Europe Ethylene Bis Stearamide Market Key Players and Forecast by 2031

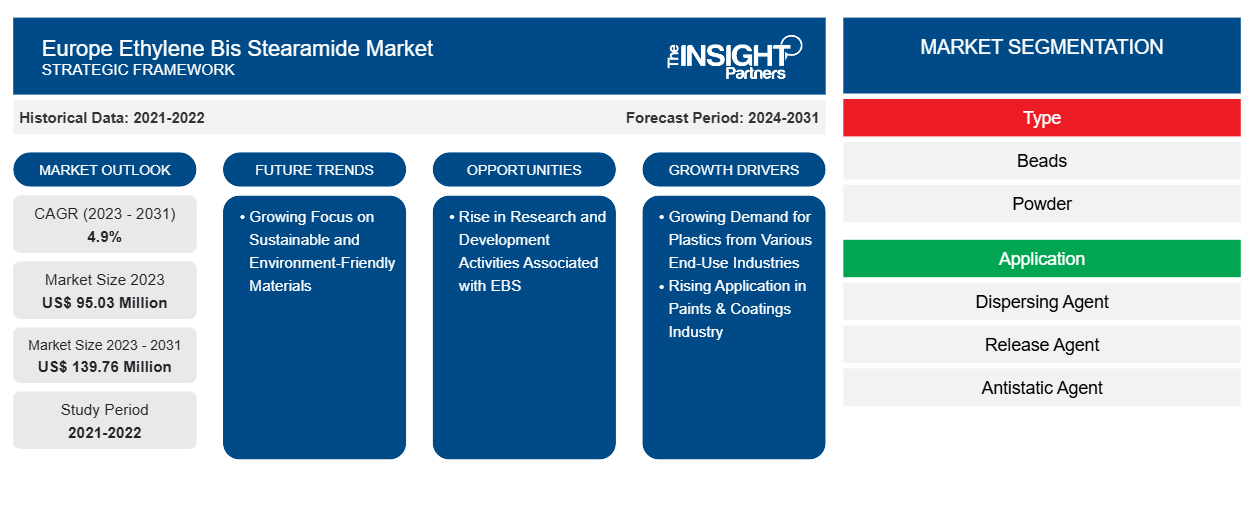

Europe Ethylene Bis Stearamide Market Size and Forecast (2021 - 2031), Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Beads, Powder, and Others), Application (Dispersing Agent, Release Agent, Antistatic Agent, Pigment Stabilizer, and Others), End-Use Industry (Plastic, Rubber, Electrical and Electronics, Paints Inks and Coatings, Textile, Adhesives and Sealants, and Others), and Country

Historic Data: 2021-2022 | Base Year: 2023 | Forecast Period: 2024-2031- Report Date : Jul 2024

- Report Code : TIPRE00039296

- Category : Chemicals and Materials

- Status : Published

- Available Report Formats :

- No. of Pages : 143

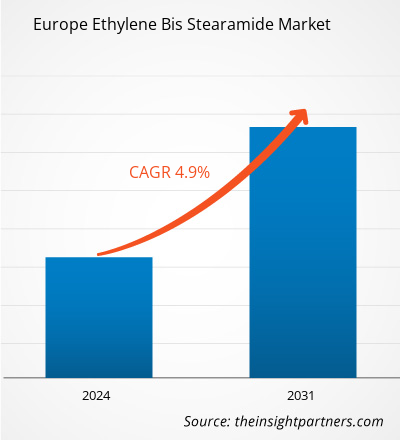

The Europe ethylene bis stearamide market size is projected to reach US$ 139.76 million by 2031 from US$ 95.03 million in 2023. The market is expected to register a CAGR of 4.9% during 2023–2031. Due to the growing demand for plastics from various industries, ethylene bis stearamide has gained traction across the region. As ethylene bis stearamide is required to manufacture various products, their utilization is trending in various industries.

