Aircraft Engine Forging Market Size, Trends, and Forecast to 2031

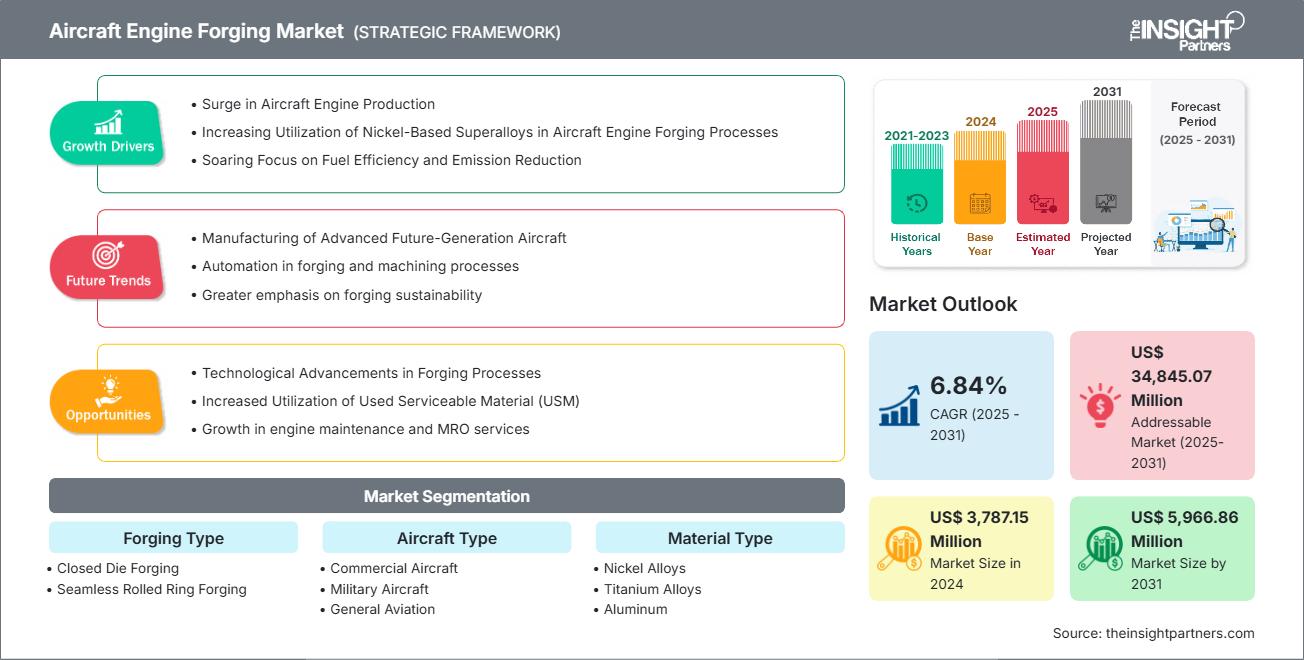

Aircraft Engine Forging Market Forecast (2021 - 2031), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Forging Type (Closed Die Forging and Seamless Rolled Ring Forging), Aircraft Type (Commercial Aircraft, Military Aircraft, General Aviation), Material Type (Nickel Alloys, Titanium Alloys, Aluminum and Others), Application ( Rotor, Turbine Disc, Combustion Chamber Outer Case, Fan Case, and Others) and Geography

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Aug 2025

- Report Code : TIPRE00006615

- Category : Aerospace and Defense

- Status : Published

- Available Report Formats :

- No. of Pages : 280

The aircraft engine forging market size is projected to reach US$ 5,966.86 million by 2031 from US$ 3,787.15 million in 2024. The market is expected to register a CAGR of 6.84% during 2025–2031.

Aircraft Engine Forging Market Analysis

The surging aircraft engine production, increasing utilization of nickel-based superalloys in aircraft engine forging processes, and rising focus on fuel efficiency and emission reduction are key factors driving the aircraft engine forging market growth. Technological advancements in forging processes and using serviceable material (USM) are expected to create an opportunity for the market in the future. Manufacturing advanced future-generation aircraft is likely to emerge as a key trend for the market in the upcoming years.

