EV Test Equipment Market Size, Share, and Future Forecast 2034

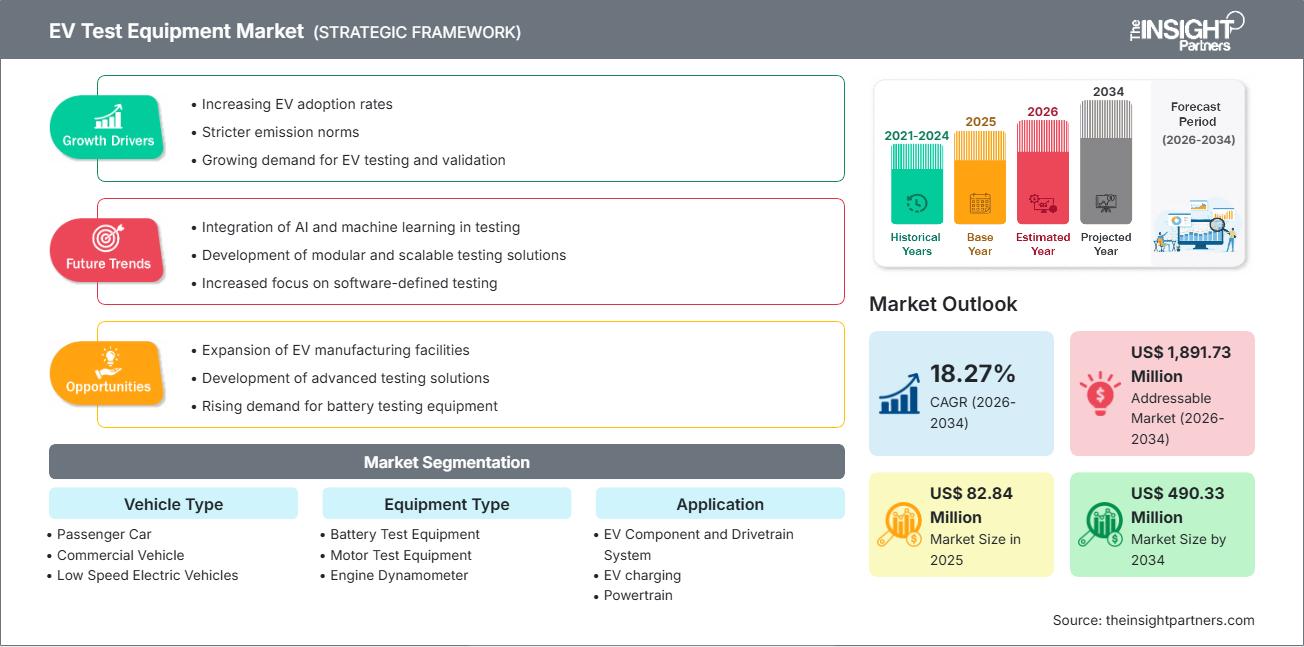

EV Test Equipment Market Size and Forecast (2021 - 2034), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Vehicle Type (Passenger Car, Commercial Vehicle, and Low Speed Electric Vehicles), Equipment Type (Battery Test Equipment, Motor Test Equipment, Engine Dynamometer, Chassis Dynamometer, Transmission Dynamometer, Fuel Injection Pump Tester, Inverter Tester, EV Drivetrain Test, On-Board Charger, and AC/DC EVSE), Application (EV Component and Drivetrain System, EV charging, and Powertrain), and End-Users (OEMs, Tier 1 Suppliers, Research and Academics, and Others)

Historic Data: 2021-2024 | Base Year: 2025 | Forecast Period: 2026-2034- Report Date : Mar 2026

- Report Code : TIPRE00020871

- Category : Electronics and Semiconductor

- Status : Upcoming

- Available Report Formats :

- No. of Pages : 150

The EV test equipment market size is expected to reach US$ 490.33 million by 2034 from US$ 82.84 million in 2025. The market is anticipated to register a CAGR of 18.27% during 2026–2034.

EV test equipment market analysis

The EV test equipment market forecast indicates robust growth, owing to surging electric vehicle production volumes, rapid advances in batteries and power electronics, and stricter validation requirements across OEM and Tier-1 workflows. The market expansion is facilitated by the need for compatibility with fast-evolving charging standards (AC/DC), higher-voltage architectures, and the integration of real-time, connected analytics. Additionally, vendors shifting toward modular, scalable platforms with safety-compliant automation to accelerate validation while reducing cost per test further boost the market growth.

