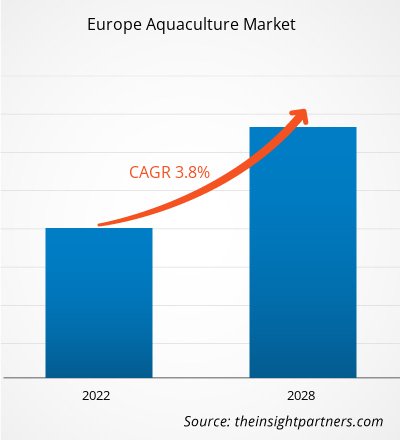

The aquaculture market in Europe is expected to grow from US$ 35,433.63 million in 2021 to US$ 45,918.99 million by 2028; it is estimated to grow at a CAGR of 3.8% from 2021 to 2028.

Aquaculture is significantly contributing to the production of fish and other aquatic animals and the adoption of aquaculture is growing at a steady rate. The increase in demand for fish for human consumption is majorly met by aquaculture, marine fisheries, and inland fisheries. However, an increase in fish production by inland and marine fisheries results in overfishing which negatively impacts the environment and marine ecosystem. Aquaculture owns huge potential for future expansion and it is a great source of fish production. Government initiatives and favorable policies play an important role in generating a suitable environment for entities involved in aquaculture. It includes research, legal framework, and infrastructure for aquaculture. Thus, aquaculture is considered a capable source to meet the increased demand for seafood. Also, there are few certifications and standards associated with the seafood production for the sustainable environment.

The World Wildlife Fund for Nature (WWF) and the Dutch Sustainable Trade Initiative (IDH) have come up with the Aquaculture Stewardship Council (ASC) which was initiated in the year 2010. The goal of this council is to transform the world’s seafood markets to promote social aquaculture performance.

In Europe, France, Russia, the UK, Italy, and Germany are among the worst-hit countries by the COVID-19 pandemic. These countries suffered from economic downfall due to restrictions on industrial activities because of lockdowns and border restrictions. The demand for seafood products declined significantly due to various restrictions imposed by the governments. Moreover, due to business shutdowns, there was a shortfall in production and supply which hampered the aquaculture industry across the region. However, the regional market is witnessing a positive recovery with the rising vaccination rates. Moreover, with the relaxation of border restrictions, the companies relying on exports are gradually recovering.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the Europe aquaculture market. The Europe aquaculture market is expected to grow at a good CAGR during the forecast period.

Europe AquacultureMarket Revenue and Forecast to 2028 (US$ Million)

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Europe Aquaculture Market Segmentation

Europe Aquaculture Market – By Product

- Aquatic Plants

- Fish

- Crustaceans

- Mollusca

- Others

Europe Aquaculture Market – By Culture Environment

- Fresh Water

- Brackish Water

- Marine Water

Europe Aquaculture Market, by Country

- France

- Germany

- Italy

- UK

- Russia

- Rest of Europe

Europe Aquaculture Market - Companies Mentioned

- Bakkafrost

- Cermaq Group AS

- Cooke Aquaculture, Inc.

- Danish Salomn

- JBS S.A.

- Leroy Seafood

- Mowi ASA

- Stolt-Nielsen Limited

- Thai Union Group PCL

Europe Aquaculture Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 35,433.63 Million |

| Market Size by 2028 | US$ 45,918.99 Million |

| Global CAGR (2021 - 2028) | 3.8% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Automotive Fabric Market

- Quantitative Structure-Activity Relationship (QSAR) Market

- Emergency Department Information System (EDIS) Market

- Embolization Devices Market

- Legal Case Management Software Market

- Latent TB Detection Market

- Battery Testing Equipment Market

- Clear Aligners Market

- Pressure Vessel Composite Materials Market

- Hair Wig Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Species, Nature, and Culture Environment

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

UK, Germany, France, Italy, Russia

Trends and growth analysis reports related to Food and Beverages : READ MORE..

- Bakkafrost

- Cermaq Group AS

- Cooke Aquaculture, Inc.

- Danish Salmon

- JBS S.A.

- Leroy Seafood

- Mowi ASA

- Stolt-Nielsen Limited

- Thai Union Group PCL

Get Free Sample For

Get Free Sample For