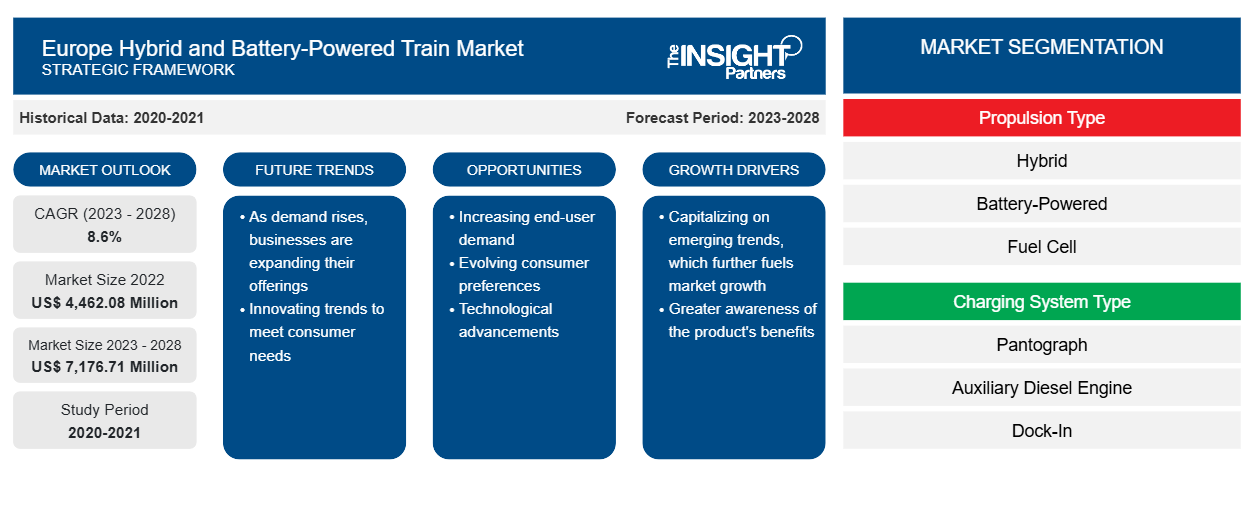

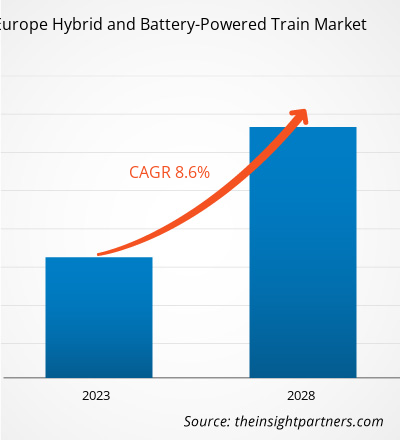

The Europe hybrid and battery-powered train market is projected to reach US$ 7,176.71 million by 2028 from US$ 4,462.08 million in 2022; it is expected to register a CAGR of 8.6% during 2023–2028.

Hybrid trains utilize an energy-saving combination of alternative fuel sources, such as hydrogen fuel cells, CNG, LNG, and electric batteries. This energy-saving combination also helps reduce environmental pollution significantly. Also, they help attain climate-neutral initiatives of the government and various organizations. Thus, the Europe hybrid and battery-powered train market growth is hastened. For instance, in June 2022, the European Commission planned to invest in 135 transport infrastructures under the Connecting Europe Facility (CEF). The Commission allotted ~US$ 5.68 billion to make transport more sustainable and efficient. Moreover, in Europe, the adoption of battery-powered trains is rising and is anticipated to continue during the forecast period. For instance, in June 2022, Nahverkehr Westfalen-Lippe (NWL), a German operator association, extended a contract worth US$ 178.76 million with CAF (Construcciones y Auxiliar de Ferrocarriles). Under this contract, the company agreed to supply ten battery-powered trains and fleet maintenance for 33 years in the North Rhine-Westphalia. All such factors contribute to the overall growth of the Europe hybrid and battery-powered train market.