EV test equipment market overview

EV test equipment includes integrated hardware, software, and automation systems necessary to validate components such as batteries, inverters, motors, drivetrains, and chargers, and complete powertrains. These solutions span specialized applications in battery cell cycling, thermal testing, dynamometer testing of motors and drivetrains, and charger protocol conformance. The exact scope of this product segment is highly variable between industry reports. Top suppliers provide fully integrated systems to secure vehicle safety, performance, efficiency, and interoperability. Among the stated capabilities of the sector are dynamic drive cycle simulations, high-fidelity data capture, and conformance testing for both battery management systems and charging ecosystems, pointing to a need for precise validation throughout the research and development process.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONEV Test Equipment Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

EV test equipment market drivers and opportunities

- Rising EV production and platform electrification: OEM roadmaps and government targets accelerate validation demand across batteries, power electronics, and charging infrastructure.

- Higher‑voltage architectures and fast charging: The shift to 800 V systems and rapid DC charging requires new test profiles, higher power ranges, and protocol conformance across CCS, CHAdeMO, GB/T, and emerging standards, pushing upgrades in lab and end-of-line equipment.

- Stringent safety, compliance, and reliability needs: Battery thermal stability, abuse testing, and lifecycle durability are central to warranty risk reduction. Dedicated battery test markets are also expanding, reflecting broader safety and performance imperatives.

Market Opportunities:

- Factory automation and end-of-line coverage expansion: Scalable, flexible test platforms help OEMs reduce takt times, improve yield, and maintain standards readiness.

- Integrated software analytics and connected test ecosystems: Demand for real-time data insights; connecting benches, labs, and production lines enables faster root‑cause analysis and model‑based validation.

- Emerging markets acceleration: Asia-Pacific is identified as the fastest-growing region in several studies, driven by OEM capacity additions, supply chain localization, and policy incentives supporting EV ecosystems.

EV test equipment market report segmentation analysis

The EV test equipment market share is analyzed across segments to provide a clearer understanding of its structure, growth potential, and emerging trends.

Below is the standard segmentation approach used in most industry reports:

By vehicle type

- Passenger car

- Commercial vehicle

- Low speed electric vehicles

By equipment type

- Battery test equipment

- Motor test equipment

- Engine dynamometer

- Chassis dynamometer

- Transmission dynamometer

- Fuel injection pump tester

- Inverter tester

- EV drivetrain test

- On‑board charger

- AC/DC EVSE

By application

- EV component and drivetrain system

- EV charging

- Powertrain

By end‑users

- OEMs

- Tier 1 suppliers

- Research and academics

By Geography

- North America

- Europe

- Asia‑Pacific

- South and Central America

- Middle East and Africa

EV Test Equipment Market Regional Insights

The regional trends and factors influencing the EV Test Equipment Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses EV Test Equipment Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

EV Test Equipment Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2025 | US$ 82.84 Million |

| Market Size by 2034 | US$ 490.33 Million |

| Global CAGR (2026 - 2034) | 18.27% |

| Historical Data | 2021-2024 |

| Forecast period | 2026-2034 |

| Segments Covered |

By Vehicle Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

EV Test Equipment Market Players Density: Understanding Its Impact on Business Dynamics

The EV Test Equipment Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the EV Test Equipment Market top key players overview

EV test equipment market share analysis by geography

Asia‑Pacific is expected to grow fastest, supported by localized EV supply chains, OEM capacity expansions, and government incentives. Mordor Intelligence explicitly identifies Asia‑Pacific as the fastest-growing market to 2030, tracking strong investments in battery and power electronics validation.

The EV test equipment market shows a different growth trajectory in each region due to factors such as EV manufacturing capacity, charging deployment, standards evolution, and regulatory support. Below is a summary of market share and trends by region:

-

North America

- Market share: Significant share driven by large OEM/Tier‑1 presence, early EVSE standardization efforts, and connected test deployments.

- Key drivers:

- End-of-line automation and standards readiness for EVSE and e-powertrain.

- Battery validation depth and safety/quality compliance across R&D and manufacturing.

- Trends: Greater integration of test data with manufacturing execution systems and digital twins to accelerate ramp‑ups and reduce cost per test.

2. Europe

- Market share: Strong due to advanced EV policies, multi-country OEM footprints, and broad standardization across AC/DC charging.