Europe Ethylene Bis Stearamide Market Analysis

The Europe ethylene bis stearamide market is expected to be driven by a strong demand from various end-use industries such as plastics, coatings, adhesives, and rubber. EBS is widely used as a lubricant or dispersing agent to manufacture plastic products, and such applications impart the final products with better processing and surface quality. As high-performance plastics have gained prominence in areas such as the automotive, packaging, and construction sectors, the use of these plastics for high-end applications has fueled the demand for EBS. The increasing demand for sustainable and biodegradable plastics is also a major reason for the growing consumption of this synthetically made wax, as plastic manufacturers opt for additives that enhance the functionality of these eco-friendly products.

Europe Ethylene Bis Stearamide Market Overview

Ethylene bis stearamide (EBS) is a synthetic wax produced by reacting stearic acid with ethylenediamine. Its lubricating, antistatic, and dispersing capabilities have given it widespread applications. The coatings and adhesives sectors also contribute significantly to the EBS market. EBS is used as a matting agent in the coatings industry; it provides a desirable finish and improves the durability of the coated surfaces. In adhesives, EBS enhances the performance by preventing the sticking together of the layers, thus facilitating easier handling and application. The growth of these industries, driven by advancements in construction, automotive, and consumer goods, directly influences the demand for EBS.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONEurope Ethylene Bis Stearamide Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Europe Ethylene Bis Stearamide Market Drivers and Opportunities

Growing Demand for Plastics from Various End-Use Industries

Ethylene bis stearamide (EBS) is a crucial additive in plastic manufacturing due to its lubricating, dispersing, and anti-blocking properties, which enhance the quality and efficiency of plastic production. Industries such as automotive, packaging, construction, electronics, and consumer goods in Europe increasingly rely on advanced plastic materials, which has led to a surge in the need for EBS. The shift toward lightweight materials in the automotive industry to enhance fuel efficiency and lower emissions has resulted in a higher demand for high-performance plastics. EBS improves these plastics' flow properties and surface finish, making it an essential additive in the production of interior and exterior automotive components. The industry's focus on innovation and sustainability further drives the demand for EBS, as it ensures the quality and durability of plastic parts used in vehicles. According to the European Automobile Manufacturers' Association, in 2023, battery-electric vehicle sales increased by 37%, accounting for approximately 15% of total vehicle sales compared to 2022. Also, in March 2023, the European Union announced the proposal of the Fit for 55 package, which aims for 55% and 50% CO2 emission reductions for new cars and vans, respectively, from 2030 to 2034 compared to the figures recorded in 2021 and 100% CO2 emission reductions for both new cars and vans from 2035.

Rise in Research and Development Activities Associated with EBS

In Europe, various organizations are making research & development (R&D) efforts focused on improving the functional characteristics of ethylene bis stearamide (EBS), such as increasing its thermal stability, enhancing dispersing capabilities, and reducing environmental impact. The National Academies of Sciences, Engineering, and Medicine published the research paper titled “Viscosity reduction mechanism and rheological properties of EBS and crumb rubber modified asphalt” in January 2024. The detailed examination of EBS properties and mechanisms in this study reveals significant improvement in the rheological properties of modified asphalt. These improvements enhance the material's performance under varying temperature conditions and suggest a reduction in energy consumption during asphalt mixing and laying processes. As a result, there is a growing interest in exploring EBS as a cost-effective additive. This burgeoning interest is likely to spur increased R&D efforts to refine EBS formulations, investigate its compatibility with other asphalt modifiers, and develop new applications in various infrastructure projects. These advancements can make EBS more effective and versatile across a broader range of applications. Further, R&D initiatives often lead to the development of specialized EBS formulations tailored to meet the specific needs of different industries. For instance, innovations in EBS can result in superior lubricants and processing aids for the plastics and rubber industries, improving product quality and manufacturing efficiency. These customized solutions can cater to the automotive, electronics, and consumer goods sectors, where precise performance and reliability are crucial. As a result, the ability to offer specialized EBS products can significantly expand its customer base as well as applications. Thus, the rise in research and development activities to enhance the properties and applications of EBS is expected to provide substantial opportunities for the Europe ethylene bis stearamide market growth during the forecast period.

