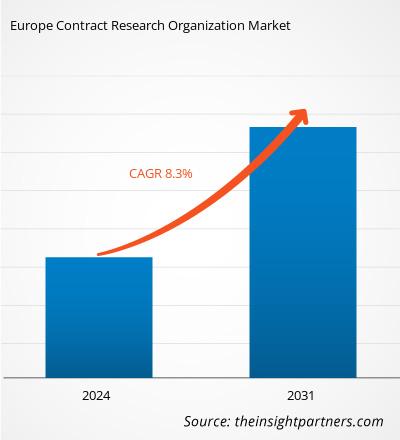

Europe Contract Research Organization Market size is projected to reach US$ 40,023.68 million by 2031 from US$ 22,885.00 million in 2024. The market is estimated to register a CAGR of 8.3% during 2024–2031. The increased outsourcing of R&D and sustainability initiatives is likely to bring new trends to the market in the coming years.

Europe Contract Research Organization Market Analysis

The Contract Research Organization (CRO) market in Europe is expanding as more pharmaceutical and biotech companies choose to outsource their research and development (R&D). Developing new drugs is a long, complex, and costly process, and CROs help ease that burden by managing clinical trials, handling regulatory paperwork, and analyzing data. This allows companies to focus on innovation while experts take care of the technical and compliance-heavy aspects. The regulatory landscape of Europe is complex, and each country has its own set of rules, making it challenging for companies to navigate approvals alone. CROs bring the expertise needed to streamline this process, saving time and resources. At the same time, advancements in technology, such as AI-driven analytics and digital trial management, are making research faster and more efficient. Countries such as Germany, France, and the UK are leading the way in clinical research, with strong healthcare systems supporting growth. While concerns around data security and intellectual property exist, the benefits—cost savings, faster market access, and specialized knowledge—far outweigh the risks. As the pharmaceutical industry evolves, CROs are anticipated to continue playing a crucial role in bringing life-changing treatments to patients more quickly and efficiently.

Europe Contract Research Organization Market Overview

The Contract Research Organization (CRO) industry is growing strongly in Europe, owing to rising outsourcing of research and development (R&D) operations in pharmaceutical, biotechnology, and medical device firms. With the healthcare sector becoming increasingly competitive and innovative, firms are under pressure to speed up drug discovery. Contracting R&D to CROs enables companies to access their specialized expertise, sophisticated infrastructure, and global connectivity without significant investments. CROs offer full-service solutions, from preclinical research to clinical trials, regulatory affairs, and post-marketing surveillance, and thus help sponsors concentrate on their core competencies. In addition, the increasing complexity of clinical trials due to the commonality of chronic diseases, orphan diseases, and personalized medicine has raised the demand for niche CROs with specialized knowledge and technological capacities.

In Europe, tightly regulated regimes such as the EU Clinical Trials Regulation (CTR) have encouraged businesses to utilize CROs since they simplify compliance procedures and have extensive familiarity with local regulatory environments. Small and medium-sized enterprises (SMEs), with their limited ability to carry out in-house R&D, increasingly use CROs' services because of their low-cost offerings and availability of cutting-edge technology such as AI-powered data analysis and decentralized clinical trials. CROs can manage multinational trials and make patients with diverse demographics available, which are imperative for obtaining regulatory approvals and ensuring market growth. In addition, the advent of biologics, biosimilars, and cell and gene therapies has introduced a demand for expert R&D services that many CROs are well-positioned to provide. This outsourcing alleviates operational pressures for sponsors and drives innovation by facilitating partnerships between CROs and academic centers, startups, and technology companies. Consequently, the market is well positioned for continued growth due to rising dependence on R&D outsourcing to achieve efficiency, save costs, and get life-saving drugs to patients more quickly.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Europe Contract Research Organization Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Europe Contract Research Organization Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Europe Contract Research Organization Market Drivers and Opportunities

Rising Demand for Clinical Trials Bolsters Market Growth

Europe is the global leader in healthcare innovation and has seen a surge in clinical trials due to its diverse patient population, advanced healthcare infrastructure, and strong regulatory framework. The need for faster drug development and approval timelines fuels the reliance on CROs to execute clinical trials efficiently. According to the European Medicines Agency 2021, The EU Clinical Trials Register displays 44,302 clinical trials with an EudraCT protocol, of which 7,355 are clinical trials conducted with subjects under 18 years old. According to the Association of the British Pharmaceutical Industry (ABPI), the clinical trials increased by 4.3% per year, from 394 trials in 2021 to 411 in 2022. Further, the UK government provides funding to encourage clinical trials. For instance, in August 2024, the UK secured a US$ 445.35 million investment by the UK government to boost clinical trials. The investments are expected to support faster patient access to cutting-edge treatments, strengthen clinical trials, and improve medicines manufacturing in the UK.

