Metal

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Electroplating Market Players Density: Understanding Its Impact on Business Dynamics

The Electroplating Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Electroplating Market top key players overview

IMPACT OF COVID-19 PANDEMIC/IMPACT OF GEOPOLITICAL SCENARIO/IMPACT OF RECESSION

Lockdowns, travel restrictions, and business shutdowns due to the COVID-19 pandemic adversely affected economies and industries in various countries across the world. The crisis disturbed supply chains, manufacturing activities, delivery schedules, and essential and nonessential product sales. These disruptions restricted the availability of raw materials. It caused delays in production and increased costs, negatively impacting the electroplating market.

The global marketplace is recovering from the losses as governments of different countries have announced relaxation in the restrictions. Manufacturing activities are rebounding as countries gradually recover from the pandemic and vaccination efforts continue. Manufacturers are permitted to operate at full capacity to overcome the supply gap. Thus, the global electroplating market is anticipated to grow strongly during the forecast period.

COMPETITIVE LANDSCAPE AND KEY COMPANIES

Allenchrome Electroplating Ltd; Atotech; Dr.-Ing. Max Schlötter GmbH & Co. KG; Jing Mei Industrial Limited.; Klein Plating Works Inc; Precision Plating Company; Sharretts Plating Co., Inc.; Summit Corporation of America; Toho Zinc Co., Ltd; and Cherng Yi Hsing Plastic Plating Factory Co., Ltd are a few of the major players operating in the global electroplating market.

Frequently Asked Questions

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For