The Europe hybrid and battery-powered train market is segmented into Germany, France, Italy, Spain, the UK, Poland, Austria, Slovenia, Bulgaria, Hungary, Romania, Greece, Serbia, Scandinavia, Croatia, and the Rest of Europe. The German government has plans to electrify 75% of the railway route network in Germany by 2030. Till October 2022, the country had ~61% of the railway route electrified, and 74% of all train kilometers were covered electrically. The German government and railway companies in the country are taking various initiatives to make the total German railway infrastructure electric. For instance, in November 2021, Niederbarnimer Eisenbahn (NEB) ordered 31 battery-operated Mireo Plus B trains from Siemens Mobility. These new environmentally friendly Mireo Plus B trains would run on all East Brandenburg rail network lines; the services of these lines are scheduled for launch in December 2024. Battery-electric trains will be used in the Verkehrsverbund Berlin-Brandenburg (VBB) public transport network for the first time. The country has also experienced various innovations in hybrid trains. Thus, government initiatives to electrify rail networks and the introduction of trains are fueling the Europe hybrid and battery-powered train market growth.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONEurope Hybrid and Battery-Powered Train Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Europe Hybrid and Battery-Powered Train Market

The COVID-19 outbreak negatively impacted European countries such as Germany, France, Spain, the UK, Poland, Austria, Slovenia, Bulgaria, Hungary, Romania, Greece, Serbia, and Croatia. Governments of these countries imposed stringent regulations such as travel restrictions, social distancing, and trade bans. Such stringent regulations applied by various governments of European countries had an adverse impact on the Europe hybrid and battery-powered train market. The railways witnessed a sharp drop in demand for rail transport services, leading to lower revenue generation. Hence, expansion plans were put on hold, causing Europe hybrid and battery-powered train market players to witness a significant drop in order intake.

Market Insights – Europe Hybrid and Battery-Powered Train Market

Next Generation EU and Similar Policies to Offer Growth Opportunities to Europe Hybrid and Battery-Powered Train Market in Coming Years

EU is introducing various policies to promote digitalization and the adoption of the European Green Deal. In May 2020, the European Commission proposed a Next Generation EU plan worth ~US$ 816.28 billion (EUR 750 billion) to build a green, digital, and resilient future. This plan aims to support businesses within the EU to recover from the COVID-19 pandemic-related losses by providing financial aid. Through these EU programs, the Commission will support cleaner transport and logistics and further boost rail travel and clean mobility in the region. Additionally, under the plan, the transport sector will receive an additional US$ 1.63 billion for the Connecting Europe Facility, thus, facilitating cross-border connections, such as Rail Baltica linking the Baltic States and Poland, toward other European Countries. Thus, the growing investment by the EU through the Next Generation EU plan to provide sustainable transportation will increase the demand for fuel-efficient trains, creating an opportunity for the Europe hybrid and battery-powered train market growth during the forecast period.

The report provides detailed market insights, which help the key Europe hybrid and battery-powered train market players strategize their market growth. A few developments are mentioned below:

- In December 2022, Alstom was awarded a contract worth US$ 400 million to supply 49 additional Coradia Stream high-capacity trains to Renfe in Spain. These trains will supplement the 152 trains already ordered in March 2021.

- In January 2020, Deutsche Bahn ordered 50 hybrid locomotives from Toshiba Infrastructure Systems and Solutions Corporation. Preparation of the series assembly of the locomotives started in 2021 at DB Cargo's maintenance depot in Rostock, Germany.

Europe hybrid and battery-powered train market players profiled in this report are:

- Alstom SA

- Westinghouse Air Brake Technologies Corp

- Construcciones y Auxiliar de Ferrocarriles SA

- Končar Electrical Industry Inc

- Hitachi Rail STS SpA

- Hyundai Rotem Co

- Siemens Mobility GmbH

- CRRC Corp Ltd

- Toshiba Infrastructure Systems and Solutions Corporation

- Stadler Rail AG

Europe Hybrid and Battery-Powered Train Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 4,462.08 Million |

| Market Size by 2028 | US$ 7,176.71 Million |

| CAGR (2023 - 2028) | 8.6% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Propulsion Type

|

| Regions and Countries Covered |

Europe

|

| Market leaders and key company profiles |

|

Europe Hybrid and Battery-Powered Train Market Players Density: Understanding Its Impact on Business Dynamics

The Europe Hybrid and Battery-Powered Train Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Frequently Asked Questions

2. Increase in Initiatives to Support Adoption of Train Travel

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For