Europe Ethylene Bis Stearamide Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Europe ethylene bis stearamide market analysis are type, application, and end-use industry.

- Based on type, the Europe ethylene bis stearamide market is segmented into beads, powder, and others. The powder segment held the largest market share in 2023.

- By application, the market is categorized into dispersing agent, release agent, anti-static agent, pigment stabilizer, and others. The dispersing agent segment held the largest share of the market in 2023.

- In terms of end-use industry, the market is segmented into plastic; rubber; electrical & electronics; paints, inks, and coatings; textile; adhesives & sealants; and others. In 2023, the plastic segment dominated the market.

Europe Ethylene Bis Stearamide Market Share Analysis by Geography

The geographic scope of the Europe ethylene bis stearamide market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

In 2023, Germany dominated the Europe ethylene bis stearamide market share. Germany is one of the leading producers of automobiles worldwide, and several major car manufacturing companies, including Volkswagen, BMW AG, and Audi, are located in the country. Germany produces ~6 million vehicles annually, including passenger cars and commercial vehicles. According to Germany Trade & Invest GmbH, Germany is Europe's largest automotive market, with strong production and sales, accounting for ~25% of all passenger cars manufactured and almost 20% of all new registrations. The country also possesses the largest concentration of original equipment manufacturer (OEM) plants in Europe. With 44 OEM sites located in Germany, the country's OEM market share in the European Union was more than 55% in 2021. Ethylene bis stearamide (EBS) is widely used as a lubricant and dispersing agent in plastics and rubbers. The automotive manufacturing and machinery production industries require high-performance materials such as EBS that improve the processing and quality of plastics and rubber products.

Europe Ethylene Bis Stearamide

Europe Ethylene Bis Stearamide Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 95.03 Million |

| Market Size by 2031 | US$ 139.76 Million |

| CAGR (2023 - 2031) | 4.9% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

Europe

|

| Market leaders and key company profiles |

|

Europe Ethylene Bis Stearamide Market Players Density: Understanding Its Impact on Business Dynamics

The Europe Ethylene Bis Stearamide Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Europe Ethylene Bis Stearamide Market News and Recent Developments

The Europe ethylene bis stearamide market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the Europe ethylene bis stearamide market are listed below:

- BASF SE, in collaboration with Linde plc and SABIC, has started two electrically heated steam cracking furnaces at BASF's Verbund site in Ludwigshafen, Germany. The demonstration plant is fully integrated into the existing crackers at Ludwigshafen and is expected to produce propylene, ethylene, and potentially heavier olefins. (Source: BASF SE, Press Release, May 2024)

- Braskem joined hands with SCG Chemicals Public Company Limited to launch a new venture, Braskem Siam Company. This company aims to produce sugarcane-derived bio-ethylene instead of fossil-based ethylene. (Source: SABIC, Press Release, Jan 2023)

- Braskem, in partnership with Lummus Technology, focuses on global licensing of commercial green ethylene technology, which can accelerate the development of chemicals and plastics made from bioethanol, a renewable feedstock. (Source: BASF SE, Press Release, Oct 2022)

Europe Ethylene Bis Stearamide Market Report Coverage and Deliverables

The “Europe Ethylene Bis Stearamide Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Europe ethylene bis stearamide market size and forecast at Europe, country, and country levels for all the key market segments covered under the scope

- Europe ethylene bis stearamide market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter’s Five Forces and SWOT analysis

- Europe ethylene bis stearamide market analysis covering key market trends, Europe and country framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Europe ethylene bis stearamide market

- Detailed company profiles

Frequently Asked Questions

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For