Europe Biostimulants Market Overview, Growth, Trends, Analysis, Research Report (2021-2031)

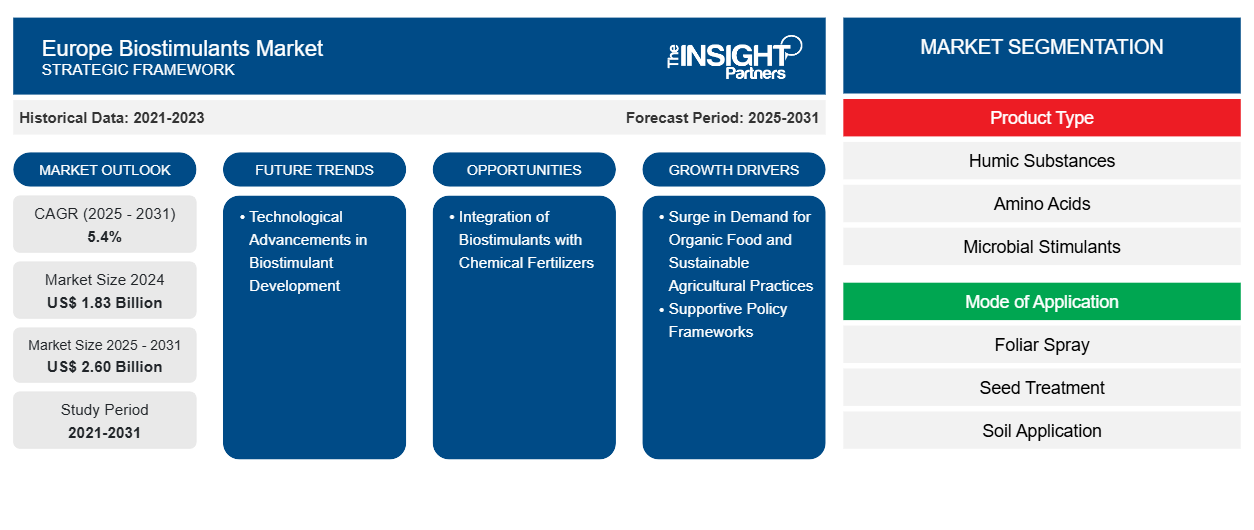

Europe Biostimulants Market Size and Forecast (2021 - 2031), Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Humic Substances, Amino Acids, Microbial Stimulants, Seaweed Extracts, and Others), Mode of Application (Foliar Spray, Seed Treatment, and Soil Application), and Crop Type (Cereals and Grains, Oilseeds and Pulses, Fruits and Vegetables, Turf and Landscapes, and Others)

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : May 2025

- Report Code : TIPRE00040931

- Category : Chemicals and Materials

- Status : Published

- Available Report Formats :

- No. of Pages : 130

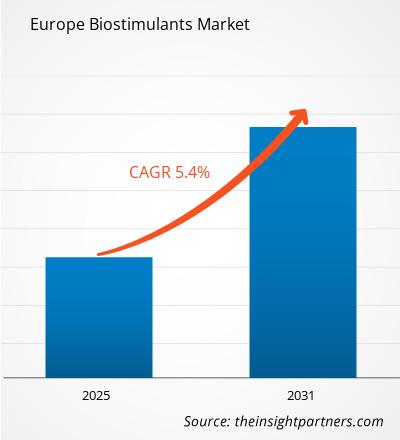

The Europe biostimulants market size is projected to reach US$ 2.60 billion by 2031 from US$ 1.83 billion in 2024. The market is expected to register a CAGR of 5.4% from 2025 to 2031. The technological advancements in biostimulant development are likely to bring in new trends in the Europe biostimulants market.

Europe Biostimulants Market Analysis

As consumers across Europe have become more health-conscious and aware of the environmental impacts of conventional farming, organic products have gained significant traction. Organic food is perceived as a healthier, safer, and more environmentally friendly alternative, as it is free from synthetic chemicals and pesticides. This growing preference has prompted farmers and agricultural companies to explore innovative solutions that can help improve crop yields. The transition toward sustainable agricultural practices has urged the use of biostimulants. Biostimulants derived from seaweed extracts, amino acids, humic substances, microorganisms, and other natural extracts enhance plant crop performance by improving plant resilience against environmental stresses, such as elevated temperatures, drought, and soil salinity. The most prevalent microbial biostimulants include arbuscular mycorrhizal fungi, species of Trichoderma fungi, and rhizosphere bacteria (plant growth-promoting rhizobacteria). These microorganisms form symbiotic relationships with plants, enhancing their overall health and productivity.