- Key drivers:

- Interoperability and protocol conformance across diverse charging networks.

- Power electronics efficiency and thermal validation for highway-capable BEVs.

- Trends: Emphasis on modular dynamometer and inverter test benches aligned to 800 V+ platforms and efficiency regulations.

3. Asia‑Pacific

- Market share: Fastest‑growing region on the back of volume manufacturing and battery ecosystem investments.

- Key drivers:

- OEM capacity expansions and localization of supply chains.

- Policy incentives for EV adoption and infrastructure.

- Trends: Increased deployment of integrated test labs spanning cell‑to‑system, and rapid EVSE rollout with protocol, safety, and performance validation at scale.

4. South and Central America

- Market share: Emerging; adoption linked to urban fleet electrification and charging deployments.

- Key drivers:

- Public-private partnerships for EV infrastructure.

- OEM pilot programs and regional assembly.

- Trends: Preference for cloud‑connected test management and cost-effective modular systems to support smaller labs and pilot lines.

5. Middle East and Africa

- Market share: Developing; anchored by national strategies in select economies and demonstration fleets.

- Key drivers:

- Infrastructure build-out and standards alignment for interoperability.

- Special economic zones targeting component manufacturing and testing services.

- Trends: Gradual integration of EVSE conformance testing with broader smart city initiatives and utility‑backed charging programs.

EV test equipment market players density: understanding its impact on business dynamics

High Market Density and Competition

Competition is intensifying with global test leaders and specialized niche vendors. AVL, TÜV Rheinland, and HORIBA among leading players in EV test equipment, reflecting multi‑disciplinary portfolios across dynamometers, battery/power electronics, and compliance services

This competitive environment pushes vendors to differentiate through:

- End‑to‑end integration across battery, inverter, motor, drivetrain, and EVSE testing, including protocol and safety conformance.

- Scalable, modular platforms adaptable to R&D, pilot, and mass production environments; end‑of‑line test expansion for EV and EVSE manufacturing is a focal area.

- Interoperability and standards coverage across CAN/LIN/Ethernet, high‑voltage ranges, and multi‑protocol charging.

Opportunities and strategic moves

- Partner with OEMs and public charging operators to co‑develop test protocols and accelerate interoperability for AC/DC EVSE.

- Invest in AI/ML‑enabled analytics for anomaly detection, yield improvement, and accelerated root‑cause analysis across battery and power electronics testing.

- Expand end‑of‑line test suites that bridge design validation and manufacturing readiness, reducing rework and field failures.

Major companies operating in the EV test equipment market are:

- National Instruments Corporation- United States

- Horiba Ltd.- Japan

- Arbin Instruments- United States

- Maccor Inc.- United States

- KEYSIGHT TECHNOLOGIES, INC.- United States

- Froude, Inc.- United States

- Dynomerk Controls India

- Comemso electronics GmbH, Germany

- Durr Group Germany

Disclaimer: The companies listed above are not ranked in any particular order.

EV test equipment market news and recent developments

- National Instruments Corporation (NI) announced advancements in EV battery test solutions. National Instruments Corporation introduced enhanced modular battery cyclers and enterprise lab management systems designed to streamline EV battery validation workflows. The new solutions integrate real‑time data analytics and CAN/Ethernet communication, enabling OEMs and Tier‑1 suppliers to accelerate pack/module testing while ensuring compliance with evolving safety standards.

- Horiba Ltd. expanded its EV and fuel cell testing portfolio. Horiba unveiled new turnkey battery and fuel cell validation systems tailored for BEV and FCEV development. Building on its acquisitions of MIRA and FuelCon, Horiba now offers integrated solutions for pack durability, efficiency, and certification. These developments strengthen its position as a global leader in EV powertrain and energy system testing.

- Arbin Instruments launched dynamic drive cycle simulation capabilities for EV batteries. Arbin Instruments announced upgrades to its battery test platforms, including advanced temperature‑stable chambers and CAN bus integration with BMS. The new systems allow precise replication of real‑world driving conditions, supporting OEMs and research institutions in validating next‑generation EV battery chemistries.

EV test equipment market report coverage and deliverables

The "EV Test Equipment Market Size and Forecast (2021–2034)" report provides a detailed analysis of the market covering below areas:

- EV Test Equipment Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- EV Test Equipment Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- EV Test Equipment Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the EV Test Equipment Market

- Detailed company profiles

Frequently Asked Questions

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For