Aircraft Engine Forging Market Overview

Aircraft engine forging is a manufacturing process used to produce high-strength, high-performance components for aircraft engines. It involves shaping metal—typically titanium, nickel-based alloys, or stainless steel—under extreme pressure using hammers, presses, or dies. This process aligns the metal's grain structure with the shape of the part, enhancing mechanical properties such as strength, fatigue resistance, and durability, which are critical in the harsh operating conditions of jet engines.

Forging creates engine parts such as turbine disks, compressor blades, shafts, and casings. These components must withstand extreme temperatures, high rotational speeds, and enormous stresses. Compared to casting or machining, forging results in superior structural integrity and fewer internal defects, making it ideal for aerospace applications where safety and performance are paramount. Advanced forging techniques, such as isothermal and precision die forging, allow for tight tolerances and complex geometries, minimizing the need for further machining. With the increasing demand for fuel efficiency and lightweight engines, forged parts are essential in modern engine designs, including those used in commercial jets and military aircraft. Overall, forging is vital in the aerospace industry, ensuring reliability and safety in demanding engine environments.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONAircraft Engine Forging Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Aircraft Engine Forging Market Drivers and Opportunities

Market Drivers

- Increasing Air Traffic and Fleet Expansion Rising global passenger and cargo air traffic is driving demand for new aircraft, boosting the need for forged engine components that offer strength and durability.

- Demand for Fuel-Efficient Engines Airlines prioritize fuel efficiency to reduce operational costs and emissions, leading to increased adoption of forged parts that support lightweight, high-performance engine designs.

- Stringent Safety and Performance Standards Aviation regulations require high-reliability components. Forging ensures structural integrity and fatigue resistance, making it essential for critical engine parts.

- Growth in Defense Aviation Military aircraft programs are expanding globally, requiring robust engine components to withstand extreme conditions, further driving market expansion.

- Technological Advancements in Materials and Processes Innovations in titanium and nickel-based alloys and precision forging techniques enhance engine performance and lifecycle.

Market Opportunities

- Next-Generation Aircraft Programs Upcoming commercial and defense aircraft platforms present opportunities for forging suppliers to integrate advanced materials and designs.

- Sustainable Aviation Initiatives The push for sustainable aviation fuels and hybrid-electric propulsion systems will require new forged components optimized for novel engine architectures.

- Aftermarket and MRO Services As global fleets age, the demand for maintenance, repair, and overhaul (MRO) of engine components rises, creating a steady aftermarket opportunity.

- Emerging Markets Expansion Rapid aviation growth in Asia Pacific, the Middle East, and Africa drives regional manufacturing and forging capabilities.

- Digital Manufacturing and Automation Adopting Industry 4.0 technologies in forging processes can improve efficiency, reduce waste, and enable real-time quality control.

Aircraft Engine Forging Market Report Segmentation Analysis

The aircraft engine forging market is divided into different segments to give a clearer view of how it works, its growth potential, and the latest trends. Below is the standard segmentation approach used in most industry reports

By Forging Type

- Closed Die Forging Used for producing complex, high-strength components with precise dimensions. Ideal for turbine blades, discs, and shafts in aircraft engines. Offers excellent mechanical properties and material utilization.

- Seamless Rolled Ring Forging Preferred for large, circular components such as engine rings and bearing races. It provides superior structural integrity and fatigue and thermal stress resistance, essential for high-performance jet engines.

By Material Type

- Nickel Alloy Dominates the market due to its high-temperature strength, corrosion resistance, and durability. Crucial for turbine sections exposed to extreme heat and pressure.

- Titanium Alloy Valued for its lightweight and high strength-to-weight ratio. Widely used in fan blades and compressor sections to improve fuel efficiency and reduce engine weight.

- Aluminum Used in low-stress engine components. Offers cost-effectiveness and ease of machining but is limited in high-temperature applications.

- Others (e.g., Steel, Cobalt Alloys) Specialty materials used in niche applications require unique mechanical or thermal properties. Often found in military or experimental engines.