Sponsors tend to outsource these trials to CROs to access their specialized skill sets, exposure to innovative technologies, and established networks for trial management and patient recruitment. In Europe, the introduction of the EU Clinical Trials Regulation (CTR) has centralized the clinical trial application procedure in all the member states, making it an attractive place for sponsors from other parts of the world. CROs become invaluable resources for handling such regulatory needs, compliance, and minimizing administrative burdens for the sponsors.

In 2021, Europe hosted the highest proportion of clinical trials worldwide, with Germany, the UK, France, and Spain proving to be primary centers based on the strength of their healthcare infrastructures and conducive regulatory landscapes. Small and medium-sized enterprises (SMEs) increasingly resorted to the cost-saving offerings of CROs while frequently pioneering innovation with having limited funds for running in-house clinical trials. Increased demand for clinical trials has also been fueled by the expanding pipeline of new drugs, especially in oncology, immunology, and neurology, where clinical trials are essential to prove efficacy and safety. CROs offer full-service support, from protocol development and patient enrollment to data analysis and reporting, allowing sponsors to concentrate on their core strengths while guaranteeing high-quality trial execution.

Expansion of Biologics and Biosimilars to Create Growth Opportunities

The growth potential for the CRO market is largely supplemented with the upcoming biologics and biosimilars, mainly due to the increased competition from innovative therapies and the expired patents of blockbuster biologics. Biologics include product types such as monoclonal antibodies and recombinant proteins, and these will rule the landscape of biopharmaceuticals mainly owing to their strengths in curing chronic and life-threatening diseases. With patent expiration for most biologics, the market for biosimilars, copies of biologics that are very similar and price-effective, is already developing rapidly. CROs are expected to gain lucratively in outsourcing research and development for the faster delivery of biosimilars.

The high cost and lengthy process of developing biologics attract outsourcing to CROs, with companies looking to cost cutting and shorten time-to-market. CROs investing in advanced technologies, biologics, and biosimilar expertise should expect to profit most from this expanding pool. The world's push for financially affordable health solutions continues to fuel this growth, with the cost savings generated by biosimilars that are therapeutically equivalent to their reference biologics. Therefore, the continuous increase in biologics and biosimilars is exciting the market and stressing the importance of CROs in advancing biopharmaceutical development and helping to meet unmet medical needs.

Europe Contract Research Organization Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Europe Contract Research Organization Market analysis are Service Type, Product Type, Type, Application, End User, and Country.

Based on service type, the Europe contract research organization market is segmented into early phase development services, clinical research services, laboratory services, and post-approval services. The Clinical Research Services segment held the largest share of the Europe Contract Research Organization Market in 2024, and it is expected to register a significant CAGR during 2024–2031.

By Product type, the market is segmented into cell and gene therapy, biosimilars, antibody drug conjugates, and others. The Biosimilars segment held the largest share of the Europe contract research organization market in 2024.

In terms of type, the Europe contract research organization market is bifurcated into in-house and outsource. The outsource segment held a larger share of the Europe contract research organization market in 2024.

Based on application, the market is segmented into oncology, neurology, cardiology, infectious diseases, metabolic disorders, nephrology, respiratory, dermatology, ophthalmology, hematology, and others. The oncology segment held the largest share of the Europe contract research organization market in 2024.

By end user, the Europe contract research organization market is divided into pharmaceutical and biotech companies, medical device companies, and academic and research institutes. The pharmaceutical and biotech companies segment held the largest share of the Europe contract research organization market in 2024.

Europe Contract Research Organization Market Share Analysis by Geography

The geographic scope of the Europe contract research organization market report is mainly divided into seven major countries: The United Kingdom, Germany, France, Italy, Spain, Netherlands, Greece, and the Rest of Europe.

The market growth trajectory is determined by a surge in clinical trials and a rise in demand for outsourced drug discovery services. According to the Association of the British Pharmaceutical Industry (ABPI), the total number of clinical trials increased by 4.3% per year, from 394 trials in 2021 to 411 in 2022. Further, the UK government encourages clinical trials by funding. For instance, in August 2024, the Voluntary Scheme for Branded Medicine Pricing, Access and Growth (VPAG) Investment Programme was launched by the government of the UK. The government announced that NHS patients will benefit from earlier access to new treatments as the UK government launches a US$ 445.35 million (£400 million) public-private investment program. This initiative aims to enhance clinical trials, improve medicine manufacturing, and establish 18 new clinical trial hubs across the UK to accelerate research.

Technological advancements such as AI technologies in France contribute to the growing demand for Contract Research Organizations. CROs in France are increasingly adopting advanced technologies to improve the efficiency and quality of clinical trials. For instance, ICTA, a full-service international CRO, uses an integrated IT platform called I-SIT to manage clinical trials, ensuring secure and efficient data handling throughout the study process.

