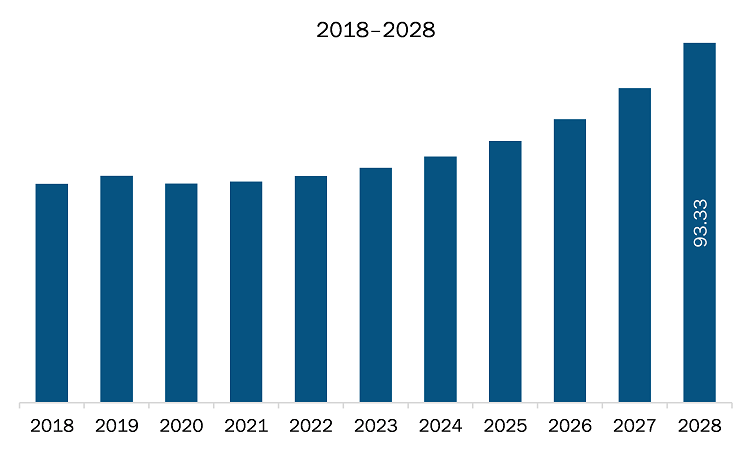

The tilt rotor aircraft market in Europe is expected to grow from US$ 57.37million in 2021 to US$ 93.33 million by 2028; it is estimated to grow at a CAGR of 7.2% from 2021 to 2028.

The UK, Germany, France and Italy are major economies in Europe. Increasing Military Spending for Procurement of Advanced Aircraft. As global tensions have persisted over the last few years, various affected nations plan and take measures to improve and recapitalize the defense status. Threats are continually evolving, i.e., from the conventional land-based force on force to hybrid warfare. To address security threats and tackle terrorism, governments of several nations have already started to increase their defense budgets. According to the Stockholm International Peace Research Institute (SIPRI), the global military expenditure rose to US$ 1,981 billion in 2020, which represents 2.6% increase from 2020. The increasing geopolitical tensions and trade wars among major countries are driving high investments in the defense sector. A significant portion of the investment is dedicated for the procurement of advanced military aircraft and tilt rotor aircraft. For instance, the deliveries of Bell Boeing V-22 Osprey, a military tilt rotor aircraft, reached 400 in June 2020, and some of recent deliveries of Bell Boeing V-22 Osprey in 2020 were to the US and Japan armed forces. Thus, the growing procurement of tilt rotor aircraft for military application is projected to drive the growth of the market during the forecast period. is also bolstering the growth of the industry.

The European tilt rotor aircraft market also had minimal impact on the market growth throughout 2020 as the majority of the products are in development stage or in prototype phase. Countries such as the UK, Italy, and Russia have a notable number of players with prominent product developments. Several manufacturers have postponed their product launch initiatives or product deliveries, which had a negative impact on the tilt rotor market. Russia launched it unmanned tilt rotor aircraft in April 2021, that was scheduled to be launched in mid-2020. The component suppliers and OEMs of tilt rotor aircraft faced challenges in supplying parts and components to the OEMs due to disruption in the supply chain. This hampered the growth of the tilt rotor market.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Europe Tilt Rotor Aircraft Market Segmentation

Europe Tilt Rotor Aircraft Market – By Type

- Unmanned Aerial Vehicle

- Manned Aerial Vehicle

Europe Tilt Rotor Aircraft Market – By End User

- Civil

- Military

Europe Tilt Rotor Aircraft Market, by Country

- France

- Germany

- Italy

- UK

- Russia

- Rest of Europe

Europe Tilt Rotor Aircraft Market Mentioned

- BAE Systems plc

- Boeing

- Honeywell International Inc.

- Israel Aerospace Industries Ltd.

- Leonardo S.p.A

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Rostec

Europe Tilt Rotor Aircraft Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 57.37 Million |

| Market Size by 2028 | US$ 93.33 Million |

| CAGR (2021 - 2028) | 7.2% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

Europe

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For