Europe Biostimulants Market Overview

In Europe, biostimulants are used for soil conditioning in fertilizers as biostimulants enhance soil fertility and water-holding capacity. Biostimulants are sold in the region by online and offline distribution. The growth of online retail channels has made biostimulants readily available for cereals, grains, gardening, and landscaping applications. This is one of the most significant factors responsible for the region's biostimulants market growth. Farmers in the region increasingly recognize the benefits of integrating biostimulants into their agricultural practices to improve soil health, increase crop yields, and mitigate climate change impacts. Government policies promoting sustainable agriculture, such as the Environmental Land Management Scheme, provide financial incentives for farmers to adopt biostimulants as soil amendments.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONEurope Biostimulants Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Europe Biostimulants Market Drivers and Opportunities

Supportive Policy Frameworks

The European Union has supported the adoption of biostimulants through regulatory frameworks that ensure their safe and effective use in agriculture. The European Union has put in place clear regulatory frameworks to govern the use of biostimulants. The EU Regulation 1107/2009 (which covers plant protection products) and the more recent Regulation (EU) No 2019/1009 on biostimulants provide clear guidelines for biostimulant products, ensuring their safety and effectiveness. This regulatory clarity has encouraged more widespread adoption of biostimulants by farmers across Europe. Further, the European Green Deal, with its Farm to Fork Strategy, prioritizes enhanced resource efficiency, a clean and circular economy, biodiversity restoration, and pollution reduction. This move toward sustainability goals propels the demand for environmentally friendly agricultural products, including biostimulants, to achieve the aim of positioning Europe as the first climate-neutral region by 2050.

Integration of Biostimulants with Chemical Fertilizers

Sustainable resource management can be achieved with the integration of biostimulants with chemical fertilizers, as it helps optimize nutrient uptake, stimulate robust crop development, and potentially curtail reliance on synthetic fertilizer inputs. This strategy can also lead to less environmental pollution from the excessive use of fertilizers. While biostimulant products may entail a higher upfront investment compared to certain conventional chemical fertilizers, their agronomic and economic advantages—such as higher yields and better profits for farmers—can deliver a superior return on investment in the long run. For instance, a study published by the Italian Journal of Agronomy on durum wheat revealed that the application of biostimulants can considerably enhance key morpho-physiological parameters and grain yield while offering the potential to reduce dependence on synthetic nitrogen fertilizers. Therefore, the aforementioned advantages are likely to promote the reliance on biostimulants and subsequently propel the market expansion in the upcoming years.

Europe Biostimulants Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Europe biostimulants market analysis are product type, mode of application, and crop type.

- Based on product type, the market is segmented into humic substances, amino acids, microbial stimulants, seaweed extracts, and others. The seaweed extracts segment held the largest share of the market in 2024.

- In terms of mode of application, the market is segmented into foliar spray, seed treatment, and soil application. The foliar spray segment held the largest share of the market in 2024.

- Based on crop type, the market is segmented into cereals and grains, oilseeds and pulses, fruits and vegetables, turf and landscapes, and others. The cereals and grains segment held the largest share of the market in 2024.

Europe Biostimulants Market Share Analysis, by Geography

The scope of the Europe biostimulants market report focuses on the market scenario in terms of historical market revenues and forecasts.

Based on geography, the Europe biostimulants market is segmented into Germany, UK, France, Italy, Russia, and the Rest of Europe. France held the largest market share in 2024, and the UK is expected to grow at the fastest CAGR during the forecast period. This can be attributed to the growing sustainable and organic agricultural practices in these countries. Favorable government support and initiatives will also contribute to the market growth in the UK.

Europe Biostimulants

Europe Biostimulants Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 1.83 Billion |

| Market Size by 2031 | US$ 2.60 Billion |

| CAGR (2025 - 2031) | 5.4% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

Europe

|

| Market leaders and key company profiles |

|

Europe Biostimulants Market Players Density: Understanding Its Impact on Business Dynamics

The Europe Biostimulants Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Europe Biostimulants Market top key players overview

Europe Biostimulants Market News and Recent Developments

Europe biostimulants market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the Europe biostimulants market are listed below:

- Nichino Europe Co Ltd (Nichino) acquired Interagro (UK) Limited (Interagro). Nichino purchased the entire share capital of Interagro (UK) Limited. The acquisition is intended to grow Nichino's and Interagro's portfolio of products for their customers now and in the future. (Source: Nichino Europe Co Ltd, Press Release, Apr-2023)

- IntraCrop visited Greece to strengthen relationships with NitroFarm, their primary distributor, and discuss biostimulant positioning with sales representatives. (Source: IntraCrop, Press Release, Feb-2025)

- Syngenta and TraitSeq collaborated to accelerate biostimulant R&D, utilizing AI to develop innovative, high-performance biostimulants for sustainable agriculture, a crucial component of plant growth enhancement. (Source: Syngenta, Press Release, Jan-2025)

Europe Biostimulants Market Report Coverage and Deliverables

The "Europe Biostimulants Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Europe biostimulants market size and forecast at country levels for all the key market segments covered under the scope

- Europe biostimulants market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter's Five Forces and SWOT analysis

- Europe biostimulants market analysis covering key market trends, country framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Europe biostimulants market

- Detailed company profiles

Frequently Asked Questions

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For