The changing regulatory environment for clinical trials in France is also positively influencing the market. In August 2024, France introduced the Convention Unique, which includes updated templates for clinical trial agreements. These changes aim to standardize and simplify the initiation of clinical trials by providing standardized clauses for equipment and biological resources. While intended to streamline processes, these updates may also impact the overall budget due to changes in the cost of research. CROs in France play a crucial role in the pharmaceutical and biotechnology sectors by providing a wide range of services to support clinical trials and research initiatives. The surging number of clinical trials and supportive regulatory environment in the country are significantly creating the demand for CRO services.

Market players are adopting inorganic growth strategies for the development of the CRO services market in France. For instance, in September 2023, 1MED, a specialist CRO providing regulatory and clinical support to medical device companies, acquired Evamed, a CRO based in northwest France, also focused on the medical device market. This acquisition established 1MED's presence in France and strengthened the company's capabilities in high-complexity interventional trials with higher-risk devices.

Europe Contract Research Organization Market Regional Insights

The regional trends and factors influencing the Europe Contract Research Organization Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Europe Contract Research Organization Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Europe Contract Research Organization Market

Europe Contract Research Organization Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 22,885.00 Million |

| Market Size by 2031 | US$ 40,023.68 Million |

| Global CAGR (2024 - 2031) | 8.3% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Service Type

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

Europe Contract Research Organization Market Players Density: Understanding Its Impact on Business Dynamics

The Europe Contract Research Organization Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Europe Contract Research Organization Market are:

- Smerud Medical Research Group

- AURIGON GMBH

- Pharmaxi LLC

- Clinmark sp. z o.o

- Siron Clinical

- Julius Clinical

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Europe Contract Research Organization Market top key players overview

Europe Contract Research Organization Market News and Recent Developments

Europe Contract Research Organization Market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the key developments in the market are listed below:

- Thermo Fisher Scientific launched the International CorEvitas Clinical Registry in Adolescent Alopecia Areata. The registry was made active in both Europe and the US. The first patient was enrolled in Europe. This marked the 12th independent registry from CorEvitas, which was part of the PPD clinical research division of Thermo Fisher Scientific. It complemented an existing CorEvitas registry that focused on adult AA, launched in 2023.

Thermo Fisher Scientific launched International CorEvitas Clinical Registry in adolescent atopic dermatitis, a chronic skin condition. The registry enrolled its first European Union patient, expanding its geographic footprint of enrollment beyond North America, where the first patient was enrolled in December 2023. The registry addressed a critical unmet need for real-world evidence and adolescent-specific developmental and safety data related to novel therapies for AD, and it complemented the existing adult CorEvitas AD Registry that had been launched in 2020.

Europe Contract Research Organization Market Report Coverage and Deliverables

The " Europe Contract Research Organization Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Europe Contract Research Organization Market size and forecast at regional, and country levels for all the key market segments covered under the scope

- Europe Contract Research Organization Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Europe Contract Research Organization Market analysis covering key market trends, regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Europe Contract Research Organization Market

- Detailed company profiles

Frequently Asked Questions

What are the factors driving the Europe contract research organization market growth?

Rising demand for clinical trials and growing outsourcing of R&D are among the significant factors fueling the market growth.

Which country dominated the Europe contract research organization market in 2024?

The UK dominated the market in 2024.

Which are the leading players operating in the Europe contract research organization market?

Parexel International Corp, Thermo Fisher Scientific (PPD Inc), Precision Medicine Group, LLC, ProPharma Group, Medpace Holdings Inc, O4 Research Ltd, Julius Clinical, Siron Clinical, Clinmark sp. z o.o., Pharmaxi LL are among the prominent players operating in the market.

What are the future trends in the Europe contract research organization market?

The adoption of advanced technologies in clinical research and sustainability initiatives is expected to emerge as a prime trend in the market during the forecast period.

What is the expected CAGR of the Europe contract research organization market?

The market is expected to register a CAGR of 8.3% during 2024–2031.

What is the estimated value of the Europe contract research organization market by 2031?

The market value is expected to reach US$ 40,023.68 million by 2031.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

I wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA, MANAGING DIRECTOR, PineCrest Healthcare Ltd.The Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

Yukihiko Adachi CEO, Deep Blue, LLC.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Strategic Planning

- Investment Justification

- Identifying Emerging Markets

- Enhancing Marketing Strategies

- Boosting Operational Efficiency

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - Europe Contract Research Organization (CRO) Market

- Smerud Medical Research Group

- AURIGON GMBH,

- Pharmaxi LLC,

- Clinmark sp. z o.o,

- Siron Clinical,

- Julius Clinical,

- O4 Research Ltd,

- Medpace Holdings Inc,

- ProPharma Group,

- Precision Medicine Group, LLC,

- Thermo Fisher Scientific (PPD Inc),

- Parexel International Corp.

Get Free Sample For

Get Free Sample For