By Aircraft Type

- Commercial Aircraft The largest segment is driven by global air travel demand. Requires high-volume, precision-forged components for fuel-efficient and reliable engines.

- Military Aircraft Focuses on performance under extreme conditions. Uses advanced alloys and forging techniques for durability, stealth, and high-speed capabilities.

- General Aviation Includes private jets and small aircraft. Demand is growing for lightweight, cost-effective forged components that balance performance and affordability.

By Application

- Fan Case

- Combustion Chamber Outer Case

- Turbine Disc

- Rotors

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

The aircraft engine forging market in Asia Pacific is witnessing significant growth.

Aircraft Engine Forging

Aircraft Engine Forging Market Regional InsightsThe regional trends influencing the Aircraft Engine Forging Market have been analyzed across key geographies.

Aircraft Engine Forging Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 3,787.15 Million |

| Market Size by 2031 | US$ 5,966.86 Million |

| Global CAGR (2025 - 2031) | 6.84% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Forging Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Aircraft Engine Forging Market Players Density: Understanding Its Impact on Business Dynamics

The Aircraft Engine Forging Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Aircraft Engine Forging Market Share Analysis by Geography

The aircraft engine forging market is segmented into five major regions North America, Europe, Asia Pacific (APAC), the Middle East and Africa (MEA), and South America. North America dominated the market in 2024, followed by Europe and Asia Pacific.

North America, particularly the US, dominates the aircraft engine forging market. The region hosts some of the world's largest aerospace manufacturers and defense contractors, including General Electric Aviation and Pratt & Whitney. Due to stringent safety and performance standards in commercial and military aviation, these companies drive demand for high-performance forged components, such as turbine discs and compressor blades. A well-established industrial base, access to advanced forging technologies, and investment in aerospace R&D contribute to North America's leadership. Canada plays a supporting role, with firms specializing in aerospace component manufacturing and precision engineering.

Below is a summary of market share and trends by region

1. North America

- Market Share Dominant due to advanced aerospace manufacturing and defense spending.

-

Key Drivers

- Strong presence of aircraft OEMs and forging suppliers.

- High demand for commercial and military aircraft.

- Technological leadership in forging processes and materials.

- Trends Growth in titanium and nickel alloy forging; increased investment in sustainable aviation technologies.

2. Europe

- Market Share Significant, supported by Airbus and defense programs.

-

Key Drivers

- Focus on lightweight, fuel-efficient engines.

- Strong regulatory push for low-emission aviation.

- Collaborative R&D across EU nations.

- Trends Expansion of forging capacity for next-gen engines; emphasis on circular economy and material recycling.

3. Asia Pacific

- Market Share Fastest-growing region due to rising air traffic and fleet expansion.

-

Key Drivers

- Rapid growth in domestic aviation markets (China and India).

- Increasing local manufacturing and MRO capabilities.

- Government support for aerospace sector development.

- Trends Surging demand for aluminum and titanium forgings; emergence of regional forging hubs.

4. Middle East and Africa

- Market Share Emerging market with strategic aviation investments.

-

Key Drivers

- Expansion of national carriers and airport infrastructure.

- Growing interest in defense aviation.

- Partnerships with global aerospace firms.

- Trends Investment in forging facilities; focus on high-performance materials for harsh environments.

5. South America

- Market Share Modest but growing, led by Brazil’s aerospace industry.

-

Key Drivers

- Demand for regional jets and general aviation.

- Development of local aerospace supply chains.

- Economic recovery is driving fleet modernization.

- Trends Growth in aluminum forging; increased participation in global aerospace programs.

Aircraft Engine Forging Market Players Density Understanding Its Impact on Business Dynamics

Medium Market Density and Competition

Competition is medium due to the presence of established players such as All Metals & Forge Group, OTTO FUCHS KG, Pacific Forge Incorporated, Precision Castparts Corp., Safran SA, VSMPO-AVISMA Corp, Farinia Group, Doncasters Group, LISI GROUP, and Allegheny Technologies Inc.

This medium level of competition urges companies to stand out by offering

- Diverse product types and materials cater to varied consumer needs, increasing rivalry.

- Low entry barriers allow many small and regional players to enter the market.

- Customization demand pushes brands to innovate and differentiate constantly.

- Strong presence of global and local manufacturers intensifies price and feature competition.

- E-commerce growth enables direct-to-consumer sales, increasing market saturation.

- Technological advancements like smart sheds and modular designs raise the innovation stakes.

- Price-sensitive consumers drive aggressive pricing and promotional strategies.

Opportunities and Strategic Moves

- Advanced Alloy Development Invest in high-performance materials such as titanium aluminides and nickel-based superalloys to meet the demands of next-gen aircraft engines.

- Support for Sustainable Aviation Forge components optimized for engines running on Sustainable Aviation Fuels (SAF) and hybrid-electric propulsion systems.

- Digital Forging Technologies Integrate AI, IoT, and digital twins for real-time monitoring, predictive maintenance, and process optimization in forging operations.

- Modular Engine Component Design Develop modular forged parts that simplify maintenance and upgrades, especially for regional and general aviation aircraft.

- Expansion into Emerging Markets Establish forging facilities in the Asia Pacific, Middle East, and South America to meet growing regional demand and reduce supply chain risks.

- Lightweight Component Innovation Focus on forging lightweight components to improve fuel efficiency and reduce commercial and military aircraft emissions.

- Aftermarket and MRO Growth Capitalize on the rising demand for maintenance, repair, and overhaul (MRO) services by supplying forged replacement parts.

- Collaborative R&D Initiatives Partner with OEMs, research institutions, and government bodies to co-develop forging technologies for future propulsion systems.

- Automation and Smart Manufacturing Adopt robotics and automated forging lines to enhance productivity, consistency, and scalability.

- Compliance with Global Standards Align forging processes with international aviation safety and environmental standards to ensure global market access.

Major Companies operating in the Aircraft Engine Forging Market are

- All Metals & Forge Group

- OTTO FUCHS KG

- Pacific Forge Incorporated

- Precision Castparts Corp.

- Safran SA

- VSMPO-AVISMA Corp

- Farinia Group

- Doncasters Group

- LISI GROUP

- Allegheny Technologies Inc

Disclaimer The companies listed above are not ranked in any particular order.

Other companies analyzed during the course of research

- Mettis Aerospace Limited.

- FRISA

- ELLWOOD Texas Forge Houston

- Wuxi Paike New Materials Technology Co., Ltd.

- SIFCO Forge

- SQuAD Forging India

- Canton Forge

- Carlton Forge Works

- Weldaloy Specialty Forging Company

- MATTCO FORGE INC.

- Arconic Corporation

- Consolidated Industries, Inc.

- Forgital Group

- Bharat Forge

- Voestalpine Bohler Aerospace GmbH & Co KG

- Howmet Aerospace

Aircraft Engine Forging Market News and Recent Developments

Safran Aircraft Engine Signed an Agreement with HAL

Safran Aircraft Engines signed an agreement with Hindustan Aeronautics Limited (HAL), India's leading aerospace and defense company, for the industrialization and production of rotating parts for LEAP engines. This agreement supports the government’s “Make in India” policy. It follows the memorandum of understanding signed by Safran Aircraft Engines and HAL in October 2023 to develop industrial cooperation in LEAP engine parts manufacturing, as well as the contract signed last February by both partners to produce forged parts. Safran Aircraft Engines is continuing to expand its footprint in India and is extending the scope of its cooperation with HAL through the production of Inconel parts.

ATI Inc. Signed an Agreement with Airbus

In May 2025, ATI Inc. announced it has signed a multi-year agreement with Airbus, securing the airframer's supply of titanium plate, sheet, and billet as it continues to ramp production of narrow and widebody aircraft. It positions ATI as a top supplier of titanium flat rolled and long products to Airbus.

Aircraft Engine Forging Market Report Coverage and Deliverables

The "Aircraft Engine Forging Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering the following areas

- Aircraft engine forging market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Aircraft engine forging market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Aircraft engine forging market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Aircraft engine forging market

- Detailed company profiles

Frequently Asked Questions

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For